The rise of Bitcoin ETFs and future market implications

The rise of Bitcoin ETFs and future market implications

The rise of Bitcoin ETFs and future market implications The rise of Bitcoin ETFs and future market implications

SEC approval of 11 Bitcoin ETFs in January 2024 marks a vital liquidity and credibility milestone for Bitcoin.

Veil artwork/illustration by technique of CryptoSlate. Image involves combined speak which could presumably embody AI-generated speak.

The next is a guest post from Shane Neagle.

No subject an assetâs fundamentals, its ticket is dominated by one underlying characteristic – market liquidity. Is it easy for the broader public to sell or aquire this asset?Â

If the resolution is disappear, then the asset receives excessive trading volume. When that occurs, executing trades at varied ticket levels is more uncomplicated. In turn, a feedback loop is created – extra tough ticket discovery boosts investor self assurance, which boosts extra market participation.

Since Bitcoin launched in 2009, it has relied on crypto exchanges to verify and lengthen its market depth. The more uncomplicated it grew to change into to trade Bitcoin worldwide, the more uncomplicated it grew to change into for the BTC ticket to rise.

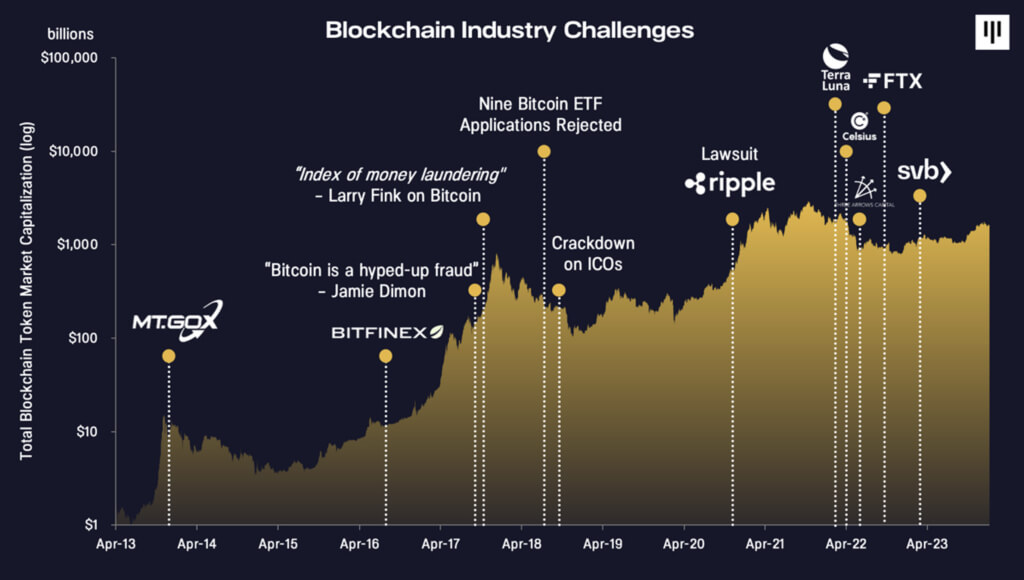

By the same token, when fiat-to-crypto rails such as Mt. Gox or FTX fail, the BTC ticket suffers seriously. These are correct some boundaries to Bitcoinâs course to legitimization and adoption.

Nevertheless, when the Securities and Alternate Commission (SEC) well-liked 11 achieve-traded Bitcoin change-traded funds (ETFs) in January 2024, Bitcoin received a singular layer of liquidity.

It is miles a liquidity milestone and a singular layer of credibility for Bitcoin. Coming into the arena of regulated exchanges, alongside stocks, ran the steam out of naysayers who wondered Bitcoin’s reputation as a decentralized digital gold.

Nonetheless how does this unique market dynamic play out in the long bustle?

The Democratization of Bitcoin By blueprint of ETFs

From the receive-dawdle, Bitcoin’s novelty has been its weak point and energy. On the one hand, it's a financial revolution to shield wealth in oneâs head after which be ready to switch that wealth without boundaries.Â

Bitcoin miners can switch it without permission, and anybody with cyber net access can change into a miner. No diversified asset has that property. Even gold, with its reasonably restricted present resistant to inflation, could even be without effort confiscated as it took reputation in 1933 below Executive Convey 6102.

This implies that Bitcoin is an inherently democratizing wealth automobile. Nonetheless with self-custody comes huge responsibility and achieve for error. Glassnode files exhibits that spherical 2.5 million bitcoins possess change into inaccessible in consequence of misplaced seed phrases that can regenerate access to the Bitcoin mainnet.Â

This is 13.2% of Bitcoin’s 21 million BTC mounted present. In make, self-custody induces terror among each retail and institutional investors. Would fund managers interact in Bitcoin allocation with such menace?

Nonetheless Bitcoin ETFs changed this dynamic entirely. Investors taking a look to hedge towards currency debasement can now delegate the custody to desirable funding corporations. And they, from BlackRock and Constancy to VanEck, delegate it to chosen crypto exchanges take care of Coinbase.

Although this reduces Bitcoin’s self-custody characteristic, it boosts investor self assurance. At the same time, miners, by technique of proof-of-work, composed originate Bitcoin a decentralized asset, irrespective of how a lot BTC is hoarded interior ETFs. And Bitcoin stays each a digital asset and a hard asset grounded in computing energy (hashrate) and energy.

Bitcoin ETFs Reshaping Market Dynamics and Investor Confidence

Since January 11th, Bitcoin ETFs opened the capital floodgates to deepen Bitcoinâs market depth, ensuing in a $240 billion cumulative volume. This mammoth inflow of capital has also shifted the ruin-even ticket for many investors, influencing their systems and expectations about future profitability.

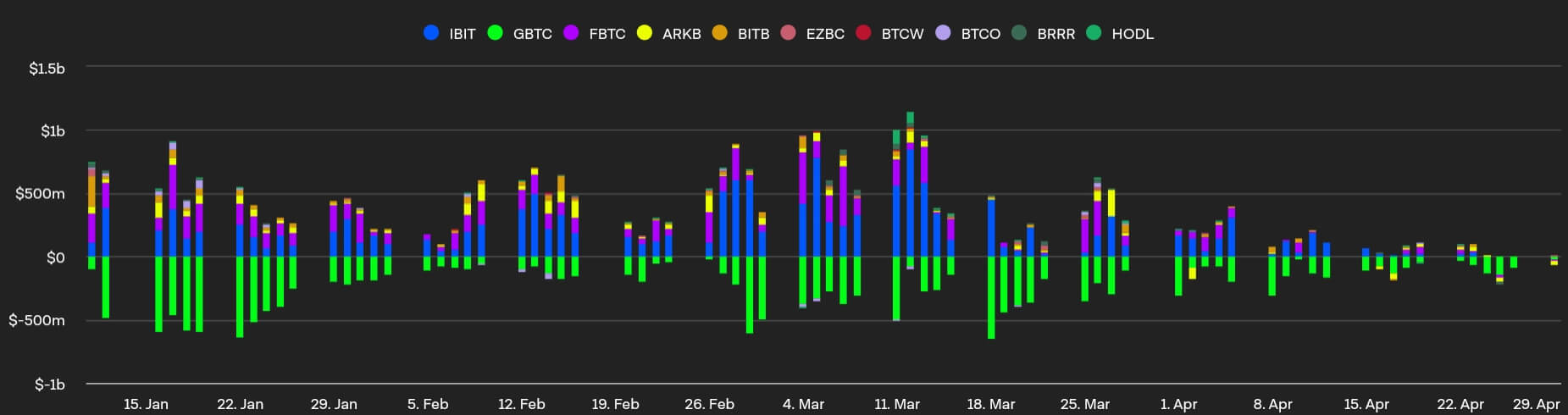

Yet, irrespective of the originate being widely a hit in exceeding expectations, harmful outflows possess received ground as Bitcoin ETF hype subsided.

As of April Thirtieth, Bitcoin ETF flows netted harmful $162 million, marking the fifth consecutive day harmful outflows. For the principle time, Arkâs ARKB outflow (yellow) outpaced GBTC (green), at harmful $31 million vs $25 million respectively.

Brooding about this used to be after Bitcoinâs 4th halving, which diminished Bitcoinâs inflation payment to 0.85%, it's safe to explain that macroeconomic and geopolitical concerns temporarily overshadowed Bitcoinâs fundamentals and deepened market depth.

This used to be even extra evident when the Hong Kong Stock Exchangeâs opening of Bitcoin ETFs failed to issue. No subject opening capital access to Hong Kong investors, the volume accounted for simplest $11 million ($2.5 million in Ether ETFs), when put next with the anticipated $100 million.

In brief, Hong Kongâs crypto ETF debut used to be almost 60x no longer up to in the US. Although Chinese language voters with registered HK companies could presumably snatch part, mainland Chinese language investors are composed prohibited.

Likewise, taking into legend that the New York Stock Alternate (NYSE) is approximately five instances larger than HKSE, it is no longer in point of fact that HKSE’s Bitcoin/Ether ETFs are going to exceed $1 billion flows in the principle two years, per Bloomberg ETF analyst Eric Balchunas.

Future Outlook and Capacity Challenges

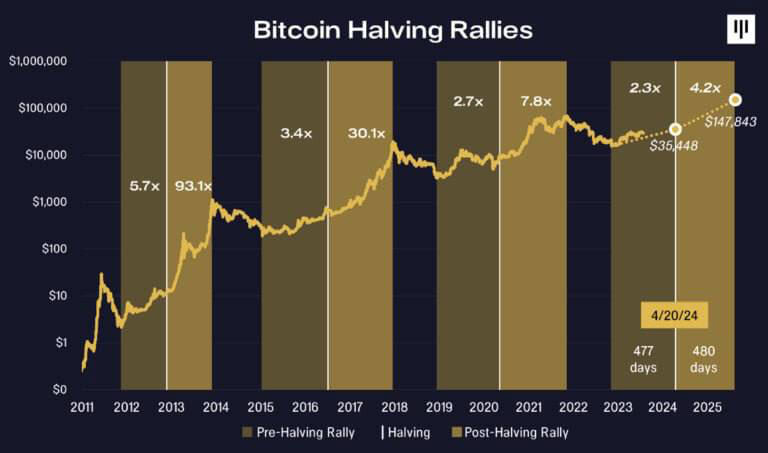

Throughout the Bitcoin ETF liquidity extravaganza, BTC ticket probed the above-$70k threshold extra than one instances, achieving the unique all-time excessive of $73.7k mid-March.

Nevertheless, miners and holders took that chance to erect a selling force and reap good points. With spirits now subdued to the $60k differ, investors will possess larger alternatives to aquire discounted Bitcoin.

No longer simplest is Bitcoin’s inflation payment at 0.85% after the fourth halving, vs. the Fed’s USD draw of 2%, however over 93% of BTC present has already been mined. The mined BTC inflow turned from ~900 BTC day-after-day to ~450 BTC day-after-day.

This interprets to larger Bitcoin scarcity, and what is scarce tends to change into extra necessary, in particular after legitimizing Bitcoin investing on an institutional degree thru Bitcoin ETFs. A lot in divulge that Bybitâs prognosis forecasts present shock on exchanges by the live of 2024. Alex Greene, Blockchain Insights senior analyst said:

âThe surge in institutional curiosity has stabilized and tremendously elevated question for Bitcoin. This amplify will doubtless exacerbate the dearth and push costs elevated after the halving.â

After earlier halvings in the absence of the Bitcoin ETF atmosphere, Bitcoin ticket leveled up to 7.8x good points interior 480 days. Although a elevated Bitcoin market cap makes such good points less doubtless, extra than one appreciation boosts remain on the table.

Nevertheless, market volatility is composed to be anticipated for the time being. With Binance scenario resolved, alongside forsaking the string of crypto bankruptcies all the blueprint in which thru 2022, potentially the most necessary FUD source stays the authorities.

No subject Tom Emmerâs efforts, because the GOP majority whip, even self-custody wallets will be focused as money transmitters. The FBI hinted at this course recently with the warning towards using âunregistered crypto money transmitting servicesâ.

Likewise, this 12 months, the Federal Reserveâs route on curiosity rates could presumably suppress the appetite for menace-on sources take care of Bitcoin. Then again, the conception of Bitcoin and the market surrounding it has never been extra aged and stable.

If the regulatory regime adjustments route, cramped companies could presumably even ditch alternate suggestions take care of bill financing and switch to a BTC ETF-supported system.

Conclusion

After years of Bitcoin ETF rejections for achieve-trading, these funding autos erected stamp-unique liquidity bridges. Even suppressed by Barry Silbert’s Grayscale (GBTC), they've confirmed huge institutional question for an appreciating commodity.

With the fourth Bitcoin halving gradual, elevated scarcity and allocations from fund managers are truly a disappear wager. Moreover, the existing sentiment is that fiat currencies will and not using a extinguish in sight be devalued as long as central banking exists.

In spite of every little thing, how could presumably governments shield funding themselves irrespective of big funds deficits?

This makes Bitcoin all of the extra compelling in the long bustle after holders absorb the profits from unique ATH aspects. Between these peaks and valleys, Bitcoinâs bottom will doubtless shield rising in the deeper institutional waters.

Talked about in this article

Source credit : cryptoslate.com