Rising stablecoin supply shows an influx of capital into the crypto market

Final week, Bitcoin rode the bullish wave it got on final tumble and broke above the coveted $52,000 level. Bitcoin regaining practically all of its losses since the give procedure of FTX is a indispensable milestone for the industry that has been struggling to salvage out of a endure marketplace for the simpler phase of the previous year.

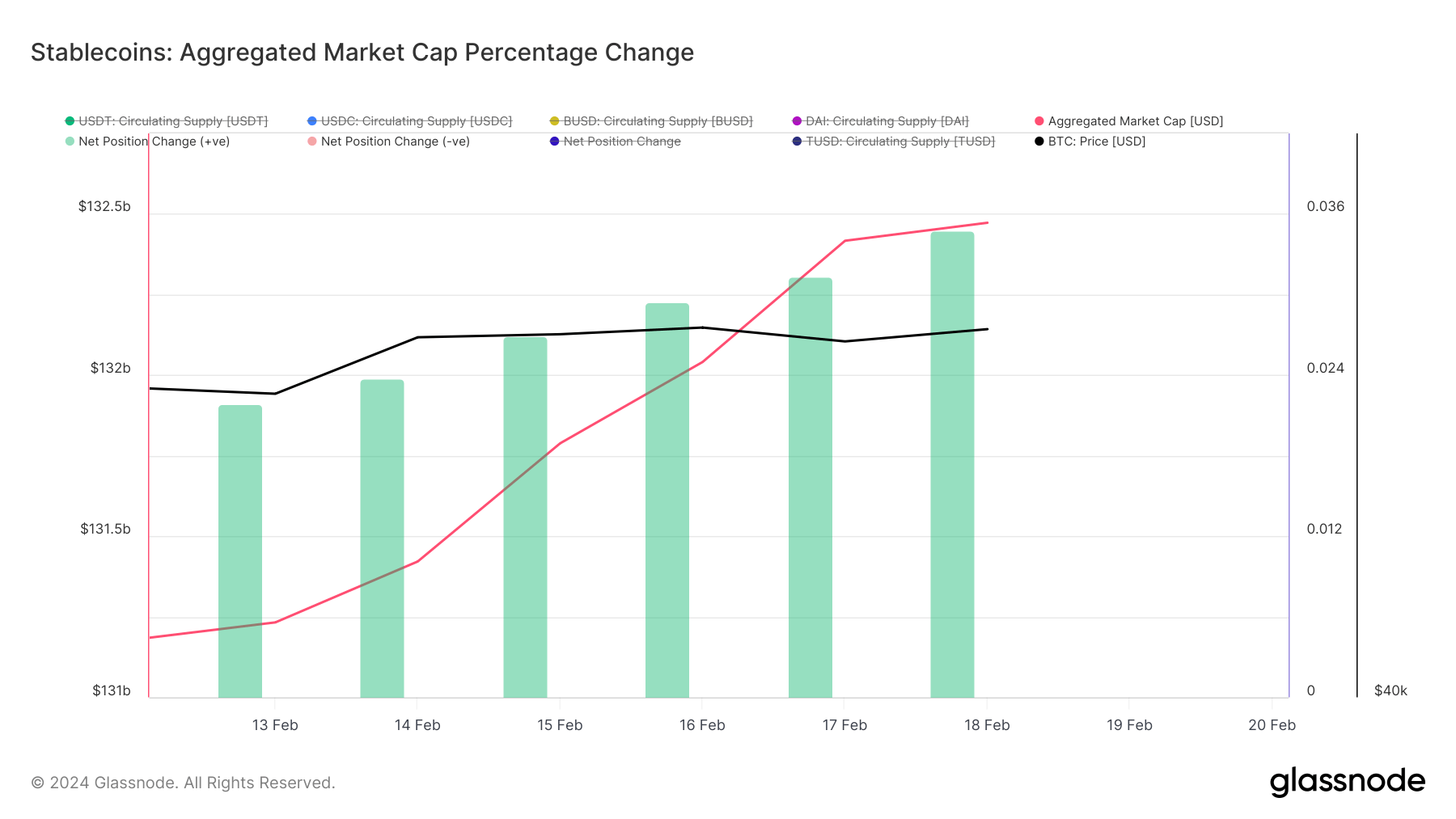

Bitcoin’s upward momentum has been followed by an elevate in the aggregated market cap of indispensable stablecoins, most significantly USDT, USDC, BUSD, and DAI. The four stablecoin giants noticed their mixture market cap develop from $131.232 billion to $132.472 billion between Feb. 13 and Feb. 18, showing a rising search recordsdata from.

Stablecoins are a bridge between fiat currencies and the crypto market, making up the huge majority of crypto buying and selling pairs and, which implies that truth, the huge majority of market liquidity. The elevate in market cap shows a higher adoption rate of stablecoins and reaffirms them as a most current medium for interacting with cryptocurrencies.

Zooming out reveals a 3.475% elevate in the provision of the highest four stablecoins all around the last 30 days. This elevate in offer could perhaps perhaps perchance end result from a pair of things, however it for sprint’s in all likelihood a market-broad push to cross resources (be it fiat or crypto) into stablecoins to put together for buying and selling. This implies that the market is expecting job in the upcoming weeks and preparing for faster entry or exit from Bitcoin.

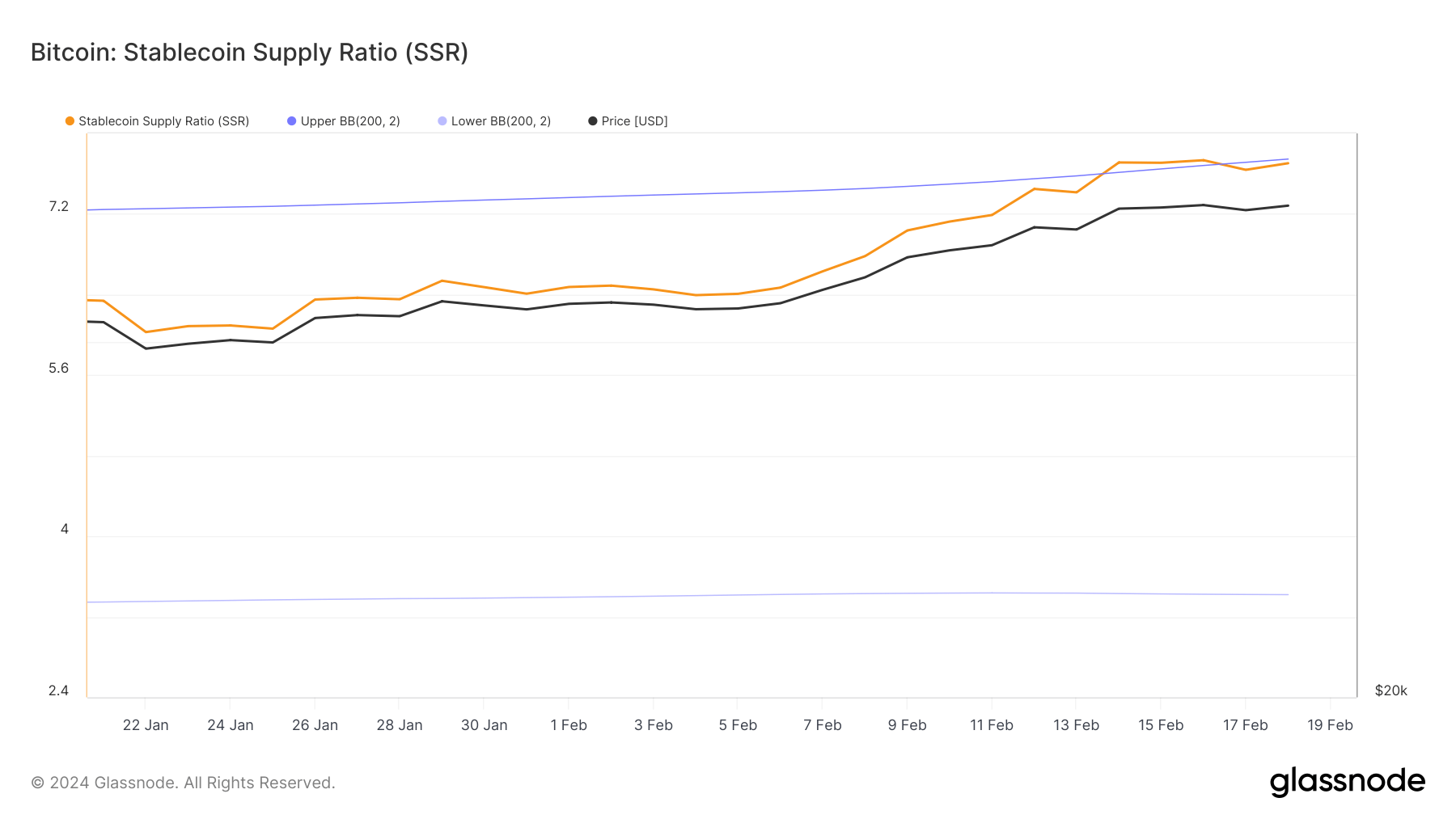

That is extra supported by a indispensable stablecoin offer ratio (SSR) elevate. The SSR is an fundamental metric that measures the provision of stablecoins relative to Bitcoin’s market cap, showing how deep market liquidity is and the market’s skill buying energy. The next SSR implies that there are extra stablecoins relative to Bitcoin, so the means buying energy could perhaps perhaps perchance pressure Bitcoin’s stamp up if the stablecoin offer had been to be exchanged into Bitcoin.

The SSR being above the upper Bollinger band from Feb. 14 to Feb. 16 indicators an abnormal elevate in skill buying energy, perchance indicating that traders had been preparing to cross into Bitcoin or other cryptocurrencies, which is per the noticed stamp elevate in Bitcoin at some stage in this duration.

The elevate in Bitcoin’s stamp, alongside a rising market cap and present of indispensable stablecoins, suggests an influx of capital into the market. For stablecoins, the noticed trends spotlight their indispensable role in the ecosystem, acting no longer most productive as receive havens at some stage in times of volatility however also as needed instruments for capital deployment into Bitcoin.

Final week’s trends display correct how linked the stablecoin market is to Bitcoin and the procedure actions in the provision and market cap of stablecoins can assist as indicators of imminent market job.

Source credit : cryptoslate.com