Prediction: Bitcoin ETF will now dwarf gold performance based on historical data

On a undeniable-to-be historic day for Bitcoin, I spent the morning searching abet at historic data to hunt data from how impactful the main Gold ETF used to be at the time. We’ve viewed masses of analysts, including our maintain, focus on how Gold ETFs changed the landscape for the commodity, main to outsized gains over the proceeding twenty years. Yet, what used to be it in any case love at the time? Did gold explode on day one, or did it snatch time? Let’s dig in.

First, let’s study the timeline of the relevant replace-traded merchandise we can study.

On Nov. 18, 2004, Disclose Avenue Company launched SPDR Gold Shares (GLD), acquiring $114,920,000 in property below administration on begin and $1 billion in its first three shopping and selling days.

On Oct. 19, 2021, ProShares launched ProShares Bitcoin Intention ETF (BITO), which had $570 million in inflows on day one, hitting $1 billion in property the following day.

On Jan. 11, 2024, eleven role Bitcoin ETFs will begin within the U.S. with $115.88 million below administration by the sponsors’ seed funds. This suggests after they’ve taken $115 million in inflows, issuers love BlackRock, Ark, VanEck, and company will buy Bitcoin from the originate market by Coinbase and Gemini, fair love the the rest of us.

Thus, earlier than shopping and selling commences (casting off Grayscale, which is changing its believe* into an ETF that already has $28.58 billion in AUM), the combined role Bitcoin ETFs will get surpassed GLD’s day one shopping and selling. If we consist of Grayscale, role Bitcoin ETFs get extra property below administration than gold did for the main 5 years. GLD didn’t garner $29 billion in AUM until Feb. 12, 2009.

On the opposite hand, to be intellectual, it used to be now no longer the handiest gold ETF by this point. BlackRock launched its iShares® COMEX® Gold Belief in 2005. Mixed with GLD, gold ETFs reached an equivalent AUM round Feb. 10, 2009, with IAU obtaining $2 billion in property by the smash of Q1 2009.

By the smash of 2009, three gold-backed ETFs had been traded within the US: ETFS Bodily Swiss Gold Shares, SPDR Gold Shares, and iShares Comex Gold Belief.

| Company | Seed Funding ($M) |

|---|---|

| Bitwise | 20 |

| VanEck | 72.50 |

| Valkyrie | 0.52 |

| Franklin Templeton | 2.60 |

| WisdomTree | 4.95 |

| Invesco Galaxy | 4.85 |

| BlackRock | 10 |

| Ark | 0.46 |

| Grayscale | 2,858 |

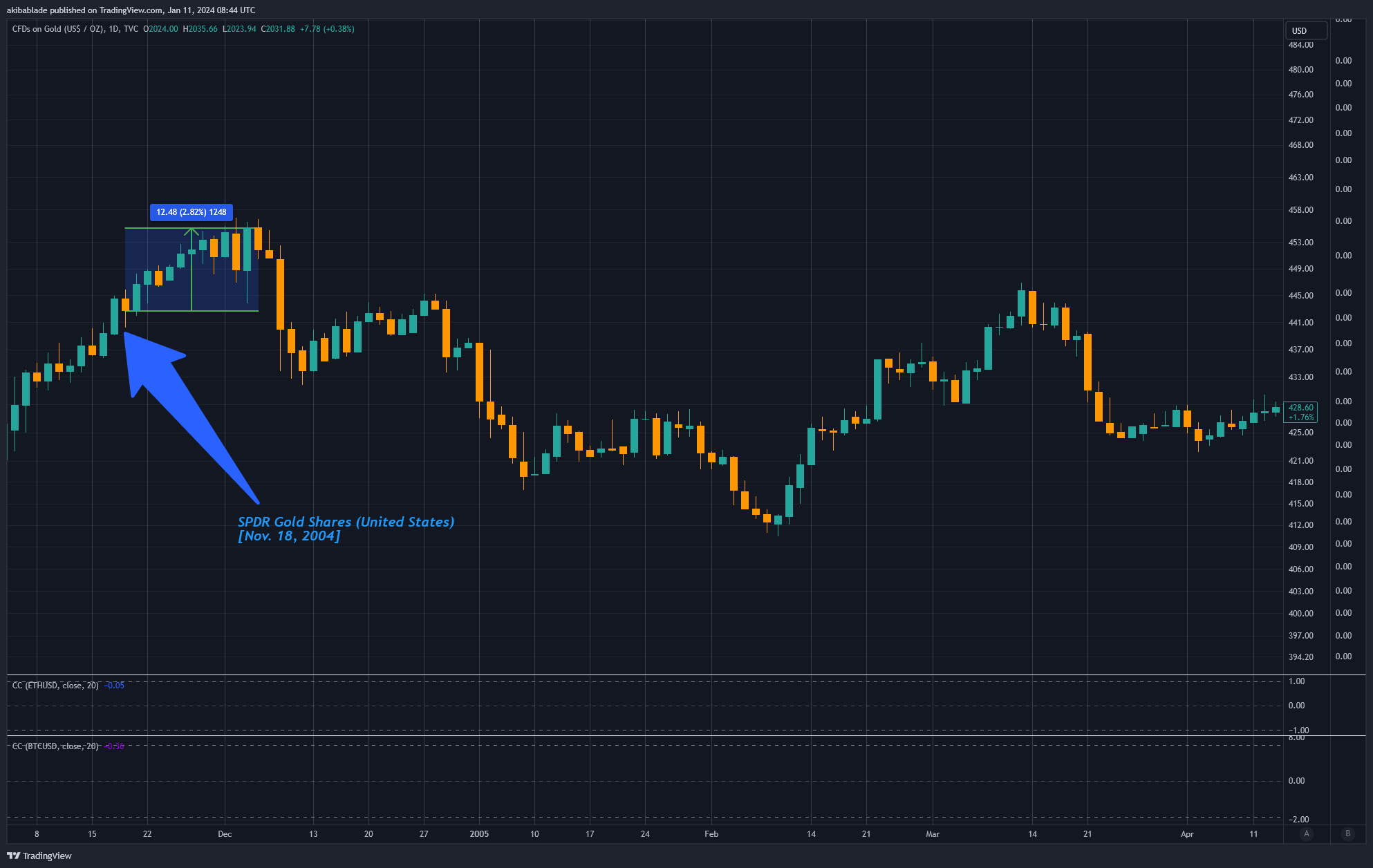

How did GLD trade at begin?

The main gold ETF used to be launched within the U.S. on Nov. 18, 2004, and inside 12 days, the pricetag of gold used to be up fair 2.82%.

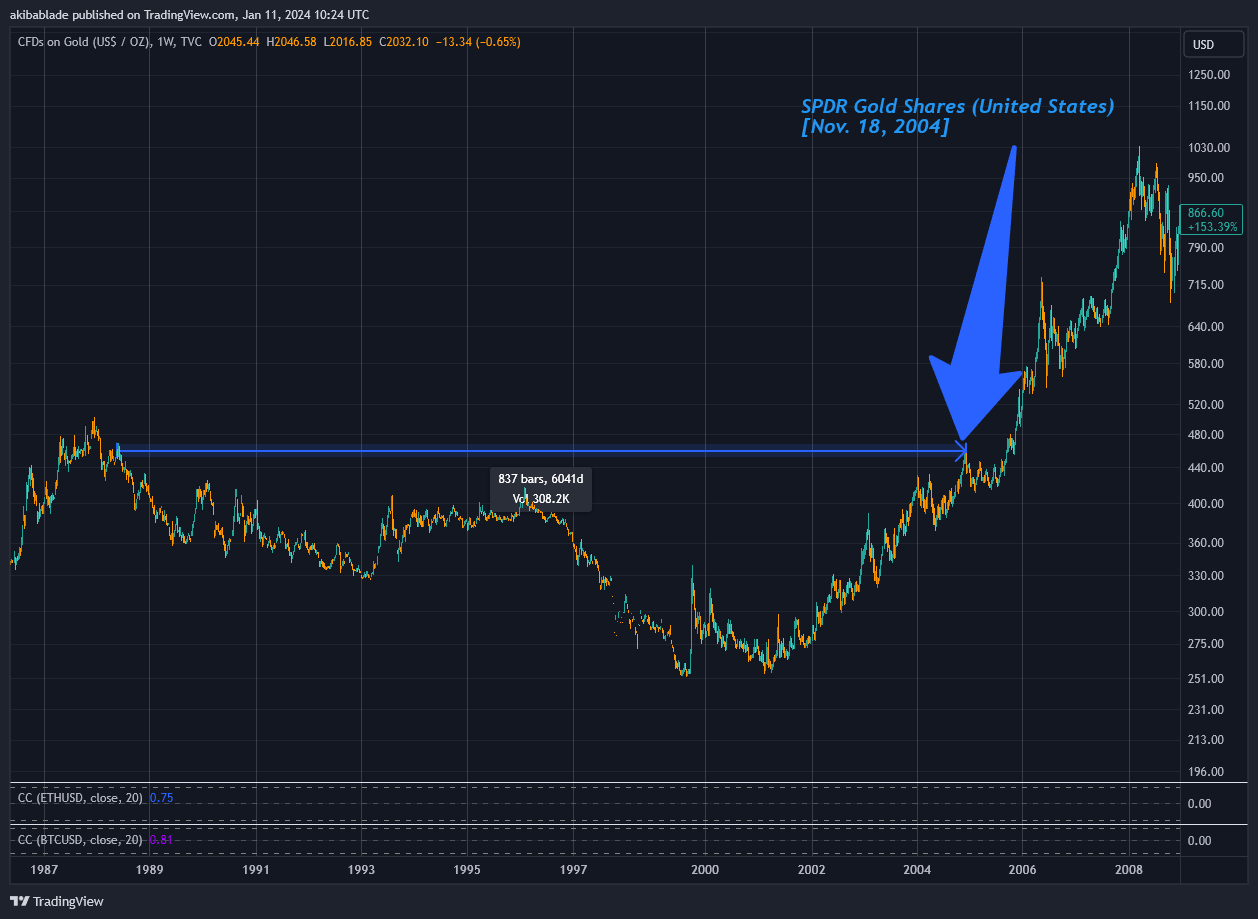

This marked a sixteen-year excessive for gold, which had no longer reached $453 per ounce since May perchance perchance 1988. On the opposite hand, it used to be no longer at an all-time excessive. Genuinely, it would snatch one other four years earlier than that can perchance well occur.

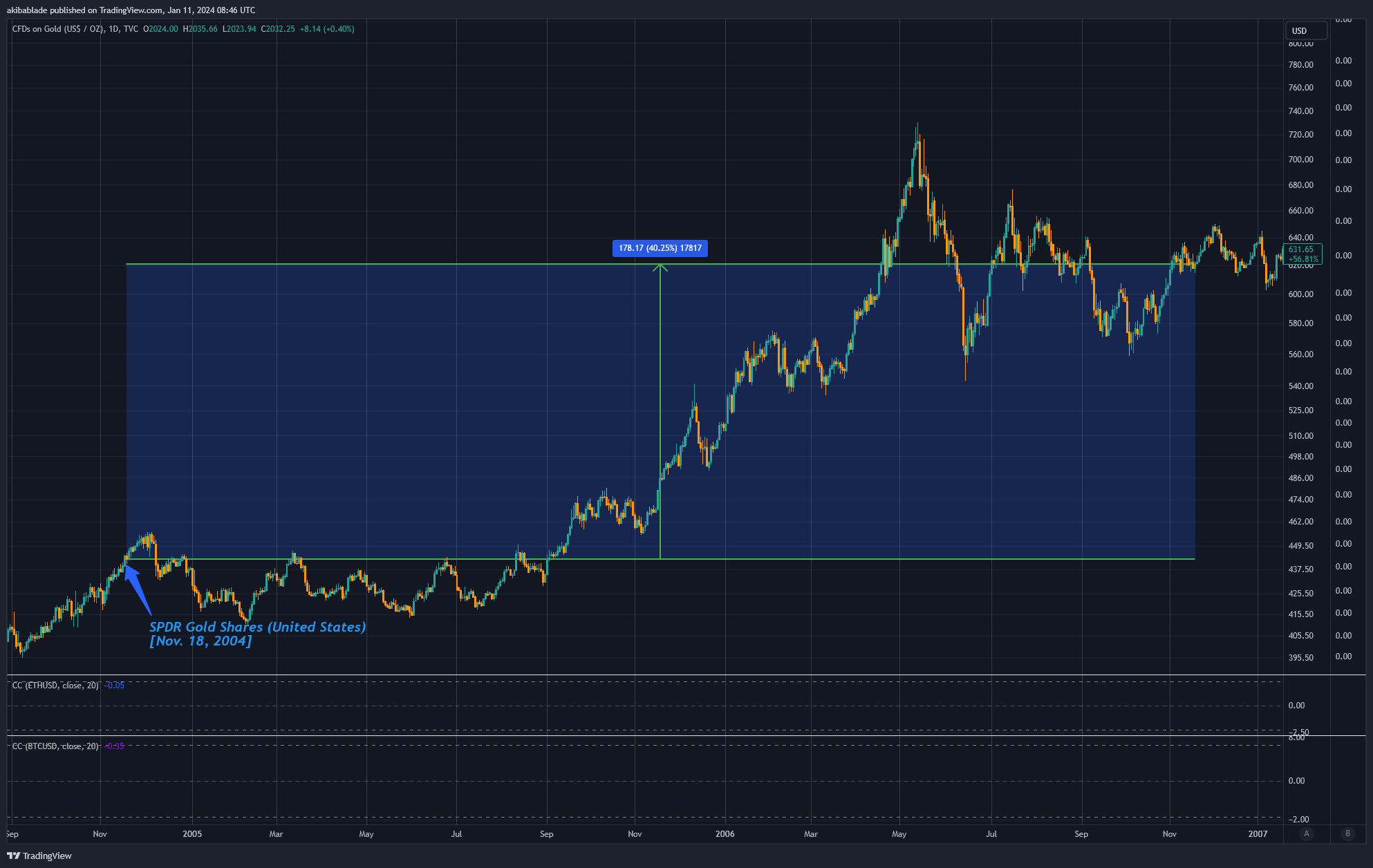

Following the native excessive in Dec. 2004 at $453.40, gold went on a extended downward trajectory, with the pricetag down 4% over the next six months. On its sixth-month birthday, GLD had received $2.4 billion in property below administration, with gold priced at $419.75.

On the opposite hand, things began to salvage significantly better for the flagship commodity. By Nov. 2004, on the anniversary of its begin, gold had risen to $485,85, up 8.15% since begin. Thus, gold used to be up no longer as much as Bitcoin after a year and can swing on a Gary Gensler tweet. A long way from the earth-shattering impact many predict from the comparability to the gold ETF begin.

As GLD grew to become 2 on Nov. 18, 2006, gold used to be as much as $620.50, an expand of round 40%.

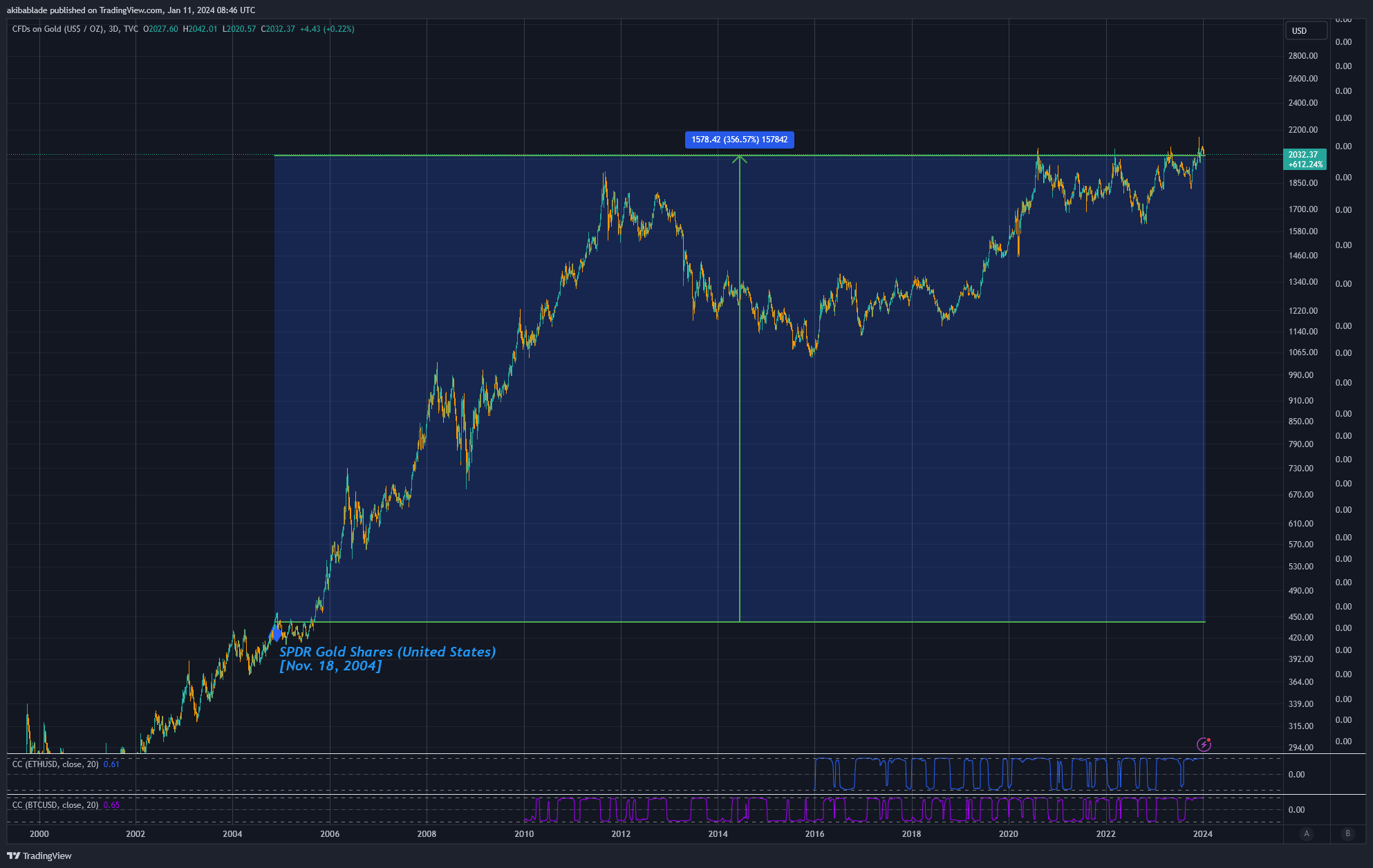

This day, gold is priced at round $2,032 as of press time and a staggering 356%. On the opposite hand, that’s on a almost 20-year timeframe. By comparability, had been Bitcoin priced at $210,000 on Jan. 11, 2044, how many traders may perchance perchance well be blissful with that return? Following gold’s trajectory, that’s the pricetag point we’d be taking a study.

On the opposite hand, gold and Bitcoin are love comparing apples with oranges. While we may perchance perchance also focus on Bitcoin as digital gold, it is miles undoubtedly mighty extra.

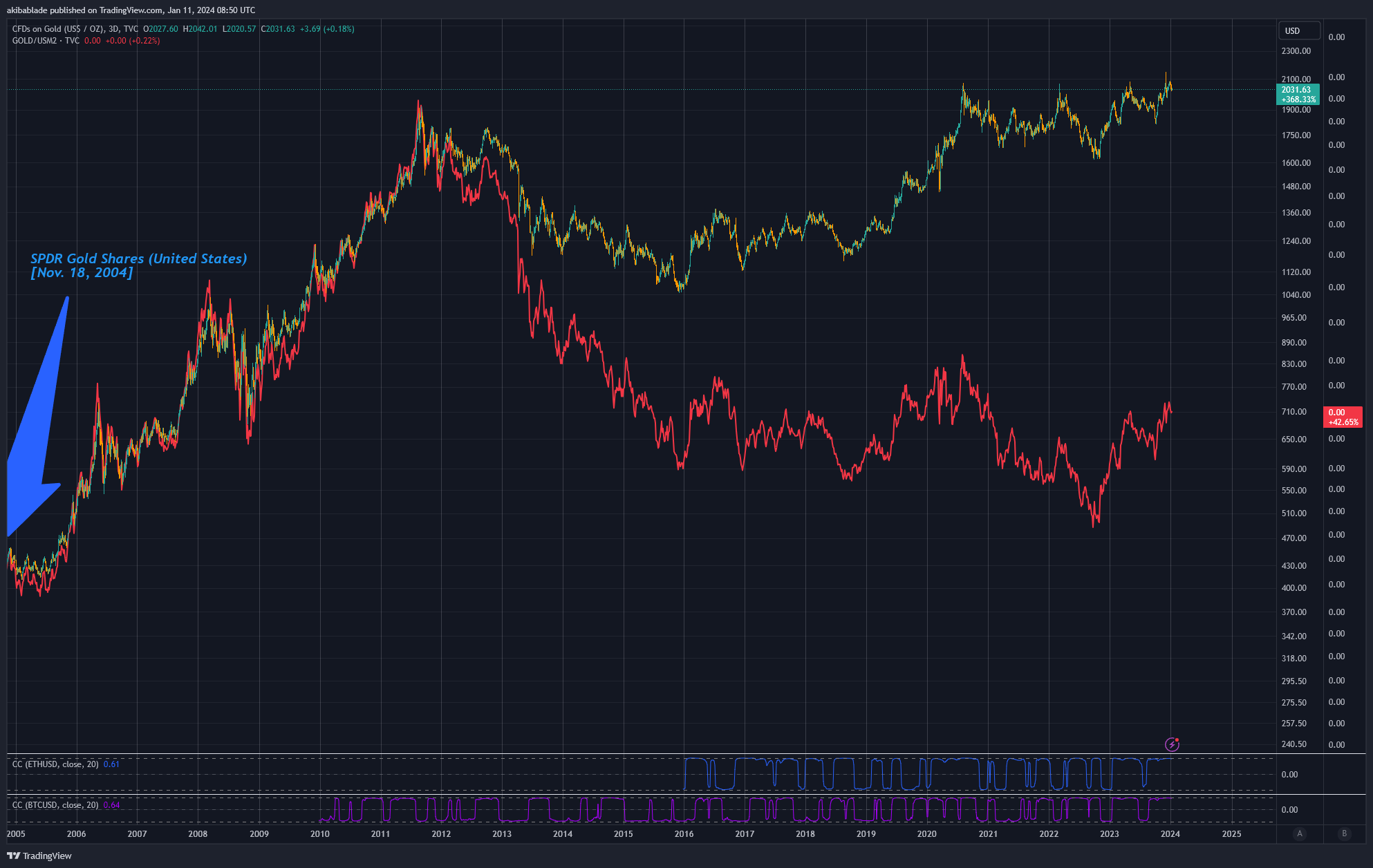

Let’s begin by taking a study gold in the case of the M2 cash offer within the U.S. M2 is a huge measure of the cash offer. It contains all elements of M1 (notes and cash, checking accounts, other checkable deposits, traveler’s assessments) plus savings deposits, limited-denomination time deposits (time deposits in amounts of no longer as much as $100,000), and balances in retail cash market funds.

M2 handiest excludes large deposits, institutional cash market funds, immediate-term repurchase agreements, and other extra substantial liquid property, making it a relevant prolonged-term metric to evaluate the spending energy of the U.S. dollar.

When adjusted for the M2 offer, gold is up fair 42%. Gold adopted Gold/M2 moderately tightly from 2004 until 2012, and whereas the dollar rate of gold persisted to rise, Gold/M2 has been on a downtrend ever since.

Comparisons with Bitcoin

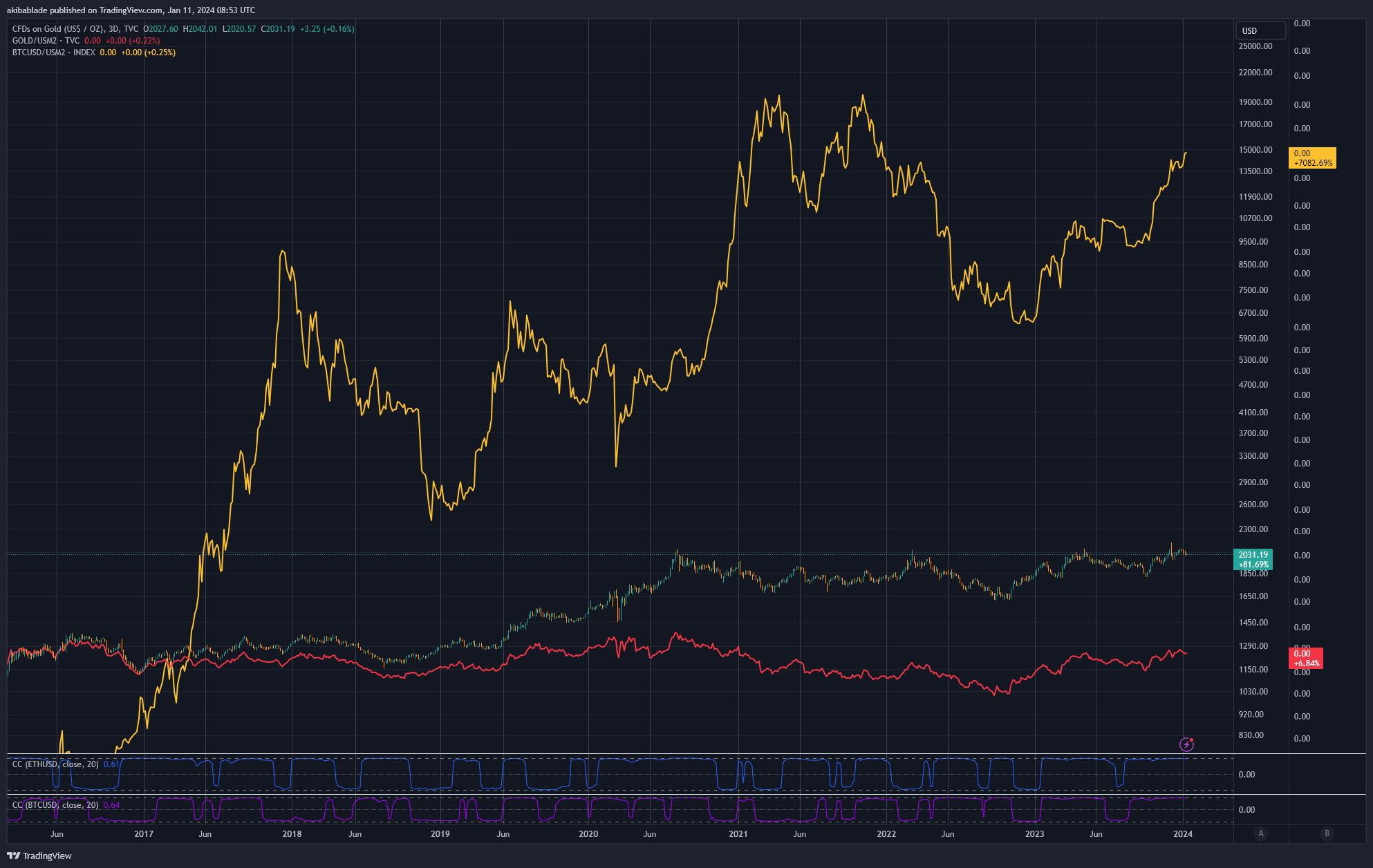

As we can’t study Bitcoin over the identical interval as it used to be no longer launched until 2009, and its rate discovery used to be highly volatile loyal by its early days, I’ve venerable 2015 – 2024 within the chart below to study Gold/M2 to Bitcoin/M2.

As you may perchance perchance well perchance also witness, Bitcoin has performed very much better than gold (7,082%) over the last decade, even accounting for the 70% expand within the need of greenbacks incorporated within the M2 offer.

On the opposite hand, no longer handiest has Bitcoin confirmed to expand even in opposition to dollar dilution, but it also has a mounted offer and tight market dynamics. Most efficient 30% of all Bitcoin in circulation has been traded inside the past twelve months.

Bitcoin’s offer is capped at 21 million cash, making it fundamentally scarce. This scarcity is a needed driver of its cost, equivalent to precious metals love gold. On the opposite hand, Bitcoin’s offer is predictably finite, in difference to gold, the put unusual reserves will even be stumbled on and mined. The introduction of the role Bitcoin ETFs is more doubtless to expand the scarcity attain.

As extra traders buy into the ETF, a portion of Bitcoin’s small offer will doubtless be locked as much as abet these investment merchandise, reducing the out there offer for traditional shopping and selling on originate markets. This diminished offer may perchance perchance also consequence in rate appreciation, in particular within the face of increasing quiz (on the total spurred by more straightforward entry by financial merchandise love ETFs). There may perchance be also a cyclical attain here whereby ETF issuers must consider baskets of shares with Bitcoin from the originate market.

Moreover, the proven truth that 70% of the present circulating offer of Bitcoin hasn’t moved in over a year signifies an ideal keeping behavior amongst present Bitcoin house owners. This keeping sample reduces the effective circulation of Bitcoin, further bettering its scarcity.

When prolonged-term holders take care of portion of an asset, any expand in quiz, equivalent to that generated by the begin of a brand unusual investment vehicle love the role Bitcoin ETFs, can get a disproportionate attain on the pricetag. There’s less offer out there to meet this unusual quiz.

This behavior contrasts with gold, the put keeping patterns are extra diverse and consist of predominant industrial and jewellery utilize, which can dampen the scarcity-pushed rate appreciation viewed in property love Bitcoin.

Thus, whereas gold has viewed exceedingly solid gains over the last twenty years, comparing its ETF-fueled progress to Bitcoin may perchance perchance also, primarily, be exceedingly underwhelming.

It’s principal to point to that quiz for Bitcoin in the case of its scarcity calm has to correlate to its quiz at the asking rate. It’s no longer going that Bitcoin will get the identical quiz at $1 million per coin as it would at $1 per coin, for instance. In my view, here’s the put the rubber meets the boulevard; at what rate does the quiz for Bitcoin replace?

Digging into the numbers – Bitcoin vs gold AUM

The day earlier than nowadays, Bitcoin traded $52 billion loyal by all exchanges at round $forty five,000 – $47,000.

Around 6.2 million BTC are within the market (they moved inside the past twelve months). Glassnode estimates round 7.9 million cash get been misplaced or are no longer going to move any time soon. Given the present circulating offer of round 19.59 million, we can thus estimate a liquid pool of between 6.2 and 11.6 million cash out there for contain.

At nowadays’s cost, this equates to round $291 to $545 billion in liquid cash within the market, or round ten times the on daily foundation quantity traded.

Thus, hypothetically, each of the 11 role Bitcoin ETFs launching nowadays would need to accomplish round $49 billion in AUM to utilize up your entire theoretical liquidity within the market.

As of Jan. 10, 2024, the cease gold ETF, GLD, has an AUM of $56 billion. Assessing the general top ETFs, SPY has $483 billion, and IVV has $396 billion.

The general cost of property below administration for all gold ETFs within the U.S. is round $114 billion.

Thus, there may perchance be largely room within the marketplace for role Bitcoin ETFs to accomplish at the 2d liquid cash, but it is miles calm an knowledgeable market, and in no longer as much as 100 days, this would perchance also become even tighter.

When analysts study the success of a job gold begin twenty years within the past with the aptitude for Bitcoin to apply suit, I judge they are frequently enormously underestimating the diversifications between gold and ‘digital gold.’

Placing it into context, if BlackRock acquires the identical AUM in Bitcoin as it has in gold (roughly $27 billion,) it’d be 5% to 9% of all liquid Bitcoin on the market. Moreover, there are at the 2d 2.35 million BTC on exchanges. So it would need to obtain 24% of replace-listed Bitcoin… at the moment prices, that’s.

Drawing on the parallels and contrasts between the historic impact of Gold ETFs and the aptitude impact of the upcoming role Bitcoin ETFs, it becomes evident that whereas the success of Gold ETFs used to be predominant, the strange attributes of Bitcoin, equivalent to its mounted offer and prevailing keeping patterns, may perchance perchance also consequence in an mighty extra profound impact on the market, accentuating the aptitude for a transformative attain a long way past what used to be noticed with gold.

Source credit : cryptoslate.com