DeFi giant Aave achieves $6M revenue in volatile market conditions

DeFi massive Aave achieves $6M revenue in unstable market stipulations

DeFi massive Aave achieves $6M revenue in unstable market stipulations DeFi massive Aave achieves $6M revenue in unstable market stipulations

The DeFi sector used to be praised for performing optimally no matter the broader market turmoil.

Cover art/illustration by CryptoSlate. Image comprises blended hiss that would possibly presumably encompass AI-generated hiss.

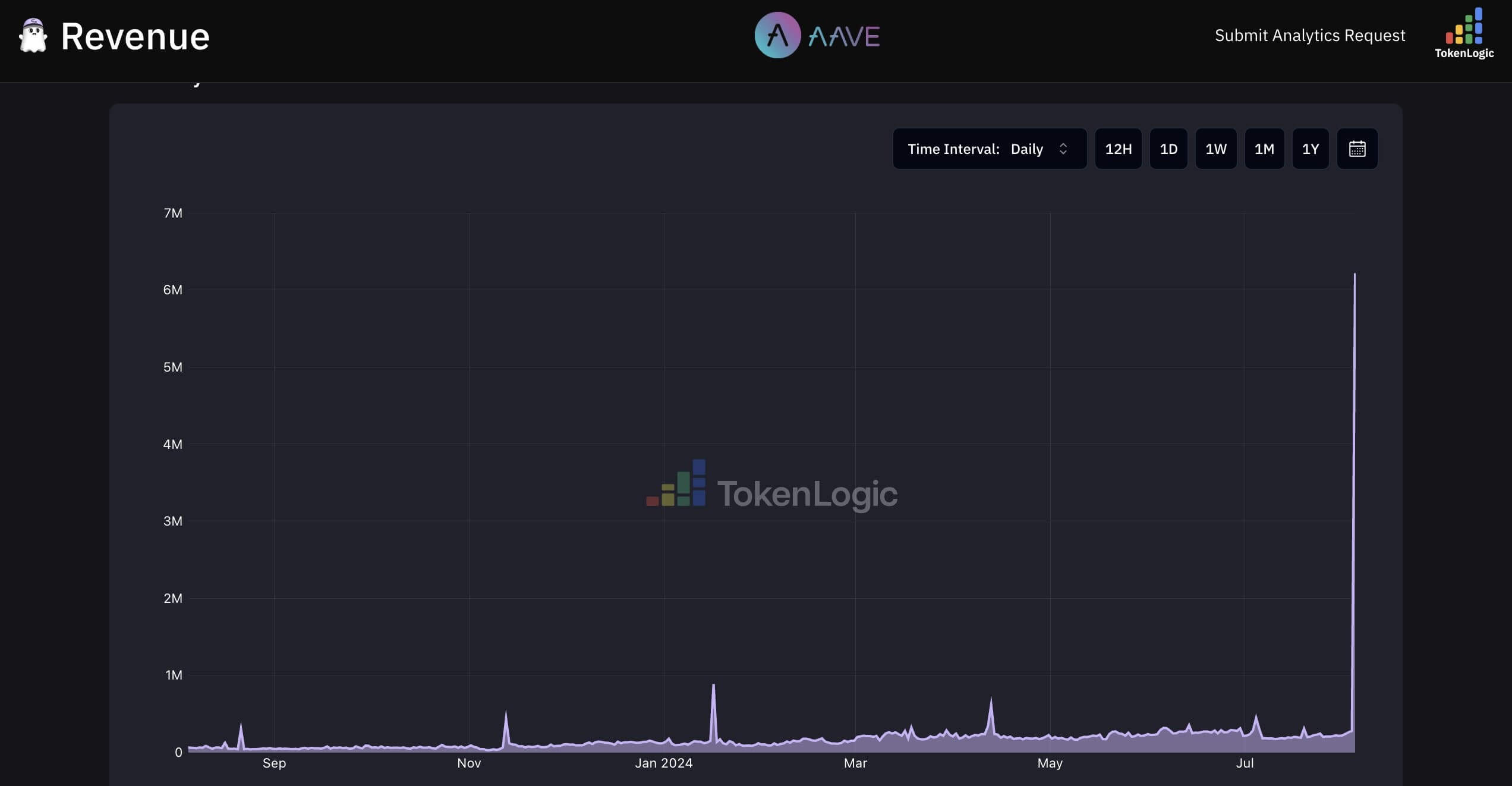

Leading DeFi platform Aave Protocol generated over $6 million in revenue right by the recent market downturn.

On-chain knowledge shows that Aave earned $802,000 from a $7.4 million wrapped Ether (WETH) liquidation, reflecting a surge in liquidation exercise on the platform. Overall, Aave V3 seen $233 million in liquidations, the protocol’s most real looking seemingly single-day resolve, per Blockanalitica.

Attributable to those critical actions, Aave Founder Stani Kulechov published that the protocol earned $6 million in only one night from facilitating liquidations. He said:

“Aave Protocol withstood market stress all the device by 14 filled with life markets on various L1s and L2s, securing $21 billion value of value. Aave Treasury used to be rewarded with $6 million in revenue in a single day from decentralized liquidations for maintaining the markets find.”

Kulechov emphasised that the protocol’s revenue from these liquidations shows its resilience and demonstrates why constructing in DeFi is critical.

Marc Zeller, the founder of Aave Chain, corroborated Kulechov’s observation and pointed out that the platform used to be thriving amid the broader market turmoil. He wrote:

“Aave protocol stays tough no depraved debt, revenue ATH & Price swap TEMP CHECK vote authorized.”

In accordance with DeFillama knowledge, Aave is the supreme crypto-lending platform in the industrial, essentially per the Ethereum network. As of press time, the general value of sources locked on the platform stood at spherical $9.8 billion.

DeFi stands solid

Aave’s tough efficiency over the last day, no matter most modern market volatility, shows a broader pattern for the length of the DeFi sector.

DeFi researcher Ignas pointed out that critical DeFi protocols functioned without effort right by the jittery market without many complaints.

In accordance with him, there contain been no critical increases in Lido’s stETH withdrawal queue, and liquid staking asset sources experiencing minimal depeggingâwith weETH falling by 1%, ezETH by 0.6%, and stETH by 0.4% from ETH.

He furthered that even supposing ETH gasoline charges spiked to 370 gwei, they've since stabilized spherical 20 gwei. Furthermore, there are no longer any critical liquidation dangers for DeFi except ETH falls to $1,771 or WBTC to $31,000.

Talked about listed right here

Source credit : cryptoslate.com