DeFi platforms Lido and Aave surpass Bitcoin and Ethereum in fee generation

DeFi platforms Lido and Aave surpass Bitcoin and Ethereum in rate generation

DeFi platforms Lido and Aave surpass Bitcoin and Ethereum in rate generation DeFi platforms Lido and Aave surpass Bitcoin and Ethereum in rate generation

Lido and Aave are amongst the head 3 DeFi protocols within the crypto exchange.

Quilt art work/illustration by technique of CryptoSlate. Image contains blended bellow material that will encompass AI-generated bellow material.

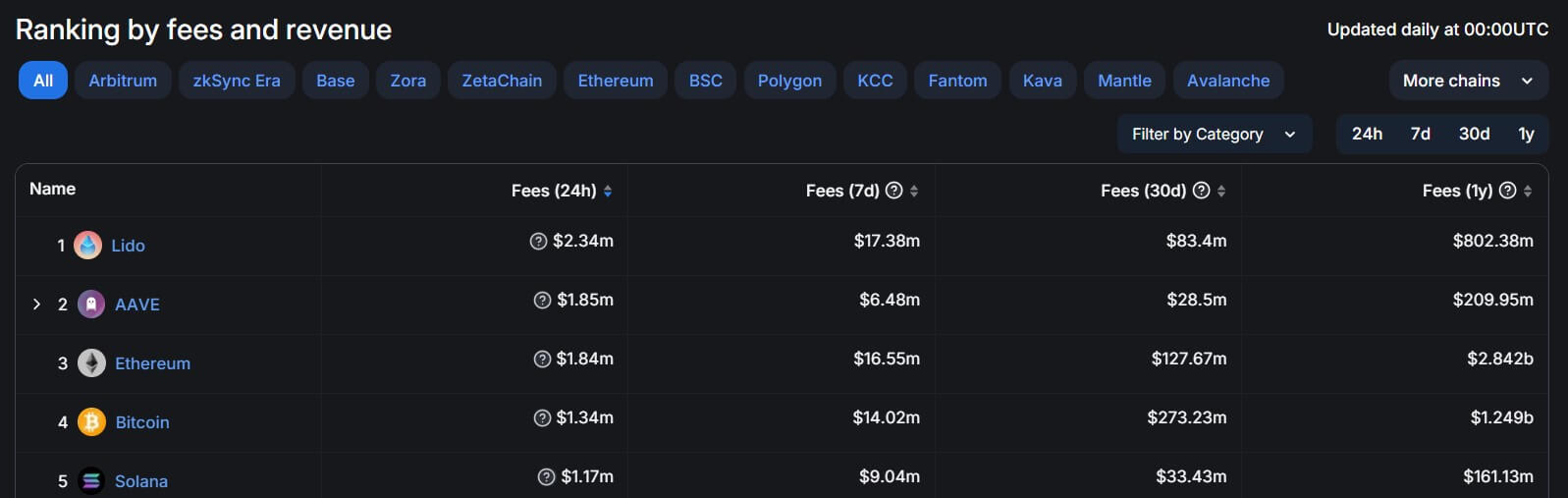

Decentralized finance initiatives Lido and Aave generated more costs within the final 24 hours than top blockchain networks esteem Bitcoin, Ethereum, and Solana.

In accordance with DeFillama recordsdata, Lido accrued $2.34 million, while Aave accrued $1.85 million throughout this era. In difference, Ethereum, Bitcoin, and Solana secured $1.84 million, $1.34 million, and $1.17 million, respectively, in costs.

Market observers outlined that the associated rate surge reflects crypto users’ willingness to engage with these platforms over frail blockchain networks.

Why invent other people consume Aave?

The Bank for Global Settlement (BIS) outlined that crypto merchants consume DeFi lending pools esteem Aave to seem yield.

BIS acknowledged:

“This enact is particularly stable for retail users and has been bolstered by the ‘low-for-long’ passion charge atmosphere in evolved economies.”

Given its sizable adoption, Aave Labs, the entity within the succor of the DeFi lending platform, these days unveiled a strategic roadmap 2030 that introduces numerous key initiatives, including launching Aave V4, a contemporary visual identity, and expanded DeFi functionalities.

In the intervening time, Marc Zeller, founder of the Aave Chan Initiative, these days immediate that the protocol is gearing up to implement a rate switch to stimulate engagement and funding in its ecosystem.

This characteristic in actuality permits platforms to immediate or deactivate sure user costs. In the case of Aave, it will lead to the redistribution of costs generated from transactions to platform participants, especially Aave holders and stakers.

DeFiLlama recordsdata reveals that Aave is the ideal lending protocol, with over $10 billion value of sources locked.

Lido’s dominance

Lido is a decentralized self reliant group (DAO) that provides a liquid staking retort for numerous proof-of-stake blockchain networks, esteem Ethereum.

The protocol lets users pool and stake their sources on these blockchain networks to blueprint up to a pair% APR rewards. Lido accounts for round 28.5% of staked Ethereum, making it the ideal DeFi protocol. In accordance with DeFillama recordsdata, its total price locked is approximately $28 billion.

In the intervening time, Lido’s market dominance is below heavy competition from the radical restaking belief led by EigenLayer.

Talked about on this text

Source credit : cryptoslate.com