Yield strategies in DeFi: From staking to recursive lending

Yield systems in DeFi: From staking to recursive lending

Yield systems in DeFi: From staking to recursive lending Yield systems in DeFi: From staking to recursive lending

The DeFi region is successfully-acknowledged for its yield opportunities, offering revolutionary mechanisms which would per chance well be entirely unique to the financial world. From staking to recursive lending, each and every approach comes with its possess space of rewards and dangers. This article offers an in-depth admire at these yield-skills systems

Duvet art/illustration by project of CryptoSlate. Image involves mixed grunt material which would per chance well also merely consist of AI-generated grunt material.

The following is a guest article from Vincent Maliepaard, Advertising Director at IntoTheBlock.

Staking

Staking is a basic yield skills approach in DeFi. It entails locking a blockchainâs native tokens to real the network and validate transactions, incomes rewards in transaction charges and extra token emissions.

The rewards from staking fluctuate with network activityâthe higher the transaction volume, the higher the rewards. Nonetheless, stakers can possess to nonetheless be wide awake of dangers comparable to token devaluation and network-notify vulnerabilities. Staking, while in most cases stable, requires an intensive working out of the underlying blockchainâs dynamics and possible dangers.

Shall we squawk, some protocols, love Cosmos, require a notify release length for stakers. This implies that after youâre withdrawing your sources from staking, you wonât be ready to if reality be told transfer your sources for a 21-day length. For the length of this time, you are nonetheless area to mark fluctuations and canât spend your sources for other yield systems.

Liquidity Providing

Liquidity offering is one more procedure of generating yield in DeFi. Liquidity suppliers (LPs) customarily make a contribution an equal mark of two sources to a liquidity pool on decentralized exchanges (DEXs). LPs draw charges from each and every alternate performed within the pool. The returns from this approach rely on buying and selling volumes and rate tiers.

High-volume pools can generate tall charges, nevertheless LPs can possess to nonetheless be responsive to the menace of impermanent loss, which occurs when the mark of sources in the pool diverges. To mitigate this menace, traders can resolve stable pools with highly correlated sources, making sure extra consistent returns.

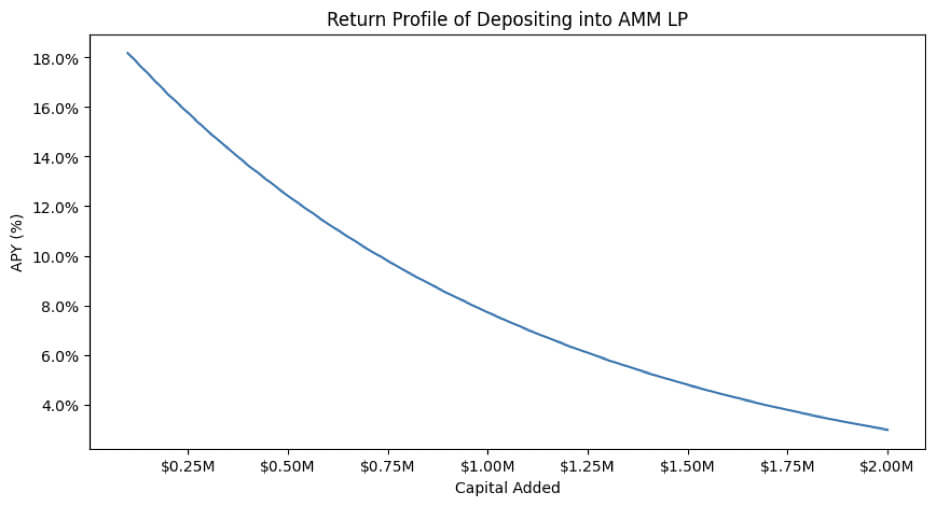

It's some distance moreover fundamental to remember that the projected returns from this approach are as we pronounce dependent on the total liquidity in the pool. In other words, as extra liquidity enters the pool, the expected reward decreases.

Lending

Lending protocols offer a straightforward but effective yield-skills procedure. Users deposit sources, which others can borrow in exchange for paying ardour. The eagerness rates fluctuate in step with the availability and inquire for the asset.

High borrowing inquire will increase yields for lenders, making this a lucrative option for the length of bullish market prerequisites. Nonetheless, lenders must put in mind liquidity dangers and possible defaults. Monitoring market prerequisites and utilizing platforms with tough liquidity buffers can mitigate these dangers.

Airdrops and Parts Systems

Protocols customarily spend airdrops to distribute tokens to early customers or these that meet notify criteria. More lately, parts programs possess emerged as a unique procedure to be obvious these airdrops trudge to notify customers and contributors of a notify protocol. The conception is that particular person behaviors reward customers with parts, and these parts correlate to a notify allocation in the airdrop.

Making swaps on a DEX, offering liquidity, borrowing capital, or even fair correct the utilization of a dApp are all actions that would in most cases draw you parts. Parts programs provide transparency nevertheless are by no procedure a fool-proof procedure of incomes returns. Shall we squawk, essentially the latest Eigenlayer airdrop became restricted to customers from notify geographical areas and tokens were locked upon the token skills tournament, sparking debate among the many community.

Leverage in Yield systems

Leverage shall be venerable in yield systems love staking and lending to optimize returns. Whereas this might increase returns, it moreover will increase the complexity of a procedure, and thus its dangers. Let’s admire at how this works in a notify assert: lending.

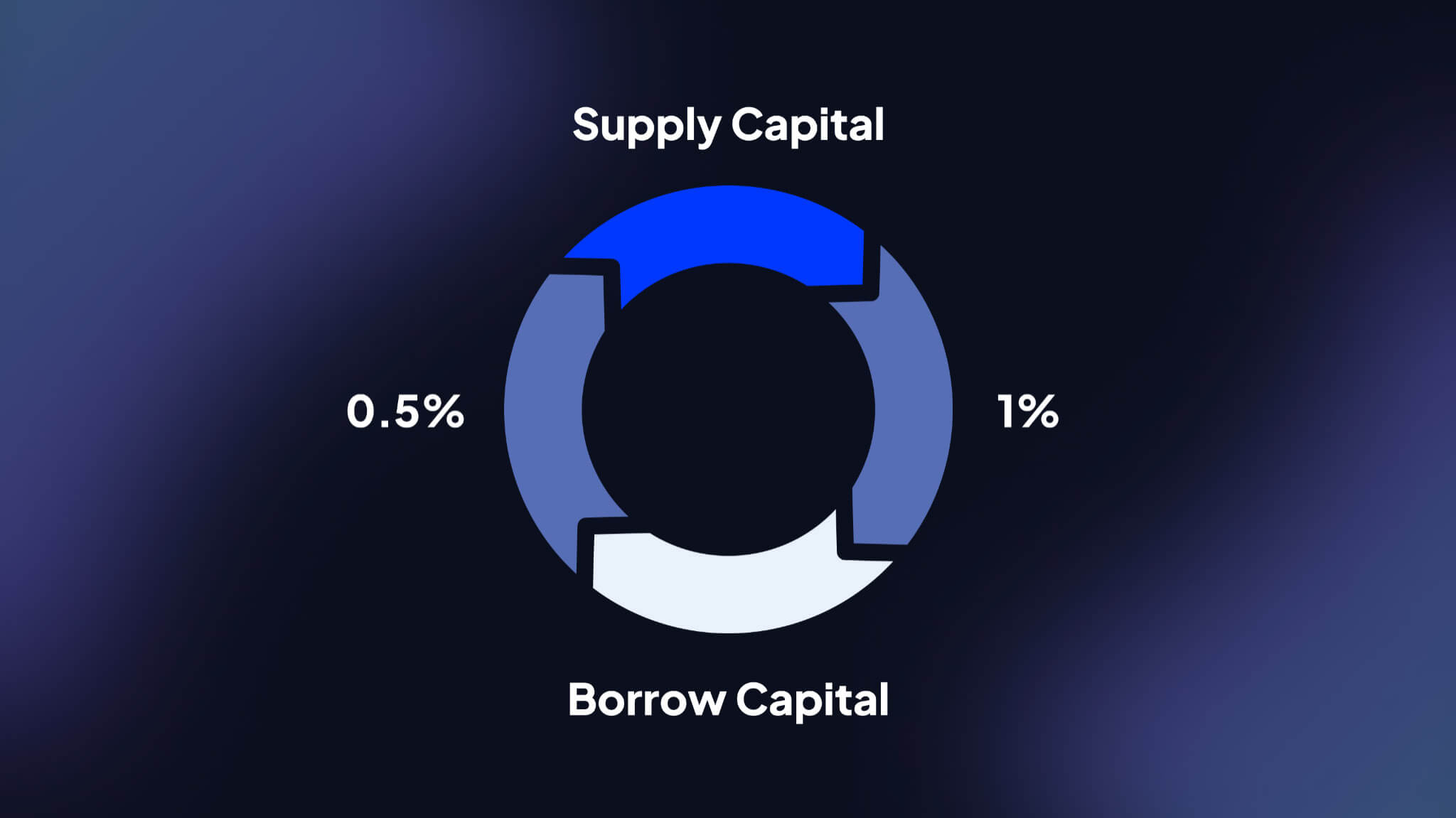

Recursive lending capitalizes on incentive buildings within DeFi lending protocols. It entails repeated lending and borrowing of the identical asset to accrue rewards equipped by a platform, vastly bettering the final yield.

Hereâs how it works:

- Asset Provide: Before all the pieces, an asset is equipped to a lending protocol that offers higher rewards for supplying than the costs associated with borrowing.

- Borrow and Re-Provide: The identical asset is then borrowed and re-equipped, creating a loop that will increase the preliminary stake and the corresponding returns.

- Incentive Capture: As each and every loop is finished, extra governance tokens or other incentives are earned, increasing the total APY.

Shall we squawk, on platforms love Moonwell, this approach can transform a offer APY of 1% to an efficient APY of 6.5% once extra rewards are integrated. Nonetheless, the approach entails indispensable dangers, comparable to ardour rate fluctuations and liquidation menace, which require continuous monitoring and administration. This makes systems love this one extra factual for institutional DeFi people.

The style ahead for DeFi & Yield Alternatives

Unless 2023, DeFi and ragged finance (TradFi) operated as separate silos. Nonetheless, increasing treasury rates in 2023 spurred a inquire for integration between DeFi and TradFi, resulting in a wave of protocols coming into the âstaunch-world assetâ (RWA) region. Precise-world sources possess essentially equipped treasury yields on-chain, nevertheless unique spend cases are emerging that leverage blockchainâs odd traits.

Shall we squawk, on-chain sources love sDAI operate gaining access to treasury yields more uncomplicated. Main financial establishments love BlackRock are moreover coming into the on-chain economy. Blackrockâs BUIDL fund, offering treasury yields on-chain, gathered over $450 million in deposits within about a months of launching. This signifies that the long urge of finance is more seemingly to develop into an increasing selection of on-chain, with centralized firms deciding whether to give companies and products on decentralized protocols or thru permissioned paths love KYC.

This article is in step with IntoTheBlockâs most latest analysis paper on institutional DeFi. It's possible you'll well learn the fleshy portray here.

Mentioned listed here

Source credit : cryptoslate.com