Why ETFs are not having positive effect on Bitcoin price, yet

Despite the influx of big capital into these new station Bitcoin ETFs, with CoinShares reporting $1.18 billion in inflows into digital asset ETFs globally final week, the anticipated definite impact on Bitcoin’s label hasn’t materialized. This raises questions regarding the underlying mechanics of these ETFs and their impact on Bitcoin’s payment.

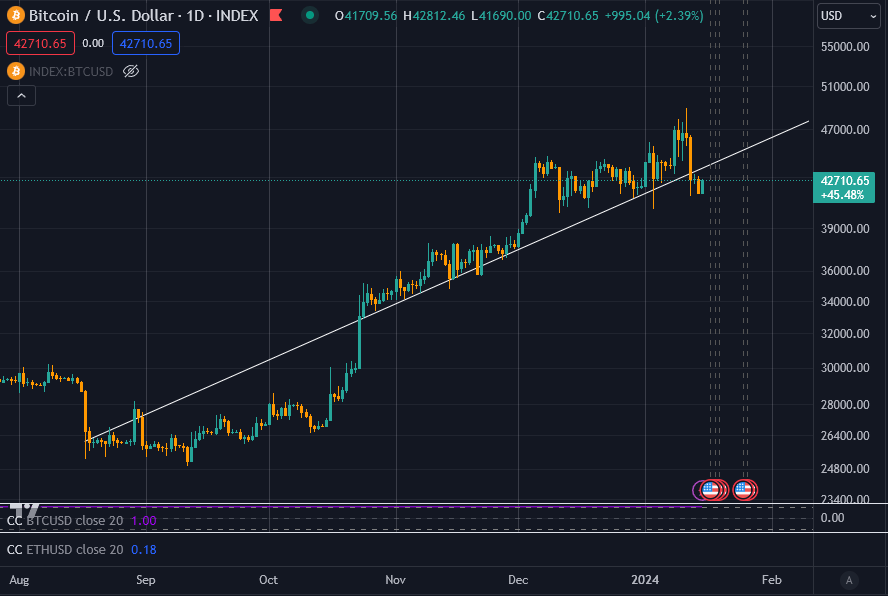

Let’s first be definite we accurately frame the arena. The most stylish label bustle-up picked up steam when BlackRock announced their submitting for a station Bitcoin ETF on June 15, 2023. At that time, Bitcoin’s label used to be round $25,000. Therefore, there used to be a 70% amplify to round $42,000, where it no doubt traded sideways.

Because the ETFs launched, Bitcoin spiked to $49,000 but supplied off all of a sudden to round $42,000. Looking at the chart, it’s rational to counsel that possible Bitcoin used to be overbought at above $44,000 for this level within the cycle.

With that in suggestions, let’s survey at how Bitcoin purchases work in terms of the lately sanctioned station Bitcoin ETFs.

How Bitcoin is valued for ETF applications.

The operation of station Bitcoin ETFs is extra complex than it looks. When folks buy or sell shares of an ETF, just like the one supplied by BlackRock, Bitcoin is now now not supplied or supplied in right time. As a substitute, the Bitcoin that represents the shares is bought in any case a day earlier.

The ETF issuer creates shares with cash, which is then customary to possess Bitcoin. This indirect mechanism manner that recount transfers of Bitcoin between ETFs accomplish now now not occur. Therefore, the impact on Bitcoin’s label is delayed and doesn’t replicate right-time buying and selling bid.

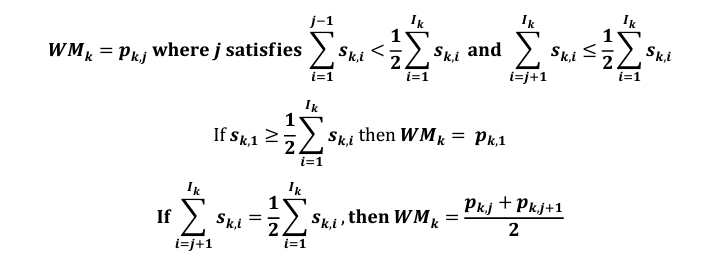

In actuality, with an ETF like BlackRock’s, the percentage label on any given day is meant to indicate the average label for Bitcoin across customary buying and selling hours, now now not the live label of Bitcoin at any given time. Most ETFs employ ‘The CF Benchmarks Index’ to calculate the price of Bitcoin for any given day; the CF Benchmarks internet characteristic describes it as;

“The CME CF Bitcoin Reference Price (BRR) is a as soon as a day benchmark index label for Bitcoin that aggregates exchange data from extra than one Bitcoin-USD markets operated by predominant cryptocurrency exchanges.”

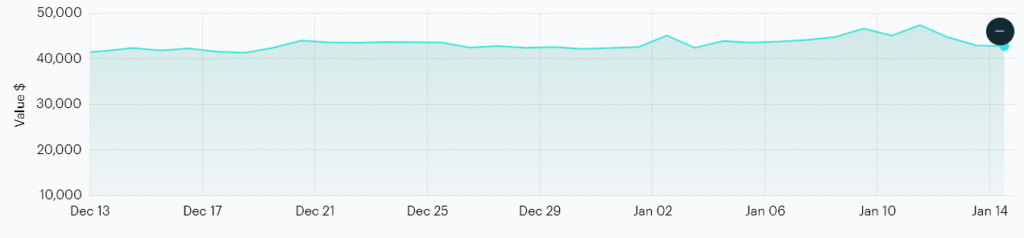

It makes employ of a median label across Bitstamp, Coinbase, Gemini, Itbit, Kraken, and LMAX Digital. Per CF Benchmarks, here’s what the price of Bitcoin looks like. Set a question to its most stylish excessive used to be $47,525 on Jan. 11.

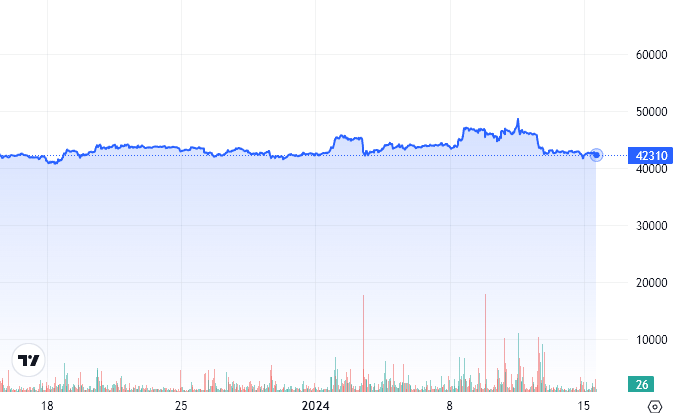

Right here is the identical length and Y-axis scale the employ of CryptoSlate data on a 1-hour timeframe. As of press time, Bitcoin is price $42,594.27, in accordance with CF Benchmarks, whereas CryptoSlate has it at $42,332.35 in right-time. This suggests the station ETF, which is now now not available at this time time because it’s a public holiday within the U.S., is buying and selling at a gash price to station Bitcoin ETFs.

I’ll be horny: I didn’t deem this used to be what would occur when the ETFs launched. I humbly believed that the ETFs would in actuality note the price of Bitcoin, and institutions would buy and sell BTC relative to the traded ETF shares. How depraved and naive I used to be.

I learn thru the S1 filings intensive but didn’t rob into consideration that the underlying Bitcoin would be supplied doubtlessly days later thru closed-door trades for average prices. I took it for granted that the CF Benchmark Index label would be a live combination label. Seriously, that does exist, and it’s known as the BRTI. Nonetheless, here’s greatest customary for ‘reference’ applications, now now not to calculate exchange prices.

How Bitcoin will get into an ETF.

Right here’s how Bitcoin is in overall traded across the different station Bitcoin ETFs.

Licensed Contributors comparable to Goldman Sachs, Jane Road, and JPMorgan Securities build their creation orders for baskets of shares with a ‘Switch Agent, Cash Custodian, or Prime Execution Agent’ by a region time on any customary industry day. Right here’s 2 pm for Grayscale, whereas BlackRock has a 6 pm gash-off time.

Following this, the Sponsor (ETF) is accountable for determining the total basket Web Asset Keep (NAV) and calculating any prices. This route of is mostly done as soon as practicable; as an instance, with Grayscale, it’s 4 pm; for BlackRock, it’s 8 pm, Novel York time. Proper timing here is an crucial for guaranteeing the lawful valuation of the hampers in accordance to the day’s closing market data.

That it’s essential to possess considered phrases comparable to T+1 and T+2 floating round touching on ETFs. The term “T+1” or “T+2” refers back to the settlement dates for these transactions. “T” stands for the transaction date, the day the repeat is placed. “T+1” manner the transaction will likely be settled the following industry day after the repeat is placed, whereas “T+2” indicates settlement occurring two days later.

With the station Bitcoin ETFs, a liquidity provider transfers the total basket quantity in Bitcoin to the Trust’s vault balance on either the T+1 or T+2 date, reckoning on the remark prospectus. This reportedly ensures the transaction aligns with customary monetary market practices for settling trades.

The execution and settlement of the Bitcoin possess and its switch into the Trust’s buying and selling wallet customarily occur on T+1, now now not when the ETF shares are bought.

OTC Trading and its implications

A an crucial aspect of this mechanism is the Over-The-Counter (OTC) buying and selling eager. Trades are performed between institutional gamers in a interior most surroundings, a long way from public exchanges. While circuitously influencing market prices, these transactions region a precedent for alternate prices.

Thunder institutions, comparable to BlackRock, agree on a decrease label for Bitcoin at some level of these OTC trades. If that is so, it will in a roundabout diagram impact the market label if that data turns into available to the public or market makers. It doesn’t, nevertheless, possess an impact on the live label of Bitcoin as these trades aren’t added to the global blended repeat e-book. They are no doubt find-to-find interior most trades.

Further, in accordance to the CF Benchmark Index pricing methodology, if Bitcoin had been to exchange at, command, $42,000 all day but then rally into shut to $50,000 within the closing minutes of the day, the CF index label would likely be effectively beneath essentially the most stylish station label reckoning on volume (and other sophisticated calculations made by CF Benchmarks.)

This would then imply the NAV would be calculated in accordance to a decrease label than the station label, and any creations or redemptions for the following day would occur OTC, aiming to be as shut to NAV as doable.

Any market makers who possess secure entry to to these OTC desk trades are then now now no more likely to deserve to exchange Bitcoin at essentially the most stylish station label of $50,000, doubtlessly casting off liquidity at these increased prices and thus bringing the station label assist in accordance to the NAV of the ETFs. In the short term, the ETF NAVs could well possible play an extraordinary extra important characteristic in defining the station Bitcoin label and, therefore, gash volatility in direction of a smoother average label.

Nonetheless, these trades must light occur on the blockchain, necessitating the switch of Bitcoin between wallets. This bound, especially among institutional wallets, will became extra and extra important for market diagnosis.

As an illustration, Coinbase Prime’s hot wallet facilitates trades, whereas institutions’ frigid storage wallets are customary for longer-term holding and could well possible moreover be analyzed on platforms like Arkham Intelligence.

I imagine the extra clear these OTC trades can became, the easier for all market participants. Nonetheless, the visibility of these activities is at exhibit unbiased a minute opaque, one thing the SEC seemingly believes is ‘most efficient’ for consumers.

A present crunch is coming for Bitcoin ETFs.

Yet, these desks don’t possess an a lot of present of Bitcoin; it isn’t gold or cash. This limitation turns into even extra relevant when brooding regarding the total liquid Bitcoin available, estimated to be between 6.2 and 11.6 million cash, or round $400 billion. As ETFs develop and the available Bitcoin present tightens, OTC desks will likely be forced to possess Bitcoin from the initiate market, doubtlessly impacting prices.

A important part of Bitcoin remains unmovable, locked in long-term holdings or misplaced wallets. Over time, this scarcity of liquid Bitcoin could well possible impact market dynamics critically. Samsom Mow believes this is in a position to well possible also be even extra forthcoming than I deem.

By comparing the influx of Bitcoin into ETF in opposition to the issuance thru mining, he argues that Bitcoin could well possible fly to $1 million within weeks. I deem there’s too unprecedented liquidity within the markets unbiased correct now for this to occur, but a man can dream.

Grayscale’s Bitcoin holdings and payment construction are essential in this ecosystem. With its increased prices (1.5%) when put next with competitors (~0.2%), any redemptions from Grayscale could well possible open Bitcoin into the OTC market, influencing average prices and market dynamics.

There could be round $29 billion Bitcoin in Grayscale ready to be supplied into other Bitcoin ETFs; that’s rather a few liquidity. This interplay between different ETFs and their pricing mechanisms accentuates the complex nature of Bitcoin’s market.

Final suggestions and person ‘protection.’

The most stylish market direct, with important inflows into Bitcoin ETFs but no proportional amplify in Bitcoin’s label, is attributed to the delayed and averaged pricing mechanism of ETF buying and selling. This phenomenon, coupled with institutional gamers running beneath different suggestions, raises questions about market efficiency and doable’ manipulation.’

Gary Gensler worked ‘tirelessly’ to salvage definite consumers had been protected when investing in any Bitcoin-related product. I’m definite glad that these ETFs are so clear and clear, with out a possibility for label fixing within the assist of closed doors, and that every thing is out within the initiate find it irresistible’s on the clear, initiate ledger that is Bitcoin…

The 11+ 100-page ETF prospectuses succinctly disclose all facets of how investing in Bitcoin works beneath Gary Gensler. Coupled with the T+1 CF Benchmark Index averaged pricing for share basket creation and redemption, the price of investing in Bitcoin has to be safer and extra easy than ever… unbiased correct?

Sarcasm aside, here’s how regulated ETFs work; the station Bitcoin ETFs must now not any different from an identical merchandise, and I deem these that employ them realize what they are investing in.

Indirectly, the finite nature of Bitcoin (21 million cash) coupled with the halving occasions and market liquidity means that important label impact from ETFs could well possible continue to be delayed, but now now not with out a extinguish in sight. For retail consumers, holding Bitcoin could well possible impact markets by limiting the provision of Bitcoin for institutional purchases.

This scarcity could well possible force ETFs and institutional gamers to source Bitcoin from the initiate market, doubtlessly riding up prices.

The comparison to the GameStop’ Mom of all short squeezes’ comes to suggestions to spotlight the doable energy of collective retail action. True as shareholders had been encouraged now now not to sell their shares to short sellers, Bitcoin holders could well possible impact the market by now now not promoting their cash to ETFs. As assets beneath administration (AUM) in these ETFs amplify and the liquid Bitcoin present diminishes, the market could well possible shift critically.

In summary, whereas OTC buying and selling and averaged pricing mechanisms at exhibit dominate the scene, the evolving panorama means that the finite present of Bitcoin and the increasing query from ETFs could well possible consequence in essential market shifts.

“Hodling” Bitcoin in overall is a strategic ride, now better than ever, influencing the provision and pricing of Bitcoin to institutional consumers who could well possible soon bustle out of cash to possess at these ‘average’ prices.

Substitute: Clarification on CF Benchmarks Index reference payment.

The U.S. station Bitcoin ETFs employ the Novel York variant of the BRR, the BRRNY. This payment is identical to the BRR but “calculated as of 4:00 p.m. Eastern time (“ET”), whereas the BRR is calculated as of 4:00 p.m. London time.”

Source credit : cryptoslate.com