What you need to know about Bitcoin staking

What you ought to find out about Bitcoin staking

What you ought to find out about Bitcoin staking What you ought to find out about Bitcoin staking

Platforms love Lombard and Babylon are spearheading the innovative landscape of Bitcoin staking through Liquid Staking Tokens, transforming how BTC holders can produce rewards.

Duvet art/illustration by means of CryptoSlate. Image involves blended snort that will also embrace AI-generated snort.

The next is a guest post by Vincent Maliepaard, Marketing and marketing Director at IntoTheBlock.

In case you first hear about Bitcoin staking, you must maybe also judge thereâs a mistake, given Bitcoin’s Proof of Work (PoW) mechanism. On the opposite hand, Bitcoin staking is indeed a actuality, with hundreds of addresses taking part and generating returns on their belongings. Hereâs what you ought to know.

Bitcoin Staking Explained

Staking historically refers again to the approach where holders of a cryptocurrency lock up their funds to participate in network operations, corresponding to transaction validation on Proof of Stake (PoS) blockchains. Bitcoin, alternatively, operates on a PoW consensus mechanism, which would now not natively strengthen staking. This dynamic has modified with the introduction of Bitcoin staking through platforms offering Bitcoin-primarily based mostly Liquid Staking Tokens (LSTs). These platforms allow BTC holders to engage in staking actions sooner or later.

EigenLayer, Babylon, and AVS’s

On Ethereum, the theorem that of “restaking” modified into presented in 2023 with EigenLayer, which acquired critical traction by mid-2024, reaching a complete payment locked (TVL) of over $20 billion in June. In most cases, staking ETH helps actual the Ethereum network, rewarding stakers in return. EigenLayer extends this plan by permitting users to “restake” their ETH to actual extra companies and products, incomes extra rewards.

Before all the pieces coined as Active Validated Products and companies (AVS) on Eigenlayer, these functions by utterly different terms looking on their associated (re)staking platform. AVSs are functions or companies and products that could maybe even be secured with restaked ETH. This plan is now being extended to the Bitcoin blockchain and BTC-pegged tokens. Babylon is main this effort, constructing an architecture that enables functions to leverage Bitcoin’s crypto-financial security. Meanwhile, on the Ethereum side, Symbiotic and rapidly Eigenlayer are restaking protocols accepting tokens corresponding to Wrapped Bitcoin (WBTC) as collateral to enhance functions that study to procure the most of these belongings for enhanced security.

Working out Bitcoin Staking

In Bitcoin staking, users deposit their BTC true into a staking protocol and receive Liquid Staking Tokens (LSTs) in return. These LSTs signify the staked BTC nonetheless on the total offer enhanced liquidity and other functionalities. This allows contributors to engage in DeFi actions without sacrificing staking rewards.

Presently, the most in vogue Bitcoin LST is LBTC, originating from the Lombard protocol. Here’s a breakdown of the device in which it if truth be told works:

- How LBTC is Created: To mint LBTC, users ship their BTC to particular addresses linked to the Babylon protocol. This circulation creates LBTC on Ethereum, acting as a placeholder for the Bitcoin you despatched.

- What Occurs to the BTC: The express BTC despatched is held securely inner Babylon protocolâs contracts. Presently, this BTC isn’t being utilized or accessible, alternatively it remains safely saved.

- Rewards for Depositors: While the BTC is held in reserve, depositors are rewarded with components from each the Babylon and Lombard systems as an incentive for his or her participation.

- The Future Device: The aim is to in a roundabout device use the BTC held by Babylon’s contracts to actual a broader ecosystem. This could maybe obtain permitting utterly different apps and chains to procure the most of this BTC to actual their networks whereas declaring a connection to the most critical Bitcoin network.

Main Protocols in Bitcoin Staking

Numerous protocols possess emerged as frontrunners within the Bitcoin staking area:

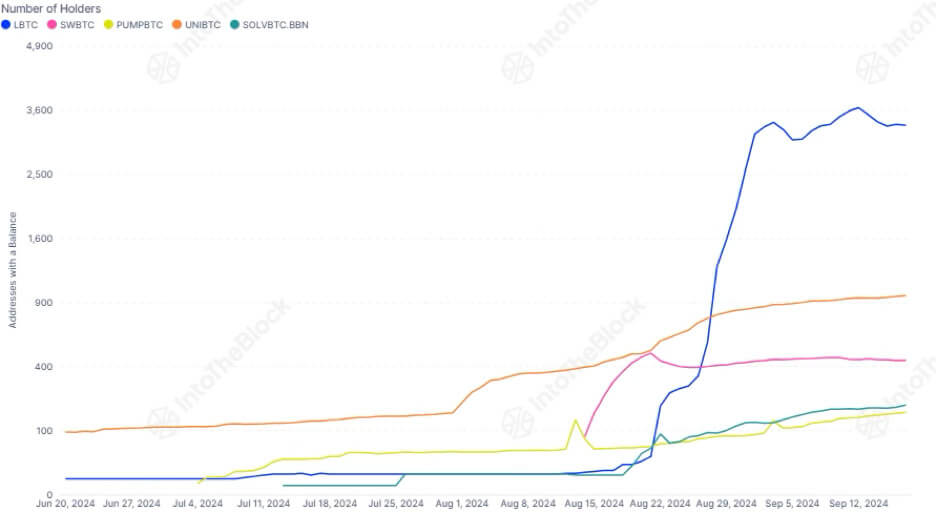

- Lombard Staked BTC (LBTC): As a frontrunner on this market, LBTC has seen its market cap develop seriously, now sitting at $300 million with over 3,000 holders.

- UniBTC: UnitBTC secured a big assortment of holders early on. While LBTC has surpassed it, it tranquil ranks second with roughly 1000 holders.

- Swell BTC (SWBTC): SWBTC had a solid open and regarded more likely to surpass uniBTC. On the opposite hand, boost has slowed down and it currently ranks third with spherical 440 holders.

Is Bitcoin Staking the Future of Bitcoin yield?

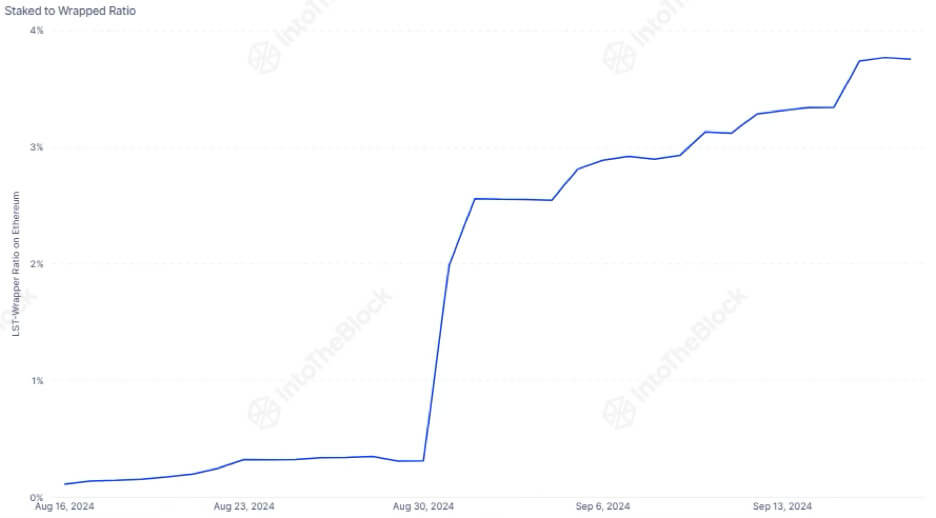

Bitcoin staking has seen a solid open, with hundreds of holders already incomes components through main protocols. Presently, staked Bitcoin represents 3.75% of all wrapped Bitcoin, indicating there is tranquil lots of room for boost within the arrival months.

The theorem that is promising, nonetheless its long-term success will rely upon whether the economics of staking procure sense previous the preliminary level rewards. The predominant part could maybe maybe be the attain of companies and products constructed on top of these protocols. If a sturdy ecosystem of companies and products develops, Bitcoin staking could maybe maybe turn into one of the important enticing yield alternatives for Bitcoin holders.

Source credit : cryptoslate.com