What happened to PayPal stablecoin PYUSD after last year’s launch?

PayPal’s entrance into the stablecoin market on Aug. 7, 2023, used to be welcomed by many within the industry, with Circle CEO Jeremy Allaire stating that opponents from PayPal used to be ‘mighty to have.’

The facts of the open led to a modest 4% upward push within the price of Bitcoin, and within days, exchanges have been offering low-fee promotional opportunities for traders gripping to use PayPal’s PYUSD. Ahead of the pause of August, Coinbase, Kraken, and HTX had listed the stablecoin, including Venmo crimson meat up appropriate a month later.

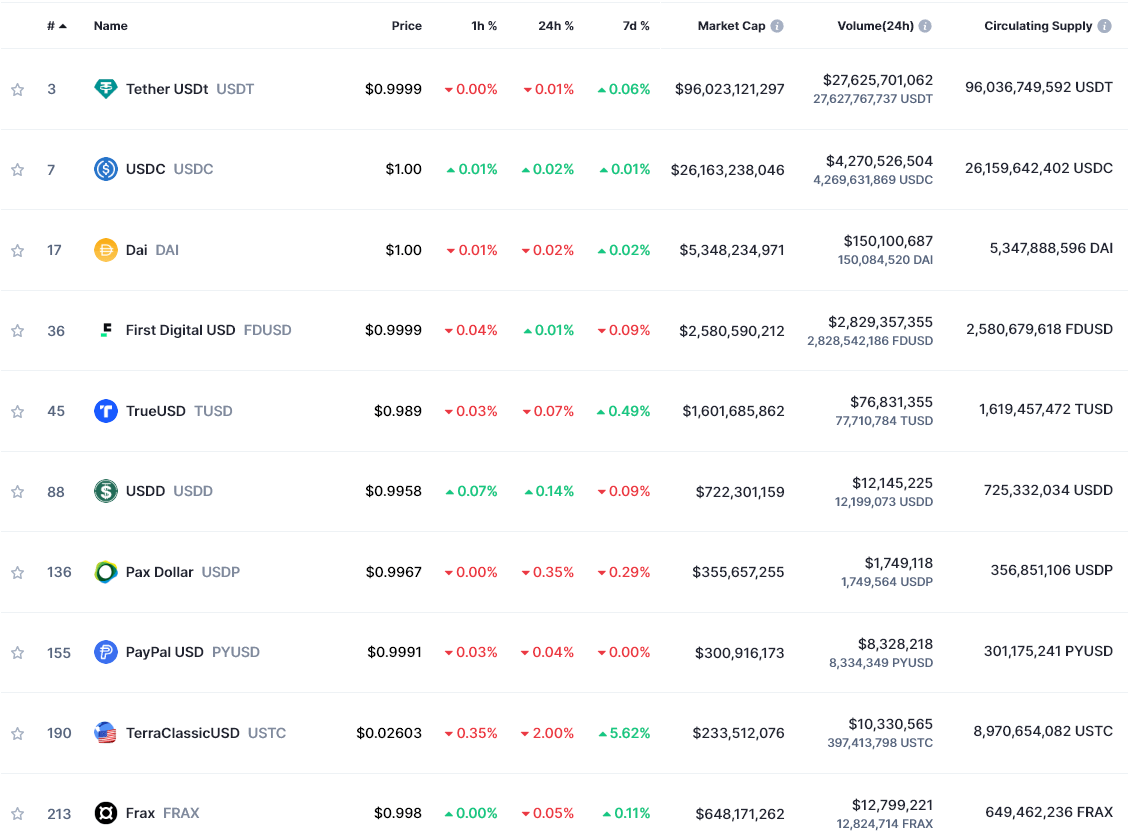

Five months after its open, PYUSD has now claimed the number eight space by market cap within the realm stablecoin charts, having captured the $300 million ticket around Jan. 22. However, PYUSD drops to eleventh general when ordered by quantity, with appropriate $10 million in 24-hour alternate quantity. This locations it splendid a puny earlier than UST Classic, which, with a ticket 98% off its at the originate intended $1 peg, traded appropriate $500,000 less over the final day.

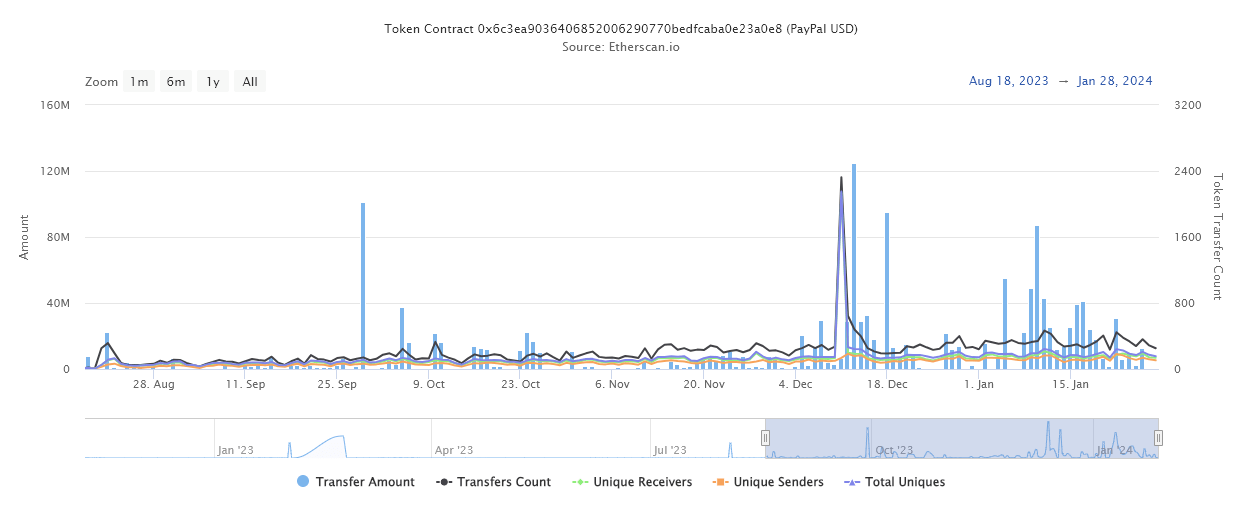

Nonetheless, PayPal’s PYUSD climb to $300 million in price locked in five months is spectacular. As properly as to an salvage bigger in market cap, the token has viewed in vogue on-chain exercise, with a modest 200 – 400 transactions per day.

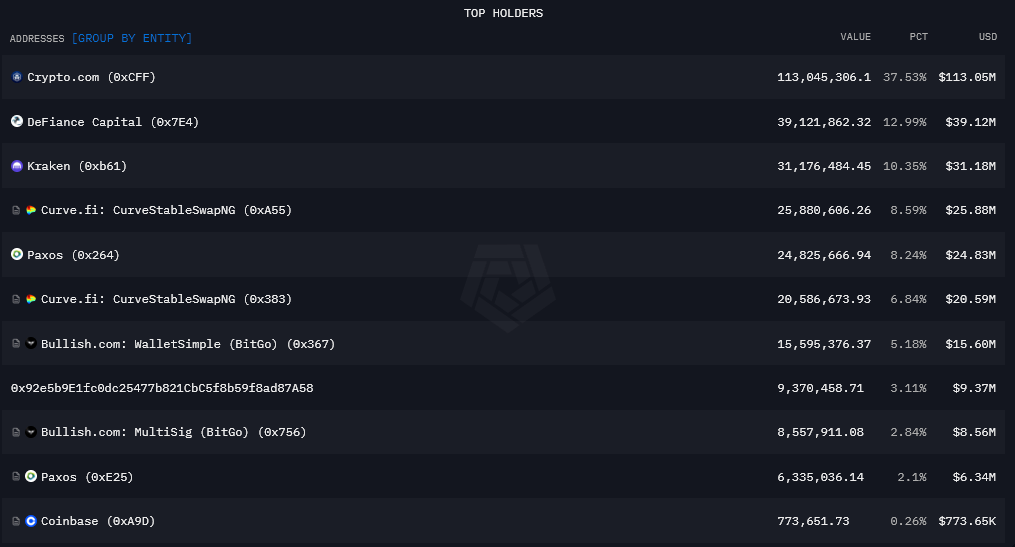

However, PYUSD has yet to destroy into the DeFi landscape in any meaningful diagram, as the below table and plot highlight. The majority of the PYUSD liquidity sits on centralized exchanges, with Crypto.com being the largest single holder of the token at $113 million, appropriate over one-third of the total market cap.

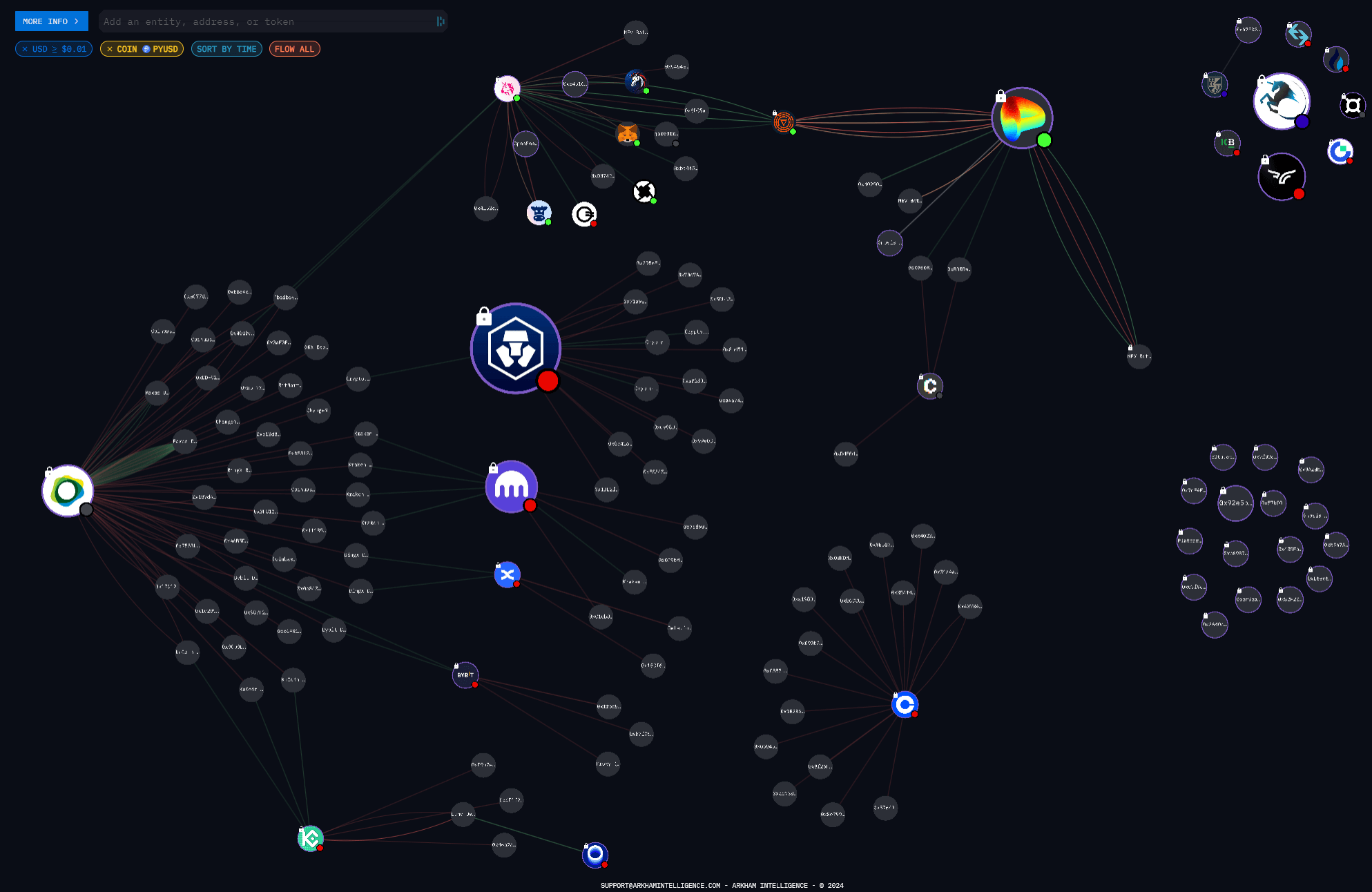

The visualization below depicts the transactions between essential entities solely for PYUSD. Entities with more sizable PYUSD holdings are confirmed greater than these with smaller portions. The entities without a emblems on the a long way true are unknown wallets keeping above $30,000. The emblems within the tip true depict industry entity tokens, likely treasury holdings.

Apparently, there are several connections between PYUSD issuer Paxos, Uniswap, and Curve. But, these entities attain now not then hyperlink into the essential exchanges, suggesting the DeFi and CEX ecosystems for PYUSD are wholly separate.

Whereas PayPal used to be subpoenaed by the SEC when PYUSD had half the original market cap, it used to be reported to have complied with requests, and puny has been heard on the topic since. The announcement of the submitting marked the local low for PayPal’s stock ticket furthermore, with it rallying 24% since November.

Additional, PayPal Ventures has right this moment started utilizing the PYUSD stablecoin as a mechanism for strategic investments, utilizing it for a stake within the institutional crypto platform Mesh. Amman Bhasin, Accomplice at PayPal Ventures, commented,

“Because the field of financial services undergoes like a flash transformation, we agree with that consumer ownership and portability of resources will was a extreme constructing block of product innovation, with crypto serving as the essential beachhead where here is that you just’re going to be in a neighborhood to like of.”

Thus, while PYUSD peaceable has some diagram to inch to uncover behemoths a lot like Circle and Tether, the debutant and web2 disruptor is with out a doubt within the technique of cementing its space within the industry.

Source credit : cryptoslate.com