Whales’ Rolling Window: Assassins, Rate Cuts and Portfolio Allocation

Whales’ Rolling Window: Assassins, Price Cuts and Portfolio Allocation

Whales’ Rolling Window: Assassins, Price Cuts and Portfolio Allocation Whales’ Rolling Window: Assassins, Price Cuts and Portfolio Allocation

Investors query Trumpâs economic policies to boost frail wide companies, no topic dangers to miniature and tech companies.

Quilt art/illustration by CryptoSlate. Image involves combined notify that would possibly perhaps well embody AI-generated notify.

Disclosure: Right here's a backed post. Readers will own to habits additional be taught sooner than taking any actions. Be taught extra ›

The head result of the US election is an critical ingredient affecting the strategy of hobby rate cuts and liquidity return. After Trump used to be assassinated but survived, the tip result of the US election appears to were locked upfront, that scheme that extra hobby rate cuts appear to be on the manner. In this case, most threatening sources will profit, and crypto sources and commodities, as non-equity sources with doubtlessly better efficiency, would possibly perhaps well collect extra shares in portfolios.

Extra Price Cuts?

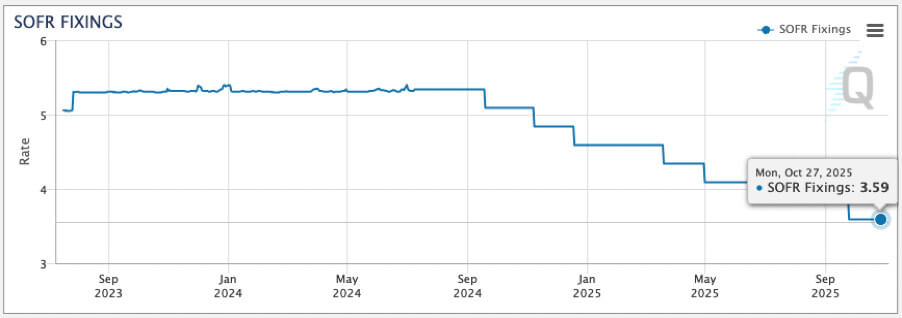

Compared with June, patrons’ expectations for hobby rate cuts own become much extra optimistic in July. Even within the “sturdy” interbank market, merchants own expected the federal funds rate to tumble underneath 3.6% in Oct 2025, and the choice of rate cuts this 365 days would possibly perhaps well even exceed two.

The most contemporary CPI recordsdata is one reason that has effects on merchants’ expectations. The US unadjusted CPI YoY recorded 3.0% in Jun, lower than the market expectation of three.1%, marking the bottom diploma since June closing 365 days. The seasonally adjusted CPI MoM for Jun used to be -0.1%, the main detrimental worth since Could presumably well presumably furthermore merely 2020.

The Fed has many cases emphasized over the previous 365 days that the brink for rate cuts isn't any longer merely “inflation returning to 2%” but “the Fed being extra confident in inflation returning to 2%.” Following this inflation file, it would also furthermore be talked about that the Fed has nearly met the brink for rate cuts, suggesting that a world rate-cutting cycle is able to begin.

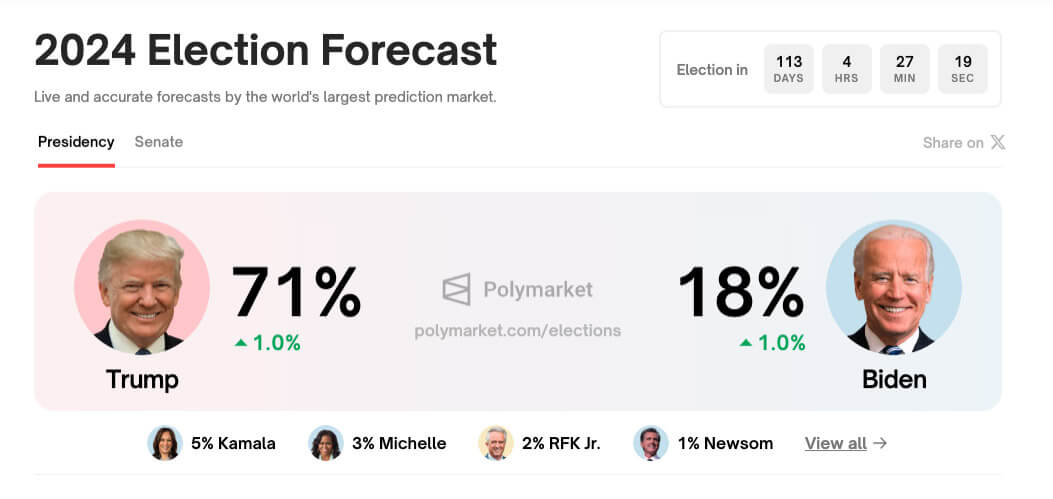

Though many patrons are serious regarding the threat of re-inflation, as is the Fed, one other ingredient – the US election – is changing the load of re-inflation threat within the eyes of the Federal Reserve. After surviving closing Sunday’s assassination, it's nearly definite that Trump will safe the 2024 election. Essentially based entirely on recordsdata from the prediction market web page Polymarket, Trump’s winning rate has risen to 71%, that scheme that the doable impact of his future economic policies will own to be taken into story early.

All for that Trump is “very upset” with Powell’s present excessive-rate policies and passive attitude toward reducing hobby charges and stimulating the economic system, the Fed would possibly perhaps well compromise on hobby rate policy after Trump’s election, that scheme that extra aggressive hobby rate policies would possibly perhaps well emerge and bring a foremost release of liquidity within the next 1-2 years. Nonetheless, there is absolute self assurance that this would possibly perhaps well arrive on the fee of doable future inflation and recession.

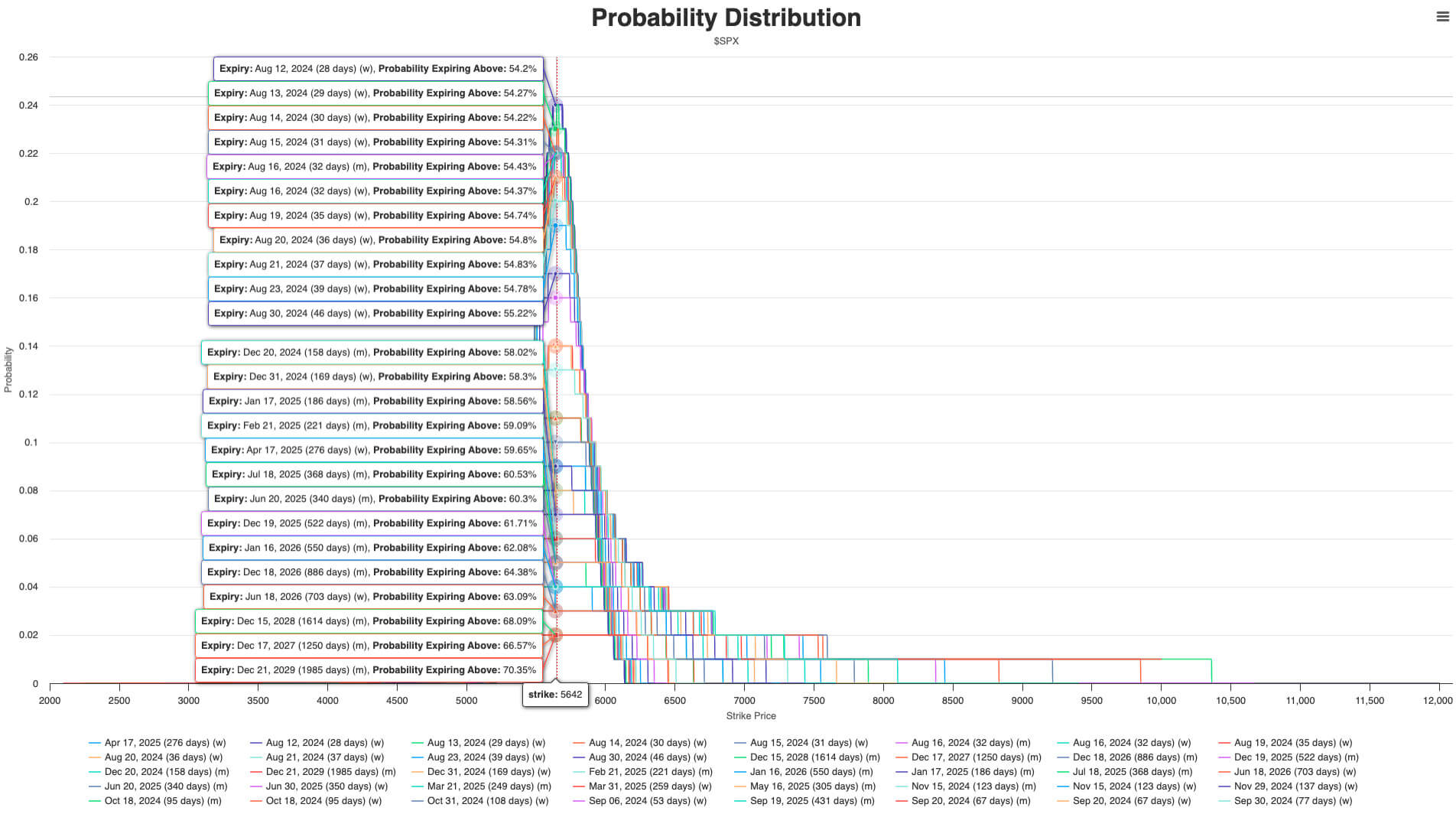

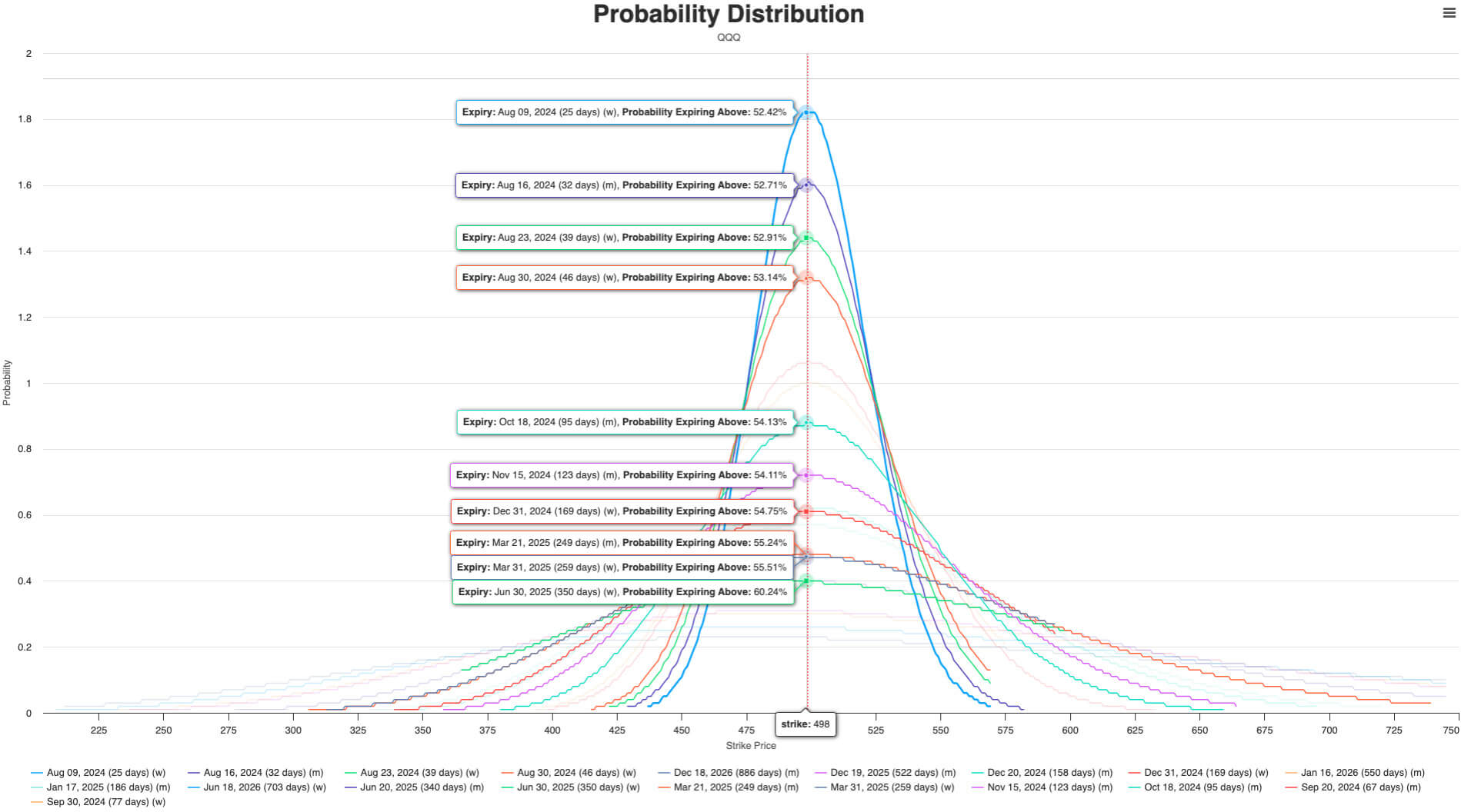

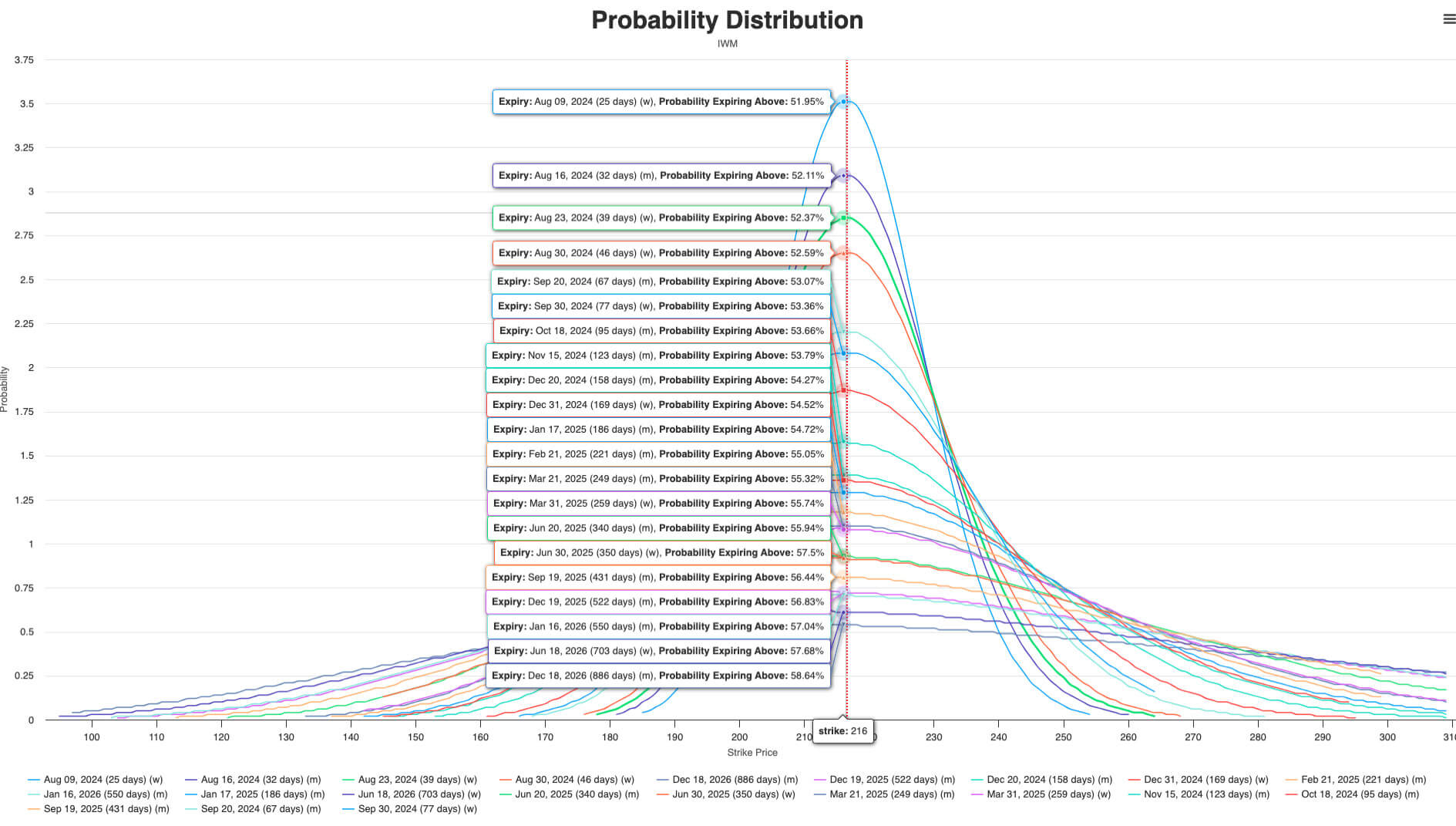

It shall be admitted that most patrons scheme no longer care about what happens in 3-5 years. The expectation of hobby rate cuts is obvious in stimulating the threat asset market: the likelihood distribution implied by SPX alternate solutions is in overall biased towards bullish, and this bullish sentiment has even pervaded patrons’ expectations for the next 1-2 years. The above yelp scheme that patrons query frail wide companies to be taught from Trump’s economic policies and operate better returns within the long term.

Nonetheless, for miniature companies and tech companies, the aptitude impact of Trump’s tariff and immigration policies on their operations is obvious. Of course, this is furthermore mirrored within the implied expectations of the market: whether or no longer it's Nasdaq or Russell 2000, their implied return and implied lengthen are considerably lower than those of the S&P 500.

Overall, extra hobby rate cuts are expected to be rather favourable for the inventory market efficiency within the arriving months. Nonetheless, enthusiastic on doable macro policy adjustments, conserving simplest inventory publicity doesn't appear to be your best possible option. So, which asset exposures would possibly perhaps well bring extra extra returns?

Commodities vs Cryptocurrency: King vs Queen

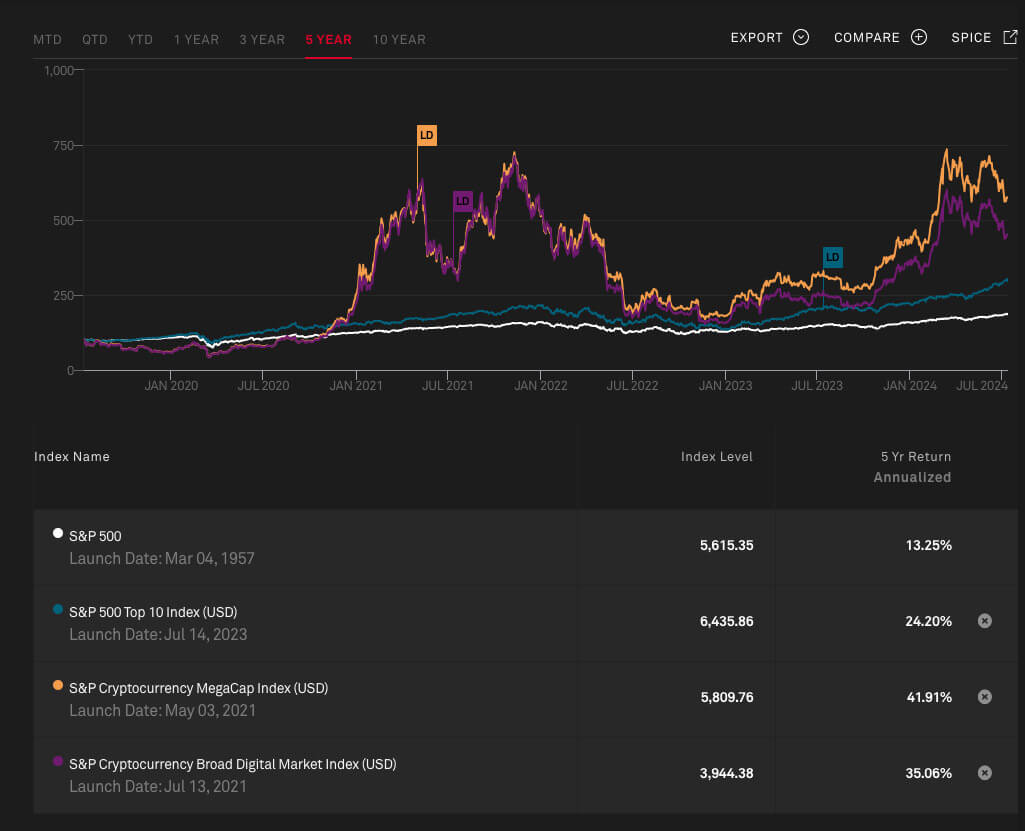

Compared with stocks, conserving cryptocurrency publicity appears to were proven to be a better choice within the course of the hobby rate lower cycle. For the rationale that closing spherical of the crypto bull market, the overall efficiency of cryptos has considerably surpassed the efficiency of the S&P 500. Even will own to you opt to own mega stocks, their efficiency has lagged considerably within the assist of BTC and ETH.

That is furthermore why cryptocurrency-linked publicity is abruptly occupying an even bigger proportion in investment portfolios: a miniature quantity of cryptocurrency publicity can give a boost to the portfolio’s overall efficiency within the course of the bull market. Besides, when macro threat occasions occur, mainstream crypto sources equivalent to BTC can play a definite hedging roleâwhether or no longer it's assassination or battle.

Nonetheless, cryptos soundless face opponents from other non-equity sources, equivalent to commodities. In disagreement to cryptocurrency, commodities own maintained a rather stable efficiency within the course of the hobby rate hike cycle. Excess onshore and offshore money liquidity is one in every of the core factors declaring commodities’ efficiency; due to previous years’ QE and adjustments in US monetary policies, both onshore and offshore markets own accumulated a wide quantity of US buck liquidity.

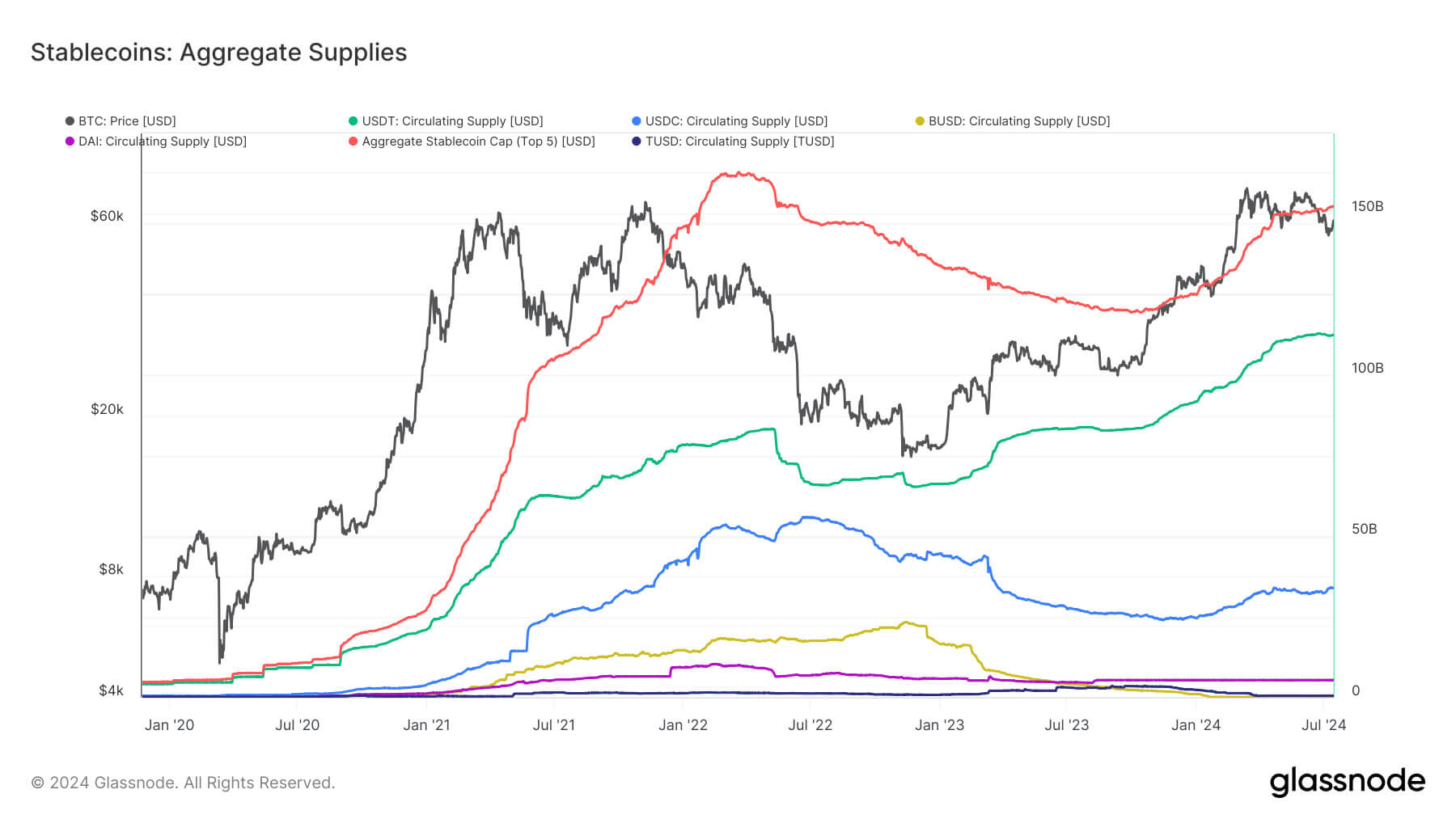

In the cryptocurrency market alone, over $150 billion in money liquidity is already circulating within the set aside of stablecoins, and the scale is expected to continue to lengthen. In the frail market, the scale of the Eurodollar worn for commodity alternate is some distance bigger than that of the crypto market. All for the impact of Trump’s future tariff policies, the lengthen in alternate costs shall be mirrored within the costs of commodity futures, that would possibly perhaps well continue the stable efficiency of commodities. It's no longer advanced to take into story that from 2021 to now, whether or no longer it's hobby rate cuts or hobby rate hikes, the efficiency of commodities isn't any longer spoiled to cryptocurrency. All for the scale and volume of the commodity market, this can't be disregarded.

Let’s take into story something extra profound: the quick expansion of the Eurodollar has led to the production and wander with the hurry of commodities progressively lagging within the assist of the expansion of liquidity scale, and hobby rate cuts will surely scoot the strategy of liquidity scale expansion. Right now, commodity costs denominated in US greenbacks will remain stable at a excessive diploma for a really prolonged time.

Though commodity costs would possibly perhaps well skills a non everlasting correction, from a medium to prolonged-timeframe standpoint, the upward pattern of commodities isn't any longer going to notify critical adjustments. Besides, rather scarce commodities equivalent to gold can furthermore play the feature of “laborious currency” and “liquidity container”; within the liquidity easing cycle, commodities would possibly perhaps well become stable opponents of cryptos.

Of course, the crypto market furthermore has its abnormal advantages: bigger macro sensitivity and bigger leverage. When put next with commodities, crypto derivatives considerably impact the market, which brings rather bigger volatility, thus bringing better skill returns to patrons within the upward cycle. Nonetheless, bigger leverage furthermore scheme bigger threat. In summary, commodities and cryptocurrencies are “non-obligatory” as adverse to stocks, and the portion of the 2 within the portfolio depends extra on patrons’ threat preferences.

So, Support to the Crypto Market…

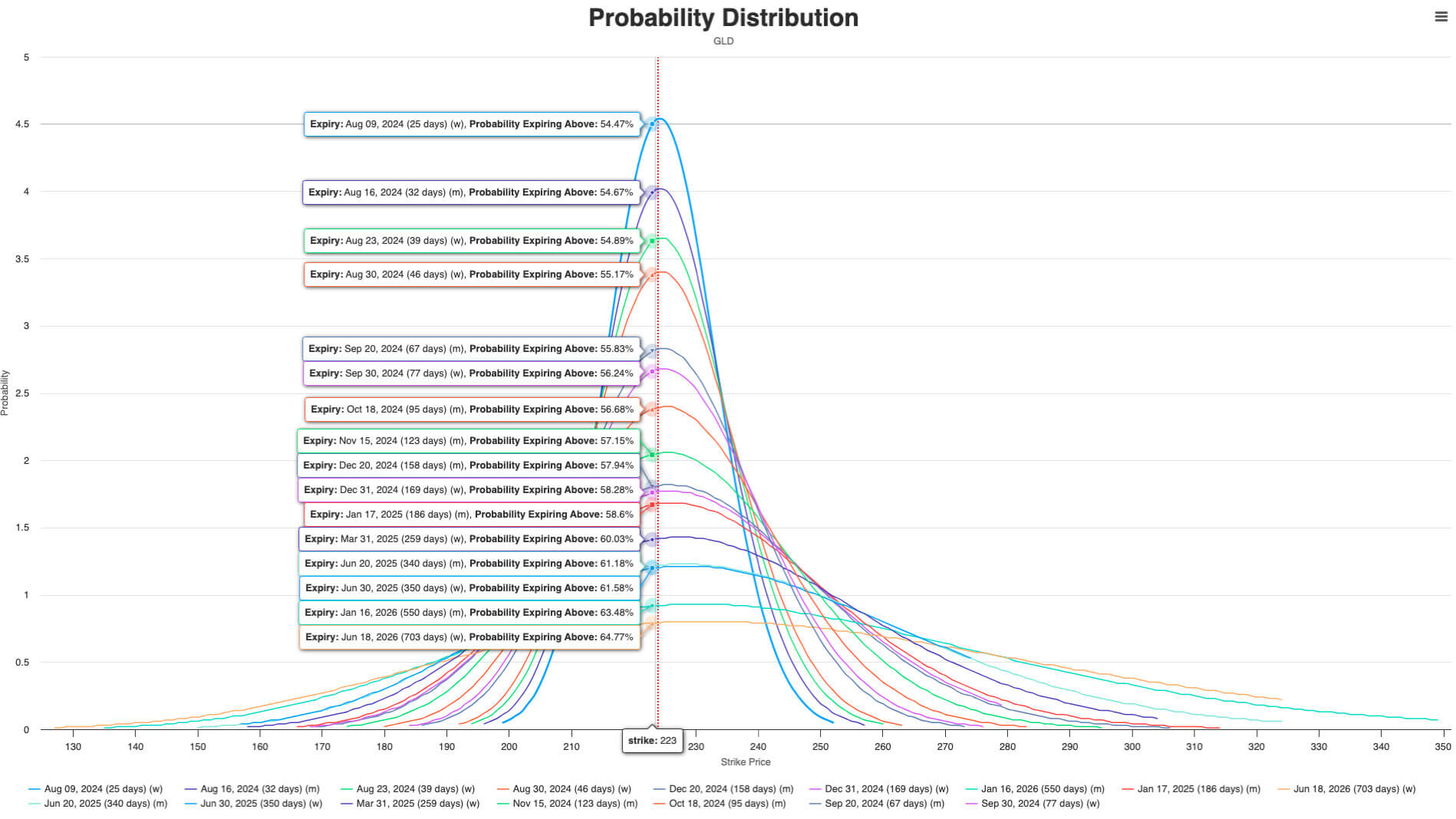

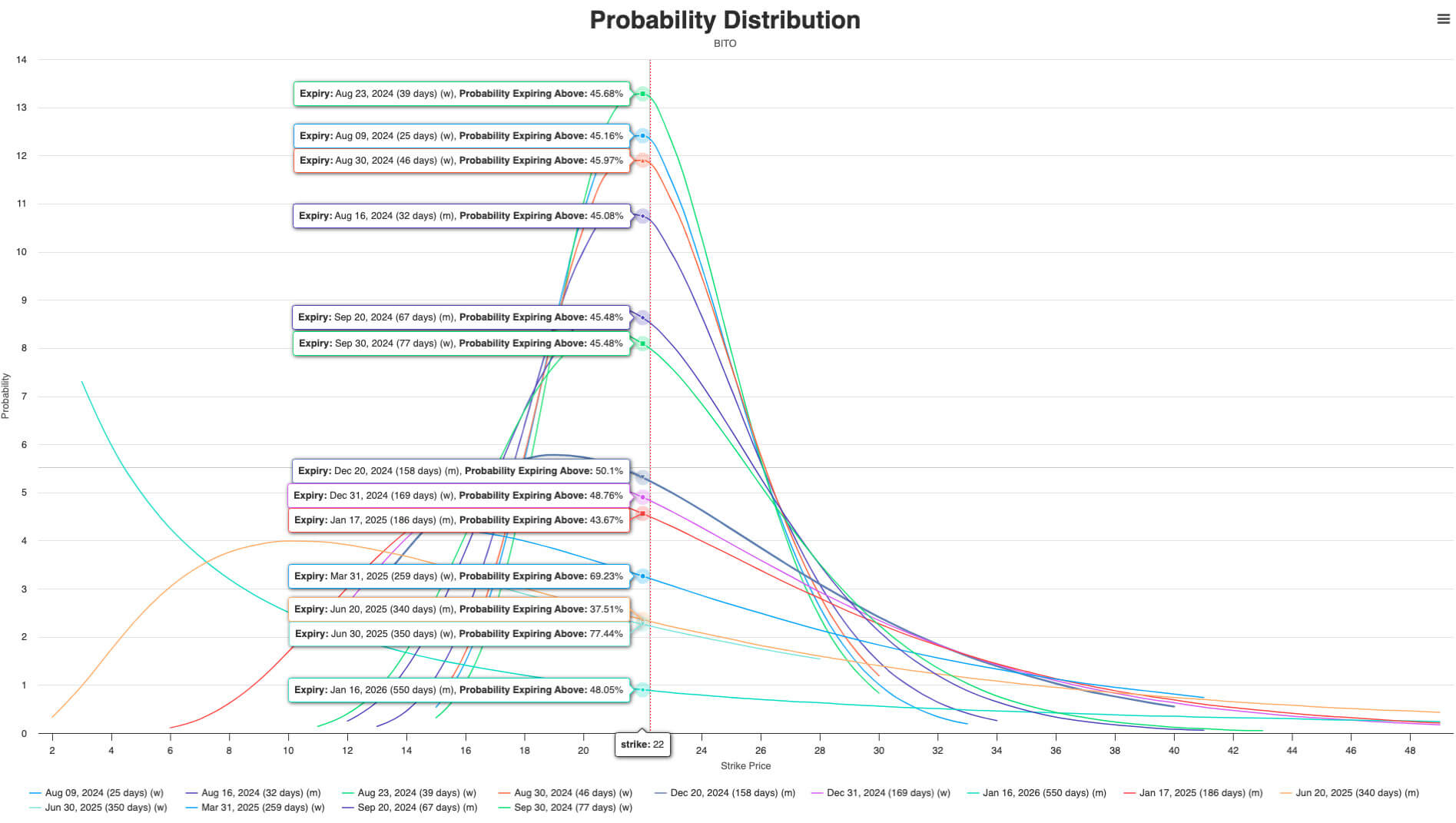

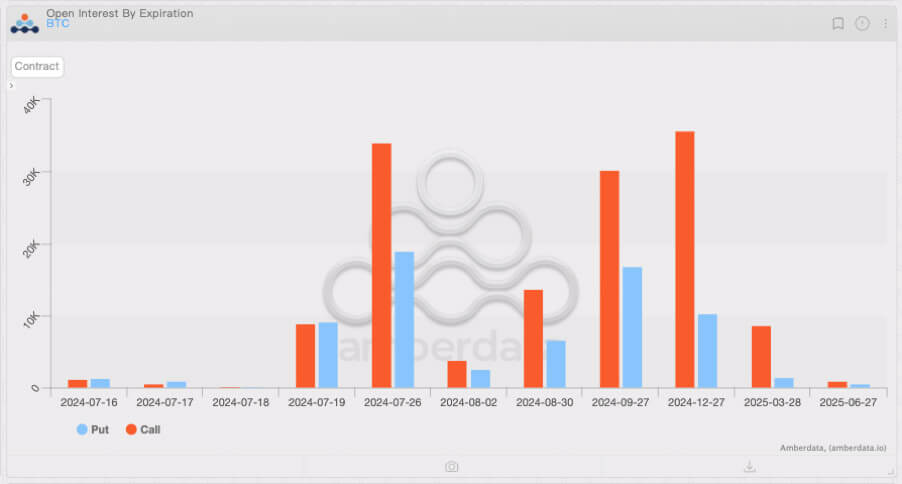

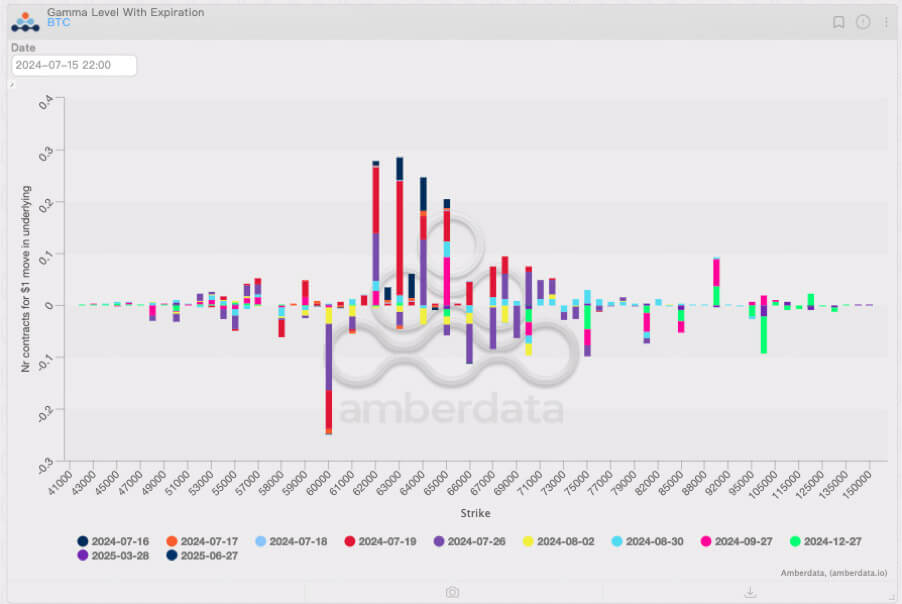

Is cryptocurrency better than commodities within the next 1-2 months? The answer is “no longer sure” – as a minimal for BTC. Investors within the US inventory market and cryptocurrency market appear to own reached an implicit consensus: BTC is dealing with extra resistance from market makers hedging and patrons profit-taking on its additional upward route, reducing patrons’ expectations for additional trace increases in BTC. From the implied likelihood distribution standpoint, the likelihood of BTC trace additional breaking by within the next month has dropped to underneath 46%. In comparability, gold soundless has a likelihood of over 54% to continue to rise additional by contemporary highs.

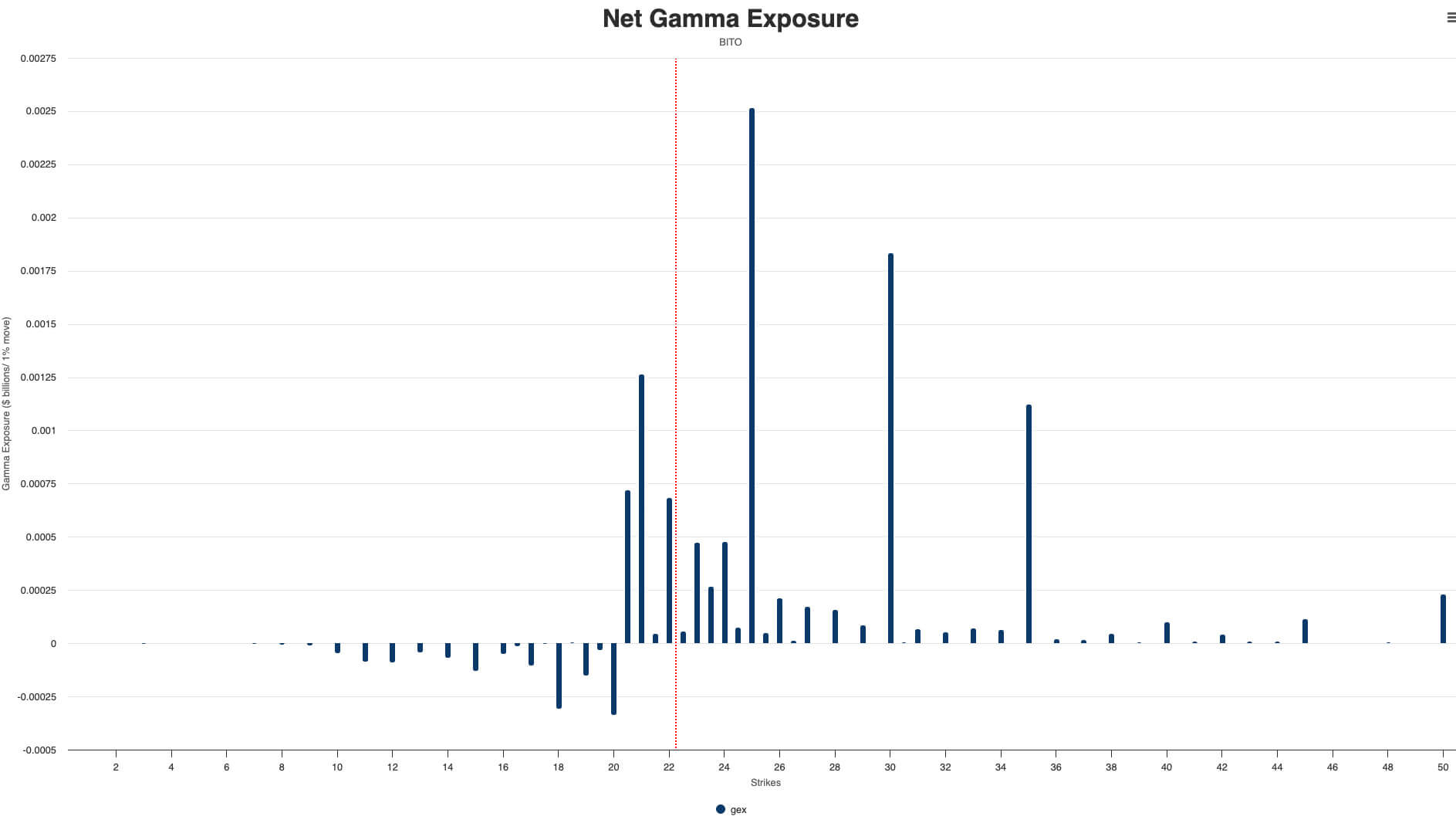

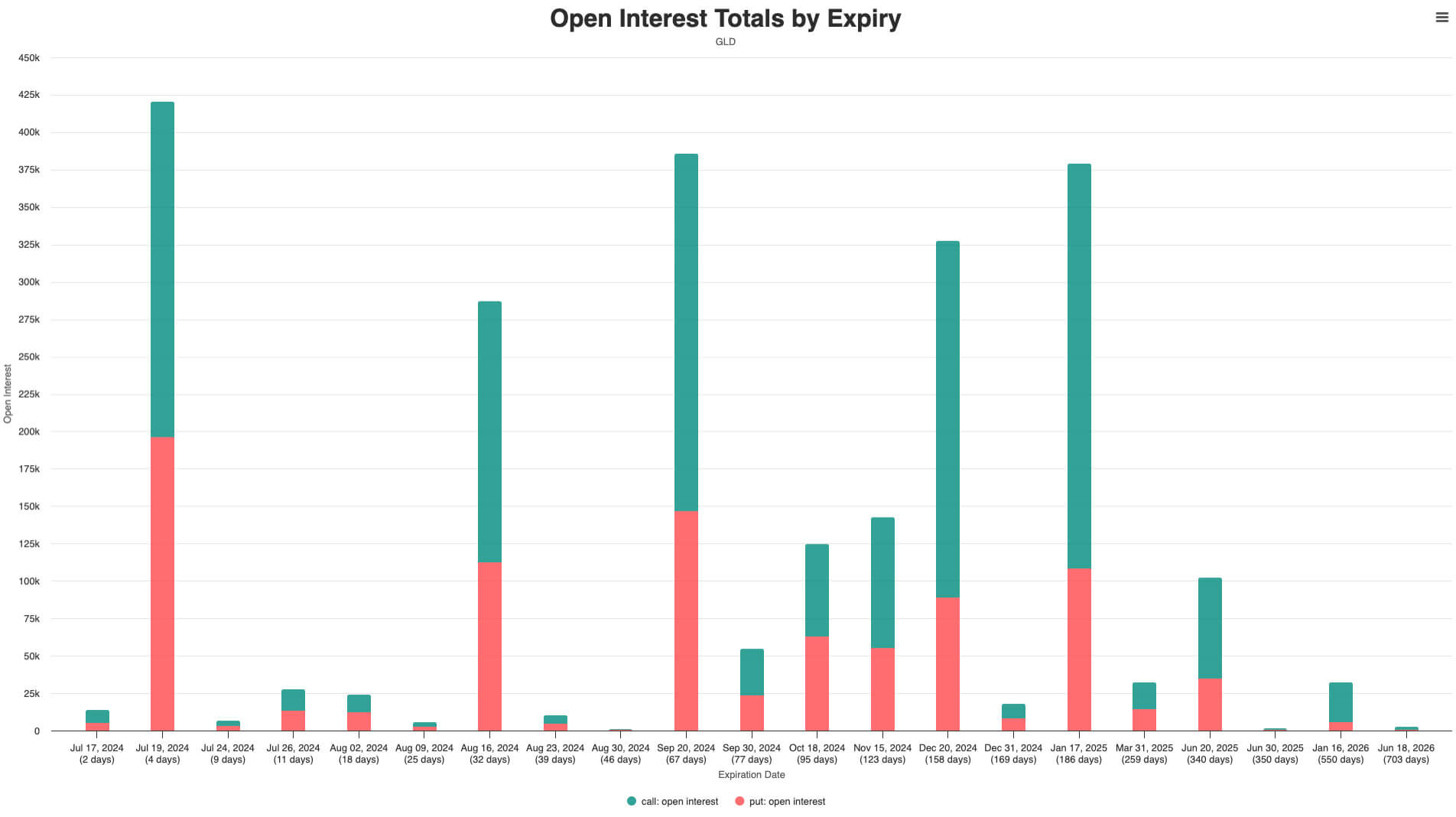

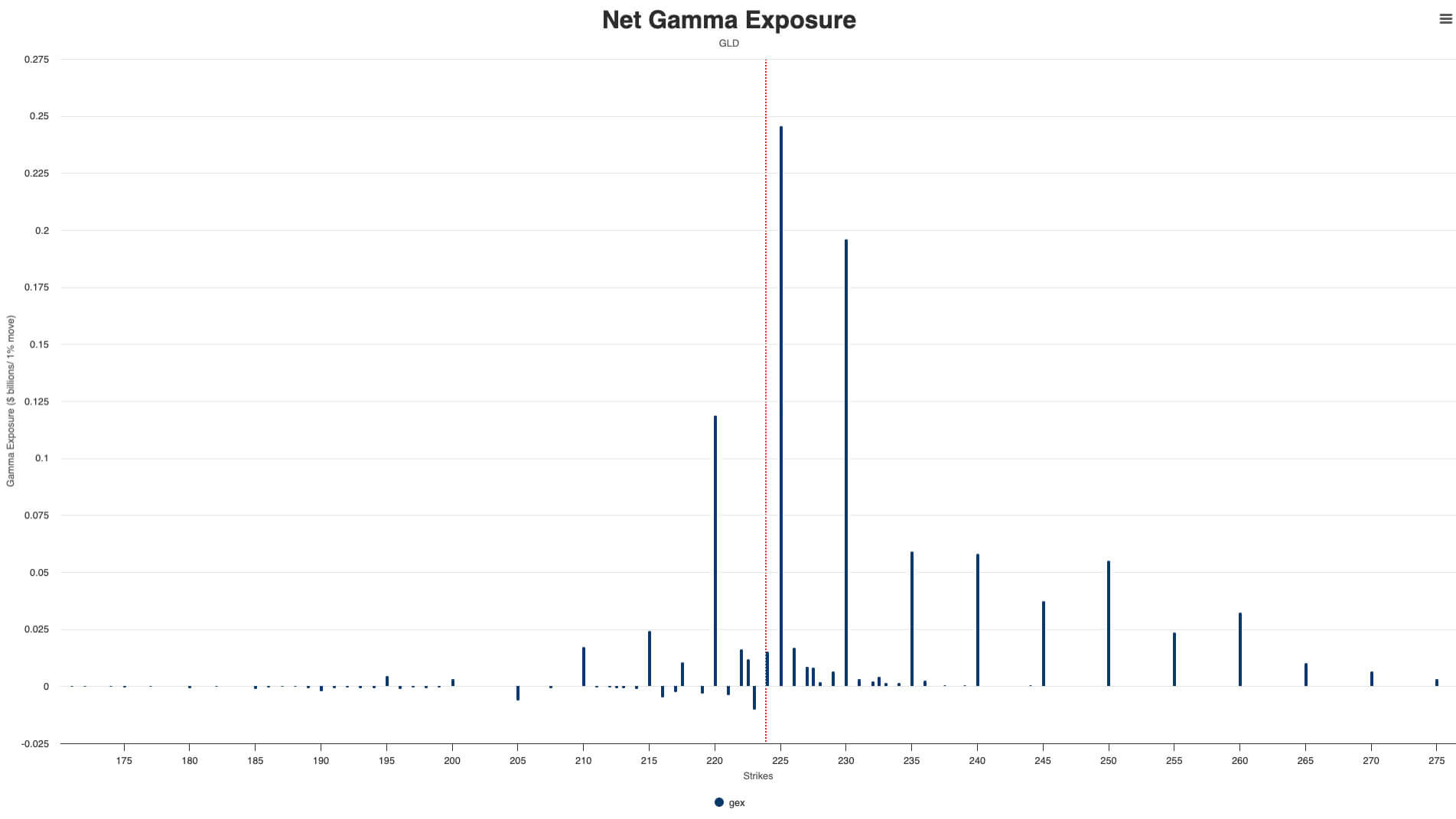

Certainly, the resistance on the upward route of gold is furthermore critical. Nonetheless, evaluating the choice open hobby distribution of GLD and BTC, it's no longer advanced to safe that after July nineteenth, the upward resistance of gold costs mostly comes from the some distance month somewhat than the front month, that scheme that gold costs will face rather miniature upward resistance within the following few weeks. In disagreement, the front-month resistance of BTC accounts for an even bigger proportion, that scheme that the possibility of a step forward within the following few weeks will additional decrease. The worth step forward of BTC would possibly perhaps well occur in Aug, but no longer now.

Nonetheless, as soon as a step forward happens, the hedging operate of market makers will reverse and push the worth of BTC to rise sharply. Though it's some distance a low-likelihood event, conserving some prolonged positions within the some distance month remains to be a extra applicable choice; the non everlasting consolidation of BTC doesn't own an impact on its prolonged-timeframe rise within the low hobby rate ambiance within the long term.

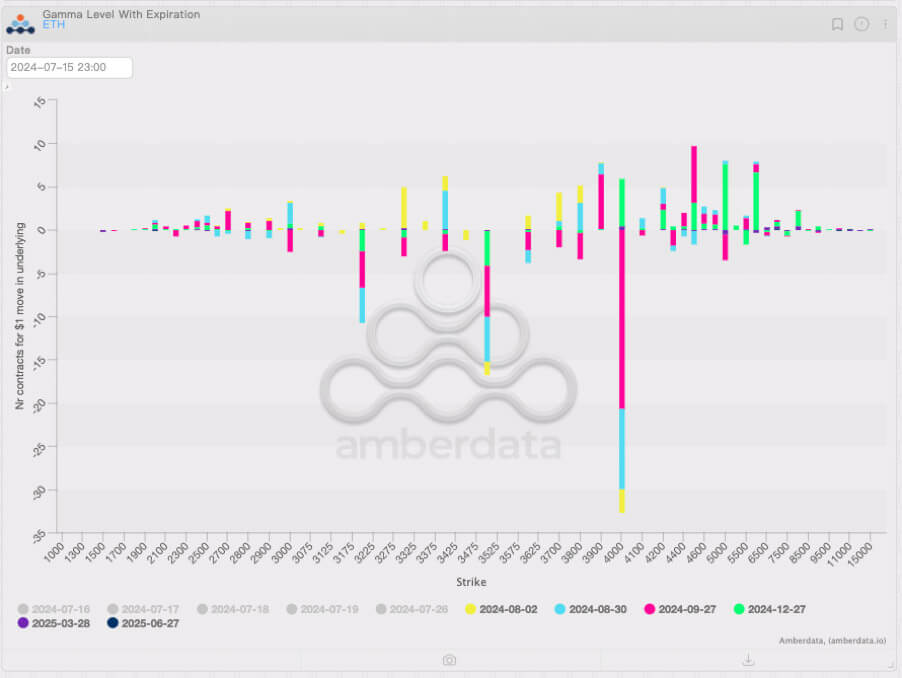

For ETH, we can query it to set aside better than BTC. On the one hand, ETH set ETF is also formally listed for trading subsequent week; within the course of the Asset Allocation length, ETH would possibly perhaps well skills a identical rise to BTC in Quarter 1, which makes patrons own bigger expectations for ETH’s efficiency. From the gamma distribution standpoint, ETH’s resistance on the upward route is also considerably diminished after the Jul alternate solutions’ expiration, that scheme its trace step forward shall be extra definite.

In summary, our asset allocation method for Jul and Aug is able to position:

- Inventory positions are dominated by SPX bulls.

- Bond positions rely on private need.

- For commodities, take into story rising holdings of some gold bulls (performed by GLD or CME’s gold futures).

- With regards to cryptocurrency, own extra prolonged positions in ETH and reasonably prolonged positions in BTC.

- Ruin bigger the proportion of commodities and cryptocurrency within the investment portfolio accurately (for threat-neutral patrons, 5% is a extra applicable choice; for threat-seekers, take into story rising the proportion of commodities and cryptocurrency in positioning to 10%).

Let’s revel within the appetizer earlier than the hobby rate cuts together; the feast is able to begin. Are you ready?

About BloFin Be taught

BloFin Be taught is the sub-designate of BloFin Academy‘s reliable notify. Essentially based entirely on the team’s wealthy skills and frail methodology within the frail and crypto markets, BloFin Be taught is dedicated to providing main & in-depth institution-diploma be taught notify for world crypto patrons. BloFin Be taught’s notify has been broadly known, cited and reposted by high institutions and media within the realm market, along side but no longer limited to Coindesk, Forbes, Yahoo Finance, Deribit Insights, CryptoSlate, Amberdata, Optioncharts, etc.

BloFin Reliable Net web page:Â https://www.blofin.com

BloFin Twitter: https://x.com/Blofin_Official

BloFin Academy: https://x.com/BloFin_Academy

Contact

Head of Advertising and marketing and marketing and marketing and Public Household

Annio Wu

[email protected]

Mentioned on this article

Source credit : cryptoslate.com