Western Union and MoneyGram app usage drops as stablecoin adoption surges

Western Union and MoneyGram app usage drops as stablecoin adoption surges

Western Union and MoneyGram app usage drops as stablecoin adoption surges Western Union and MoneyGram app usage drops as stablecoin adoption surges

Stablecoins redefine remittance by offering sooner, more cost effective ghastly-border funds amid declining app downloads for used giants.

Disguise art/illustration by strategy of CryptoSlate. Image involves blended vow which would maybe furthermore fair embrace AI-generated vow.

Venerable remittance giants delight in Western Union and MoneyGram are struggling to inspire tempo in an evolving monetary ecosystem increasingly extra fashioned by stablecoins.

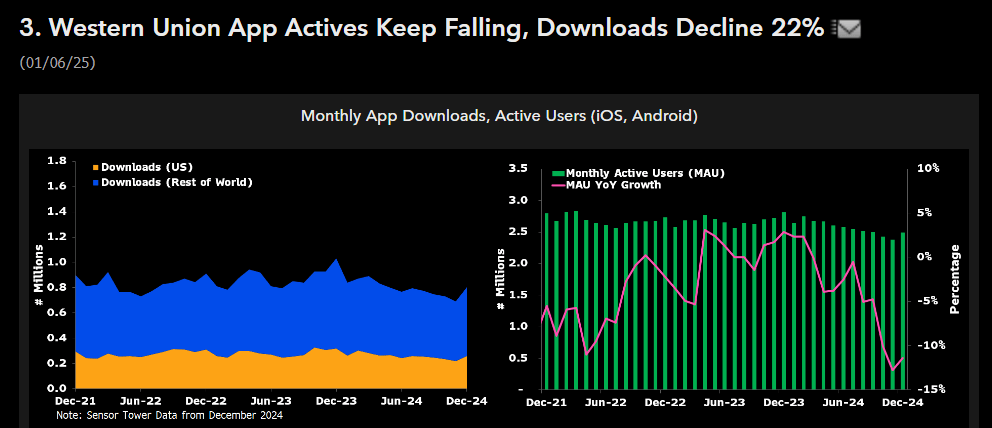

In step with Matthew Sigel, Head of Digital Assets Research at VanEck, downloads of remittance giants apps enjoy dropped very a lot, with Western Union seeing a 22% decline and MoneyGram experiencing a 27% reduction.

Meanwhile, this tumble isn’t puny to app downloads. The number of monthly energetic customers (MAU) enticing these platforms has remained below 3 million since 2021. From January to November 2024, these platforms enjoy faced regular declines in user exercise, signaling a shift in consumer behavior.

The upward thrust of stablecoins

Sigel suggested that stablecoins are rising as an spectacular different to used remittance methods by offering sooner, more cost effective, and extra accessible ghastly-border transactions.

Blockchain prognosis firm Chainalysis reported that these digital sources, which would maybe per chance maybe be pegged to secure values delight in the US buck, enjoy turn out to be indispensable in areas going thru forex instability or puny acquire admission to to skilled banking methods.

The global adoption of stablecoins continues to develop as they occupy gaps left by used monetary services. People and corporations exercise stablecoins for worldwide funds, protect wealth from forex fluctuations, and put together liquidity efficiently.

No longer like used banking, stablecoins allow instantaneous transfers, sidestepping the delays and excessive prices linked to the older system.

In 2024, the stablecoin market hit a milestone, surpassing $200 billion in capitalization. The field furthermore observed the upward thrust of progressive digital currencies delight in Ethena’s synthetic USDe stablecoin, which now competes with major players equivalent to Tether (USDT) and Circle (USDC).

Moreover, the profitability of the stablecoin exchange is equally considerable, with issuers delight in Tether and Circle collectively incomes over $664 million closing Decemberârepresenting a principal allotment of the earnings generated by crypto protocols.

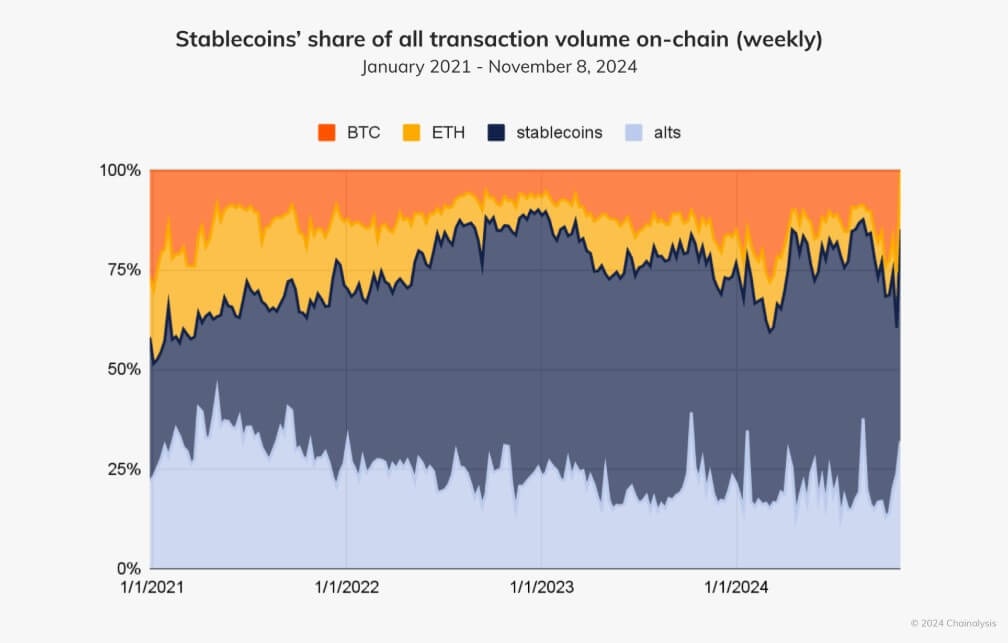

Furthermore, Chainalysis identified that stablecoins are to blame for over 75% of the trillions in crypto transactions recorded in most modern months.

This excellent boost has attracted attention from used monetary establishments and blockchain corporations, including Ripple, which would maybe per chance maybe be exploring ways to faucet into this booming market.

Pondering this, Liz Bazurto, the ecosystem engagement supervisor for MetaMask, talked about the used remittance giants might maybe per chance maybe embrace stablecoin funds for his or her operations. She talked about:

“I will query a course for Western Union and MoneyGram to allow Stables. MoneyGram has enabled Stellar (USDC) for on and offramps.”

Mentioned listed right here

Source credit : cryptoslate.com

CoinGlass

CoinGlass