TUSD’s supply hits low as stablecoin struggles to maintain $1 peg

TrueUSD (TUSD) stablecoin experienced wild volatility the past day because it fell below the $1 peg amid its declining provide.

Files from CryptoSlate shows that the stablecoin fell to as low as $0.984 all by the reporting duration and has yet to regain its peg as of press time. Chainlink’s TUSD data moreover confirms this downtrend, with the Justin Sun-linked stablecoin exchanging fingers for $0.98535493.

Purchasing and selling assignment analyzed on varied platforms shows that the stablecoin holders were dumping their property.

For context, Binance data shows that about 60% of the money drift round TUSD has gone to the asset’s gross sales. TUSD saw promote orders exceeding $450 million against round $296 million in aquire orders. This leaves a deficit of round $155 million.

Observers fetch suggested the absence of TUSD mining in Binance’s latest start pool contributed to the gross sales. Adam Cochran, the managing partner at Cinneamhain Ventures, praised the crypto exchange for no longer supporting the embattled asset in its latest pool.

TUSD’s Curve pool extra shows it’s carefully imbalanced as of press time, with crypto merchants exhibiting preferences for Tether’s USDT, Circle’s USD Coin (USDC), and DAI.

The TUSD Curve dashboard shows that the stablecoin accounts for nearly 88% of the pool’s $70,396 reserve, while USDT made up roughly 8%. The replacement stablecoins in the pool produce up the 5% balance.

Equally, Whale Alert moreover flagged the burning of 54 million TUSD tokens all by the past day. Stablecoins are burned when users convert their holdings into fiat.

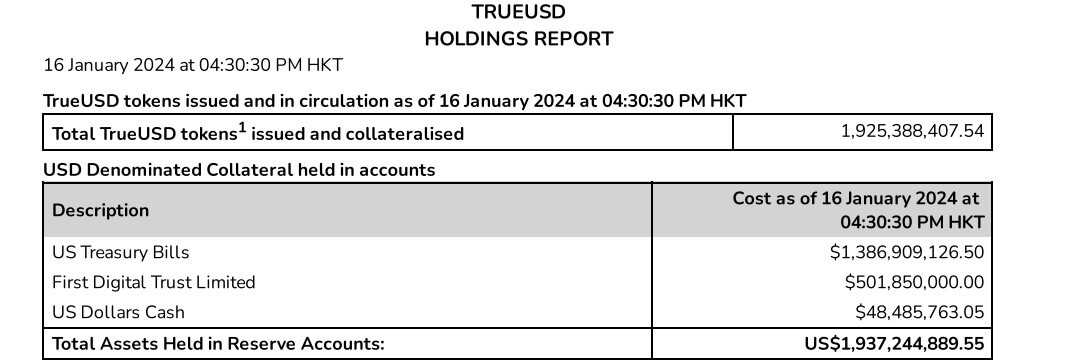

The stablecoin is moreover facing considerations over its collateral attestations represent. Contributors of the crypto community highlighted a pause in the precise-time attestation of TUSD on Jan. 10. The screenshot shared showed that the balance ripcord is usually brought on when there’s an “proper imbalance of liabilities and corresponding property.”

On the replacement hand, the attestation has change into purposeful, with the stablecoin collateral at 101% on the secure pages as of press time.

Meanwhile, the drama surrounding the stablecoin has severely impacted its provide, falling below $2 billion, its lowest level since June 2023. TUSD had seen a dramatic uptick in 2023, climbing to a height of $3.5 billion in September from $840 million on the launch of the one year.

Source credit : cryptoslate.com