Trump buzz drives $2.2B inflow, setting new records for Bitcoin and AUM

Trump buzz drives $2.2B influx, surroundings unusual files for Bitcoin and AUM

Trump buzz drives $2.2B influx, surroundings unusual files for Bitcoin and AUM Trump buzz drives $2.2B influx, surroundings unusual files for Bitcoin and AUM

Market enthusiasm for Trump's period catalyzes all-time excessive for Bitcoin and trading volumes.

Conceal art work/illustration by CryptoSlate. Image contains mixed squawk material that may perchance maybe encompass AI-generated squawk material.

The crypto market has recorded its best weekly influx this year, reaching a ambitious $2.2 billion.

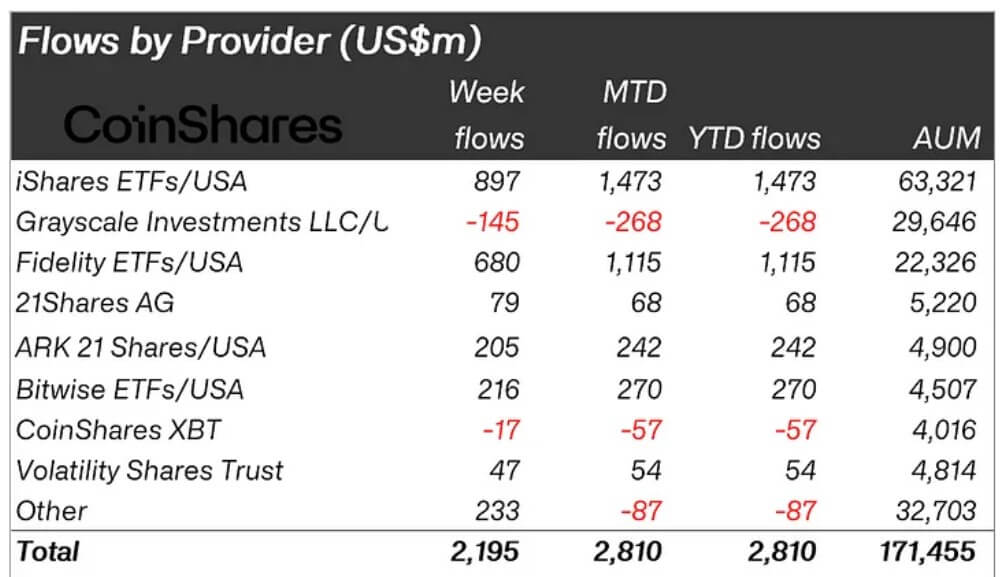

Per the most up-to-date CoinShares memoir, this influx of capital was as soon as fueled by rising pleasure around Donald Trump’s Jan. 20 inauguration. The firm licensed that the surge pushed full year-to-date inflows to $2.8 billion.

This influx has additionally pushed resources under management (AUM) to a file excessive of $171 billion. The surge coincided with Bitcoin’s spectacular efficiency, with the flagship crypto hiking practically 20% over the final week to hit an all-time excessive advance the $110,000 label.

Within the meantime, the market additionally skilled a corresponding spike in change-traded product (ETP) trading volumes, which reached $21 billion final week.

James Butterfill, CoinShares head of compare, identified that this quantity accounted for 34% of Bitcoin’s trading narrate on main exchanges. This sturdy quantity highlights rising institutional hobby and the increasing mainstream adoption of crypto.

Bitcoin and XRP shine

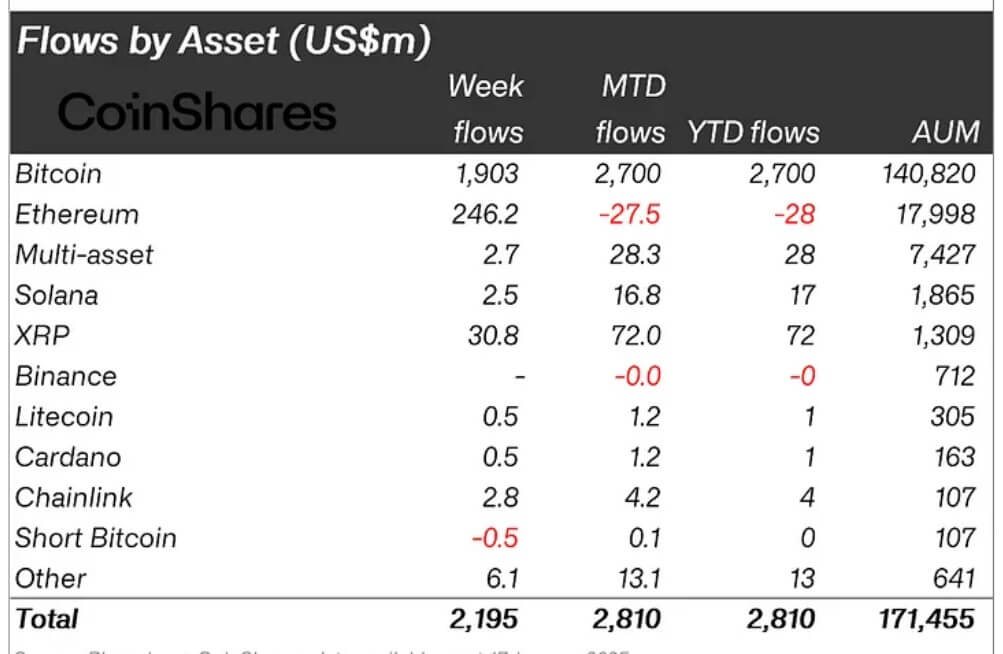

Bitcoin persevered its dominance, securing $1.9 billion in inflows final week and bringing its full for the year to $2.7 billion.

The memoir highlighted that recount Bitcoin ETFs, supplied by key gamers love BlackRock, Fidelity, Ark Invest, and Bitwise, collectively attracted over $2.1 billion in inflows. The inflows are seen as a undeniable response to market optimism about supportive regulatory insurance policies anticipated under the incoming administration.

Interestingly, rapid-Bitcoin merchandise registered modest inflows of $500,000, a grisly deviation from traditional bearish habits throughout bullish inclinations.

Within the meantime, Ethereum drew $246 million in inflows, marking a reversal of its outdated outflows this year. On the opposite hand, the 2nd-largest crypto continues to underperform in comparability to its mates.

Butterfill licensed that Ethereum stays the weakest performer this year from an influx perspective despite seriously outpacing Solana, which introduced in $2.5 million final week.

On the opposite hand, XRP has proven to be a standout performer, attracting $31 million in inflows final week. Since mid-November 2024, XRP’s full inflows like reached a ambitious $484 million, underscoring its rising allure to merchants.

Stellar followed with smaller inflows of $2.1 million, whereas other altcoins showed little narrate throughout the duration.

Mentioned on this article

Source credit : cryptoslate.com

Binance

Binance