Top 10 DeFi dApps generating an average of $4.8 billion in fees annually

High 10 DeFi dApps producing a median of $4.8 billion in payments yearly

High 10 DeFi dApps producing a median of $4.8 billion in payments yearly High 10 DeFi dApps producing a median of $4.8 billion in payments yearly

$13 million in 24 hour payments were produced from DeFi as Lido tops the charts.

Quilt paintings/illustration thru CryptoSlate. Image entails blended advise material that also can consist of AI-generated advise material.

Total payments generated from the tip 10 DeFi dApps tracks thru DefiLlama will amount to $4.8 billion yearly primarily based entirely on the previous 24 hours of exercise. Actual thru staking, dexes, lending, and wallets, $13.15 million in payments were generated in yesterday.

| Title | Category | 24hr Bills | 24hrs Income |

|---|---|---|---|

| Lido | Liquid Staking | $3.38m | $337,749 |

| Uniswap | Dexes | $2.62m | $0 |

| PancakeSwap | Dexes | $2.1m | $426,372 |

| Curve Finance | CDP | $1.54m | $659,343 |

| AAVE | Lending | $1.2m | $172,860 |

| Maker | CDP | $1.08m | $545,105 |

| Raydium | Dexes | $1.01m | $124,524 |

| Seller Joe | Dexes | $623,784 | $69,357 |

| MetaMask | Wallets | $391,846 | $391,846 |

| Camelot | Dexes | $271,722 | $63,802 |

On the opposite hand, the entire income for yesterday involves precise $2.78 million, which is 21% of total payments.

Lido tops the chart for charge generation, while Curve retains the amount 1 slot for income, with Maker and Lido precise leisurely. Two of the greatest gaps between payments and income is also seen in Aave and Raydium, which generated over $1 million in payments over yesterday. Gentle, income turned into as soon as $172,860 and $124,524, respectively.

Notably, while Uniswap is positioned second in charge generation, DefiLlama reviews $0 in income as Uniswap facilitates the assortment of payments. Gentle, it does no longer take care of these payments as income for the protocol. As a substitute, the payments lengthen the cost of liquidity tokens, functioning as a payout to all liquidity suppliers proportional to their half of the pool.

There had been discussions and suggestions within the Uniswap team relating to implementing a “protocol charge,” that also can very successfully be turned on by UNI governance. This charge would enable the Uniswap protocol to blueprint income by taking a percentage of the swap payments that may perhaps well otherwise journey to liquidity suppliers.

The poll turned into as soon as the most major step, “temperature test,” which passed at a charge of 55 million to 144, that blueprint the upgrade has no longer yet been utilized. Therefore, Uniswap does no longer yarn this as income.

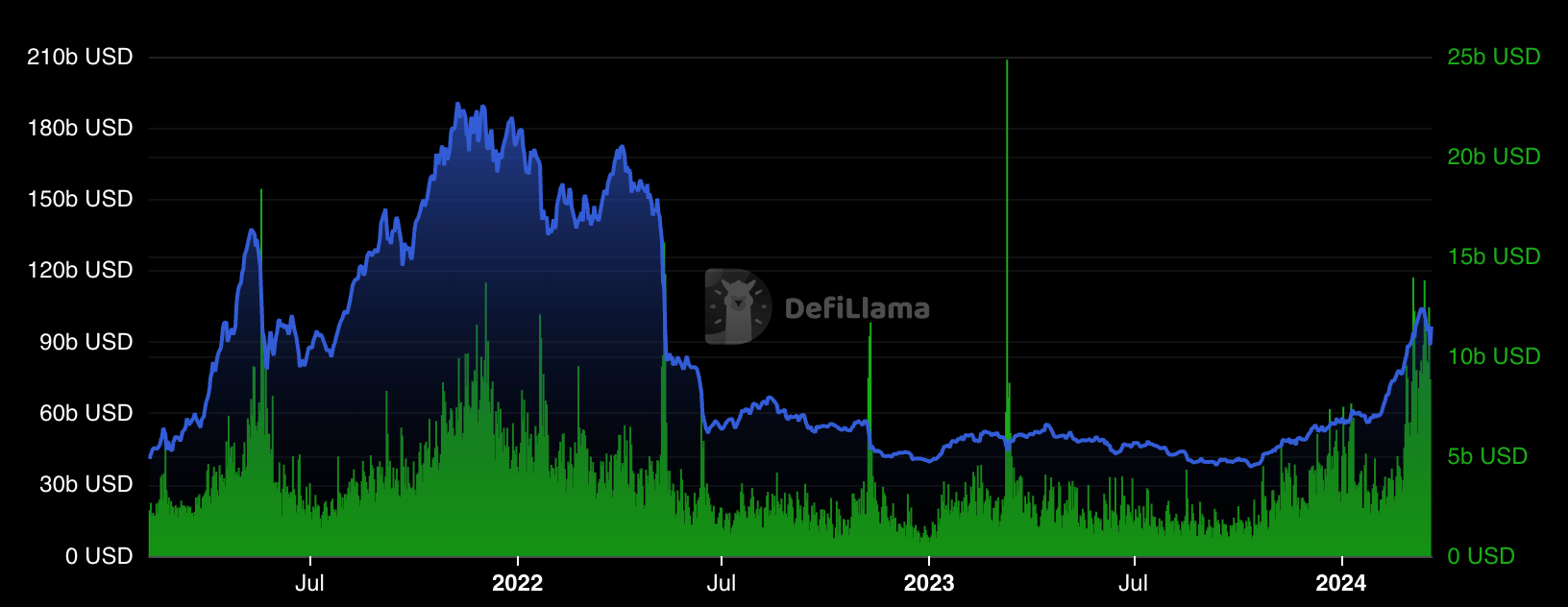

The DeFi market at enlighten has a blended market cap of $101 billion per CryptoSlate facts, with the sector up 5% over yesterday. DefiLlama facts displays that DeFi’s market cap resurgence has yet to hit its 2021 peaks. On the opposite hand, volumes personal risen to a similar ranges, exhibiting a extra fixed growth. Over the previous month, volumes around $10 billion had been commonplace after starting the three hundred and sixty five days closer to $5 billion.

Mentioned listed here

Source credit : cryptoslate.com