Is this the Bitcoin ETF supply squeeze playing out already?

Seven days after the novel Bitcoin ETFs launched, I analyzed how they’ll establish rigidity on Bitcoin’s supply dynamics in an editorial known as “If BlackRock continues 6k BTC on each day basis buys, we gain a supply crunch within 18 months; right here’s why.’ On the day of e-newsletter, Jan. 18, Bitcoin closed at $41,248 after falling from a high of $49,000 on Jan. 11. Since then, the flagship digital asset has soared 37% to wreck $57,000.

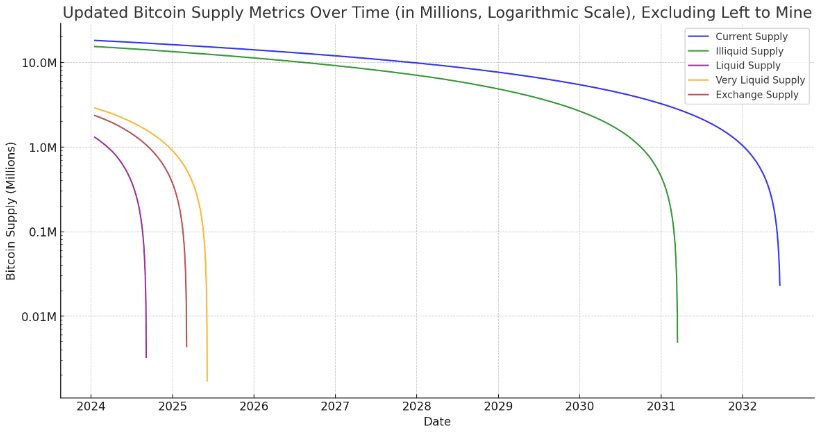

Whereas Bitcoin had fallen consistently after the ETF launched, CryptoSlate famed the chronic BTC inflows, which, at the time, averaged around 6,266 BTC per day for BlackRock by myself. The diagnosis identified that were such inflows continue, the liquid supply of Bitcoin would possibly perhaps well also be absorbed this twelve months, with the swap balances or very liquid affords targetable by mid-2025.

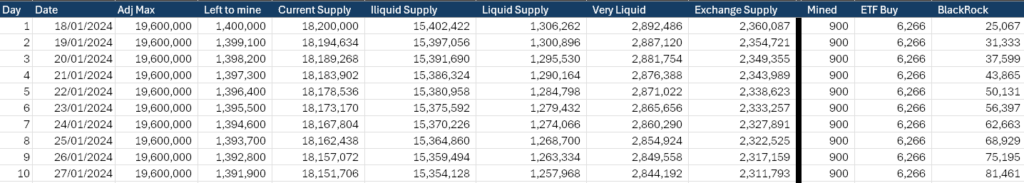

As famed at the time, the diagnosis modified into once purely hypothetical and didn’t take into myth the outflows from Grayscale GBTC. Additionally, it splendid checked out BlackRock, necessary fund’s inflows, to simplify the records at that time. The thunder aimed to emphasise the chance of a supply squeeze and the dearth of liquid Bitcoin to facilitate chronic ETF rigidity on the provision. On Jan. 18, BlackRock had 25,067 BTC beneath management, valued at $1 billion.

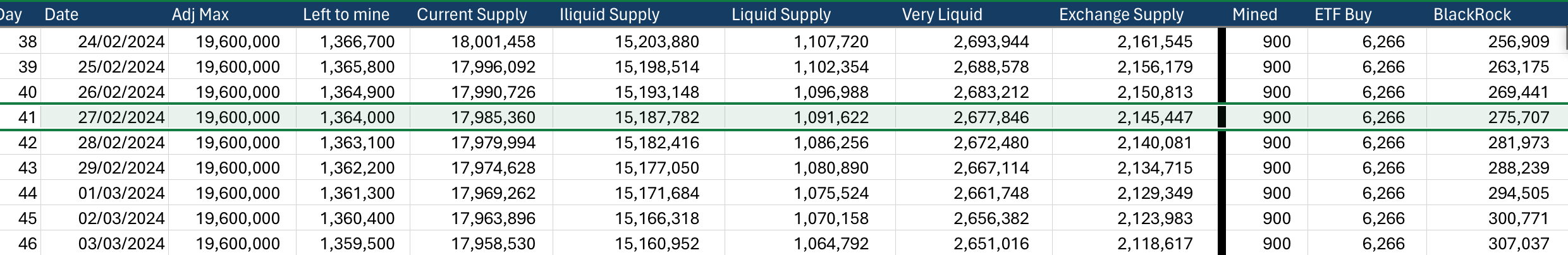

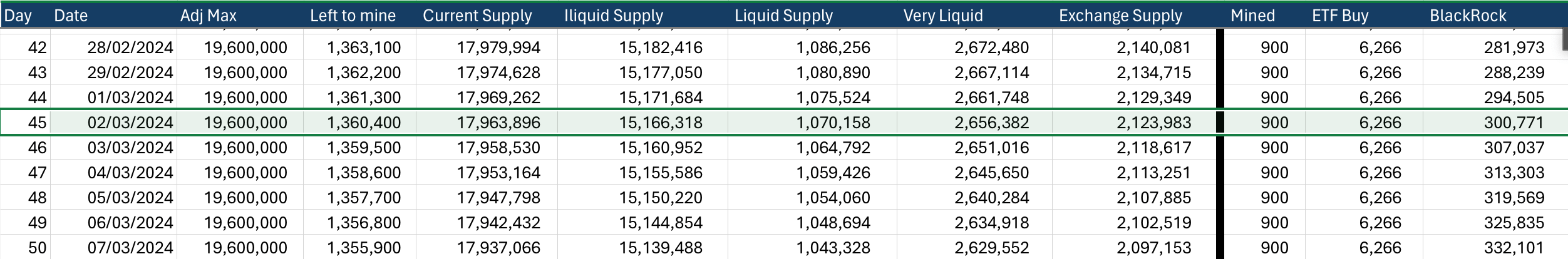

Interestingly, while the inflows into BlackRock didn’t defend the 6,266 BTC on each day basis moderate rigidity, inflows into the Fresh child 9 have surpassed this level. BlackRock currently has 130,231 BTC beneath management, whereas the fund would have 275,707 BTC if it continued at 6,266 BTC on each day basis. On the other hand, on Jan. 18, 6,266 BTC modified into once valued at $258 million, which would possibly perhaps well now listing an influx of $357 million, given the dramatic note surge.

It’s most necessary to envision in mind that the sector Bitcoin ETFs are bought with greenbacks and denominated in greenbacks in a brokerage myth. Thus, while inflows into the ETF have been fixed in buck phrases, they have got been lowered by formulation of Bitcoin purchases.

Across the Fresh child 9, 303,002 BTC is now held beneath management per K33 Look at. Taking a sight at the CryptoSlate table old for the Jan. 18 article, this aligns with inflows projected for BlackRock by March 2, 2024.

Utilizing this info, would possibly perhaps well peaceable the Fresh child 9 continue to take in Grayscale’s declining outflows and buy further Bitcoin from the broader market at this lunge, 1 million BTC would possibly perhaps well also be beneath management by June. Additional, this price would swallow the BTC same of the total contemporary liquid supply of Bitcoin (roughly 1.3 million BTC) by September.

On Feb. 8, I mentioned the chance of the ‘Mother of all Supply Squeezes‘ for Bitcoin, which is same to the GameStop saga but even more effective. The price has surged 29% since that article went reside in barely 19 days, an moderate of 0.65% per day. Bitcoin ETFs have continued to buy, and Grayscale’s outflows are slowing.

The requirements for a supply squeeze seem like contemporary; the splendid quiz I gape is, at what level does the seek info from turn out to be affected by the price? Attain Bitcoin ETF purchasers continue to buy if Bitcoin is at $100,000? Well, at that note, BlackRock’s IBIT would be around $60 per fragment. That doesn’t sound reasonably as costly to novel traders now, does it?

Source credit : cryptoslate.com