The key challenges for institutional DeFi adoption

Essentially the most notable challenges for institutional DeFi adoption

Essentially the most notable challenges for institutional DeFi adoption Essentially the most notable challenges for institutional DeFi adoption

Unclear guidelines, liquidity concerns, and menace management hurdles bog down institutional DeFi adoption despite potential innovations.

Duvet art work/illustration by the employ of CryptoSlate. Image contains blended bid which could possibly presumably presumably also embody AI-generated bid.

The next is a guest article from Vincent Maliepaard, Marketing and marketing Director at IntoTheBlock.

As Bitcoin surpassed its all-time high earlier this year, driven by institutional ardour, many expected a identical surge within the decentralized finance (DeFi) express. With DeFi surpassing $100 billion in complete price locked (TVL), it turn into as soon as the right time for institutions to soar on board. On the quite loads of hand, the anticipated flood of institutional capital into DeFi has been slower than predicted. Listed right here, weâll explore the key challenges hindering institutional DeFi adoption.

Regulatory Hurdles

Regulatory uncertainty could presumably presumably be a most notable roadblock for institutions. In main markets enjoy the U.S. and the EU, the unclear classification of crypto assetsâin particular stablecoinsâcomplicates compliance. This ambiguity drives up prices and deters institutional involvement. Some jurisdictions, equivalent to Switzerland, Singapore, and the UAE, salvage embraced clearer regulatory frameworks, which has attracted early movers. On the quite loads of hand, the dearth of world regulatory consistency complicates rotten-border capital allocation, making institutions hesitant to enter the DeFi express with self perception.

Moreover, regulatory frameworks enjoy Basel III impose stringent capital requirements on financial institutions that withhold crypto resources, additional disincentivizing negate participation. Many institutions are opting for indirect exposure via subsidiaries or specialized funding vehicles to sidestep these regulatory constraints.

On the quite loads of hand, Trump’s position of job is expected to prioritize innovation over restrictions, doubtlessly reshaping U.S. DeFi guidelines. Clearer guidelines could presumably per chance also lower compliance barriers, attract institutional capital, and position the U.S. as a frontrunner within the express.

Structural Barriers Past Compliance

Whereas regulatory concerns on the total dominate the conversation, other structural barriers also prevent institutional DeFi adoption.

One eminent reputation is the dearth of correct pockets infrastructure. Retail customers are properly-served by wallets enjoy MetaMask, but institutions require bring together and compliant ideas, equivalent to Fireblocks, to make sure correct custody and governance. Additionally, the need for seamless on-and-off ramps between worn finance and DeFi is serious for reducing friction in capital drift. With out tough infrastructure, institutions fight to navigate between these two financial ecosystems successfully.

DeFi infrastructure requires developers with a highly explicit skillset. The skillset required on the total differs from worn finance instrument constructing and could presumably per chance also additionally fluctuate blockchain by blockchain. Institutions that are most productive making an are trying to deploy in essentially the most liquid ideas, will seemingly salvage to deploy into multiple blockchains which could possibly lengthen overhead and complexity.

Liquidity Fragmentation

Liquidity stays one in every of DeFiâs most chronic concerns. Fragmented liquidity throughout varied decentralized exchanges (DEXs) and borrowing platforms poses dangers equivalent to slippage and depraved debt. For institutions, executing mountainous transactions with out enormously affecting market prices is the largest, and shallow liquidity makes this advanced.

This can manufacture scenarios the build aside institutions salvage to enact transactions over multiple blockchains to construct one trade, at the side of to complexity and extending menace vectors on the scheme. To scheme institutional capital, DeFi protocols must manufacture deep and concentrated liquidity pools in a position to supporting very mountainous trades.

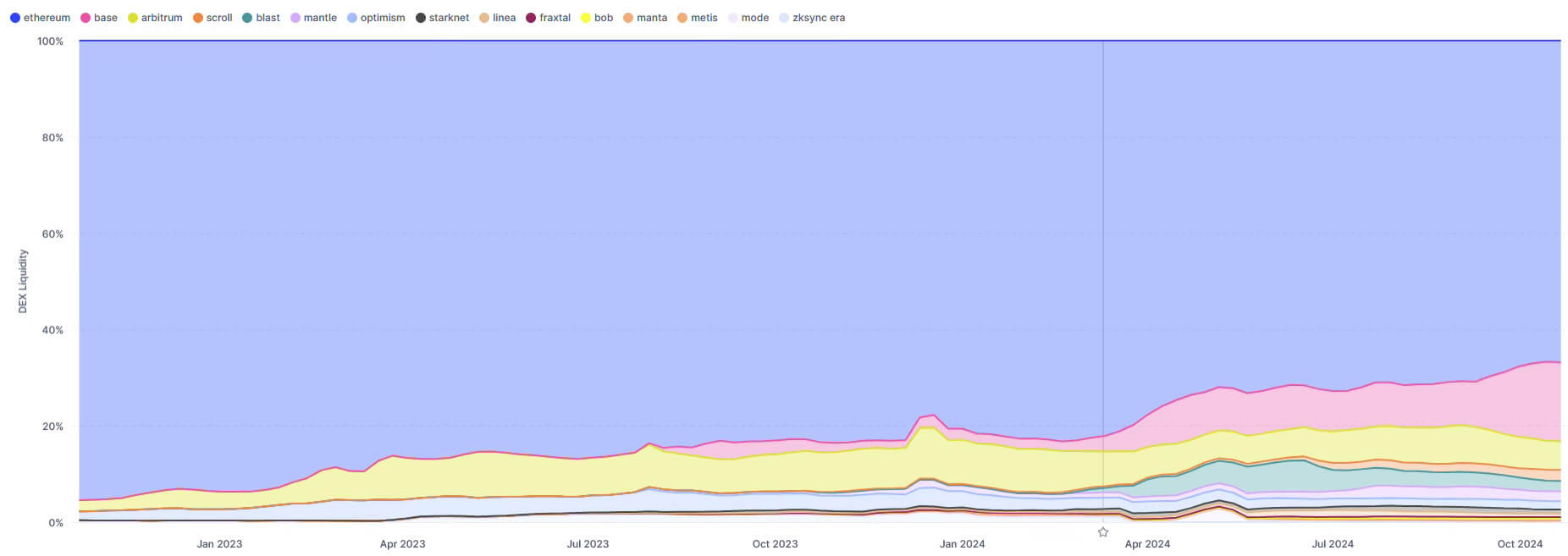

A true example of liquidity fragmentation can even be seen with the evolution of the Layer 2 (L2) blockchain panorama. Because it turns into more affordable to invent and transact on L2 blockchains, liquidity has migrated far from Ethereum mainnet. This has reduced liquidity on mainnet for sure resources and trades, attributable to this fact reducing the scale of deployment that institutions can build.

Whereas applied sciences and infrastructure enhancements are in constructing to solve many liquidity fragmentation concerns, this has been a key blocker for institutional deployment. That is amazingly correct for deployments onto L2s the build aside liquidity and infrastructure concerns are extra pronounced than on mainnet.

Possibility Management

Possibility management is paramount for institutions, in particular when enticing with a nascent sector enjoy DeFi. Past technical safety, which mitigates hacks and exploits, institutions salvage to realise the industrial dangers inherent in DeFi protocols. Protocol vulnerabilities, whether or not in governance or tokenomics, can present institutions to most notable dangers.

To compound these complexities, the dearth of insurance ideas at institutional dimension to quilt mountainous loss events enjoy a protocol exploit, on the total capacity that nearly all efficient the resources earmarked for high R/R bring together allocated to DeFi. This implies that lower menace funds that will seemingly be open to BTC exposure are not deploying into DeFi. Furthermore, liquidity constraintsâequivalent to the incapacity to exit positions with out triggering main market impactsâbuild it hard for institutions to regulate exposure successfully.

Institutions also need sophisticated tools to evaluate liquidity dangers, at the side of stress making an are trying out and modeling. With out these, DeFi will stay too terrible for institutional portfolios, which prioritize balance and the flexibility to deploy or unwind mountainous capital positions with minimal exposure to volatility.

The Route Forward: Building Institutional-Grade DeFi

To scheme institutional capital, DeFi must evolve to fulfill institutional standards. This implies developing institutional-grade wallets, developing seamless capital on-and-off ramps, offering structured incentive functions, and imposing comprehensive menace management ideas. Addressing these areas will pave the fashion for DeFi to outdated college into a parallel economic system, one in a position to supporting the scale and class required by mountainous financial avid gamers.

By constructing the correct infrastructure and aligning with institutional needs, DeFi has the potential to transform worn finance. As these enhancements are made, DeFi will not be going to most productive attract extra institutional capital but additionally set up itself as a foundational a part of the world financial ecosystem, ushering in a recent era of commercial innovation.

This text is per IntoTheBlockâs most restful evaluate paper referring to the fashion forward for institutional DeFi.

Mentioned on this text

Source credit : cryptoslate.com

CryptoQuant

CryptoQuant