The Bitcoin-Altcoin relationship: A reversion of altcoin dynamics

The Bitcoin-Altcoin relationship: A reversion of altcoin dynamics

The Bitcoin-Altcoin relationship: A reversion of altcoin dynamics The Bitcoin-Altcoin relationship: A reversion of altcoin dynamics

Bitcoin's resurgence sparks renewed altcoin alignment amid involving crypto dynamics.

Conceal art/illustration via CryptoSlate. Image comprises blended snarl material that may maybe maybe maybe embrace AI-generated snarl material.

The next is a guest put up from Shane Neagle, Editor In Chief from The Tokenist.

With US presidential elections concluded, Bitcoin has been hitting original all-time highs with regards to on a weekly basis at some stage in November. Having reached almost $100,000 threshold on November twenty 2nd, Bitcoin reinvigorated the altcoin market, now holding a $1.49 trillion market cap.

The long-established wisdom would counsel that altcoins will put collectively Bitcoinâs lead, as prior trends salvage proven. Nonetheless what types of altcoins must witness important efficiency? Extra importantly, are there original fundamentals in play to rob into yarn this time?

First, letâs revisit the connection between Bitcoin and altcoins. It is extra important than one would possess.

Why Does Bitcoin Lead the Crypto Market?

From the delivery of Bitcoin mainnet in January 2009, to Bitcoin tag breaching $10k threshold in November 2017, it took with regards to 9 years. Though Bitcoin step by step grew to change into a family title, it composed retained the set apart of a peculiar, highly speculative asset. Right here is understandable in a central banking system, the set up money is synonymous with govt edicts – fiat (by decree) money.

Subsequently, perception in govt edicts, and governmentâs utility of drive, is what gives money its tag. This has been the habituated long-established wisdom for generations. Furthermore, there may maybe be the inquire of medium. If Bitcoin is now no longer a bodily paper token issued by a central bank, but digital, how can it's relied on?

Blockchain enthusiasts already know the answer. The central bank, the Federal Reserve, also relies on an digital ledger, which may maybe maybe maybe manifest its accounting as bodily tokens (paper money) but now no longer necessarily. In distinction, the entire level of Bitcoinâs ledger is that its accounting is fortified in opposition to arbitrary dilution.

That makes Bitcoin pseudo-digital. Its accounting is enforced by computing energy via its proof-of-work algorithm, which erects a bridge between the digital and bodily. The bodily being the energy and hardware sources wished for computing energy. For that reason, Bitcoin items the altcoin market:

- As the first cryptocurrency, Bitcoinâs sound money side is easy to understand.

- As the Bitcoin networkâs computing energy grows, holders are extra confident within the inviolability of Bitcoinâs accounting (distributed ledger).

- As original altcoins seem, they are traded in opposition to Bitcoin, it being the market benchmark tethered to physicality of energy and hardware.

- In instances of uncertainty of altcoinsâ valuations, holders revert to Bitcoin as a safer asset.

- Likewise, in instances of rising Bitcoin tag, holders spill over to little cap altcoins for the reason that profit doable is better. Regardless of all the pieces, it's extra hard to transfer a big market weight that Bitcoin holds.

Inversely, the sizable Bitcoin market cap serves as a psychological cushion, always ready to absorb fleeing altcoin capital in instances of harm. Nonetheless in a highly stressful landscape, that capital may maybe maybe maybe cruise Bitcoin itself.

The topic is, if ample altcoin capital spills over, the entire crypto market goes down because many peep Bitcoin as accurate one more cryptocurrency, albeit one that has the first mover advantage.

Altcoin-Bitcoin Pullback

The relationship between the Federal Reserve and the crypto market is intrinsic. When the central bank increased its steadiness sheet in a ways extra than $6 trillion, between 2020 and 2022, the bloated liquidity spilled over into crypto sources, prompting traders to stumble on standard trading solutions to maximize alternatives.

Previously, crypto liquidity ballooned at some stage within the Preliminary Coin Offering (ICO) generation, having peaked between 2017 and 2018. This generation birthed prime altcoins at the time; Ethereum (ETH), Cardano (ADA), EOS (EOS), Tezos (XTZ), Stellar (XLM), Algorand (ALGO), NEO (NEO), Filecoin (FIL), Tron (TRX), Chainlink (LINK), and heaps others.

Nonetheless, all liquidity is limited. The enlargement of the altcoin market ate away Bitcoinâs market cap dominance. Merchants in total flip to trading rooms at some stage in such pivotal shifts to share solutions and insights into navigating market changes successfully.

Though the ICO hiss spawned dozens of altcoins, it will most certainly be the case that most were fallacious or dull within the water. For that reason, Bitcoin regained some misplaced floor unless the Fedâs unparalleled monetary intervention at some stage within the pandemic tale.

After the Fedâs money printing spree, Bitcoin dominance shrank further. Following the over-leveraged Terra (LUNA) give way, tied to algorithmic stablecoin TerraUSD, the altcoin market suffered an estimated $60 billion loss.

Nonetheless because prime altcoins already performed better than Bitcoin, because of their lower market caps and better profit doable, the speculative drive remained. This lowered Bitcoinâs dominance further, but easiest temporarily.

In a conventional domino toppling scenario, by the end of 2022, the Fed-pulled liquidity rug ended up triggering the give way of the over-leveraged FTX alternate, horrifying the entire crypto market. Bitcoin modified into engulfed within the selloff distress, having dropped to its pre-2020 tag stage of $16.5k.

Alternatively, because the mammoth inquire of impress loomed over the entire crypto market, Bitcoin started to improve. The US regional banking crisis, within the spring of 2023, helped the case for Bitcoinâs fundamentals. The approval of Bitcoin ETFs in early 2024 and the 4th halving, further laid the groundwork for most in vogue original all-time highs.

Nonetheless how has the altcoin market evolved alongside Bitcoin?

Memecoin Dominance Is Telling

Most of the âextinct-guardâ altcoins targeted on blockchain infrastructure, decentralized finance (DeFi), and other efforts to tokenize human exercise via excellent contracts. Nonetheless, the crypto wipeout at some stage in 2022 looks to salvage left psychological scarring.

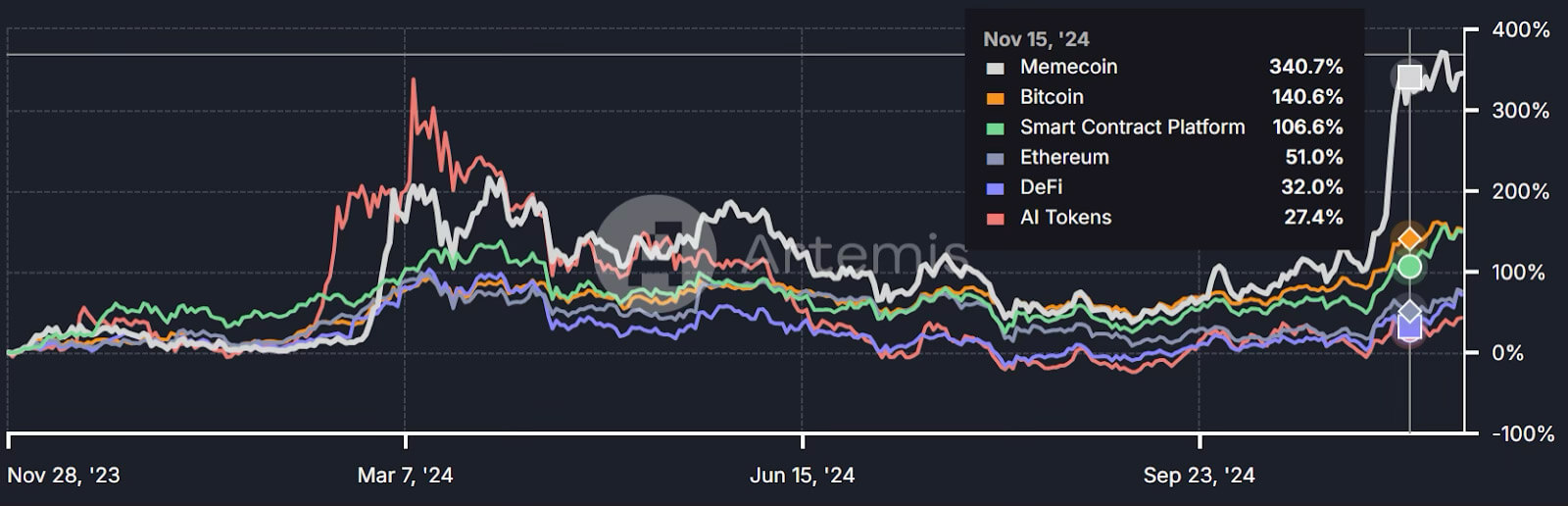

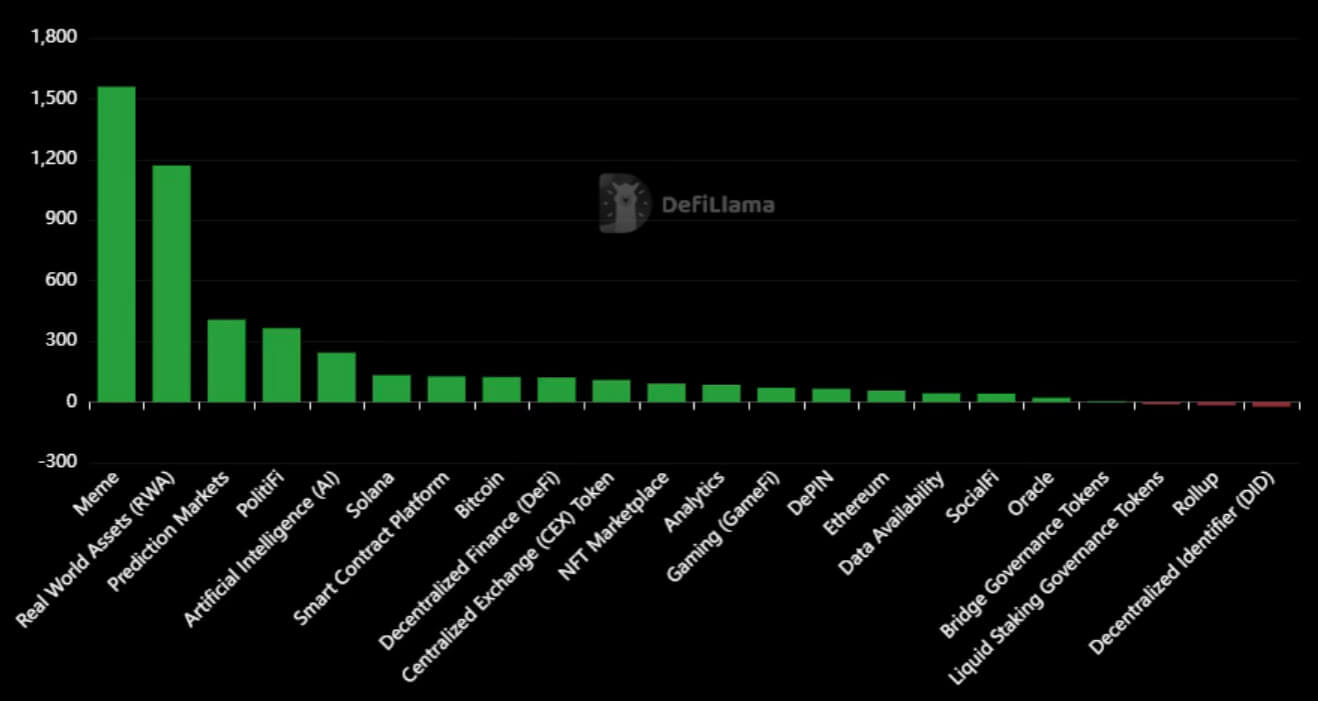

The lofty narratives of the old cycle were largely out of date by hype-playing via memecoins. Artemis data reveals that memecoins salvage dominated the crypto market, with easiest AI tokens surpassing their efficiency in early 2024.

By mid-November, memecoins returned 6x the associated price than the crypto market moderate.

This coincides with Donald Trump securing his 2nd term within the Oval Web snarl of enterprise. In flip, this points to crypto holders getting conversant in social media-pushed hype cycles round communities as an replace of altcoin fundamentals.

Likewise, the AI revolution is composed going sturdy. Rather then assorted âChatGPT with makeupâ application and companies offering hosted GPU servers, AI cryptos are also a hot topic, with the extraordinary-awaited unencumber of AI agents expected to spurn one more bullish duration.

Kaito AI, market insights platform, sprint that one in four crypto traders prioritize memecoin discourse. In other phrases, focal level is extra on temporary profits as an replace of lengthy-term return of tag. This suits extra dynamic traders who see up crypto trends on a on a typical basis basis.

Story-inspiring, the following altcoin classes performed sooner than Bitcoin twelve months-to-date: meme, valid world sources (RWA), prediction markets, PolitiFi, AI, Solana and excellent contract platforms.

In total, there are 15,713 cryptocurrencies in circulation, tracked across 1,178 exchanges and 494 classes. The form of big quantity of digital sources, across so many classes, creates a daunting mental load to filter the wheat from the chaff.

Conversely, the recognition of memecoins is one manifestation of facing that mental load. Regardless of all the pieces, their simplicity and virality is itself a filtering mechanism. Nonetheless one more coping manifestation is the reversion to the âextinct guardâ altcoins.

Older Altcoins Return to a Friendlier Scene

The 2022 give way of crypto prices modified into so excessive that it grew to change into pointless to sell altcoins at such toppled prices. For that reason, it's stunning to direct that many losses were unrealized, waiting for the original bullrun.

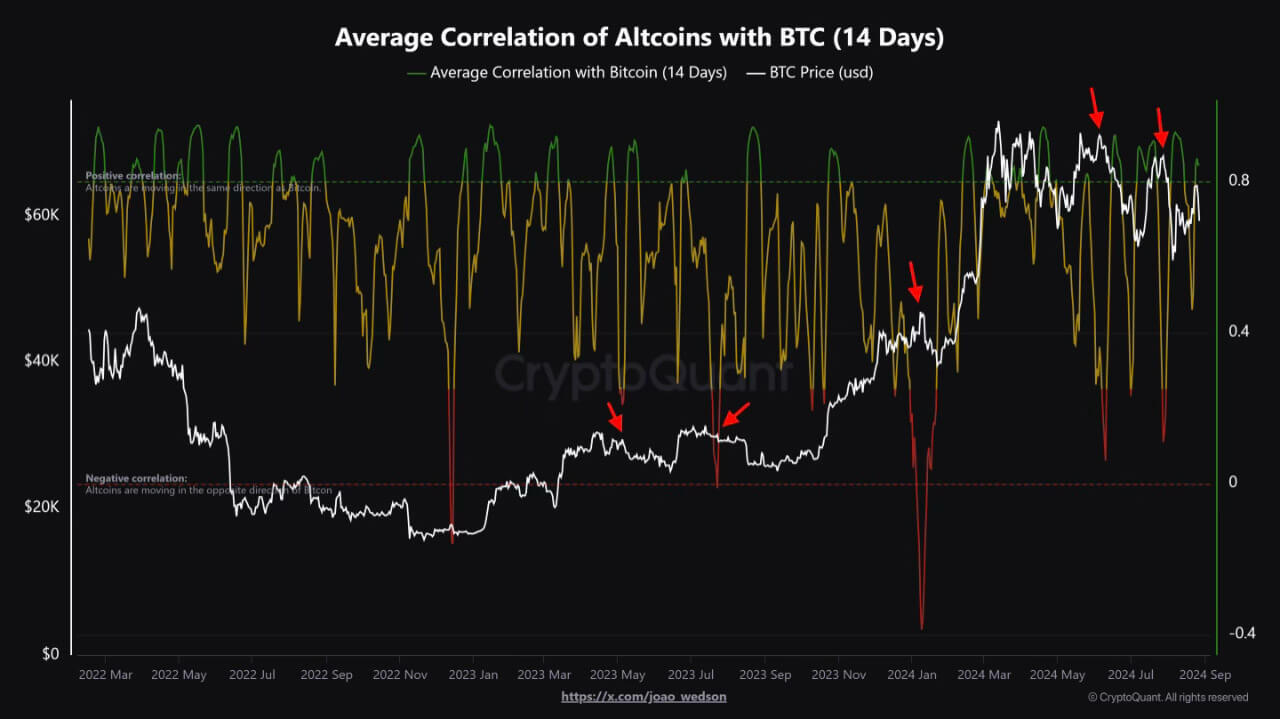

It looks that Bitcoinâs most in vogue bullrun is triggering that cycle. At the end of August, Joao Wedson of CryptoQuant noticed that the altcoin market is once extra aligning with Bitcoin.

Within the tip 20 altcoins (with the exception of stablecoins) within the old cycle, at some stage within the height of the November 2021 bullrun, 11 salvage remained. Though most of their prices are composed a ways-off from the prior tops, they've the capability to reclaim floor under the principle that right here is exact the originate of a original bullrun.

This may maybe maybe maybe be the case if extra alternate-traded funds (ETFs) are authorized, which spurred Bitcoin to rally and put better floor earlier within the twelve months. Working example, NYSE Arca these days filed for Bitwise 10 Crypto Index Fund, including the following coins:

| Portfolio Asset | Symbol | Weight |

|---|---|---|

| Bitcoin | BTC | 75.10% |

| Ethereum | ETH | 16.50% |

| Solana | SOL | 4.30% |

| XRP | XRP | 1.50% |

| Cardano | ADA | 0.70% |

| Avalanche | AVAX | 0.60% |

| Chainlink | LINK | 0.40% |

| Bitcoin Cash | BCH | 0.40% |

| Polkadot | DOT | 0.30% |

| Uniswap | UNI | 0.30% |

Apparently, the burden of Bitcoin within the index is extraordinary better than recent Bitcoin dominance. All once more, this points to the crypto dilution area. Despite altcoins being extraordinary more cost-effective, there are so extraordinary of of them that it's hard to gauge their stunning tag lengthy-term.

Likewise, their scarcity is now no longer assured. As extra centralized projects, their inflation rate may maybe maybe maybe be a area of commerce. As an illustration, Solanaâs recent inflation rate of SOL tokens is 4.886% whereas the lengthy-term proposition is 1.5%.

Alternatively, now that the anti-crypto SEC Chair is on the way out, whereas the purportedly crypto-friendly Trump admin is incoming, the crypto market is at possibility of deepen its liquidity pool. Additionally, the most in vogue verdict that sanction in opposition to Twister Cash modified into unlawful is at possibility of salvage extensive reaching implications.

The court successfully acknowledged that dApps are a original form of asset, missing sanctionable ownership as a excellent contract code. To check it differently, the court reinstated long-established sense that open-offer can't be property.

The Backside Line

Even with historic money provide boost, liquidity is finite. Bitcoin managed to capture most crypto liquidity, because it pushed a totally assorted manner of viewing money. This monetary doable spurred quite lots of altcoins into existence, expanding the utility of excellent contracts.

Nonetheless as an replace of enlargement, the crypto market underwent constriction because of big fraud and over-leverage, pulling down Bitcoin with it. In a cleaner market and extra bullish regulatory landscape, Bitcoin is now poised to location off a original altcoin bullrun.

Amid the daunting altcoin numerosity, 1st gen altcoins resurfaced, attempting to anchor tag to established familiarity.

Talked about listed right here

Bitcoin

Bitcoin  Ethereum

Ethereum  Cardano

Cardano  EOS

EOS  Tezos

Tezos  Stellar

Stellar  Algorand

Algorand  Neo

Neo  Filecoin

Filecoin  TRON

TRON  Chainlink

Chainlink  Solana

Solana  Avalanche

Avalanche  XRP

XRP  Polkadot

Polkadot  Uniswap

Uniswap  CryptoQuant

CryptoQuant  Donald Trump

Donald Trump

Source credit : cryptoslate.com