Tether reports record $4.52 billion profit in Q1 despite shrinking market share

Tether reviews file $4.52 billion profit in Q1 despite scared market share

Tether reviews file $4.52 billion profit in Q1 despite scared market share Tether reviews file $4.52 billion profit in Q1 despite scared market share

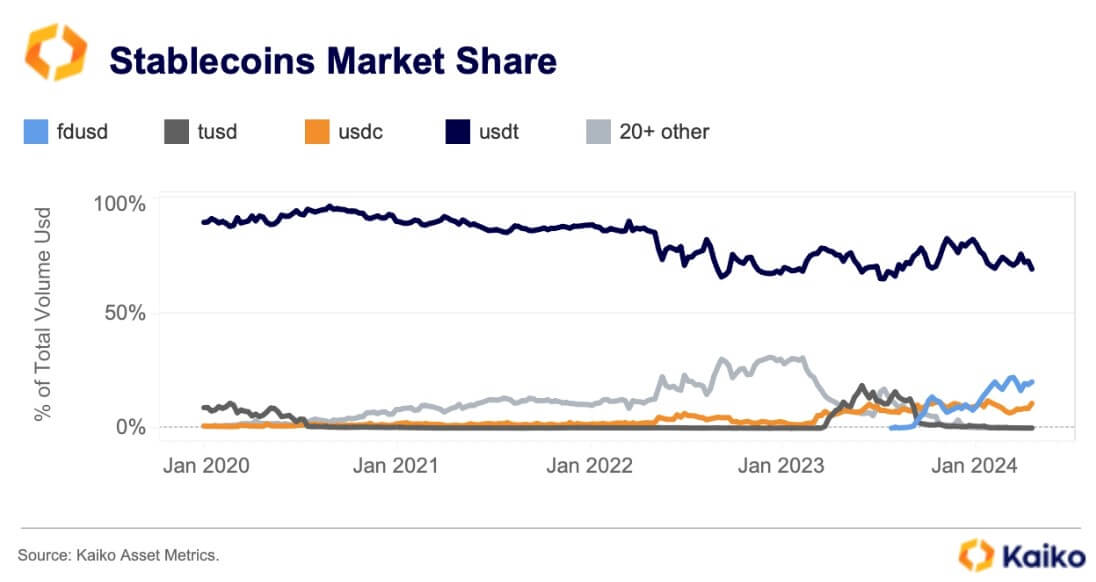

Tether's USDT market share on centralized exchanges (CEXs) has fallen to 69% twelve months-to-date.

Quilt art work/illustration by approach of CryptoSlate. Checklist consists of blended relate that could per chance per chance furthermore simply encompass AI-generated relate.

Stablecoin issuer Tether (USDT) accomplished a ancient procure profit of $4.52 billion in the important thing quarter despite going by blueprint of a necessary fall in market share.

Document procure profit

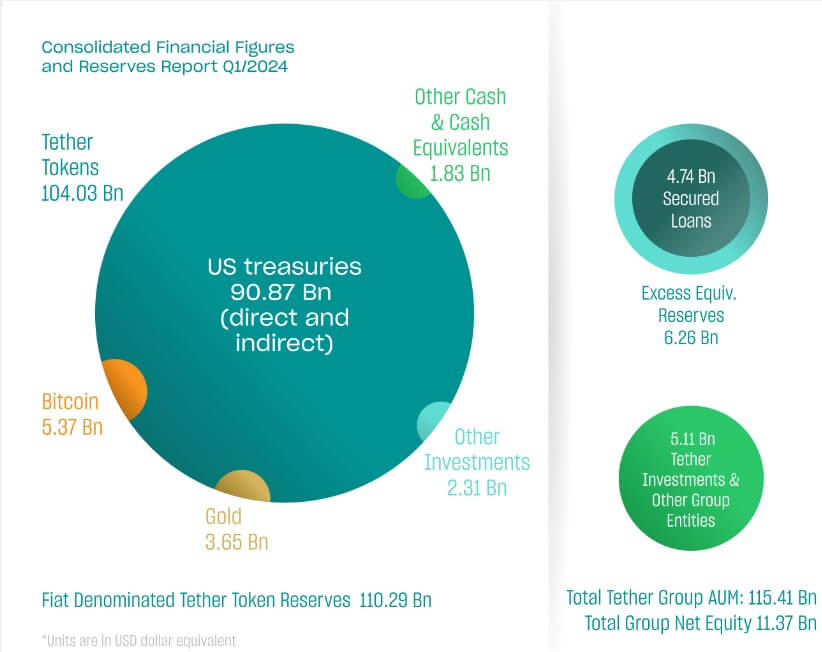

Per the attestation file shared with CryptoSlate, the company’s expansive earnings mainly originated from its US Treasury holdings, supplemented by positive aspects from its Bitcoin and gold investments.

Paolo Ardoino, Tether CEO, mentioned:

“Tether has demonstrated its unwavering dedication to transparency, stability, liquidity, and responsible risk administration. As proven on this most recent file, Tether continues to fracture recordsdata with a brand unusual profit benchmark of $4.52 billion, reflecting the companyâs sheer financial strength and stability.”

As of March 31, 2024, Tether boasted a treasury portfolio exceeding $90 billion in US Treasury bills, encompassing disclose and oblique holdings. Which capability, its surplus reserve surged by $1 billion, reaching practically about $6.3 billion.

Concurrently, Tether Community’s equity surged to $11.37 billion, a critical boost from the $7.01 billion reported on December 31, 2023.

The disclosure also affirmed that Tether-issued stablecoins dwell backed by 90%, alongside with resources akin to money and money equivalents, affirming the reserve ratio in step with the fourth quarter of closing twelve months.

Particularly, Tether token reserves totaled roughly $110.3 billion, with liabilities amounting to around $104 billion. Alternatively, the price of resources in the reserve surpassed liabilities by over $6 billion.

Declining market share

Despite minting $12.5 billion in unusual USDT tokens for the length of the important thing quarter, the company is incessantly shedding its market share in consequence of the unprecedented opponents in the stablecoin market.

Per Kaiko recordsdata, the stablecoin’s market share on centralized exchanges (CEXs) has dwindled to 69% twelve months-to-date.

At some stage in the important thing quarter, Tether encountered mounting opponents from stablecoins devour FDUSD, which capitalized on Binance’s zero-price promotions. Furthermore, USDC, backed by Circle, witnessed a surge in its market share to 11%, suggesting a rising inclination in opposition to regulated imaginable suggestions.

Market observers also identified the emergence of revolutionary yield-bearing imaginable suggestions devour Ethena’s USDe, which could per chance per chance furthermore very properly be impacting USDT’s dominance. Since its originate in February, USDe’s trading quantity has experienced expansive development, though it receded from April’s height of over $800 million following Ethena’s ENA airdrop.

Mentioned on this text

Source credit : cryptoslate.com