Tether 24 hour trading volume surpasses Bitcoin, Solana, USDC and Ethereum combined

Tether 24 hour procuring and selling volume surpasses Bitcoin, Solana, USDC and Ethereum mixed

Tether 24 hour procuring and selling volume surpasses Bitcoin, Solana, USDC and Ethereum mixed Tether 24 hour procuring and selling volume surpasses Bitcoin, Solana, USDC and Ethereum mixed

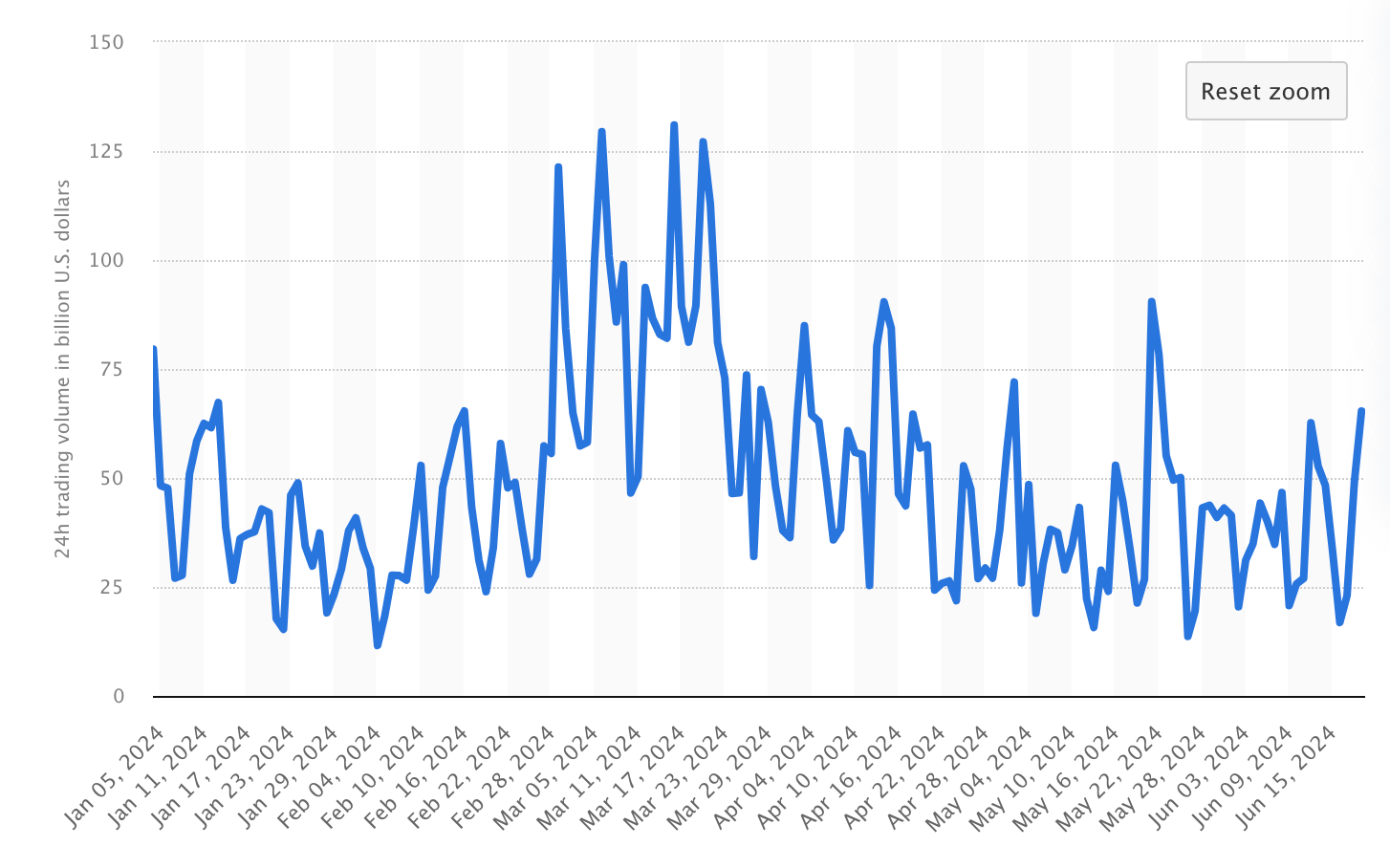

Tether's top volumes reached $130 billion in 2024, reflecting strong market question.

Duvet art/illustration by strategy of CryptoSlate. Image contains mixed voice material which could perchance encompass AI-generated voice material.

Tether USDT’s 24-hour procuring and selling volume exceeds the mixed crammed with the following 5 digital sources, including Bitcoin and Ethereum.

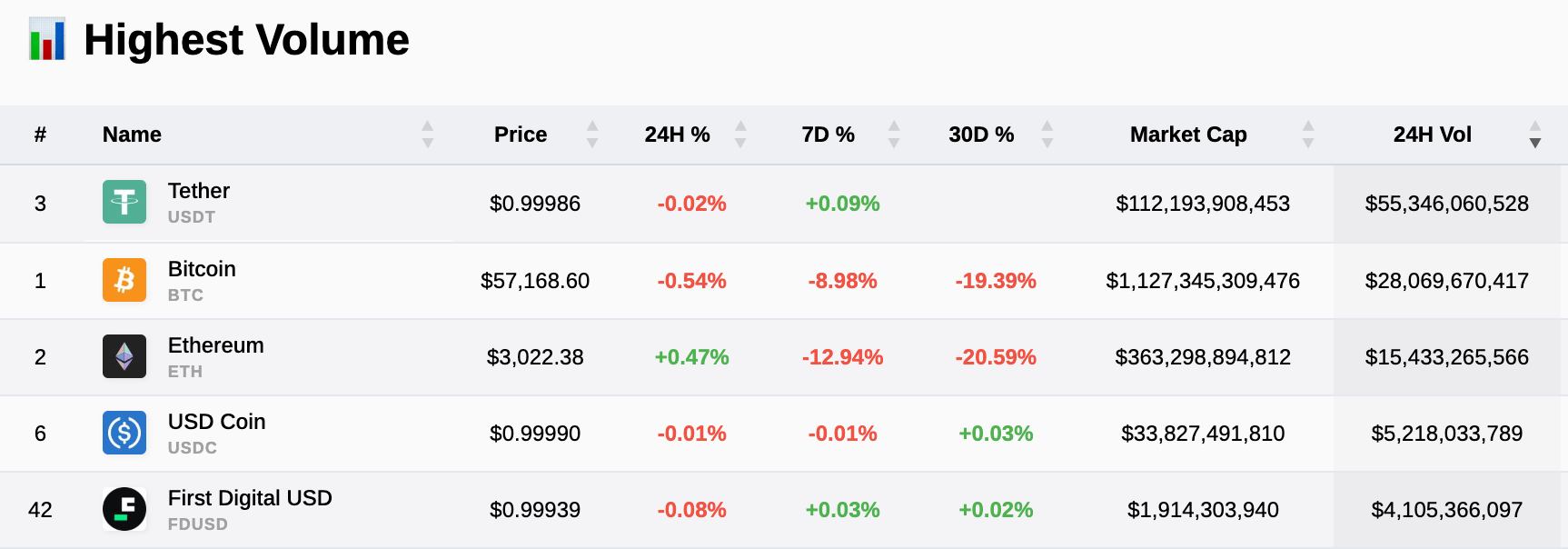

Reflecting on Tether’s dominance in procuring and selling volume affords insight into market liquidity. As CryptoSlate recordsdata indicates, Tether (USDT) maintains a higher volume than Bitcoin (BTC), Ethereum (ETH), USD Coin (USDC), Solana (SOL), and First Digital USD (FDUSD), pointing to its predominant presence available in the market. Particularly, Tether recorded a 24-hour volume of over $55 billion, far surpassing Bitcoin’s $28 billion and Ethereum’s $15 billion.

These volume statistics issue broader market traits as Tether affords liquidity and balance. Tether on a regular basis achieves day-to-day procuring and selling volumes exceeding $25 billion, reinforcing its self-discipline as a key liquidity provider in the crypto ecosystem.

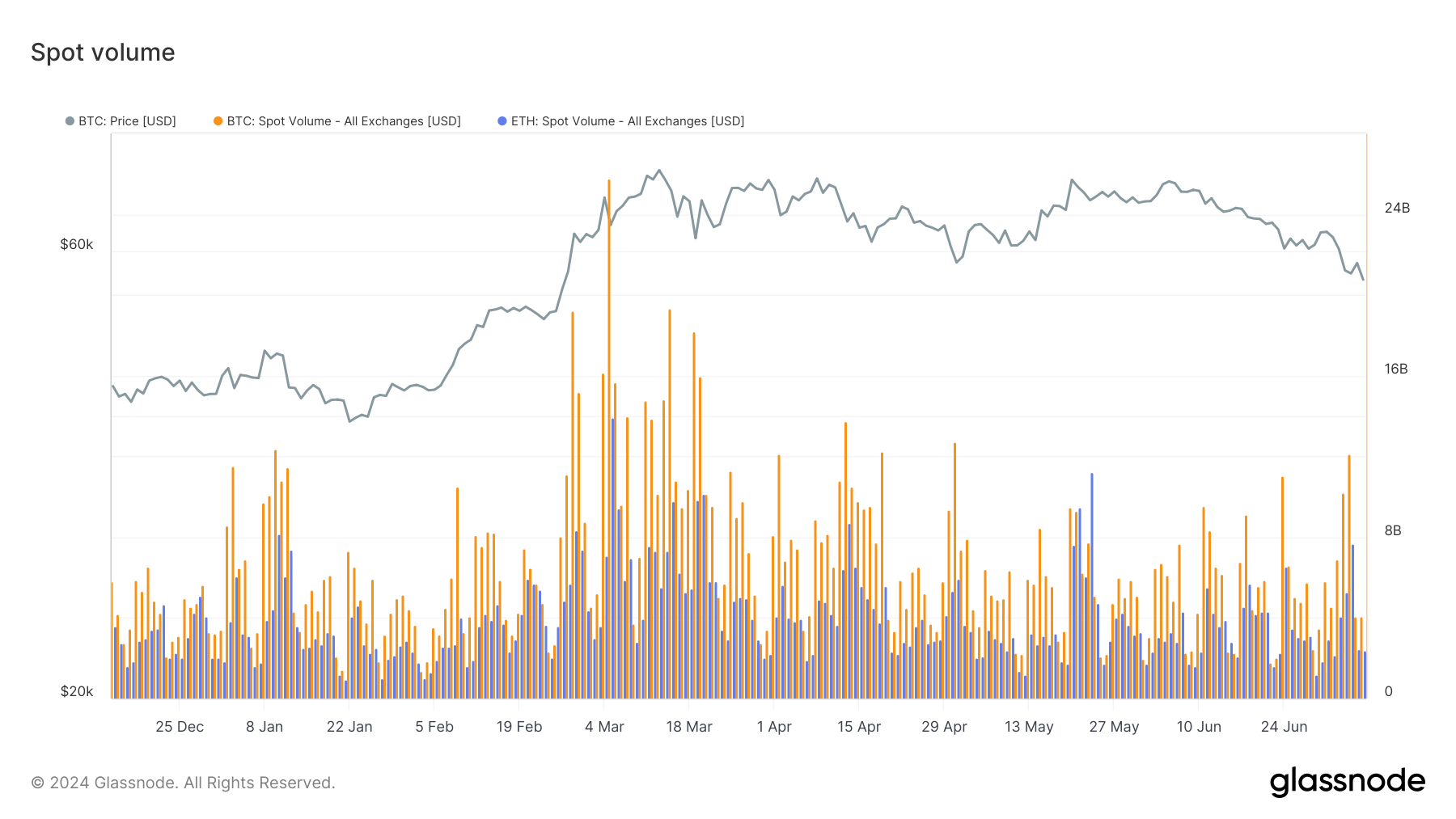

Per Glassnode recordsdata, all through 2024, Bitcoin and Ethereum have considered round $4 – $8 billion per day, far below Tether’s volumes.

The excessive procuring and selling volume of Tether when put next to other predominant digital sources illustrates its integral position in day-to-day procuring and selling activities and the broader market technique that merchants and institutions make consume of. This real excessive-volume procuring and selling signifies belief and reliance on Tether’s balance and accessibility, making it necessary for environment friendly market functioning.

Whereas Tether has traditionally confronted recounted challenges referring to its reserves and consume in illicit activities, these volumes showcase its resilience in combating these claims. Tether’s CEO Paolo Ardoino now not too long in the past suggested CryptoSlate that Tether is for the time being over-collateralized, with the firm’s revenue being effect help into reserves to toughen its balance.

Additional, Ardoino commented how Senator Warren’s discouragement of accounting companies from participating with Tether had hindered its capacity to make consume of one amongst the US’s top four accountants for audits. The CEO claimed that Tether is repeatedly making an try for to hire one amongst the leading companies but has almost given up on it going on any time quickly, no topic their efforts to tag so.

Talked about on this text

Source credit : cryptoslate.com