Tether expands fiat portfolio with new UAE Dirham stablecoin

Tether expands fiat portfolio with new UAE Dirham stablecoin

Tether expands fiat portfolio with new UAE Dirham stablecoin Tether expands fiat portfolio with new UAE Dirham stablecoin

Tether's lope comes as UAE stepped up its regulatory effort for fiat-pegged digital property.

Hide artwork/illustration by CryptoSlate. Picture entails mixed utter material that will well merely encompass AI-generated utter material.

USDT issuer Tether plans to launch a brand new stablecoin pegged to the United Arab Emirates Dirham (AED) in collaboration with the Phoenix Community and Inexperienced Acorn, essentially based on an Aug. 21 commentary shared with CryptoSlate.

This new asset might per chance be a digital representation of the UAE Dirham, pegged 1:1 and backed by reserves held within the UAE.

The introduction of this Dirham-pegged stablecoin goals to put customers with seamless internet entry to to AED while leveraging the transparency and efficiency of blockchain technology. This initiative is anticipated to raise world alternate and remittances, decrease transaction costs, and offer a hedge in opposition to forex fluctuations.

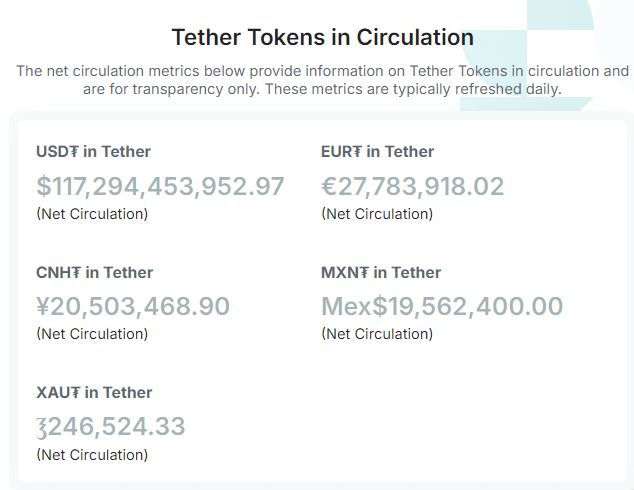

Once launched, the stablecoin might per chance be a half of Tether’s existing portfolio of fiat-essentially based tokens, including USDT, EURT, CNHT, MXNT, XAUT, and aUSDT.

Why Tether is launching an AED stablecoin

Tether CEO Paolo Ardoino cited UAE’s build of abode as a world financial hub as a key factor at the support of the launch. He emphasised the importance of making a Dirham-pegged token to facilitate regional transactions.

Ardoino said:

“Tetherâs Dirham-pegged stablecoin is decided to turn out to be an an crucial tool for corporations and folks procuring for a trusty and atmosphere friendly manner of transacting in the United Arab Emirates Dirham whether or no longer for rotten-border funds, trading, or merely diversifying oneâs digital property.”

The stablecoin’s launch coincides with Abu Dhabi’s Financial Products and services Regulatory Authority (FSRA) proposing a regulatory framework for fiat-referenced tokens (FRTs).

On Aug. 20, FSRA outlined that FRT issuers proposed that the stablecoin issuers’ reserve property must aloof equal or exceed the par price of all famed FRTs at the cessation of every and each industry day.

Additionally, the FSRA recommends that issuers of multiple FRTs defend separate pools of reserve property for every token and area up them independently.

Further, the regulator said that the FRT must no longer be promoted as nor thought to be as to be an investment or a savings product. On the other hand, this might per chance well no longer restrict an issuer from accruing and distributing earnings earned from Reserve Sources to the FRT holder.

This initiative reflects the snappily growth of the crypto market in the UAE, which has experienced well-known enhance in most up to date years.

Mentioned listed right here

Source credit : cryptoslate.com