Standard Charter reports $30 trillion tokenised real-world asset market by 2034

No longer fresh Structure experiences $30 trillion tokenised proper-world asset market by 2034

No longer fresh Structure experiences $30 trillion tokenised proper-world asset market by 2034 No longer fresh Structure experiences $30 trillion tokenised proper-world asset market by 2034

No longer fresh Chartered characterize projects predominant development with tokenization position to bridge the $2.5 trillion global alternate finance gap.

Quilt art/illustration by strategy of CryptoSlate. Record contains blended verbalize material that might per chance perchance presumably also encompass AI-generated verbalize material.

Per a characterize by No longer fresh Chartered, the marketplace for tokenized proper-world resources is projected to succeed in $30.1 trillion by 2034.

This vital market development highlights the increasing position of tokenization in reworking global alternate and finance by making improvements to liquidity, accessibility, and effectivity. The characterize emphasizes the shift in direction of integrating digital resources into mainstream finance, reflecting the broader adoption and scalability of blockchain skills and DeFi functions.

Kai Fehr, International Head of Trade, No longer fresh Chartered, commented,

“We behold the following three years as a severe junction for tokenisation, with alternate finance resources coming to the fore as a fresh asset class. To free up this trillion-buck different, industry-wide collaboration among all stakeholders, from investors and monetary institutions to governments and regulators is severe.”

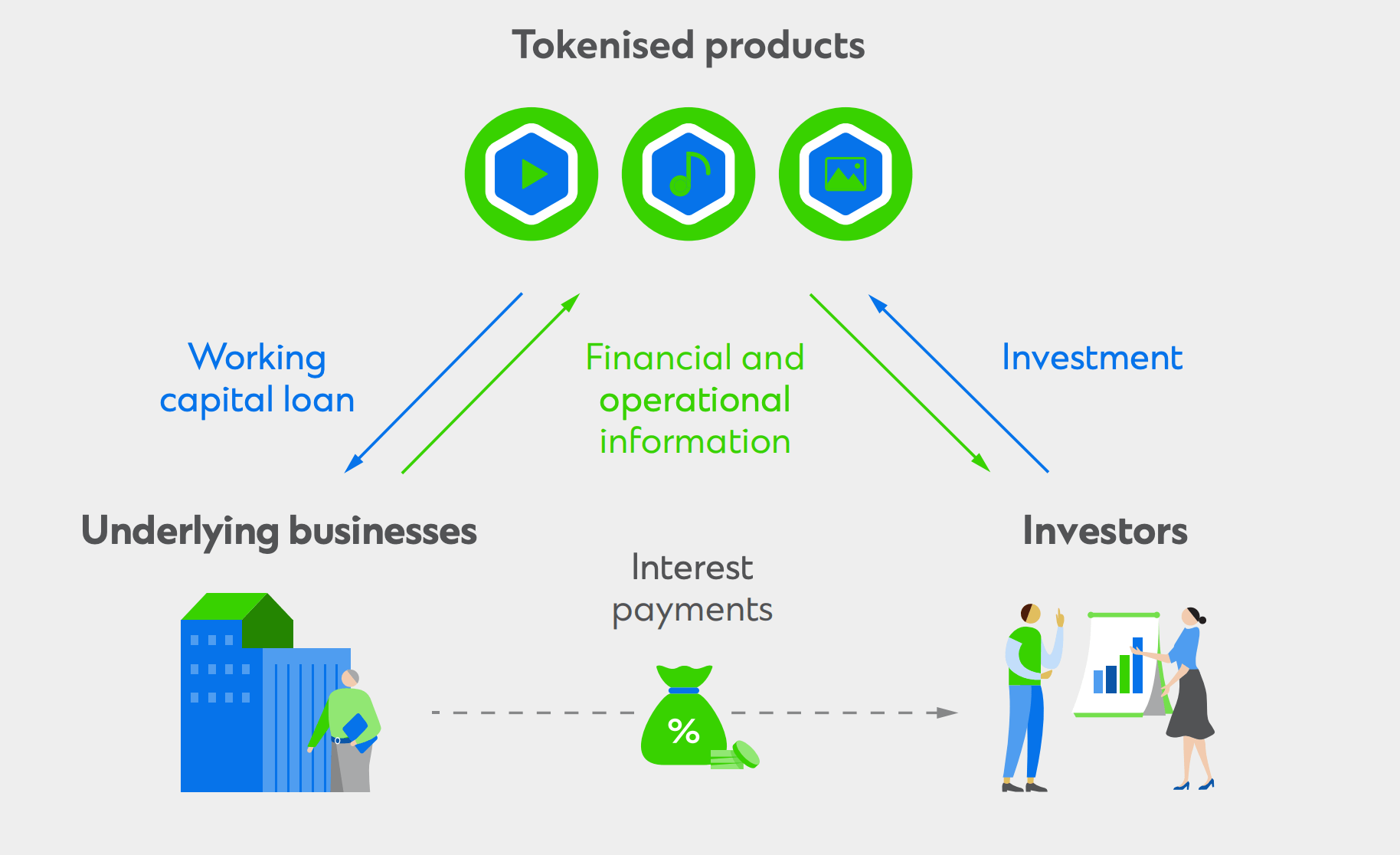

No longer fresh Chartered’s diagnosis emphasizes the transformative affect of tokenizing alternate finance resources, which would be traditionally underinvested but provide solid chance-adjusted returns and low default charges. Tokenization enables fractional possession, operational effectivity, and improved monetary market infrastructure, which analysts express will free up fresh opportunities for investors and abet to bridge the $2.5 trillion global alternate finance gap.

The characterize highlights the evolution of tokenization has been quick, with predominant milestones equivalent to the introduction of Bitcoin in 2009 and Ethereum in 2015, which introduced vivid contracts and decentralized functions into the monetary ecosystem. It additional cites, regulatory frameworks and industry collaborations, equivalent to Project Guardian, led by the Monetary Authority of Singapore, occupy additional demonstrated the viability and advantages of tokenized resources.

As the marketplace for tokenized resources expands, No longer fresh Structure expects build a question to of to hover, with projections indicating that 69% of aquire-aspect firms belief to make investments in tokenized resources by 2024. This rising ardour is driven by the aptitude for diminished transaction costs, enhanced liquidity, and entry to fresh asset classes. Irrespective of the most modern market dimension of tokenized proper-world resources being around $5 billion, other than stablecoins, the aptitude addressable market, including alternate finance gaps, is estimated to be $14 trillion.

No longer fresh Chartered’s initiatives, equivalent to the successful pilot of asset-backed security tokens on the Ethereum blockchain, highlight the intellectual functions of tokenization in making improvements to market entry and operational effectivity. The characterize advocates for increased collaboration among monetary institutions, regulators, and skills services to originate a supportive atmosphere for tokenization, emphasizing the necessity for standardized processes, regulatory compliance, and interoperability.

The characterize concludes that the monetary industry stands at a severe juncture, with tokenization poised to revolutionize asset management, alternate finance, and global economic actions. By embracing tokenization, No longer fresh Chartered believes stakeholders can toughen capital effectivity, broaden market entry, and pressure innovation, paving the absolute most real looking procedure for a extra inclusive and resilient monetary ecosystem.

Source credit : cryptoslate.com