StanChart predicts Bitcoin to reach $73K pre-election as ETF inflows, MicroStrategy stock surge

StanChart predicts Bitcoin to attain $73K pre-election as ETF inflows, MicroStrategy stock surge

StanChart predicts Bitcoin to attain $73K pre-election as ETF inflows, MicroStrategy stock surge StanChart predicts Bitcoin to attain $73K pre-election as ETF inflows, MicroStrategy stock surge

MicroStrategy's stock divergence from Bitcoin displays rising institutional self belief amid ETF inflow surges and doubtless policy shifts.

Duvet art/illustration thru CryptoSlate. Image involves combined pronounce material that will consist of AI-generated pronounce material.

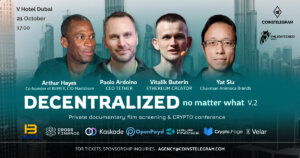

Same outdated Chartered believes Bitcoin (BTC) might rally above $73,000 sooner than the US election, pushed by rising ETF inflows and a surge in call alternate options project, in accordance with a learn label shared with CryptoSlate.

StanChart’s global head of digital sources, Geoffrey Kendrick, highlighted several key market actions signaling bullish sentiment prior to the November vote.

Bitcoin poised for a critical rally

Kendrick highlighted that fetch inflows to Bitcoin ETFs absorb climbed to spherical 916,000 BTC as of Oct. 14. This boost coincides with critical hobby in upside Bitcoin call alternate options, particularly on the $80,000 strike stage for the Dec. 27 expiry.

In the previous week by myself, an additional 1,600 BTC modified into added to the commence hobby of the $80,000 call option on Deribit. This surge in alternate options trading, combined with consistent ETF inflows, suggests that merchants are positioning for a doubtless mark breakout as financial and political stipulations align prior to the election.

Kendrick additionally highlighted the ability influence of the US presidential election on Bitcoin’s outlook. He instructed that beneath fresh conditional probabilities, if used President Donald Trump wins the presidency, there is a 70% chance of a Republican sweep. Such an might lead to extra favorable rules for digital sources, potentially boosting Bitcoin’s mark additional.

He added that Bitcoin is more seemingly to outperform Ethereum and other sources in the lead-as a lot as the election, pushed by the energy in ETF inflows and the rising integration of digital sources into used finance.

MicroStrategy outlook

Kendrick highlighted MicroStrategy’s (MSTR) fresh stock efficiency, noting a clear divergence from Bitcoin’s mark since mid-September. Whereas Bitcoin has remained rather flat, MSTR’s NAV multiple has surged, reflecting rising investor self belief in the company’s strategic operate available in the market.

Kendrick attributed this upward thrust in MSTR’s multiple to the ability influence of the Bank Custody Exemption Rule SAB 121, which can enable institutional counterparties to lend out MicroStrategy’s 250,000 BTC holdings.

This might per chance create additional yield opportunities, bettering the company’s monetary dilemma. Kendrick emphasized that this pattern makes MSTR’s stock increasingly extra beautiful, at the same time as Bitcoin’s mark remains real.

He added that the decoupling of MSTR’s stock from Bitcoin is considered as a signal of rising institutional hobby in the broader digital asset ecosystem because it gains legitimacy. MicroStrategy’s strategic dilemma as a critical holder of BTC is riding its stock increased, positioning the company for added success prior to the US election.

Mentioned on this article

Source credit : cryptoslate.com