Solana’s July DEX volume exceeds Ethereum amid wash trading concerns

Solana’s July DEX volume exceeds Ethereum amid wash procuring and selling issues

Solana’s July DEX volume exceeds Ethereum amid wash procuring and selling issues Solana’s July DEX volume exceeds Ethereum amid wash procuring and selling issues

Institutional passion and memecoins push Solanaâs DEX volume better than Ethereum final month.

Quilt art work/illustration by potential of CryptoSlate. Image comprises combined snort material which would perhaps doubtless comprise AI-generated snort material.

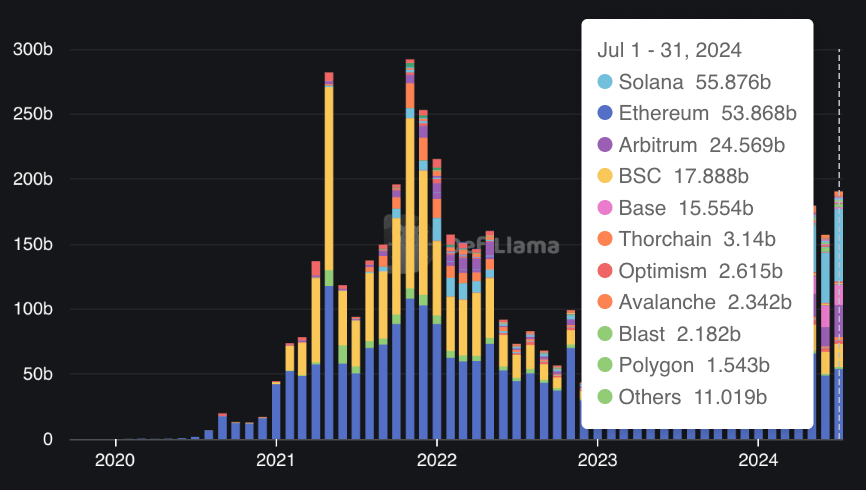

The Solana community outpaced Ethereum in month-to-month decentralized alternate (DEX) volume in July, in step with DefiLlama recordsdata.

Solana’s DEX transactions reached $55.8 billion, surpassing Ethereum’s $fifty three.8 billion for the identical length. This represents Solana’s second-very top month-to-month volume, following March 2024’s top of $60.7 billion.

Solana’s volume spike is mainly as a result of exercise on platforms fancy Raydium, Orca, and Phoenix. In incompatibility, Ethereum’s volume is predominantly driven by the Uniswap alternate.

Despite these figures, Ethereum stays the main DeFi platform, conserving approximately 61% of the market and locking $67 billion in assets. In comparability, Solana commands ideal 4.64% of the market, with a total price locked (TVL) of $5.16 billion.

What is driving Solana’s increase?

Analysts demonstrate a upward push in memecoin exercise as a key driver in the attend of Solana’s elevated DEX volume.

Over the final 365 days, the blockchain has skilled valuable increase in rather a few memecoins, from cat-themed to politically inspired tokens. This has ended in elevated liquidity as traders look to capitalize on these assets.

Institutional endorsements have also fueled passion in Solana, and speculation about a doubtless Solana alternate-traded fund (ETF) could doubtless even have contributed to its increase. In June, smartly-known asset administration companies VanEck and 21Shares utilized with the US Securities and Alternate Commission (SEC) to own a arena-essentially based mostly Solana ETF.

Extra, market analysts have illustrious elevated utilization of stablecoins on Solana. Info from Allium on Visa’s stablecoin dashboard reveals that the transaction volume for the USDC stablecoin on Solana has exceeded $8 trillion since the inspiration of final 365 days, with USDT on the Tron blockchain following at $6.5 trillion.

Wash-procuring and selling issues

Within the meantime, Solana’s recent surge in DEX procuring and selling has raised issues about doubtless wash procuring and selling. A recent file by the pseudonymous crypto analyst Flip Review claims that 93% of transactions on the blockchain are inorganic.

The file indicates that Solana’s day-to-day transactions are carefully influenced by wash procuring and selling, MEV bots, and scams, which present minimal price to retail traders. Flip Review illustrious:

“Looking on the wallets alive to, the overwhelming majority appear to be bots in the identical community with tens of thousands of transactions. They generate fraudulent volumes independently, with random quantities of SOL and a random no. of transactions except the mission rugs, earlier than inspiring onto the next one.”

Mentioned listed right here

Source credit : cryptoslate.com