Solana and ICP up over 49% against Bitcoin since SEC labeled them as securities

With Bitcoin down some 20% from its 300 and sixty five days-to-date excessive, it’s in general functional to zoom out and take into fable at the broader image. I in actuality receive a saved chart of the general tokens listed within the Coinbase and Binance complaints filed (C&B fits) on June 6 and June 5, 2023, respectively, and their prices as denominated in Bitcoin.

For context, both Binance and Coinbase are currently defending their positions in U.S. courts. The central pronounce in both complaints is whether or no longer or no longer the crypto assets offered by these exchanges desires to be labeled as securities and, as a result of this truth, descend underneath SEC law.

The tokens described as capacity securities within the abovementioned complaints included Alogrand, Solana, Cardano, Advance, Filecoin, and others, as proven within the chart underneath. Let’s take into fable how these assets receive carried out when compared to Bitcoin over the last 8 months after which take into fable at one of the vital standout tokens’ performance in buck terms.

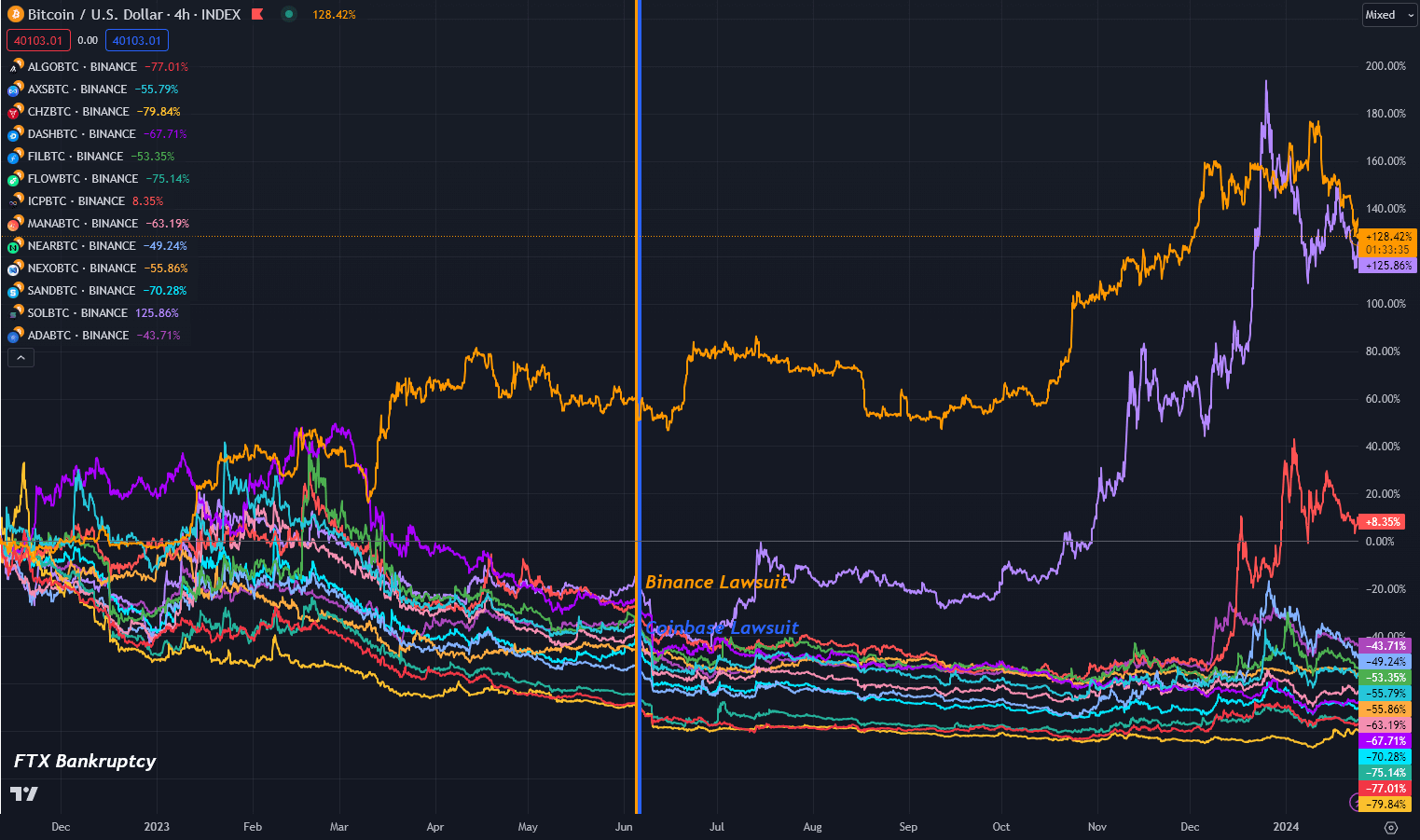

For context, we’ll first take into fable at the performance of this cohort of digital assets for the explanation that shaded swan match that preceded the C&B fits, particularly the financial distress filing and subsequent give way of FTX. The replace filed for Chapter 11 financial distress on Nov. 11, 2023, when Bitcoin turned into as soon as priced spherical $16,900. Since then, it has soared by approximately 140% in opposition to the buck, with most appealing two assets outperforming it.

Solana and ICP saw increases of their label in BTC terms, increasing 116% and 9% respectively. All other tokens listed as capacity securities declined in opposition to Bitcoin between -41% and -80%

The appropriate turned into as soon as Cardano, which misplaced 41% of its label in opposition to Bitcoin; the worst turned into as soon as Chilliz, which declined -80%. In buck terms, Cardano is up 50%, whereas Chilliz is down -fifty three%, showcasing the strength of Bitcoin over the last 15 months.

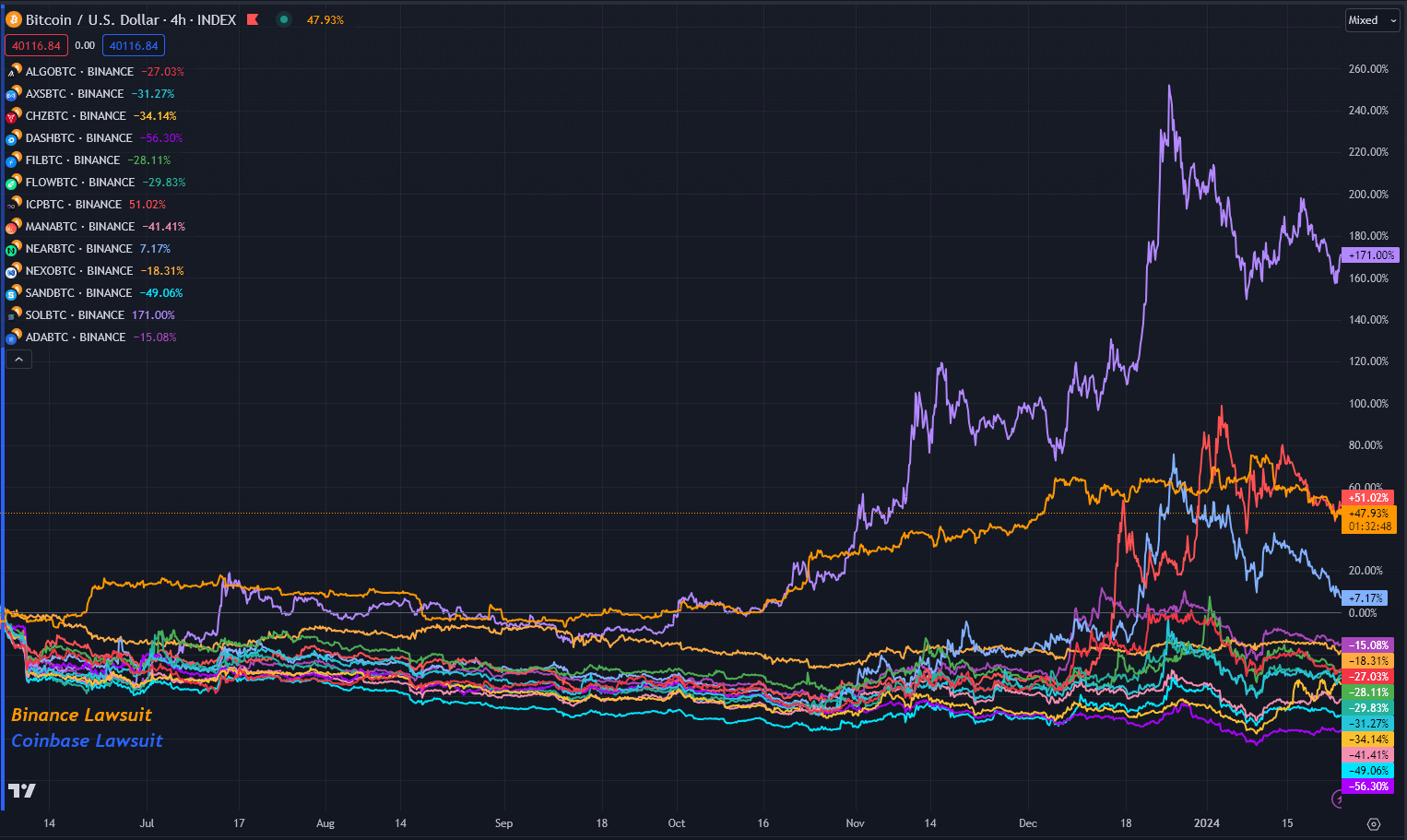

Performance since Coinbase and Binance SEC complaints.

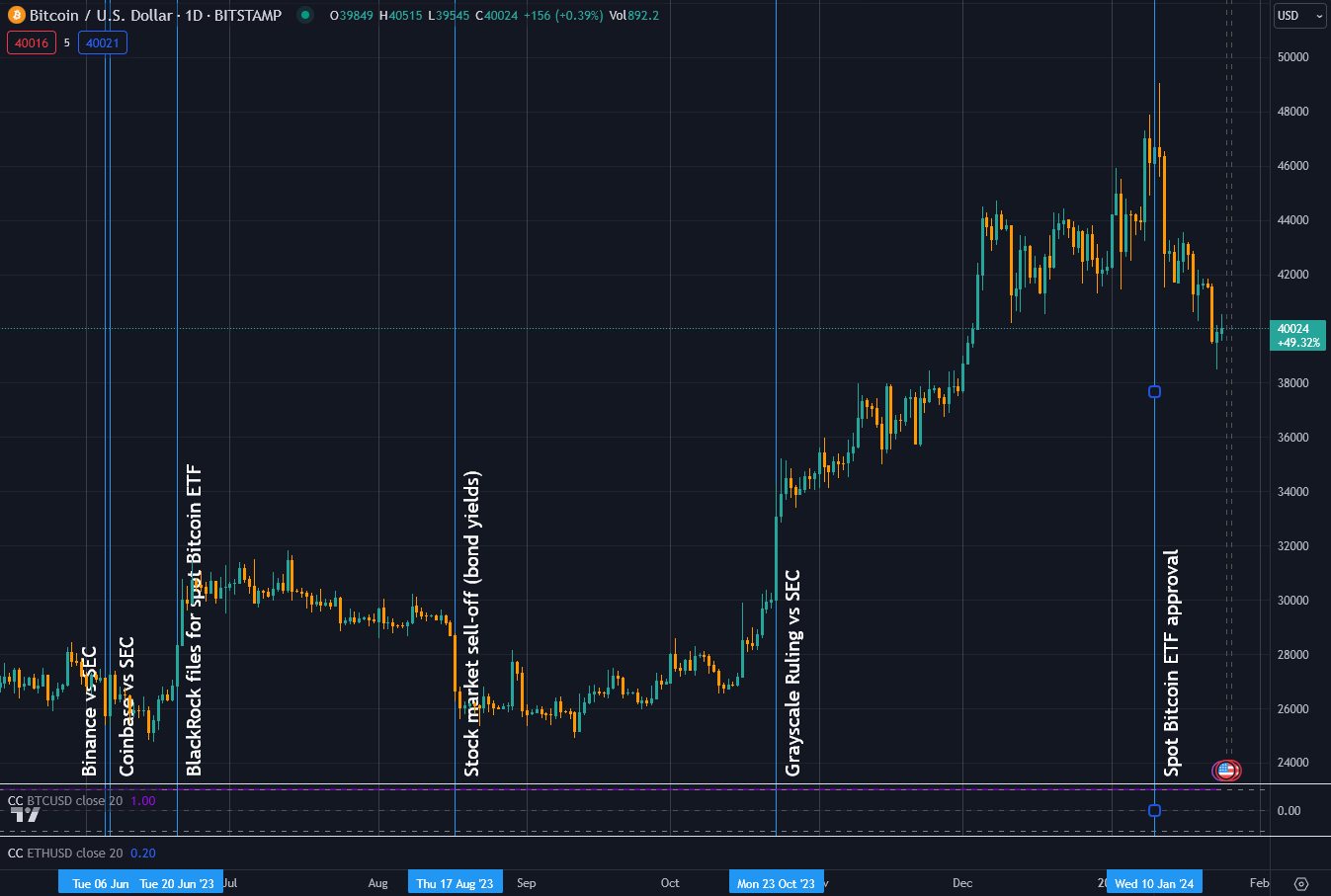

When Binance and Coinbase were hit with SEC complaints within a day of every other last June, the market reeled from the impact of the two most prominent names in crypto exchanges being so actual away centered. On June 5, when Binance turned into as soon as served, Bitcoin fell to $25,300 from spherical $26,800. Then again, on the day Coinbase turned into as soon as served, it regained its label previous to slowly bleeding out to spherical $25,00 mid-blueprint thru the cash.

On June 20, 2023, BlackRock filed its application for a attach in Bitcoin ETF, which saw Bitcoin’s label elevate to over $30,000 till a stock market promote-off in August reversed the positive factors. From there, it traded sideways till Grayscale’s victory in court in opposition to the SEC, when the price took off toward its eventual 2-300 and sixty five days excessive of $49,000 on the day the attach Bitcoin ETFs launched. At this prime, Bitcoin turned into as soon as up 90% for the explanation that C&B fits.

As of press time, having retraced a runt bit, Bitcoin is up 47% for the explanation that C&B fits, with three assets having carried out better. Solana and ICP outdid Bitcoin, this time by 169% and 49%, respectively. Then again, Advance Protocol is furthermore up 8% on Bitcoin.

All other tokens threatened with categorization as a Security fell in opposition to Bitcoin contained within the timeframe, the worst now Dawdle declining -56%, with the least affected being Cardano, down -15%.

Notably, in opposition to the buck, Solana, ICP, and Advance are up 286%, 265%, and 145%, respectively, over the same timeframe. Moreover, even the splendid loser in opposition to Bitcoin, Dawdle, is up 4%, and Cardano is up 87% in opposition to the buck.

When you label every part in bucks in crypto, that you just might maybe omit that your assets receive declined in Bitcoin terms.

Binance and Coinbase defend their positions in court.

Though quite a lot of the industry has been centered on ETFs this 300 and sixty five days, Binance’s case turned into as soon as heard on Jan. 22 in a Washington court docket, with Settle on Amy Berman Jackson of the District of Columbia presiding, and Coinbase looked in a Unique York court on Jan. 17, with Settle on Katherine Polk Failla overseeing the complaints.

The SEC’s argument in opposition to Binance centered on Binance’s BUSD stablecoin and BNB token, suggesting that no decrease than the BNB token might presumably maybe need at the origin been sold as an investment contract. Binance’s defense challenged the applicability of the Howey take a look at to cryptocurrencies and disputed the SEC’s comparisons to other complaints, much like Zakinov v. Ripple Labs.

Coinbase furthermore contested the relevance of the Howey take a look at for cryptocurrencies. The SEC’s tall capacity raised concerns about extending the definition of securities to encompass classes normally exterior its purview, much like collectibles. Settle on Failla acknowledged the complexity of the pronounce and deferred her resolution.

Elliott Stein, a senior litigation analyst at Bloomberg, assessed a 70% probability of the SEC’s June 2023 lawsuit in opposition to Coinbase being disregarded. Then again, a victory for the SEC in either case might presumably maybe receive necessary implications for the cryptocurrency industry. It might maybe presumably maybe mandate crypto exchanges to sort out digital tokens as securities, fundamentally altering how these assets are handled and regulated within the U.S.

The outcomes of these cases will place precedents for the long flee law of digital assets within the country and might presumably maybe most likely receive a tangible impact on the tokens named within the C&B fits.

Source credit : cryptoslate.com