Russian central bank proposes 3-year crypto trial for select investors

Russian central financial institution proposes 3-one year crypto trial for opt investors

Russian central financial institution proposes 3-one year crypto trial for opt investors Russian central financial institution proposes 3-one year crypto trial for opt investors

The experimental crypto buying and selling framework targets to balance innovation with strict regulatory oversight for prosperous investors in Russia.

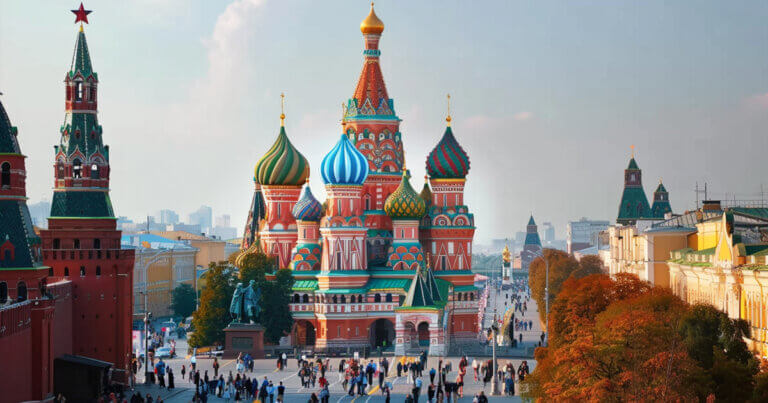

Quilt art/illustration thru CryptoSlate. Utter entails blended sigh which may perhaps well per chance perhaps fair encompass AI-generated sigh.

The Bank of Russia has proposed a three-one year experimental lawful framework that may perhaps well per chance permit a restricted neighborhood of investors to trade cryptocurrencies, marking a capability shift within the countryâs digital asset regulations.

The central financial institution announced on March 12 that it had submitted proposals to the Russian govt for discussion. The initiative would grant access to crypto buying and selling to investors who withhold now now not now now not as much as $1.1 million in securities and deposits.

Nonetheless, the proposal also entails penalties for violations of the experimental regime.

In line with the assertion:

“The Bank of Russia calm does now now not delight in shut into consideration cryptocurrency as a job of rate. Because of the this reality, it proposes to also introduce a ban on settlements between residents on transactions with cryptocurrency exterior the experimental lawful regime, besides to assign criminal responsibility for violating the ban.”

Despite the proposal, the countryâs stance on digital resources remains restrictive. The central financial institution reiterated that retail crypto funds will remain prohibited even when the proposed trial strikes forward.

Russia banned crypto funds below its âOn Digital Financial Assetsâ legislation, which took originate in January 2021.

Market transparency and alternatives

The Bank of Russia acknowledged the experimental program’s cause is to enhance market transparency and assign regulatory standards for cryptocurrency carrier suppliers. It also targets to develop investment alternatives for experienced traders inspiring to settle for heightened financial dangers.

The proposal also entails provisions to permit qualified financial establishments to raise shut part within the trial, suggesting that regulated corporations may perhaps well per chance perhaps fair be accredited to make investments in digital resources. This may perhaps well per chance perhaps pave the style for Russian corporations to adopt a Bitcoin accumulation diagram identical to Approach (previously MicroStrategy).

Below the proposed framework, affirm crypto buying and selling will seemingly be restricted to make a necessity investors. Nonetheless, all qualified investors can hang access to derivative financial devices and securities tied to cryptocurrency values.

The proposal follows Russiaâs ongoing efforts to explore digital resources for world trade. In December 2024, Finance Minister Anton Siluanov confirmed that the nation had been actively experimenting with crypto transactions for foreign trade below a separate experimental lawful regime implemented in September 2024.

The government has yet to formally approve the Bank of Russiaâs proposal. If enacted, the framework may perhaps well per chance perhaps impress a primary step toward integrating digital resources into Russiaâs financial device whereas declaring strict controls on home transactions.

Source credit : cryptoslate.com

Kaiko

Kaiko