Rumble makes first Bitcoin purchase, hints at future acquisitions

Rumble makes first Bitcoin own, hints at future acquisitions

Rumble makes first Bitcoin own, hints at future acquisitions Rumble makes first Bitcoin own, hints at future acquisitions

Pavlovski presentations Rumble's preliminary Bitcoin aquire is the indispensable of many steps in direction of solidifying a sturdy crypto asset approach.

Quilt work/illustration by technique of CryptoSlate. Image contains combined whisper material that may possibly presumably also just embody AI-generated whisper material.

Rumble, a Tether-backed video-sharing platform, has made its first Bitcoin acquisition two months after adopting the tip crypto as a strategic reserve asset.

On Jan. 20, Rumble CEO Chris Pavlovski supplied that the firm had bought Bitcoin on Friday, Jan. 17.

In step with him:

“On Friday, Rumble made its first-ever own of Bitcoin. It wonât be the final.”

While the quantity bought stays undisclosed, Pavlovski hinted here's appropriate the originate up of a better understanding to toughen Rumble’s Bitcoin save.

The acquisition aligns with Rumble’s broader crypto approach. In November 2024, the firm published plans to speculate $20 million in Bitcoin, citing self assurance within the asset’s long-length of time most likely.

On the time, Pavlovski accepted that Bitcoin adoption turned into once unruffled in its infancy, with momentum building because of supportive insurance policies and lengthening institutional hobby.

He also highlighted Bitcoin’s resilience against inflation, citing its immunity to dilution caused by excessive money printing. He known as it a worthwhile asset for the firm’s treasury.

Rumble is a video-sharing platform with 67 million active customers month-to-month and is well-known for its relaxed whisper material moderation attain. Final December, stablecoin issuer Tether invested over $775 million within the platform.

Broader adoption

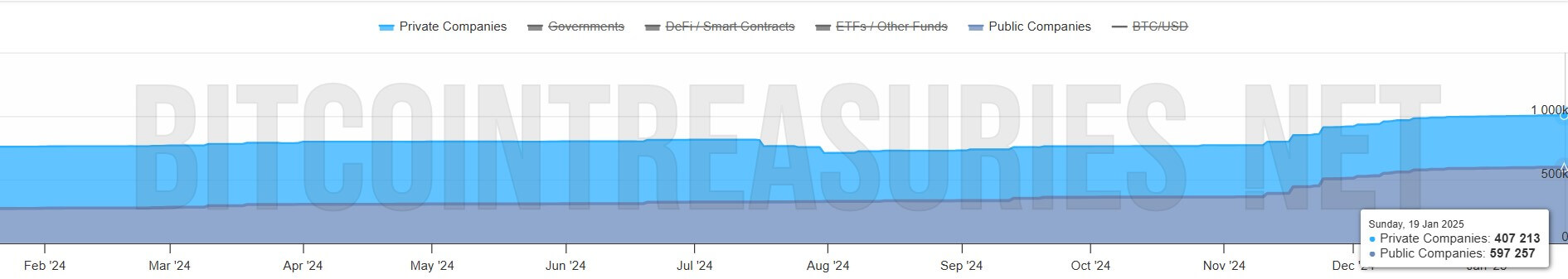

Rumble’s Bitcoin acquisition mirrors a increasing style amongst high company companies across the general public and non-public sectors embracing the flagship digital asset for their treasuries reserve.

Records from Bitcoin Treasuries reveals that over 70 publicly traded companies collectively preserve around 600,000 BTC. MicroStrategy leads this cohort with 450,000 BTC in its coffers.

On the different hand, non-public companies adore SpaceX, Tether, and Block.one comprise accrued 407,212 BTC.

Bitwise’s Chief Investment Officer Matthew Hougan believes this style is noteworthy from a one-off. Instead, he describes it as a “megatrend” that may possibly presumably also reshape the crypto market.

Hougan attributes section of this shift to the Monetary Accounting Standards Board’s (FASB) introduction of ASU 2023-08. This contemporary rule permits publicly traded companies to represent Bitcoin holdings at market label, permitting them to verbalize good points when Bitcoin’s label increases.

Talked about listed here

Source credit : cryptoslate.com

Binance

Binance