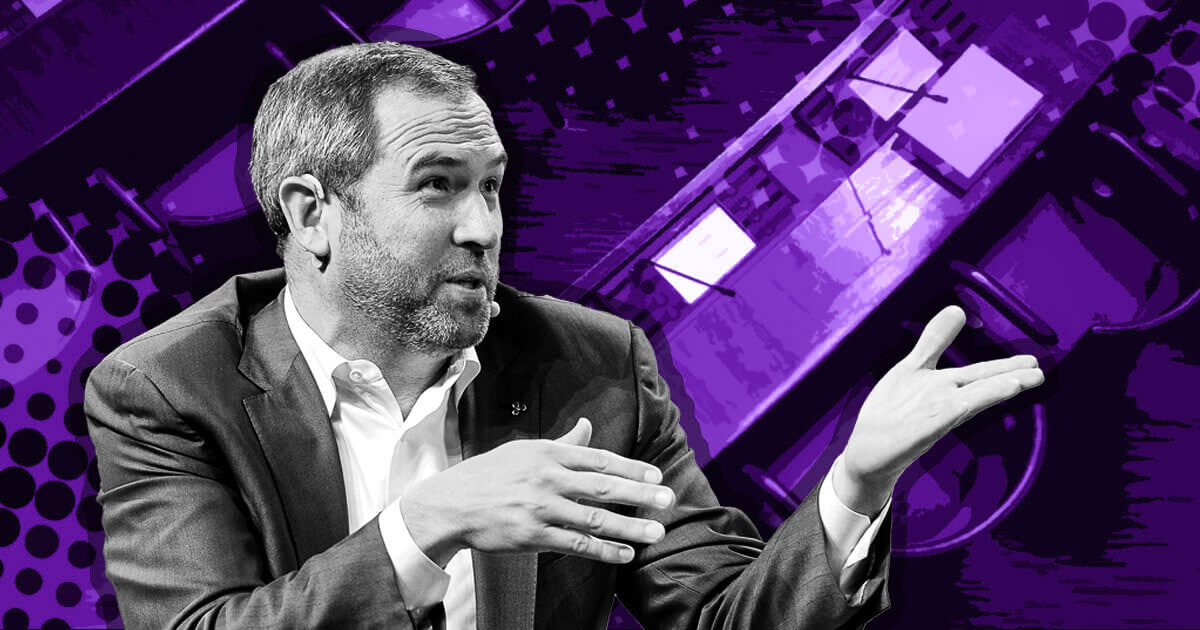

Ripple CEO calls SEC chair Gensler’s regulatory approach a ‘political liability’

Ripple CEO Brad Garlinghouse overtly criticized SEC chair Gary Gensler and said his inflexible stance toward crypto regulations and repeated licensed actions hang made him a “political licensed responsibility.”

Garlinghouse made the observation for the interval of an interview with CNBC at the World Financial Discussion board in Davos on Jan. 16. He also shared his suggestions on doable ETFs connected to other cryptocurrencies and Ripple’s outlook for 2024.

Political agenda

Garlinghouse described Gensler’s intention as unchanging and overly inflexible, even after the SEC popular a Bitcoin ETF. He accused Gensler of now not performing in “basically the most efficient hobby of the citizenry” and hindering the “lengthy-time frame direct of the financial system.”

He wondered the reason within the lend a hand of Gensler’s constant labeling of most crypto sources as securities, suggesting it reflects a political agenda reasonably than an financial or conserving one. Garlinghouse added:

“I deem Gary Gensler is doing the identical thing repeatedly, expecting to bring collectively in court, despite repeated losses.”

The Ripple CEO contrasted the U.S. regulatory surroundings with more proactive approaches within the EU and other jurisdictions. He expressed swear in regards to the U.S. lagging in organising comprehensive crypto regulations, presumably impacting its competitive stance globally.

Alternatively, he also forecasted attainable legislative actions in 2024 as a result of it is an election 365 days. He added that the U.S. has now not been left within the lend a hand of but and will remain competitive if the regulatory panorama shifts to a more certain direction.

Garlinghouse said that stablecoin regulations used to be the probably to approach into pressure soon as a consequence of their unique exhaust — echoing the emotions of Circle CEO Jeremy Allaire.

ETFs and 2024 outlook

The Ripple CEO also shared his suggestions on the broader implications of the SEC’s decision to approve a Bitcoin ETF and one of many most practical ways it’s going to hang an ticket on the lengthy flee of ETFs for other cryptos, equivalent to Ethereum (ETH).

Garlinghouse said the lickety-split compose larger in ETH’s model following the approval of relate Bitcoin ETFs indicates the market’s flee for food for broader ETF choices. He said:

“I deem it’s a certainty. I’m now not going to put a horizon on the time, however I deem there will seemingly be other ETFs for obvious.”

Alternatively, he did now not verify whether or now not Ripple would pursue an ETF offering.

Interesting the principle focus to Ripple, Garlinghouse talked in regards to the company’s growth into unique markets and products and services, including rate ideas and custody products and services. He mentioned Ripple’s strong financial standing as a foundation for future direct and attainable acquisitions.

He shared a certain outlook for the crypto market in 2024, emphasizing the company’s dedication to compliance and solving true buyer considerations. He also commented on the evolving dynamics of tech investments, indicating a shift against more staunch and extinct market environments.

Source credit : cryptoslate.com