Record global inflows into digital asset funds push AuM to $67 billion peak

Global digital asset investment products noticed well-known inflows remaining week, totaling $2.forty five billion.

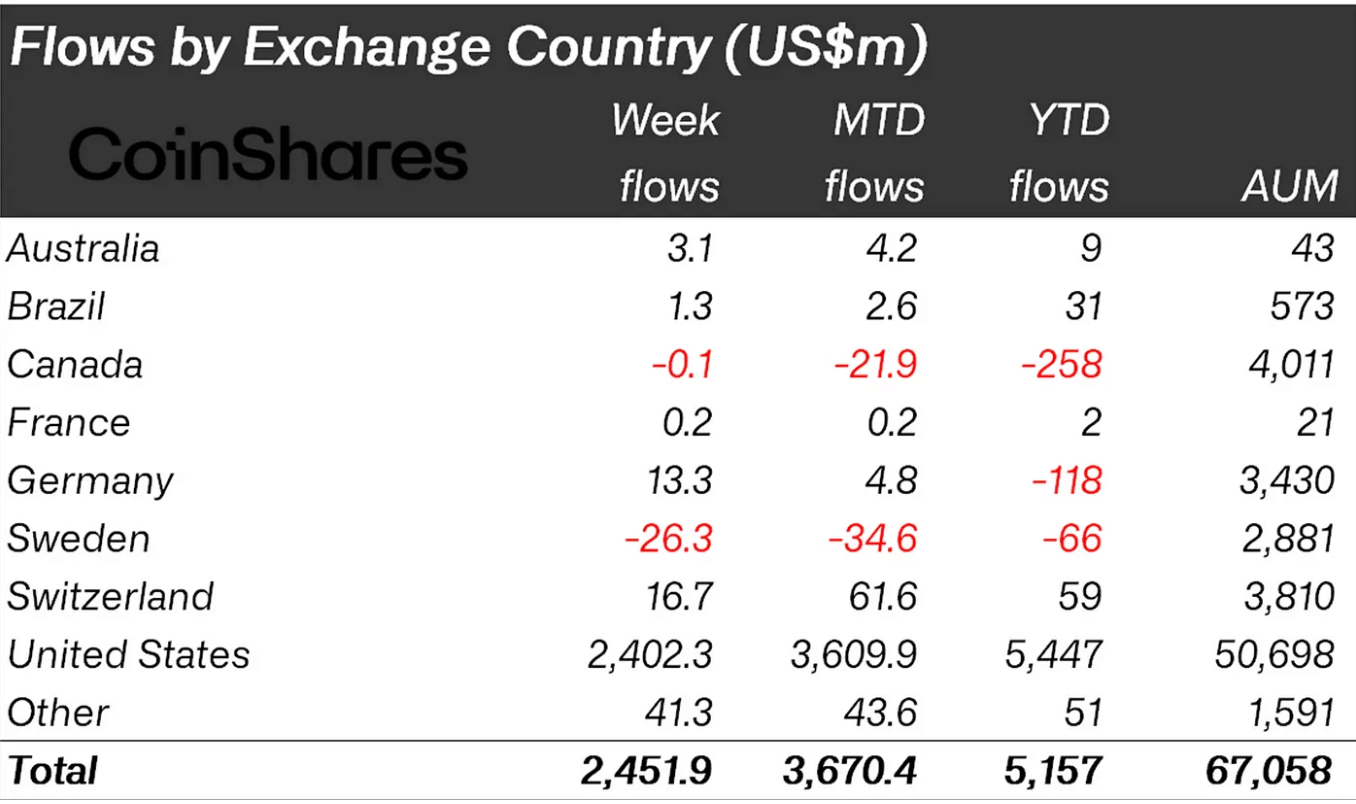

Essentially the most unique weekly fable from CoinShares confirmed the surge within the inflow of funds into digital asset investment products, which pushed the resources beneath administration to a height no longer viewed since early 2022, now standing at $67 billion. The US space ETF market executed a pivotal characteristic on this construction, shooting $2.4 billion of remaining week’s inflows.

Bitcoin stays the obvious market leader, garnering approximately 98% of total inflows remaining week. Elevated self belief additionally permeated through to Ethereum, receiving inflows of $21 million. Altcoins similar to Litecoin and XRP noticed minor but sustained inflows for the length of the length.

The fable additionally sheds light on the regional traits of these inflows. Whereas the US leads, other regions bear shown mixed reactions. Switzerland and Germany, let’s bid, reported $16.7 million and $13.3 million in inflows, respectively, contrasting with outflows from Canada and Sweden. This geographical distribution of inflows and outflows highlights the nuanced world level of view on digital asset investments.

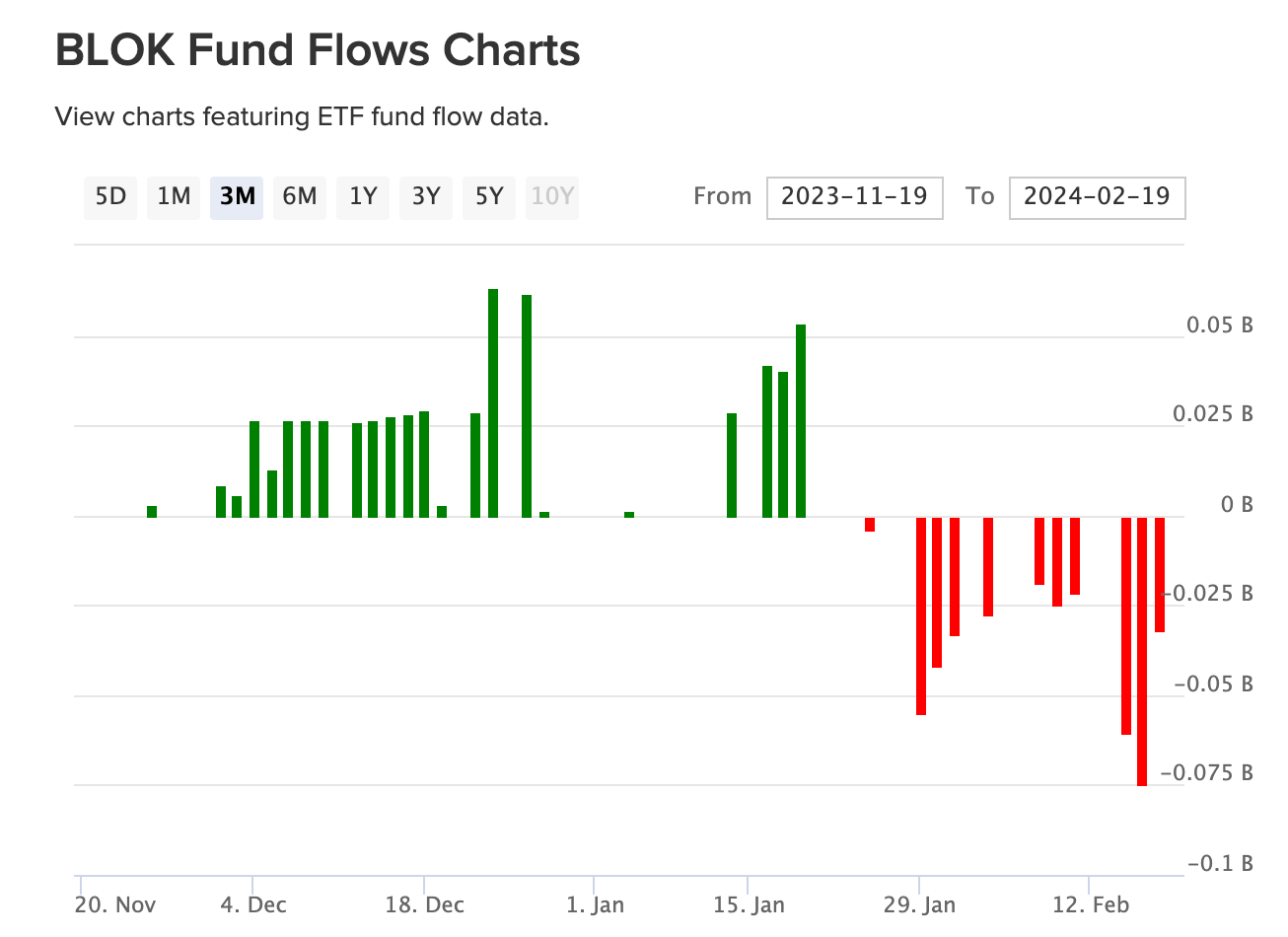

The total construction in digital asset investment products is definite. Blockchain equities, nonetheless, experienced a mixed earn, with a primary outflow from Develop Transformational Recordsdata Sharing ETF (BLOK) totaling $171 million, whereas others noticed collective safe inflows of $4 million. This contrast illustrates the assorted investor sentiment and strategies at play for the length of the broader crypto and blockchain investment panorama. In accordance to the VettaFi ETF Database, BLOK has viewed chronic outflows since mid-January.

In summary, basically the most unique CoinShares fable emphasizes a a lot inflow of capital into digital asset investment products, with a persevered concentration on Bitcoin. The numerous inflows, the excellent AuM since the December 2021 height, and the regional variations in investment plug alongside with the circulation mirror the rising maturity and complexity of the crypto investment scheme.

Correction: Updated AuM which missed most unique inflows.

Source credit : cryptoslate.com