Paxos CEO warns US risks losing financial leadership without crypto reform

Paxos CEO warns US risks losing financial leadership without crypto reform

Paxos CEO warns US risks losing financial leadership without crypto reform Paxos CEO warns US risks losing financial leadership without crypto reform

Regulatory overreach could cost The United States jobs and tech abilities, says Paxos CEO in a call for crypto-pleasant insurance policies.

Duvet art/illustration by job of CryptoSlate. Image involves blended stutter that can per chance embody AI-generated stutter.

In an initiate letter to Vice President Kamala Harris and feeble President Donald Trump, Paxos CEO and co-founder Charles Cascarilla warned that The United States’s financial leadership hinges on whether or now not the next presidential administration embraces digital assets and reforms out of date financial regulations.

Cascarilla entreated both political figures to take a look at the functionality for blockchain and stablecoins to modernize the US financial machine, cautioning that without a supportive regulatory setting, the country risks losing its competitive edge in worldwide finance.

He extra highlighted that whereas smartphone adoption has surged, banking uncover admission to remains limited, with 20% of People and 40% of the worldwide population peaceable unbanked or underbanked. He famous that blockchain, paired with US greenback-backed stablecoins, gives a solution, growing a extra clear, inclusive financial machine.

Cascarilla emphasized that digital assets had been “re-platforming the financial machine” so it could perhaps per chance just on the internet in a “safe, genuine, and clear scheme.” He added:

“Stablecoins or digital dollars â US dollars digitized by job of blockchain technology â are the predominant pork up for the associated rate machine that will revolutionize money circulation, allow increased participation within the worldwide financial system, and be obvious the supremacy of the U.S. greenback for future years wait on.”

Cascarilla expressed frustration over mounting regulatory challenges within the US, pointing to incidents of “regulatory overreach” and complex banking insurance policies, which devour pushed Paxos and other corporations to devour in thoughts relocating operations to worldwide locations cherish Singapore and the UAE, the put regulatory frameworks foster financial innovation.

Cascarilla’s letter emphasized that the US stands to lose jobs, capital, and technological abilities to jurisdictions that actively relief blockchain adoption. He called for bipartisan relief to assign a stablecoin framework, arguing that such reforms are a should always-want to preserve The United States’s influence in worldwide finance and safeguard financial competitiveness.

In closing, Cascarilla appealed for collaboration with the next administration, stressing that a constructive policy attain to blockchain and digital assets would reinforce US financial leadership and “conceal US leadership on digital assets” at a valuable juncture in financial innovation.

Mentioned in this text

Source credit : cryptoslate.com

Farside Investors

Farside Investors

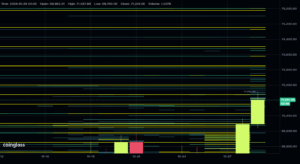

CoinGlass

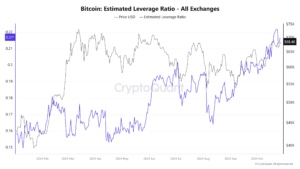

CoinGlass  CryptoQuant

CryptoQuant