MicroStrategy’s $786 million Bitcoin buy sees share value climb 3%

MicroStrategy’s $786 million Bitcoin buy sees share cost climb 3%

MicroStrategy’s $786 million Bitcoin buy sees share cost climb 3% MicroStrategy’s $786 million Bitcoin buy sees share cost climb 3%

MicroStrategy has raised extra than $2 billion for the reason that starting of the year to fund its Bitcoin acquisition drive.

Duvet artwork/illustration by map of CryptoSlate. Image contains mixed deliver material that may maybe per chance furthermore consist of AI-generated deliver material.

MicroStrategy purchased almost 12,000 BTC for $786 million, in accordance to a June 20 filing with the US Securities and Trade Charge (SEC).

Following the news, the firm shares rose by 3% at pre-market purchasing and selling to $1,507, in accordance to Google Finance recordsdata.

Bitcoin contain

The filing said:

“MicroStrategy obtained approximately 11,931 bitcoins for approximately $786.0 million in money, utilizing proceeds from the Offering and Excess Cash (outlined in our quarterly represent on Produce 10-Q for the three months ended March 31, 2024), at a median build of roughly $65,883 per bitcoin, inclusive of costs and charges.”

With this most modern acquisition, the firm’s Bitcoin holdings have confidence risen to 226,631 BTC. These had been obtained at a entire contain cost of around $8.3 billion, averaging about $36,798 per BTC. Per contemporary costs of $65,990, the contemporary market cost of those holdings is extra than $15 billion.

Severely, the firm recently done an $800 million debt offering with a 2.25% coupon and a 35% conversion premium. Since the initiate of the year, this strategy has helped the firm elevate over $2 billion for Bitcoin purchases.

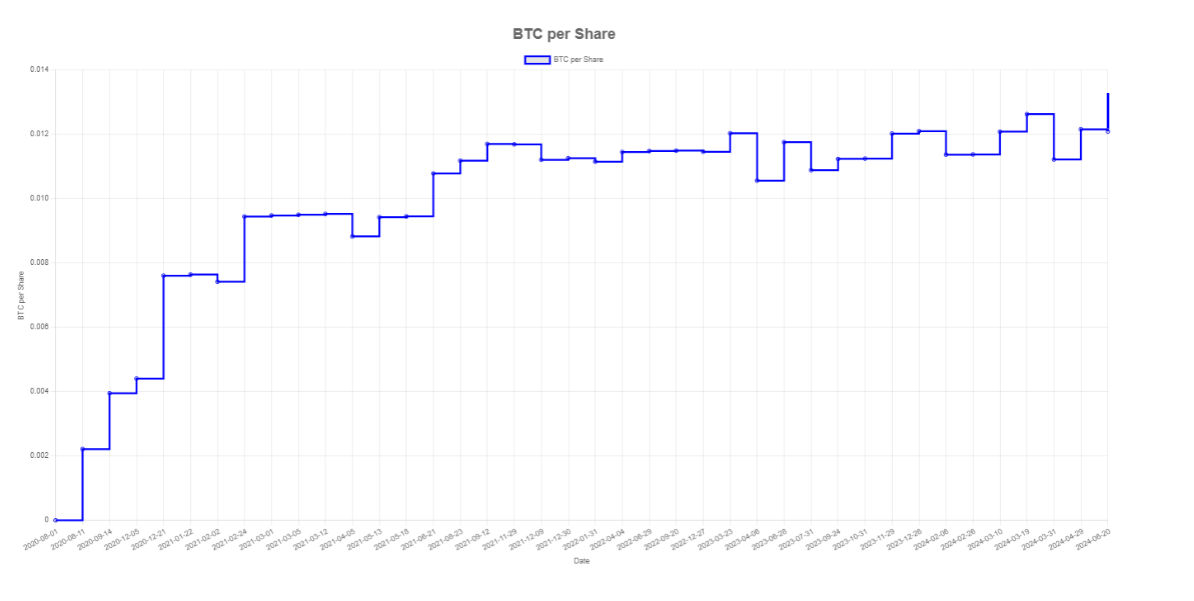

Then all over again, despite issuing extra shares, which mainly dilutes share cost, CryptoSlate Insight reported that the firm’s Bitcoin per share cost has increased. This upward thrust design every share now represents extra Bitcoin cost, benefiting shareholders.

MicroStrategy’s Bitcoin holdings per share have confidence increased to 0.013163 BTC, with 17,194,000 shares outstanding and a entire of 226,331 BTC held.

BTC to $1 million

Meanwhile, analysts at Bernstein have confidence greatly increased their Bitcoin build projections, forecasting the flagship digital asset to reach $1 million by 2033 and $200,000 by the live of 2025.

This optimistic outlook relies on the head crypto’s surging ask and runt provide. The analysts pointed out that the newly launched net site Bitcoin ETFs and several establishments have confidence begun incorporating BTC into their treasuries.

As well they celebrated that the digital asset may maybe per chance furthermore catch approvals at major wirehouses and colossal interior most financial institution platforms ahead of the live of the year, which would urged institutional basis purchasing and selling methods that may maybe per chance additional bolster its adoption.

Talked about listed right here

Source credit : cryptoslate.com