Michael Saylor tells Microsoft board Bitcoin could boost its market cap by $5 trillion

Michael Saylor tells Microsoft board Bitcoin might well enhance its market cap by $5 trillion

Michael Saylor tells Microsoft board Bitcoin might well enhance its market cap by $5 trillion Michael Saylor tells Microsoft board Bitcoin might well enhance its market cap by $5 trillion

Saylor urges Microsoft to substitute stock buybacks with Bitcoin to capitalize on the subsequent expertise wave and extinguish aggressive.

ReasonTV / CC BY 3.0 / Wikimedia. Remixed by CryptoSlate

MicroStrategy executive chairman Michael Saylor has entreated Microsoft to undertake Bitcoin as segment of its system, per a 3-minute presentation to the company’s board that became shared on X (formerly Twitter).

In the presentation, Saylor positioned Bitcoin as a necessary element of the subsequent technological wave. He warned that failing to mix Bitcoin into Microsoft’s operations might well lope away the company lagging in the befriend of opponents.

Saylor emphasised Bitcoin’s outperformance, noting it has delivered returns ten times increased than Microsoft’s stock yearly. He argued that redirecting property from stock buybacks to Bitcoin investments would generate higher payment.

He acknowledged:

“Microsoft canât manage to pay for to miss the subsequent expertise wave and Bitcoin is that wave…It makes great extra sense to aquire Bitcoin than to aquire your have stock befriend.”

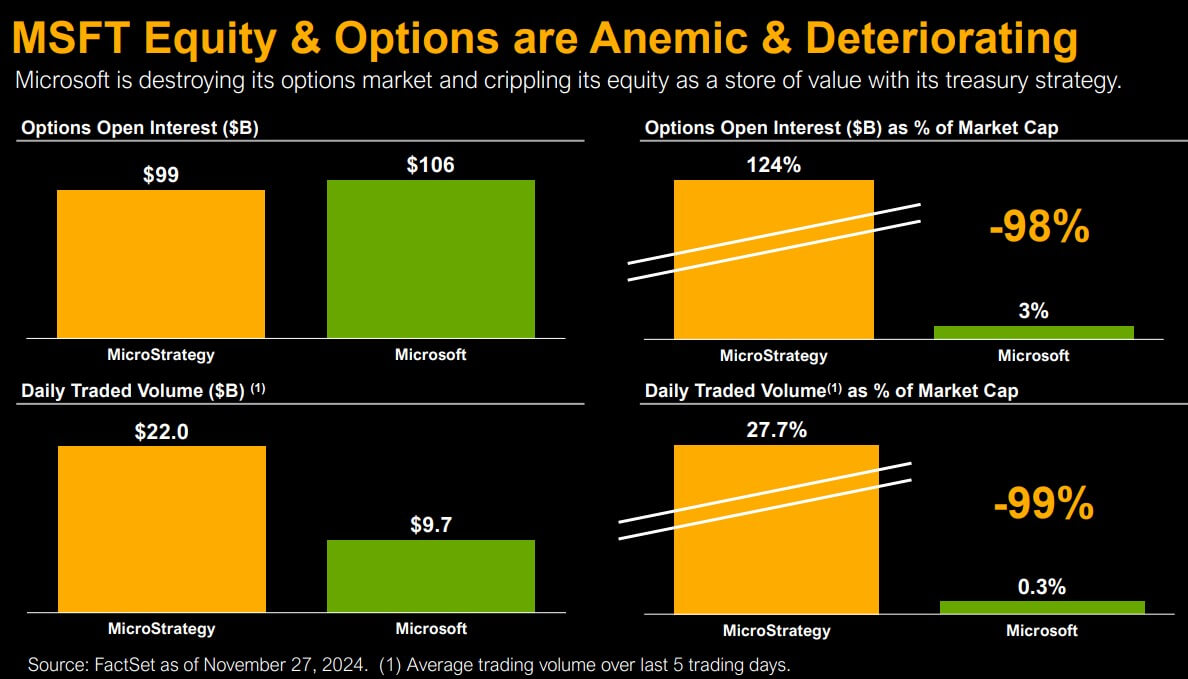

In accordance to him, Microsoft’s latest treasury system is weakening its equity and alternate solutions markets and eroding its jam as a retailer of payment.

Saylor additionally outlined a transformative roadmap for the Bitcoin ecosystem in 2025. This involves frequent Wall Avenue adoption of Bitcoin ETFs, favorable beautiful-payment accounting principles, professional-crypto leadership in Congress, and a shift in regulatory attitudes. He believes this evolving panorama makes Bitcoin adoption no longer appropriate advantageous but very necessary.

He talked about:

“You've a chance to originate: hang to the previous, or comprise the lengthy bustle. Divest billions of greenbacks and leisurely your growth fee, make investments billions of greenbacks and traipse your growth fee.”

$5 trillion addition to Microsoft’s market cap

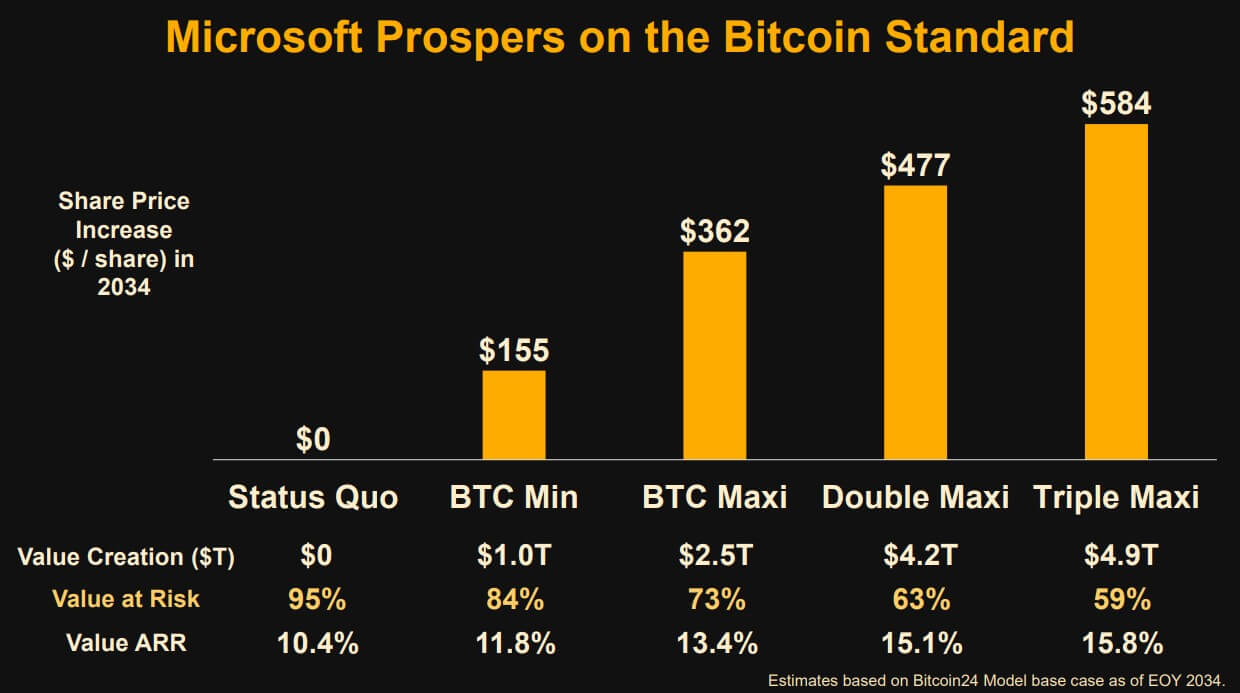

As segment of his pitch, Saylor projected that an aggressive Bitcoin system might well add spherical $5 trillion to Microsoft’s market cap over the subsequent decade.

He proposed converting Microsoft’s cash flows, dividend payouts, and stock buybacks into Bitcoin. He argued that this might add a complete bunch of greenbacks to the company’s stock tag whereas minimizing shareholder risk.

In accordance to his projections, if Bitcoin reaches $1.7 million per coin by 2034, Microsoft might well place $4.9 trillion in enterprise payment.

Saylor additionally urged investing $100 billion yearly in Bitcoin as an different of stock repurchases or bonds. He described Bitcoin as an asset free from counterparty risk, offering unmatched security and growth likely.

Mentioned listed right here

Source credit : cryptoslate.com

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass

Farside Traders

Farside Traders