MiCA goes live in Europe as the crypto regulatory framework starts with stablecoins

MiCA goes dwell in Europe because the crypto regulatory framework starts with stablecoins

MiCA goes dwell in Europe because the crypto regulatory framework starts with stablecoins MiCA goes dwell in Europe because the crypto regulatory framework starts with stablecoins

Enterprise anticipates higher institutional involvement as EU unifies crypto regulations under MiCA, even though compliance charges may perchance likely perchance also prefer higher platforms.

Quilt art/illustration by CryptoSlate. Image contains blended whisper material that may perchance likely perchance also embody AI-generated whisper material.

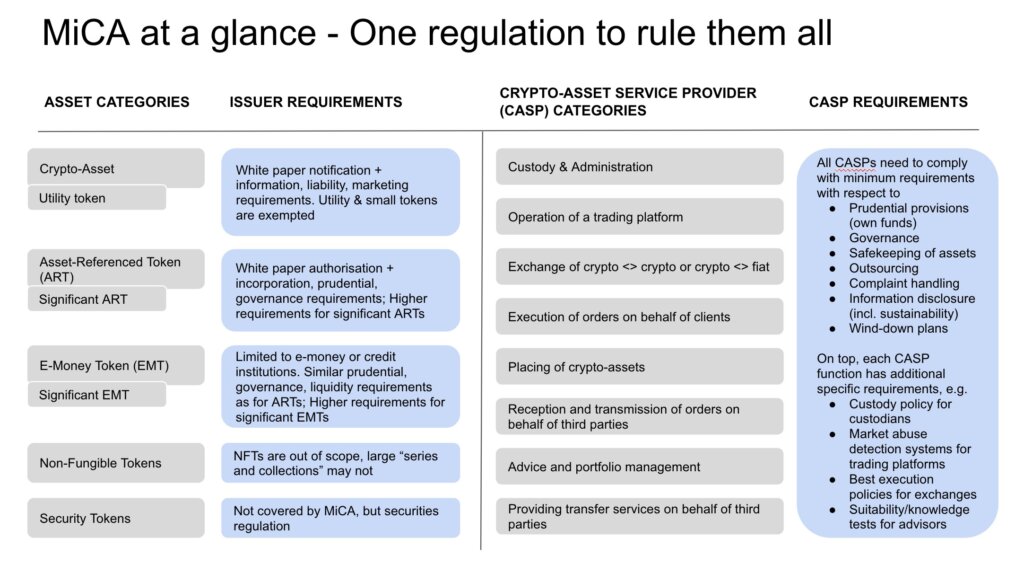

MiCA is now dwell at some stage in the European Union, marking a milestone for digital asset oversight. Enterprise contributors now feature under an EU-huge framework that covers stablecoins, token issuances, and companies and products such as custody and change.

Because the Bretton Woods Committee wrote, the technique interested years of consultation and negotiations, culminating in a rulebook that addresses oversight gaps and promotes transparency.

Corporations that utter e-money tokens (EMTs) desire to be incorporated within the EU or keep relevant e-money licenses, whereas asset-referenced tokens face increased disclosures and governance requirements after they reach definite volume or user thresholds. The measures furthermore embody stricter rules on reserve administration, redemption, and disclosure, signaling the bloc’s focal point on monetary balance in digital asset markets.

Patrick Hansen, Policy Director at Circle, wrote an intensive piece explaining how stablecoin issuers have minute more than a few but to comply or lose entry to the total EU market. Tether, the leading stablecoin issuer within the enviornment, chose the latter option, telling CryptoSlate that the opponents is pissed off by its differing design to stablecoins. He said,

“Each day you wake up, you scratch your head and also you don’t realize why these couple of Italian guys are doing a magnificent better job than you. Needless to utter you change into pissed off, real?

So You know, if your endeavor mannequin is named Abolish Tether, then you know, you may perchance likely perchance likely also quiet rethink about your product.”

Expectations for crypto companies within the EU

Crypto-asset service services (CASPs) offering actions love brokerage, change, or custody face licensing requirements that enable them to feature at some stage in all member states as soon as licensed in a single jurisdiction. That shift replaces the old patchwork of national regulations, reducing boundaries for companies that see substandard-border growth and providing a passport-love mechanism linked to the approach old in outmoded EU monetary companies and products.

Some companies are expected to consolidate or forge partnerships as a consequence of compliance tasks will most seemingly be harder to satisfy for smaller ventures. Procuring and selling platforms must furthermore save controls in opposition to market abuse and insider shopping and selling. Authorities can restrict token offerings if disclosures or possibility administration procedures seem incomplete.

MiCA formally excludes protocols working “in a truly decentralized manner” from its scope, but many operations may perchance likely perchance also fail to meet the edge for real decentralization.

The same ambiguity appears around dapper-scale NFT collections, which the law may perchance likely perchance treat as fungible, requiring compliance with white paper and issuer tasks. Uncertainty furthermore surrounds “privateness coins,” that may perchance likely perchance also face delisting if full holder identification proves impossible.

Overall expected influence of MiCA

Enterprise responses from Bretton Woods and Circle display cowl a shared gaze that MiCA’s perfect success relies on its technical standards and enforcement practices. Corporations are adapting product offerings, specializing in readability in disclosures and compliance with rules for token issuance and reserve administration. As Hansen seen, the framework’s adoption may perchance likely perchance also attract projects seeking certainty, especially if concerns over enforcement actions in other locations persist.

There are broader questions about world adoption. The U.S. has but to formalize stablecoin law, and enforcement patterns, whereas reputedly progressive, differ broadly at some stage in Asia. The European mannequin may perchance likely perchance influence other jurisdictions, prompting a “jog to the tip” in user safety and alignment with world standards.

According to Bretton Woods, a coordinated approach would foster passportability for stablecoins and mitigate dangers of regulatory arbitrage. Some lawmakers have talked a couple of MiCA 2.0, indicating that non-fungible tokens, DeFi, or additional technological aspects may perchance likely perchance at closing be revisited under an up as a lot as now directive. Officials display cowl that any unique iteration will depend on the law’s preliminary results.

Hansen aspects to MiCA’s similarities with other EU tech initiatives, where living-huge standards within the extinguish influenced business and perfect frameworks in a international country. Whether or no longer MiCA turns real into a default world reference will depend on its valid-world implementation, the role of national agencies, and the design successfully the measures safeguard markets whereas permitting companies to innovate. Within the interim, company moves to stable a MiCA license proceed, with indispensable banks and exchanges adjusting business lines or shopping smaller avid gamers.

Many put a query to MiCA to bring more institutional involvement, aided by uniform licensing and user protections. The trace of compliance, nevertheless, remains a utter that may perchance likely perchance shift activity toward successfully-capitalized platforms. Traders may perchance likely perchance also gaze a broader adoption of regulated companies and products, whereas smaller teams is at possibility of be conscious of of course perfect niches or relocate to regions where tasks are much less strict. Policymakers have pledged to display screen the final consequence, believing a unified EU stance on crypto can bolster capital formation and user safeguards.

Because the framework applies, stablecoin issuers and CASPs face earlier enforcement slice-off dates than other market contributors, whereas the leisure of the rules segment in over the year. Regulators will furthermore utter binding implementation standards that give an explanation for timelines, technical disclosures, and working prerequisites for token projects.

Hansen confirms that companies planning to navigate the European panorama are keen with authorities and preparing compliance techniques accordingly. He believes MiCA has created an atmosphere of definite responsibilities for contributors, and its skill to help responsible growth under consistent rules will measure the design it shapes crypto markets.

Implementation continues in stages because the EU refines technical guidelines and supervises licensed entities. The consequence will display cowl whether MiCA is a workable mannequin that balances innovation with oversight.

Mentioned in this text

Source credit : cryptoslate.com

DappRadar

DappRadar