Metaplanet looks to raise $70 million to bolster Bitcoin holdings

Metaplanet appears to be like to rob $70 million to bolster Bitcoin holdings

Metaplanet appears to be like to rob $70 million to bolster Bitcoin holdings Metaplanet appears to be like to rob $70 million to bolster Bitcoin holdings

The Eastern company plans to give stock rights to without delay fund a $58 million Bitcoin expansion.

Duvet artwork/illustration by the employ of CryptoSlate. Checklist involves mixed divulge that may perhaps perhaps presumably also encompass AI-generated divulge.

Bitcoin investment company Metaplanet is determined to rob ¥10.08 billion (approximately $70 million) by providing its 11th sequence of stock acquisition rights to all standard shareholders.

In an Aug. 6 observation, the Eastern firm outlined plans to allocate ¥8.5 billion (round $58.76 million) of this raised funds to win extra Bitcoin.

The company talked about it will distribute one stock acquisition ravishing per standard fragment to shareholders, as recorded on Sept. 5. These rights enable shareholders to score Metaplanet stock at a designate of ¥555 (round $4) between Sept. 6 and Oct. 15.

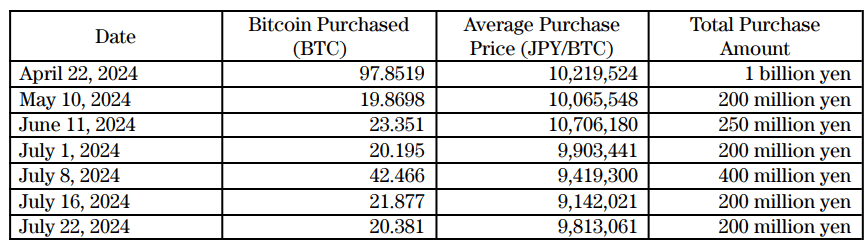

The novel funding will enable the firm to deal extend its Bitcoin holdings, aligning with its long-term growth approach. Metaplanet at existing holds about 246 BTC, valued at round $13.4 million.

Meanwhile, Metaplanet’s transfer is straight from the playbook of MicroStrategy, a enterprise intelligence company that has gathered over 220,000 Bitcoins through debt and equity raises since 2020.

Bitcoin pivot

Metaplanet plans to employ the funds raised basically to score Bitcoin and make investments in linked sectors.

The company restated its belief in the flagship digital asset’s long-term likely despite the novel declines in Bitcoin costs.

Moreover, it highlighted BTC’s energy as a hedge against forex depreciation, particularly the yen, which has no longer too long ago depreciated hugely against the US Dollar.

Metaplanet talked about:

“An increase in Bitcoin costs is expected to make stronger our steadiness sheet, make stronger asset designate, and no doubt make a contribution to our earnings.”

The firm published that it became once thinking about likely future enterprise ventures at some point of the BTC ecosystem, including that it may perhaps perhaps presumably also generate extra earnings from its Bitcoin holdings by promoting covered calls on the flagship digital resources.

Metaplanet’s shift against Bitcoin comes as it has strategically exited most of its hotel enterprise, which had suffered from declining income and routine losses over 5 consecutive periods.

Meanwhile, it advised that the hotel division may perhaps perhaps presumably be rejuvenated by transforming it to strategically cater to Bitcoin followers and companies whereas providing outlandish services and products and producing extra income sources.

Talked about in this article

Source credit : cryptoslate.com