Mark Moss on Bitcoin adoption, freedom, and $1M Bitcoin

Tag Moss on Bitcoin adoption, freedom, and $1M Bitcoin

Tag Moss on Bitcoin adoption, freedom, and $1M Bitcoin Tag Moss on Bitcoin adoption, freedom, and $1M Bitcoin

Tag Moss predicts Bitcoin's upward push to $21 trillion by 2030, likening its adoption to market disruptors love Uber and Airbnb.

Duvet art/illustration by technique of CryptoSlate. Portray comprises mixed shriek which would possibly maybe well even encompass AI-generated shriek.

The next is a visitor put up from Christina Comben.

I first met Tag Moss on the entrance to the media heart by the predominant stage at Bitcoin MENA in Abu Dhabi, the first legit Bitcoin convention in this piece of the enviornment. We havenât met old to but from his familiar command, infectious personality, and volumes of insightful shriek (including a YouTube channel and simplest-selling e book The Uncommunist Manifesto), I feel I know him already.

Tag has been championing the advantages of Bitcoin to anybody who will listen since 2016 and was as soon as a serial entrepreneur long old to.

âI began a enterprise in 1999 on the height of the dot-com enhance. That crashed. I began one more enterprise in 2001, an e-commerce enterprise, it wasn’t easy,â he laments. âIt was as soon as terrible timing. All people laughed at me and said, no one would ever aquire the leisure online. I constructed that up and had a colossal exit on it.â

From Orange County to Abu Dhabi

What brings him to Bitcoin MENA in UAEâs opulent capital all of the manner from his home in Orange County?

âIâm an educator and shriek creator,â he says. âIâm also a accomplice at a Bitcoin Mission Capital fund, so we invest within the companies constructing on and across the Bitcoin ecosystem. I in reality bear a brand unique firm that soft went public in Canada known as Matador, and that’s running a Microstrategy play with Bitcoin as a balance sheet asset and investing thru the Bitcoin Layer 2 plan. So I’m actively teaching and investing within the plan to take a peek at to make the enviornment that I must peek.â

What variety of a world is that? For Tag, itâs firmly Bitcoin, no longer crypto. Heâs been on the altcoin rollercoaster but sees no different cryptocurrencies with âlong-termâ staying energy. âI completely made heaps of cash,â he says, âa lot of cash,â he repeats with added emphasis. I look ahead to him to piece the identical old cautionary myth of retaining a stash down to zero or getting rugged on the sh**coin on line casino, but he says:

âIn 2017 and 2018, we had been competing for Layer 1s. Ethereum, Cardano, Litecoin, NEO⦠neatly, Bitcoin received that. So then the crypto yarn went to DeFi and that every fell apart, then crypto went to NFTs, and that every fell apart, and now it’s meme money. No person’s pretending that’s world-changing expertise.â

He concedes that meme money (and altcoins in frequent) would possibly maybe well even abet some reason as a âgateway drugâ in bringing members over to Bitcoin. âOf us come for the money and so they discontinuance for the freedom,â embarking on their Bitcoin journeys and discovering why they need permissionless, censorship-resistant money within the first advise.

âI deem stablecoins lead to that as neatly,â he says, âfinally members derive at risk of having a wallet and transferring digital property, but then they wonder why their U.S. dollar stablecoins aquire them fewer goods and services, and why Bitcoin buys them more, and I deem finally all of it derive of funnels over.â

The Flawed Fiat Machine and the Magic Money Printer

Tag says the predominant instruct with fiat is that it has no fee of capital.

âWhile you occur to birth to note money, that if printing money made members prosperous, why don’t we soft print quite a bit more? Money has to bear an correct fee of capital. So gold, to illustrate, I must aquire land and derive instruments and exhaust energy and capital to derive the gold, with Bitcoin, unique money are simplest released when you exhaust the money and enact the work to derive them. So the capital has to bear an correct fee. That you would possibly’t soft print money out of thin air, otherwise, we’d all be rich.â

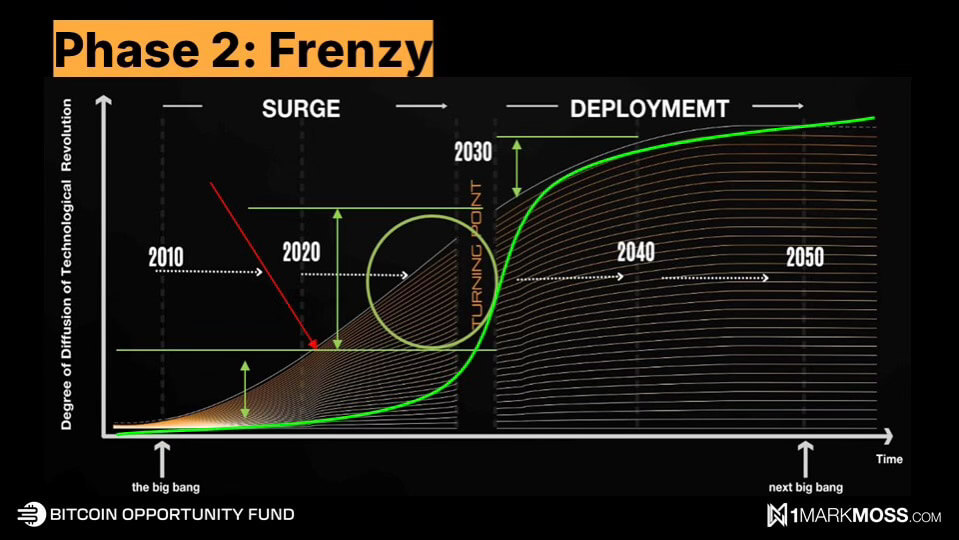

He aspects to the S-curve model for measuring Bitcoin adoption.

âThe trend an S-curve works is the time it takes to derive to 10% adoption is the identical time it would take to derive to 80-90%. So that you would possibly maybe well maybe even see that this second piece [between 2020 and 2030] is the place we derive the most development. We had retail adoption which introduced [Bitcoin] to $1.2 trillion between 2010 and 2020, after which with institutional adoption, the 90% will come.â

What does a world with 90% Bitcoin adoption peek love? Is there an inevitable collapse of the fiat system and Armageddon on the streets? Tag pauses and shakes his head.

âI deem one colossal misconception is members deem that for Bitcoin to derive to $1 million [something Mark envisions cerca 2030] or $10 million per coin, then which approach that fiat is nugatory and now it’s $1 million for a gallon of gas, but that’s completely no longer appropriate.â

A Readjustment of Retailer-of-Tag Resources

He likens Bitcoin adoption to market disrupters love Uber and Airbnb saying,

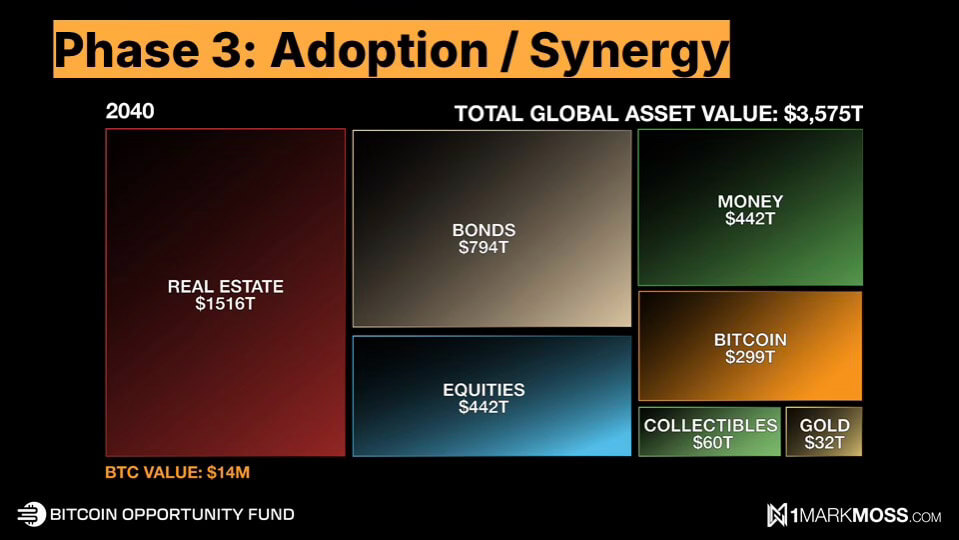

âAirbnb takes a minute bit bit from the hotels. It doesn’t mean hotels budge away, soft love Uber continues to derive an increasing number of from taxis. Bitcoin is no longer removing from the dollar. Bitcoin is removing from different store-of-fee property, love gold, equities, bonds, and true estate.â

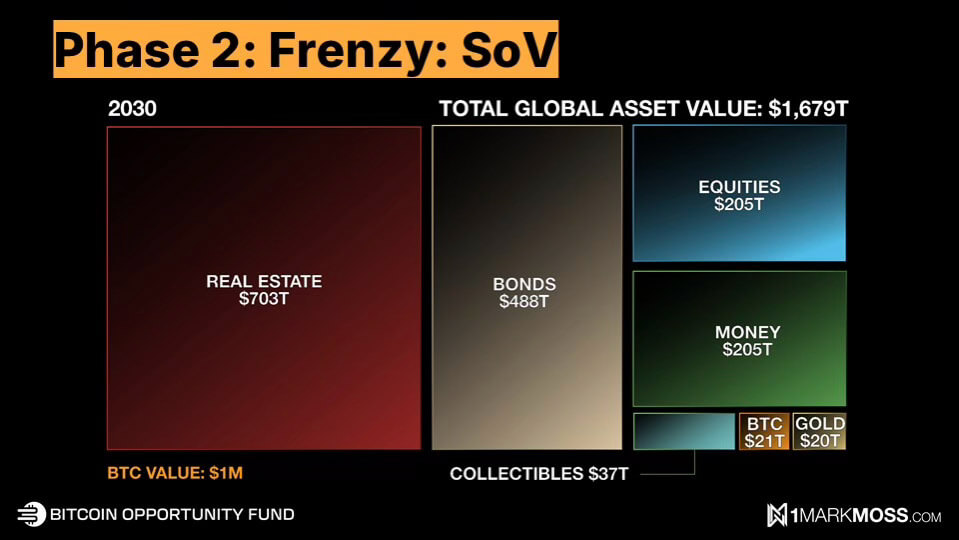

He pulls out three charts evaluating Bitcoin to store-of-fee property as its label, dimension, and market cap grow.

âBitcoin would possibly maybe well even grow to $21 trillion by 2030, which approach $1 million per Bitcoin, nonetheless it doesn’t mean all these different property budge away. It’s on par with gold. It’s taking a minute bit bit from bonds, a minute bit bit from money, and a minute bit bit from equities.â

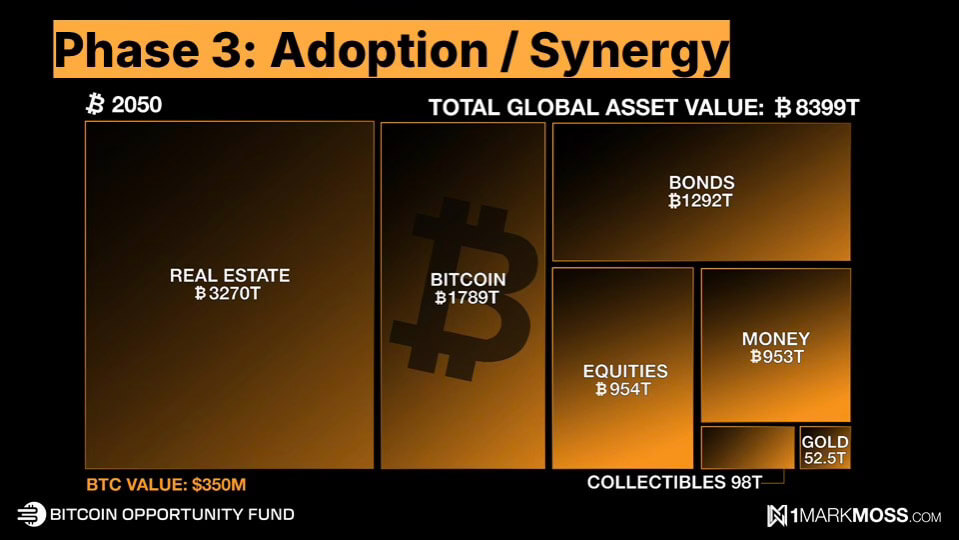

âIf we speedily forward to 2050, Bitcoin turns into the second biggest asset class, nonetheless it doesn’t mean the a number of asset classes budge away⦠By 2050, I deem all of the shop-of-fee property will be priced in Bitcoin in advise of U.S. bucks, after which one Bitcoin will be worth one Bitcoin, in advise of $100,000 or $1 million.â

He brings up Greshamâs guidelines in his argument for the persevered existence of the dollar.

âGresham’s Regulations states that unhealthy money drives out appropriate money. So an example is within the US, up to 1965, quarters and dimes had been manufactured from pure silver. After â65, they began making them out of junk steel. That you would possibly’t fetch a pre-65 quarter and dime in circulation anymore, and when you presumably did, you wouldn’t exhaust it because it’s worth love $4. So youâd attach it apart. The unhealthy money drove out the splendid money, the pre-65s out. So I will repeatedly must make exhaust of fiat and store my Bitcoin.â

âFactual Timesâ Forward for Bitcoin

The incoming Presidentâs son, Eric Trump, gave a keynote on the tournament, proclaiming to âcompletely take care of Bitcoin,â congratulating Bitcoiners on their vision, mentioning that âThe us has to guide the manner in a digital revolution,â and describing the moment he known as his father at 6 am on the day Bitcoin hit $100,000, leading to the now-nasty âYouâre welcomeâ put up on Truth Social. So, does Tag demand a golden age ahead for Bitcoin within the US? Will we see a resurgence of innovation and a return of the talent that bled out to different jurisdictions in the end of old administrations?

âThe unique administration will positively be bullish for the enterprise,â he states. âItâs no longer in reality that Bitcoin that was as soon as on the ballot. What was as soon as in reality on the ballotwas as soon as freedom. The freedom to resolve how it is advisable store you money, and the scheme in which it is advisable transact you money.â

He sees Trump constructing a ânoteworthy friendlierâ surroundings for businesses but doesnât envision a mass return of the companies that left. âWhile you’re long previous, you’re variety of long previous. Why would you come again?â he asks. âHowever perchance we’ll sluggish down the companies which would possibly maybe well maybe be leaving and maybe more will discontinuance.â

What just a few national strategic reserve in Bitcoin igniting world Bitcoin sport figuring out? He believes the probabilities are as high as 80%.

âI mean, RFK said he would enact it and heâs now within the Trump administration. Trump said he would enact it. We bear a crimson Republican Condominium, Senate, and Presidency, and now we bear already bought the invoice that’s been submitted by Senator Lummis. It soft has to be permitted. Possibly it fails and theyâll resubmit, but I'd narrate within the subsequent 24 months that goes thru.â

Yet one more prediction Tag has for the subsequent 24 months is that U.S. banking institutions will birth custodying Bitcoin, selling Bitcoin, and providing Bitcoin products.

âFinal year the banks tried to overturn an SEC rule known as SAV21, which prevents banks from being ready to custody Bitcoin. It bought to President Biden and he vetoed it. So we know they must. They already tried to overturn it and Biden vetoed it. I’m guessing as rapidly as Trump takes over they’ll resubmit it and it would possibly maybe well maybe derive approved⦠it’s appropriate cases,â he beams, âI’m optimistic. I’m very optimistic.â

While you would possibly maybe well love to listen to more about Markâs vision for Bitcoin and its phases of world adoption, you would possibly maybe well notice him on X, get his keynote from Bitcoin MENA, or see his tutorial videos on his YouTube channel.

Talked about listed here

Source credit : cryptoslate.com

Farside Investors

Farside Investors