Mark Cuban urges SEC to adapt Form S-1 for crypto companies

Mark Cuban urges SEC to adapt Acquire S-1 for crypto companies

Mark Cuban urges SEC to adapt Acquire S-1 for crypto companies Mark Cuban urges SEC to adapt Acquire S-1 for crypto companies

SEC Commissioner Mark Uyeda described the agency's fresh filing methodology as "problematic."

TechCrunch / CC BY-SA 2.0 / Flickr. Remixed by CryptoSlate

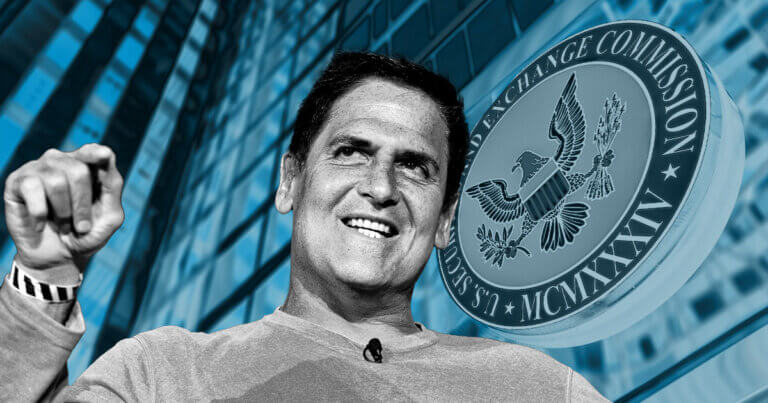

Billionaire investor Mark Cuban has urged the US Securities and Switch Charge (SEC) to adjust Acquire S-1 so token-primarily based mostly companies can with out bother register with the authorities.

Cuban’s suggestion follows SEC Commissioner Mark Uyeda’s footnote describing the agency’s fresh methodology to crypto disclosure filings as “problematic.”

Acquire S-1

Acquire S-1 is the registration statement that the SEC requires domestic issuers to file to offer fresh securities publicly. The assemble comprises foremost company information comparable to industry operations, threat factors, and varied crucial minute print about the product choices. Any company searching for to exchange its security shares on a nationwide exchange adore the Novel York Stock Switch must file the assemble.

Uyeda pointed out that practically all crypto issuers acquire uncommon characteristics that's not going to suit the solutions in the intervening time required in Acquire S-1.

“Quite a bit of these issuers and crypto digital resources acquire characteristics for which Acquire S-1 would possibly perchance honest technically require information that's not connected or appropriate, but doesn't require obvious information that would be discipline materials.”

Uyeda extra famend that the Charge’s fresh methodology “neither facilitates capital formation nor protects merchants.”

So, Uyeda proposed that the SEC enable variances for the Acquire S-1 filings of crypto digital resources, connected to those for funds, insurance products, and varied securities. Uyeda believes this methodology would possibly perchance result in choices with extra connected discipline materials information for crypto and its issuers.

Uyeda added:

“[Such an approach may have] the accompanying investor protection and coverings below the Securities Act.”

Crypto neighborhood is of the same opinion

In a July 2 social media post, Cuban supported Uyeda’s scrutinize, pointing out:

“The scenario isnât that crypto companies donât want to register. The scenario is that itâs adore attempting to put a sq. peg in a round hole. It doesnât match. Which is why there would possibly be not a single token-primarily based mostly company that's registered and operating.”

In an analogous plan, the US Blockchain Association praised Uyeda’s statement because the thoughtful engagement foremost by the exchange. They said:

“Right here's precisely what the exchange needs â thoughtful engagement by the SEC to assemble particular innovation flourishes while consumers are protected.”

Mentioned listed here

Source credit : cryptoslate.com