US leads $2 billion May crypto inflow while Ethereum ETF sparks investor interest

US leads $2 billion Would possibly well well even simply crypto influx while Ethereum ETF sparks investor hobby

US leads $2 billion Would possibly well well even simply crypto influx while Ethereum ETF sparks investor hobby US leads $2 billion Would possibly well well even simply crypto influx while Ethereum ETF sparks investor hobby

Buying and selling actions for the crypto ETPs were surprisingly subdued, shedding by around 40% final week.

Cowl art/illustration by CryptoSlate. Image involves blended roar which could well consist of AI-generated roar.

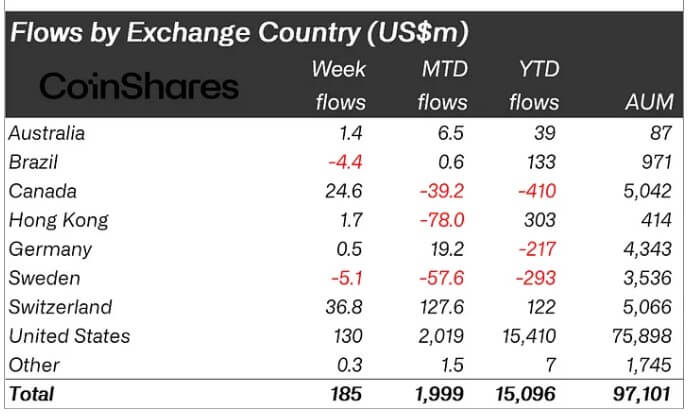

World digital asset investment merchandise recorded their fourth consecutive week of inflows, totaling $185 million, in step with CoinShares’ weekly teach.

The teach acknowledged that these inflows pushed Would possibly well well even simply’s complete to $2 billion, bringing the year-to-date inflows to over $15 billion for the principle time. Nonetheless, trading volume dropped to $8 billion from $13 billion the old week.

Bitcoin, US leads

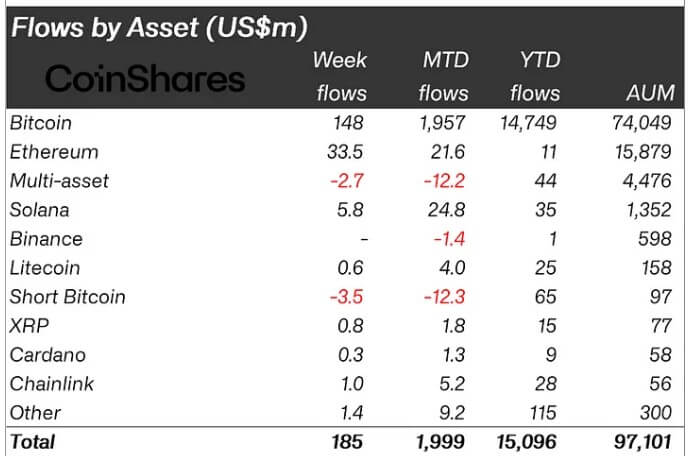

Investors’ hobby in BTC remains largely sure as Bitcoin continues to power the flows in crypto investment merchandise. At some stage in the previous week, the flagship digital asset recorded inflows totaling $148 million, while short BTC merchandise saw outflows of $3.5 million.

Locally, the US maintained its lead with $130 million in inflows despite a $260 million outflow from Grayscale’s GBTC. At some stage in the length, space Bitcoin ETFs from BlackRock and Fidelity recorded predominant inflows totaling $475 million.

Meanwhile, Switzerland saw its 2nd-largest inflows of the year, amounting to $36 million. Canada, making improvements to from the old weeks’ outflows, contributed $25 million in inflows despite a web monthly outflow of $39 million.

Remarkably, Hong Kong has been in a space to stem its outflow pattern, recording modest inflows of $1.7 million final week.

Ethereum ETF approval turns investor sentiment

Meanwhile, crypto-merchandise related to Ethereum maintain seen their 2nd consecutive week of inflows, with consumers pouring $34.5 million into these monetary devices. Closing week, ETH saw its absolute top inflows at $36 million since March.

CoinShares attributed this turnaround to the Securities and Commerce Commission’s (SEC) resolution to approve the 19b-4 filings of a complete lot of space Ethereum ETF merchandise. Before this approval, ETH used to be on a 10-week urge of outflows totaling $200 million.

Several experts maintain predicted that the Ethereum ETFs could well perhaps originate trading as early as July, nonetheless Bloomberg ETF analyst James Seyffart mentioned there is now not any definitive timeline for the launch since the monetary regulator has but to approve the issuers’ S-1 filings.

Meanwhile, the sure sentiments in Ethereum also prolonged investments into other remarkable-cap altcoins fancy Solana, which saw $5.8 million in inflows. Other belongings fancy Chainlink, XRP, and Litecoin recorded minor inflows of now not up to $1 million.

Talked about listed right here

Source credit : cryptoslate.com