KuCoin’s assets and market share slide amid legal woes and user withdrawals

KuCoin’s assets and market fragment bolt amid excellent woes and user withdrawals

KuCoin’s assets and market fragment bolt amid excellent woes and user withdrawals KuCoin’s assets and market fragment bolt amid excellent woes and user withdrawals

KuCoin printed plans for a $9 million airdrop to reward its right customers impacted by its contemporary excellent woes.

Duvet art/illustration by job of CryptoSlate. Image contains blended say material that would also fair consist of AI-generated say material.

Fresh excellent challenges with US authorities have resulted in a noticeable decline in user assets on KuCoin, in keeping with the commerce’s most modern proof-of-reserve certificate.

Per the replace, the commerce customers’ Bitcoin holdings lowered 25.4% to 12,114 BTC in March, whereas Ethereum balances plummeted by approximately 22% to around 112,000 ETH. In the same contrivance, the amount of Tether’s USDT held by customers on the commerce dropped by about 22% to 963 million USDT tokens.

Files from DeFiLlama additional corroborates this downtrend, as over $843 million worth of digital assets have been withdrawn from the platform one day of the previous week. This resulted in KuCoin’s balance dwindling to $3.2 billion from the over $4.3 billion recorded as of March 26.

On the other hand, no topic these declines and outflows, the commerce’s proof-of-reserves certificate presentations that the firm has entirely backed assets inside its machine. Basically based entirely on the reveal, the collateralization of the tokens ranged from 109-115%.

KuCoin’s contemporary challenges might per chance well well be attributed to the lend a hand-to-lend a hand complaints it confronted from the US authorities, together with the US Division of Justice and the Commodity and Futures Buying and selling Rate (CFTC), final week. The authorities alleged that the platform violated anti-money laundering regulations with its unregistered operations inside the nation.

Market fragment decline

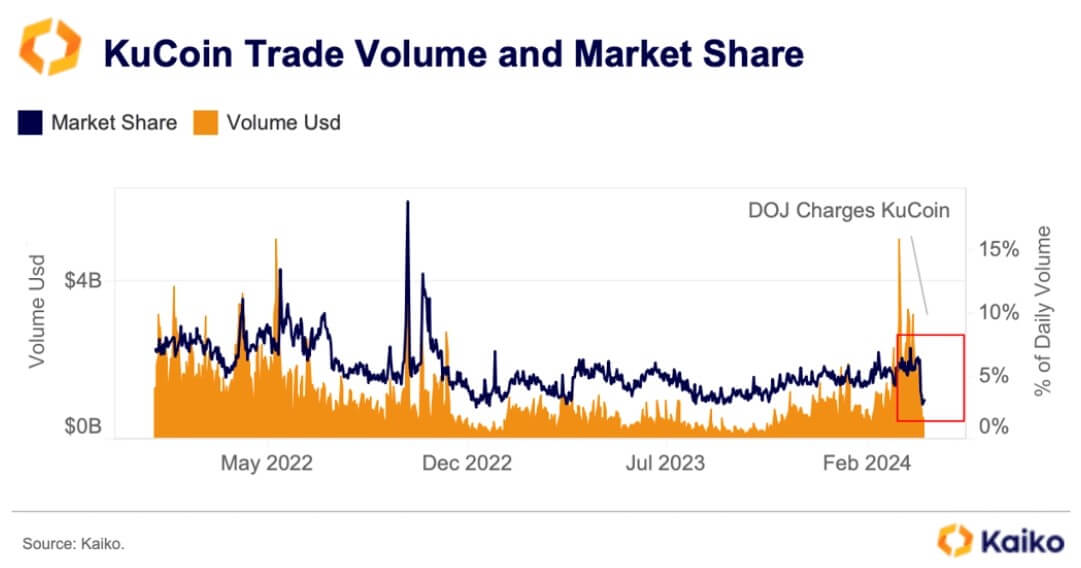

Simultaneously, KuCoin’s market fragment and trading quantity have very a lot declined one day of the previous week.

Per Kaiko recordsdata, the commerce’s day-to-day trading quantity plummeted to around $520 million from approximately $2 billion, with the commerce’s market fragment losing from about 6.5% to lower than 3%.

Kaiko reported that the commerce customers transferred their assets to rival centralized exchanges love Coinbase, Binance, and OKX. It added:

“A number of of the outflows might per chance even be attributed to market makers leaving the commerce. As properly as to transferring funds to other exchanges, some customers are sending their funds straight to their on-chain wallets.”

KuCoin’s response

KuCoin has confronted its excellent battles head-on, with the commerce touting its compliance efforts.

CEO Johnny Lyu acknowledged the commerce’s excellent battles are no longer engrossing and that the platform continues to purpose optimally

Meanwhile, the commerce fair recently unveiled plans for a engrossing $8.9 million airdrop of its KCS native token and Bitcoin to its customers. Lyu explained that this airdrop changed into as soon as designed to compensate customers who experienced withdrawal delays between March 26 and 28. Customers who did now not withdraw assets are anticipated to be airdropped extra in reward for loyalty.

He added:

“I realize the importance of user trust and pleasure. To true our gratitude on your loyalty and endurance one day of the withdrawal congestion, we’re launching this airdrop thought as promised.”

[Editor’s Note: As with all airdrops, please ensure not to engage in any activity unlinked to official channels related to airdrops. Airdrops are one of the biggest attack vectors in crypto, and strict due diligence is essential.]

Mentioned listed here

Source credit : cryptoslate.com