Italy’s largest bank Intesa Sanpaolo enters Bitcoin market with initial €1 million investment

Italy’s greatest bank Intesa Sanpaolo enters Bitcoin market with preliminary â¬1 million investment

Italy’s greatest bank Intesa Sanpaolo enters Bitcoin market with preliminary â¬1 million investment Italy’s greatest bank Intesa Sanpaolo enters Bitcoin market with preliminary â¬1 million investment

Italy's Intesa Sanpaolo reportedly joins a rising preference of monetary establishments embracing Bitcoin amidst heightened company seek files from.

Quilt art/illustration by process of CryptoSlate. Image entails blended grunt material that can also just comprise AI-generated grunt material.

Intesa Sanpaolo, Italy’s greatest bank, has reportedly entered the Bitcoin market by procuring â¬1 million value of the main digital asset.

This translates to roughly 11 BTC, constant with an internal e mail allegedly signed by Niccolo Bardoscia, the pinnacle of the bank’s digital asset trading and investment division.

Though Intesa has yet to enlighten the acquisition, several credible media outlets, alongside with Reuters, bear reported on it.

Meanwhile, Intesa’s reported Bitcoin acquisition follows a sequence of strategic moves within the digital asset field.

Final twelve months, the bank’s crypto division reportedly secured acclaim for reveal crypto trading, adding to its present offerings of crypto alternate solutions, futures, and alternate-traded funds (ETFs).

Alternatively, it is miles unclear if this Bitcoin aquire signals its broader expansion into the digital sources ecosystem.

Alternatively, Pierre Rochard, Vice President of Bitcoin Miner Riot Platforms, highlighted the importance of this shift, noting that monetary establishments extra and extra look Bitcoin’s ability.

He stated:

“The overall banks must open accumulating BTC to recapitalize their balance sheets.”

Intesa is broadly acknowledged as a rush-setter in digital asset adoption within Italy’s outmoded finance sector. It moreover holds the pause reveal amongst Eurozone banks by market capitalization, valued at â¬69 billionâoutpacing opponents indulge in Santander (â¬67 billion) and BNP Paribas (â¬66 billion).

Institutional Bitcoin hobby

Market observers famed that Intesa’s aquire reflects a broader model of elevated Bitcoin adoption amongst monetary establishments.

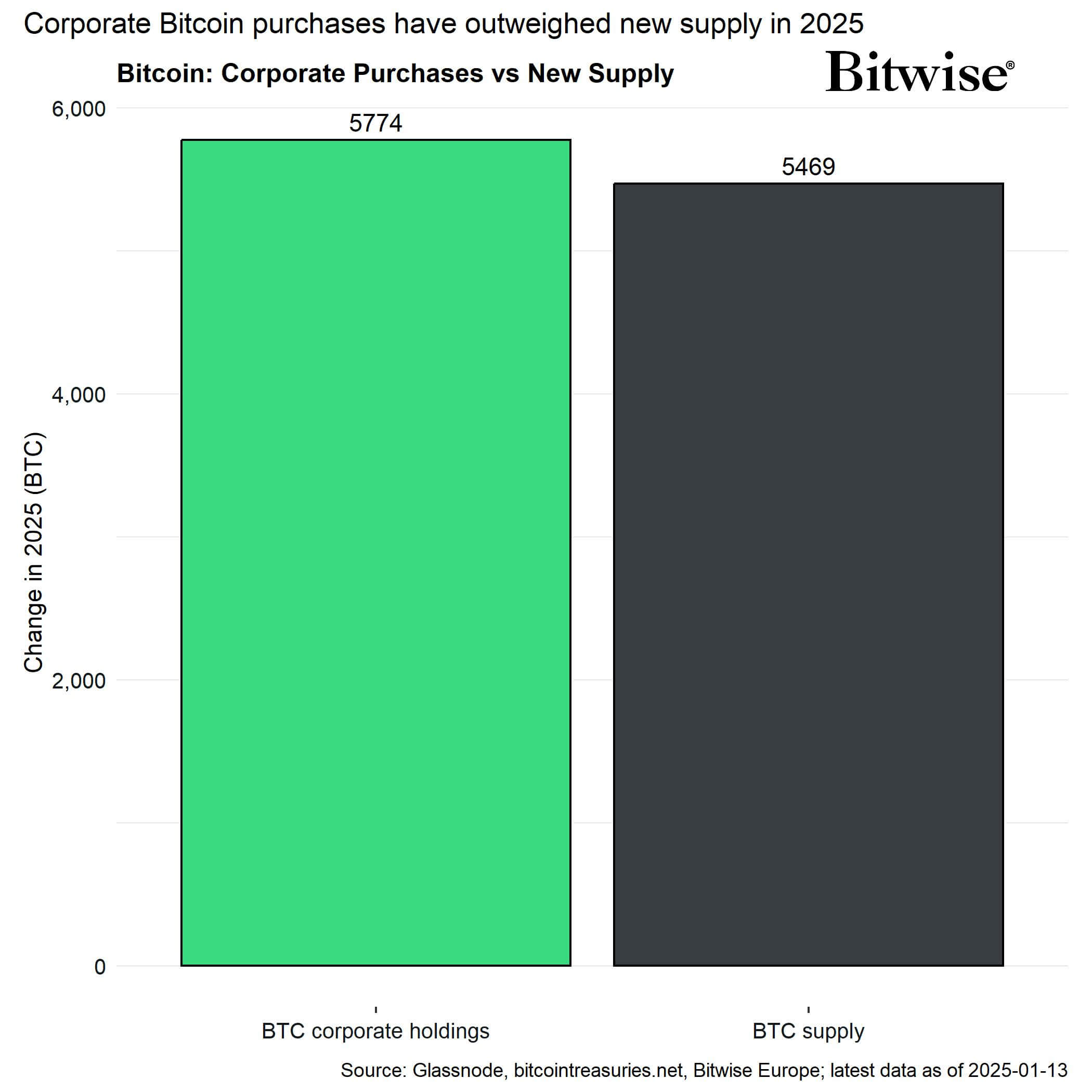

Recordsdata from Bitwise highlights that company seek files from for Bitcoin in 2025 has exceeded the provision of newly mined cash. Corporations bear collectively bought 5,774 BTC for the reason that foundation of the twelve months, whereas only 5,469 BTC had been mined at some level of the identical duration.

Amongst the eminent company investors is MicroStrategy, which has added roughly 3,600 BTC to its reserves this twelve months. Assorted corporations indulge in Semler Scientific and Ming Shing Community bear moreover turned to Bitcoin of their liquidity and reserve diversification programs.

Hunter Horsley, Bitwise CEO, expects this model to proceed this twelve months, asserting:

“Corporations procuring Bitcoin is going to be a prime theme of 2025.”

Mentioned listed here

Source credit : cryptoslate.com

CryptoQuant

CryptoQuant  Kaiko

Kaiko