Investors hedge bets on Bitcoin with $50K call options before ETF decision

The crypto market is for the time being charged with stress, looking ahead to the U.S. Securities and Replace Price’s impending decision on the major field Bitcoin ETF. Amidst divided opinions over whether or no longer the SEC will approve the ETF within the arriving days or effect off the decision again, a terminate prognosis of Deribit’s Bitcoin alternate ideas market reveals merchants bracing for substantial trace movements in January.

As of Jan. 5, the whole start hobby in Bitcoin alternate ideas on Deribit is 228,646.70 BTC, representing a notional worth of $10.05 billion. This great figure signifies a high stage of market participation and hobby in Bitcoin’s future trace movements.

The dominance of name start hobby, comprising 162,694.50 BTC in comparison to position start hobby at 65,952.20 BTC, suggests a bullish sentiment amongst investors. They give the impression of being like looking ahead to or hedging towards a doable develop in Bitcoin’s trace.

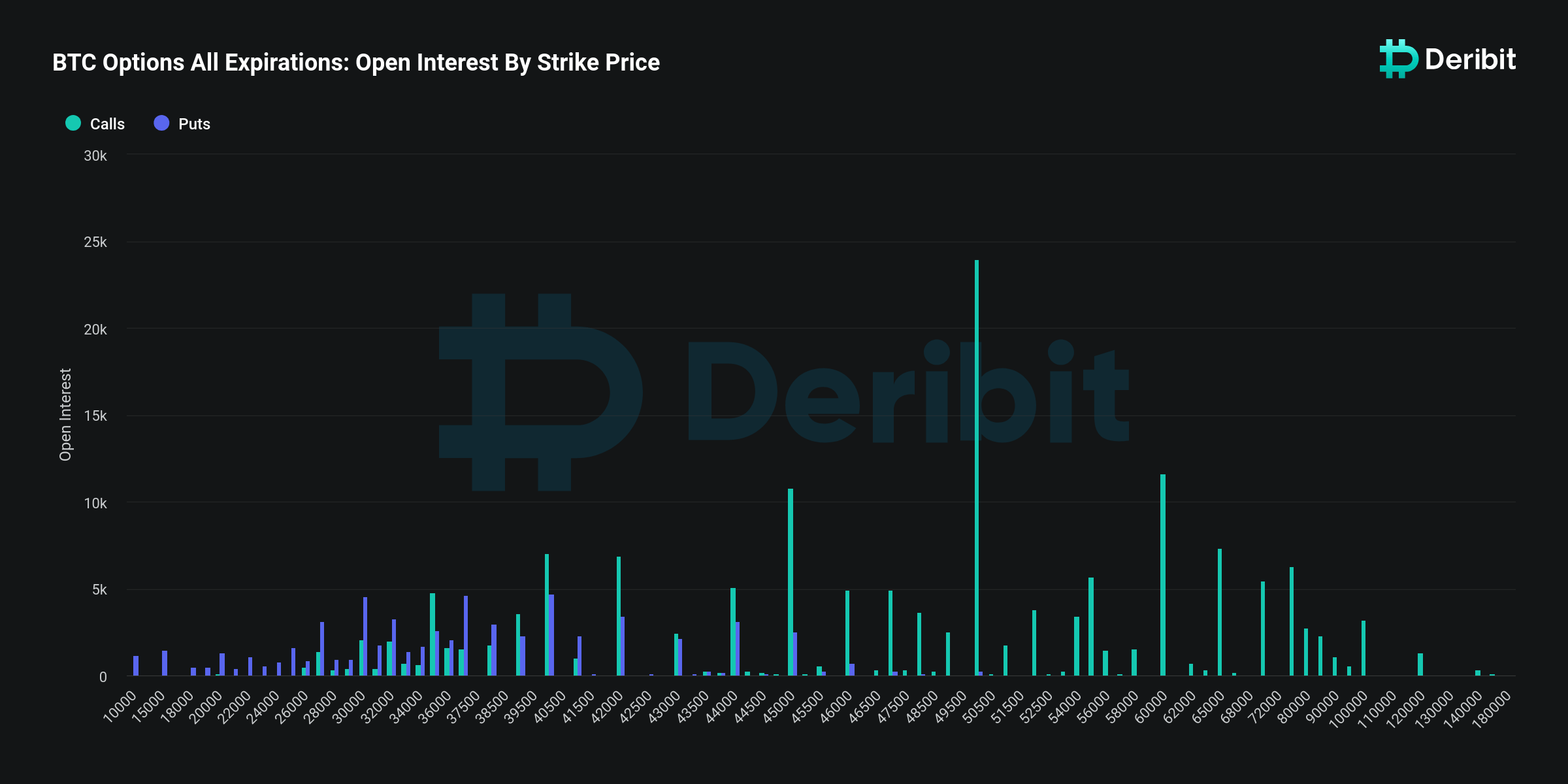

The breakdown of start hobby by strike trace additional reinforces this bullish sentiment. The finest concentration of name alternate ideas is at the $50,000 strike trace, with a trace of $1.05 billion. This stage would be viewed as a extensive psychological and financial threshold that many investors are making a bet Bitcoin will attain or surpass. The next most sensible probably concentration is at the $Forty five,000 and $60,000 strike costs, indicating optimism for even greater costs, even when with lesser conviction than for the $50,000 trace.

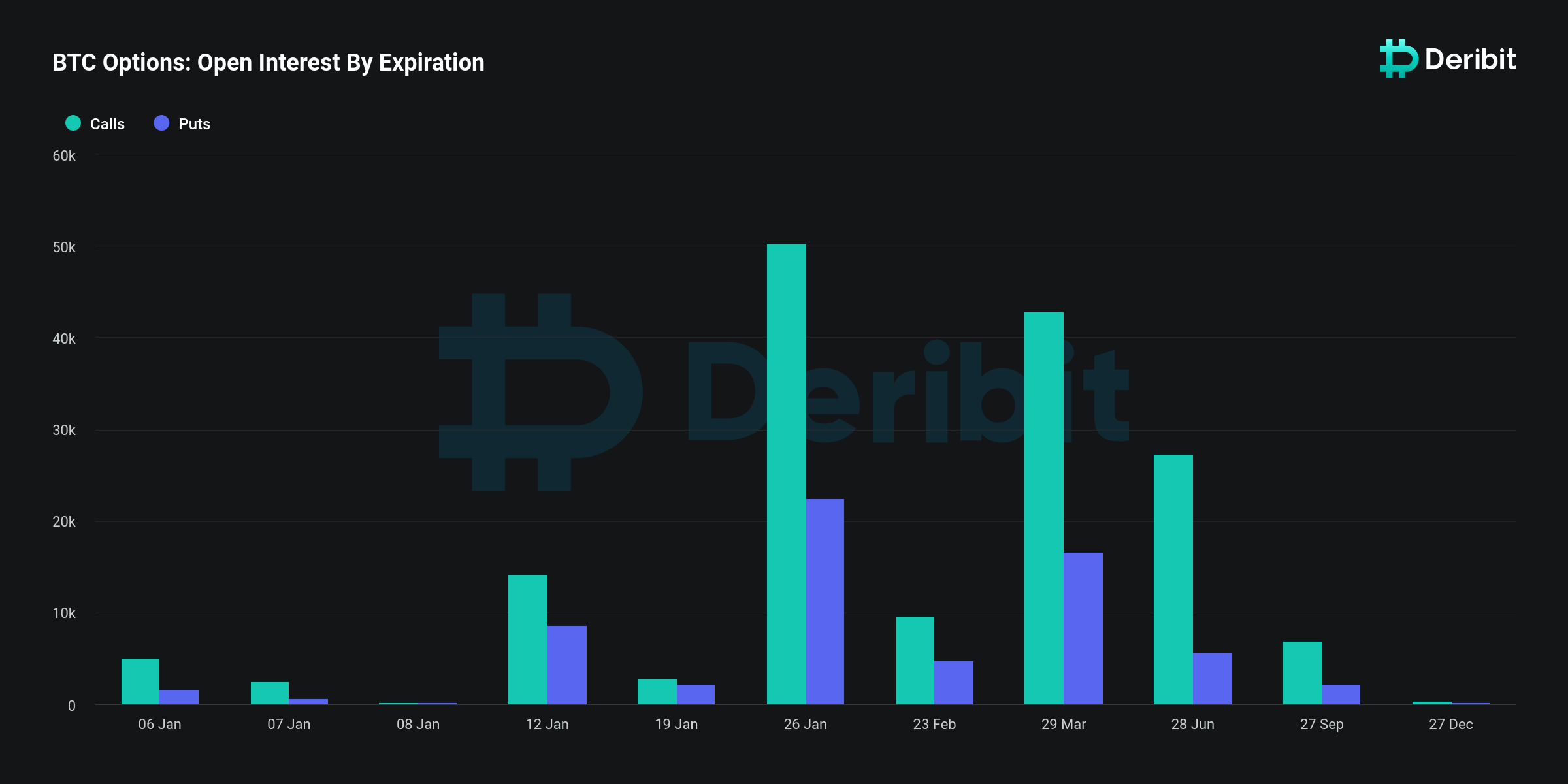

Concerning start hobby by expiration, the knowledge reveals a heavy concentration of name alternate ideas for the Jan. 26 expiration, with $2.21 billion in calls versus $988.49 million in puts. This means that the bullish sentiment is more pronounced for the medium term, with a natty piece of the market looking ahead to valuable developments surrounding the Bitcoin ETF to happen sooner than this date.

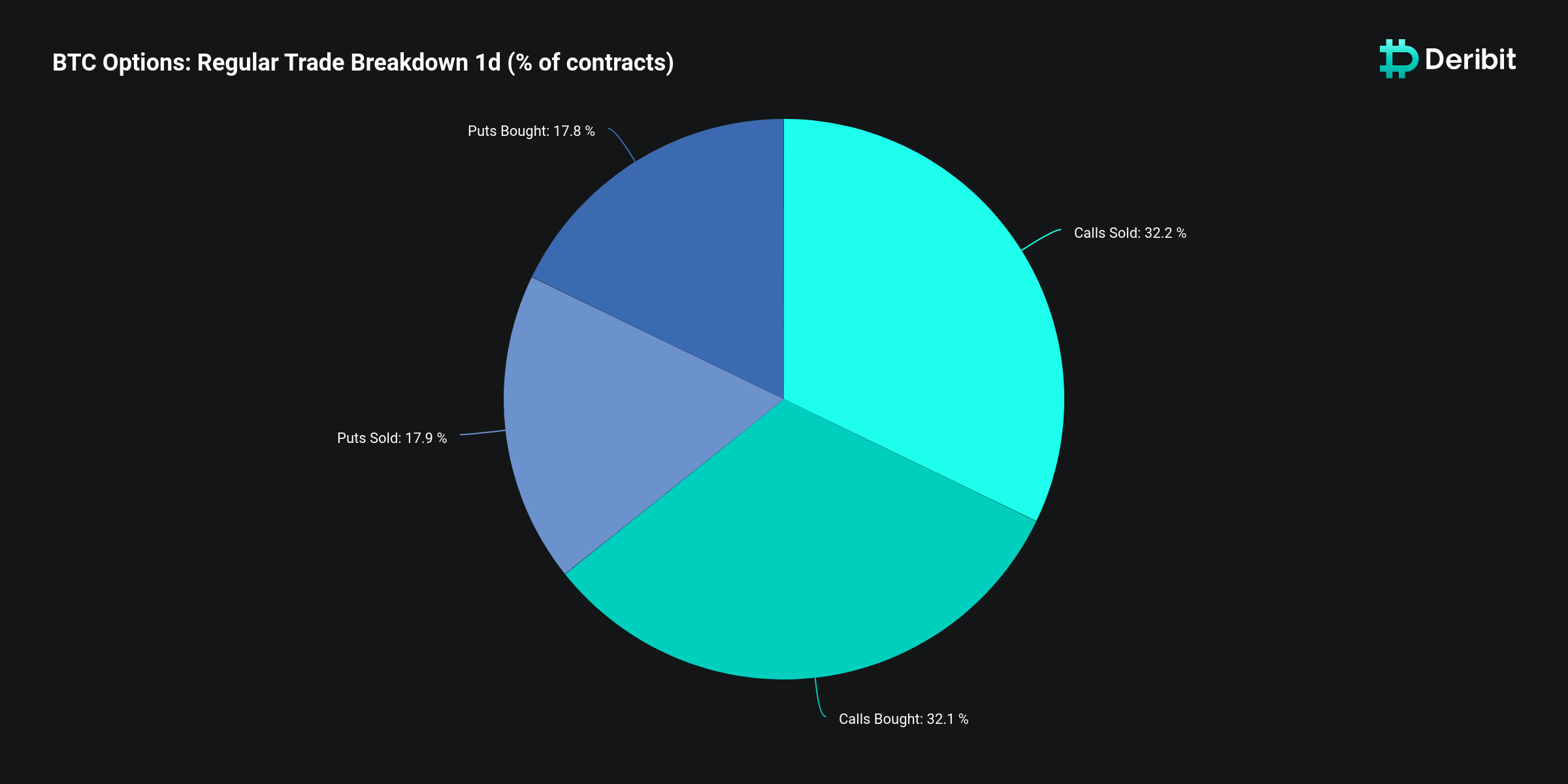

The unique alternate breakdown, exhibiting nearly equal percentages of puts and calls purchased and sold —17.8% and 17.9% for puts, 32.1% and 32.2% for calls, respectively — signifies a balanced market in phrases of trading activities. The guidelines reveals that the next share of market contributors are engaged in name possibility transactions in comparison to puts. This signifies a stronger hobby in making a bet on or hedging towards an develop in Bitcoin’s trace. The balance between calls purchased and sold is furthermore almost equal, suggesting that for every investor speculating on a trace upward push (by procuring for calls), there might perchance be quite an equal number of investors (or perchance the identical investors in numerous transactions) who are either more cautious or taking a look to earnings from promoting these alternate ideas.

Data from Deribit reflects a predominantly bullish sentiment, with investors exhibiting a valid belief within the aptitude for Bitcoin’s trace to develop, in particular in direction of the $50,000 stage within the short to medium term. Nonetheless, quite a whole lot of effect alternate ideas and balanced alternate activities conceal a cautious draw amongst merchants, with many making ready for additional volatility.

Source credit : cryptoslate.com