Investor fervor for Bitcoin ETFs cools despite $646 million weekly surge in crypto funds

Investor fervor for Bitcoin ETFs cools no topic $646 million weekly surge in crypto funds

Investor fervor for Bitcoin ETFs cools no topic $646 million weekly surge in crypto funds Investor fervor for Bitcoin ETFs cools no topic $646 million weekly surge in crypto funds

Complete assets below managements for crypto ETPs soared to $94.47 billion, pushed by file funding inflows.

Disguise art work/illustration through CryptoSlate. Image entails mixed stammer that would additionally merely consist of AI-generated stammer.

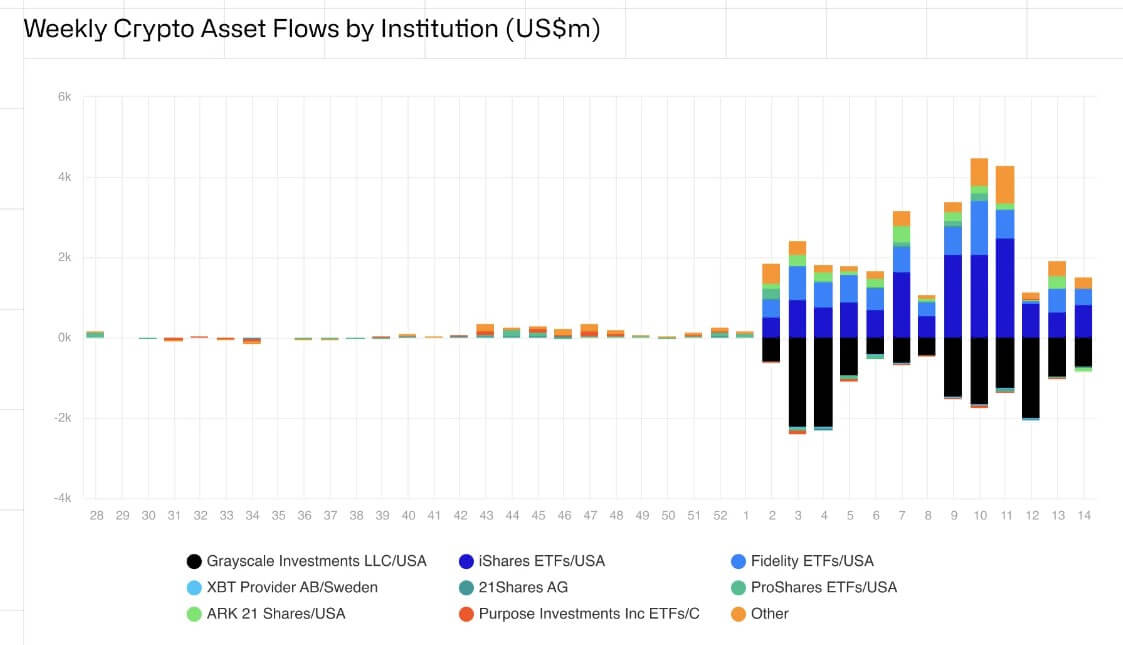

Crypto-linked funding merchandise continued their upward trajectory, recording inflows of $646 million all during the previous week, in response to CoinShares‘ weekly file.

This influx brings the total for the year to an unheard of $13.8 billion, propelling the total assets below management to a staggering $94.47 billion.

Bitcoin ETF hype moderating

Trading volume for crypto funding merchandise declined final week, dwindling to $17.4 billion from the $43 billion recorded in the most well-known week of March. This implies a attainable moderation in investor passion in Bitcoin alternate-traded funds (ETF) after weeks of consecutive hype.

Meanwhile, Bitcoin remains the focus for investors, declaring its market dominance since the ETF approvals in January. In the course of the previous week, BTC-linked merchandise witnessed a substantial particular secure breeze with the circulate of $663 million.

The lion’s half of this influx came from BlackRock’s iShares, which accrued $811 million, with Fidelity FBTC following at $395.83 million. In incompatibility, Grayscale GBTC recorded $731 million in outflows.

While Bitcoin merchandise flourished, outflows from other digital assets introduced about the total secure breeze with the circulate to dip to $646 million. Ethereum witnessed its fourth consecutive week of outflows, shedding an extra $22.5 million. In consequence, ETH’s year-to-date secure flows have dropped to $52 million.

Conversely, make a choice altcoins demonstrated resilience. Solana, Litecoin, and Filecoin attracted considerable inflows of $4 million, $4.4 million, and $1.4 million, respectively.

Moreover, the sizzling bullish sentiment in the market resulted in fast Bitcoin merchandise experiencing their third consecutive week of outflows totaling $9.5 million. This reflects a waning conviction amongst bearish investors, particularly as BTC’s price jumped by roughly 4% all the contrivance during the previous week to over $70,000 as of press time.

Whatever the “moderating” speed for meals for Bitcoin ETFs, the US retained its space because the main market, with inflows totaling $648 million. Brazil, Germany, and Hong Kong additionally witnessed big inflows of $9.8 million, $9.6 million, and $9 million, respectively.

Conversely, Canada and Switzerland skilled outflows of $27 million and $7.3 million, respectively, underscoring regional adaptations in market sentiment.

Talked about on this article

Source credit : cryptoslate.com