Investor exodus from Bitcoin ETFs as BlackRock and Fidelity see significant outflows

Investor exodus from Bitcoin ETFs as BlackRock and Fidelity search most important outflows

Investor exodus from Bitcoin ETFs as BlackRock and Fidelity search most important outflows Investor exodus from Bitcoin ETFs as BlackRock and Fidelity search most important outflows

BlackRock search aid-to-aid zero flows as Fidelityâs FBTC records first outflow.

Quilt artwork/illustration by skill of CryptoSlate. Image comprises combined notify that can embody AI-generated notify.

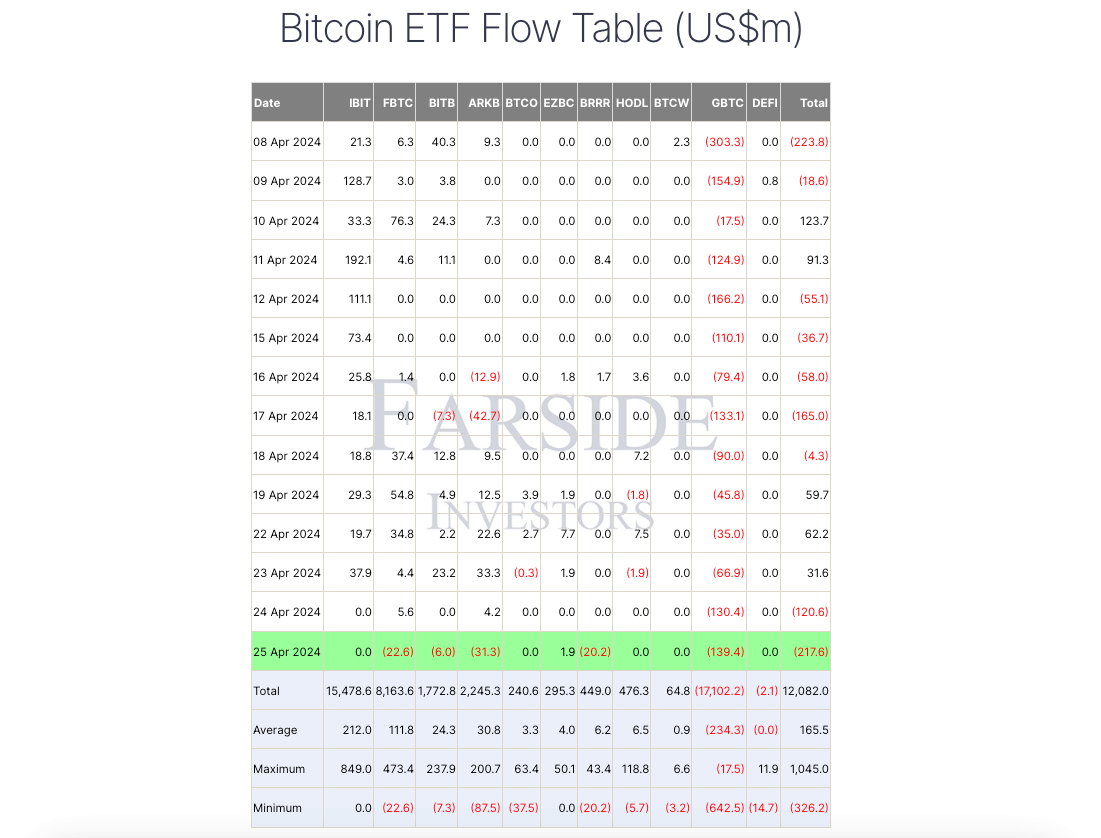

Investor passion in space Bitcoin alternate-traded funds (ETFs) appears to be like to be waning, with outflows totaling $218 million in the day gone by.

Per records from Farside Merchants, BlackRock’s IBIT Bitcoin ETF experienced its 2d consecutive day of zero flows, while Fidelity’s FBTC noticed its first daily collect outflow, totaling $23 million.

Diversified US Bitcoin funds experienced fundamental daily outflows. Grayscale GBTC fund continued its outflow development, shedding $139.37 million, while $31.34 million exited Ark Invest and 21Shares’ ARKB fund. Additionally, Valkyrie’s fund experienced $20.16 million in outflows, and Bitwise noticed a negative waft of $6 million.

In distinction, Franklin Templeton’s EZBC emerged as the correct fund with daily collect inflows, attracting $1.87 million.

Despite these most important outflows, collect inflows into the ETFs beget surpassed $12 billion since their start in January.

Why are Bitcoin ETFs seeing outflows?

Earlier in the week, James Butterfill, CoinShares’ Head of Analysis, explained that these outflows signal waning passion among ETP/ETF merchants, fueled by speculations about skill delays in rate cuts by the Federal Reserve.

Meanwhile, some market experts illustrious that the slowdown used to be most important for the market to take a breather. Bloomberg Senior ETF analyst Eric Balchunas reported that Fidelity’s FBTC and BlackRock’s IBIT had broken records for the top collect property all the map thru the first 72 days of start.

He acknowledged:

“The league of cling-ness of IBIT, FBTC et al shows how overheated it all used to be, a breather used to be previous due to the be factual.”

Fidelity FBTC and BlackRock IBIT are in particular powerful as they're market leaders, collectively managing over $27 billion in property.

On the different hand, there’s anticipation surrounding Morgan Stanley’s reported concept to allow its 15,000 brokers to imply space Bitcoin ETFs to customers, which would perchance well doubtlessly reignite passion available in the market.

Mentioned listed right here

Source credit : cryptoslate.com