Institutional investors now hold 20% of US-traded spot Bitcoin ETFs

Institutional investors now contend with 20% of US-traded affirm Bitcoin ETFs

Institutional investors now contend with 20% of US-traded affirm Bitcoin ETFs Institutional investors now contend with 20% of US-traded affirm Bitcoin ETFs

Keep Bitcoin ETFs had been exposure to 1,179 institutions since their delivery in January, in line with 13F Create filings.

Quilt artwork/illustration by arrangement of CryptoSlate. Image entails blended thunder material that can well consist of AI-generated thunder material.

Institutional investors now contend with roughly 20% of all US-traded affirm Bitcoin (BTC) alternate-traded funds (ETFs), in line with new info.

CryptoQuant CEO and founder Ki Younger Ju printed that the latest 13F Create filings demonstrate that institutional investors contend with over 193,000 BTC by arrangement of Bitcoin ETFs as of Oct. 18.

He also printed that roughly 1,179 institutions enjoy invested in US-traded affirm Bitcoin ETFs. The checklist entails $70 billion asset supervisor Millennium Management, $438 billion procuring and selling firm Jane Avenue, and $2.93 trillion funding bank Goldman Sachs.

IBIT leads in absolute quantity

In absolute numbers, BlackRock’s iShares Bitcoin Have confidence ETF (IBIT) has basically the most Bitcoins held by institutions, with over 71,000 BTC. On the assorted hand, its institutional adoption share of 18.38% is below average.

Grayscaleâs GBTC registered 44,707.89 BTC held by institutional investors, the 2d-greatest quantity, with 20.25% of its shareholders being institutional investors.

Meanwhile, ARK 21Sharesâ ARKB had the finest institutional participation, with 32.8% of its shares owned by asset managers, equating to roughly 17,166 BTC.

The ETF with the least institutional participation is Grayscale’s Bitcoin Mini Have confidence, with lawful 1.52% of its shares held by these investors, whereas CoinShares Valkyrie ETF (BRRR) displays the smallest absolute quantity in Bitcoins, with 451.26 BTC bought by institutions during the product.

The third-greatest ETF, Fidelityâs FBTC, is also the third likelihood sought by institutional investors, with 44,623.23 BTC held by institutional investors, which compose up 24.14% of its holders.

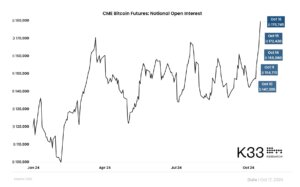

Bitcoin ETF and worth correlation

A new VanEck sage highlighted a stronger correlation between Bitcoin ETF flows and the cryptocurrency’s sign in new months, pushed largely by rising institutional adoption.

Keep Bitcoin ETFs traded in the US broke the $21 billion threshold in one year-to-date flows on Oct. 18, in line with Farside Merchants info.

In step with VanEck surge in institutional interest may maybe stamp Bitcoinâs 11% sign amplify in October, reaching $67,478. The asset supervisor suggests that rising question from institutions may maybe continue to gasoline Bitcoinâs upward momentum in the stop to future.

Talked about on this article

Bitcoin

Bitcoin  CryptoQuant

CryptoQuant  BlackRock

BlackRock  Constancy Investments

Constancy Investments  Grayscale Investments

Grayscale Investments  Ark Invest

Ark Invest  21shares

21shares  CoinShares

CoinShares  Valkyrie

Valkyrie  VanEck

VanEck  Goldman Sachs

Goldman Sachs  iShares Bitcoin Have confidence

iShares Bitcoin Have confidence  ARK 21Shares Bitcoin ETF

ARK 21Shares Bitcoin ETF  Constancy Engaging Origin Bitcoin Have confidence

Constancy Engaging Origin Bitcoin Have confidence

Source credit : cryptoslate.com

CoinGlass

CoinGlass

Dune Analytics

Dune Analytics