In a bull market, everyone thinks they’re a VC

In a bull market, each person thinks theyâre a VC

In a bull market, each person thinks theyâre a VC In a bull market, each person thinks theyâre a VC

The bull market chronicle turns beginners into aspiring VCs amidst a frenzy of profits and optimism.

Duvet art/illustration by capability of CryptoSlate. Image involves blended speak that could well consist of AI-generated speak.

The following is a visitor submit by Tim Haldorsson, CEO of Lunar Approach.

The candy sounds of upward designate indicators hit your phone non-discontinuance. Mega inexperienced candles are seen on each crypto chart. The smells of profits are everywhere.Â

In diverse words, the bull market is encourage in rotund swing, and it feels take care of a digital gold dawdle has adopted. Within the course of this bullish craziness, each person without note imagines themselves as project capitalists.

Pointless to declare, this raises more questions than answers. Why is this the case? Does the market need more VCs? Is this a wholesome signal or a high signal, a warning of one other bubble?Â

Listed right here, weâll receive that the answers are not as binary as a straight forward âyesâ or âno.â

What Fuels Hype in a Bull Market?

The pleasure in a bullish market is just not upright driven by spectacular profits. What if truth be told attracts other folks in correct by a crypto bull market are the extremely effective psychological and financial factors that are self-discipline loose.Â

With a surge in market project and true media hype, a contagious sense of optimism takes retain. Some could well even call it a frenzy, although I don’t ponder we’re moderately there yet.

In such an energized atmosphere, the excellence between experienced merchants and rookies blurs. Of us caught up in the fervor launch to take a look at themselves as savvy project capitalists. Every fresh startup or project, no topic its true potentialities of success, is named âthe subsequent sizable thing.â

It’s upright that this wave of enjoyment isn’t baseless. Previous bull markets include shown time and all all over again that fortunes is also made practically overnight. On the exchange hand, what assuredly gets omitted are the intricate programs that lead to successful investments. Seasoned project capitalists carry with them years of expertise and distinctive skills that encourage them navigate the unpredictable world of investing with warning.

Psychological Drivers At the encourage of the VC Mindset

One could well argue that this fashioned mindset faucets into diverse core psychological drivers:Â

- The awe of lacking out (FOMO);

- A feeling of outrageous self assurance;

- The bright charm of mercurial profits.Â

FOMO, namely, performs a predominant role. It's a ways the continual conception that someplace within the wide array of tokens and projects being introduced on the chain, there exists a precious exchange that that you just would possibly deeply remorse overlooking without discontinuance.

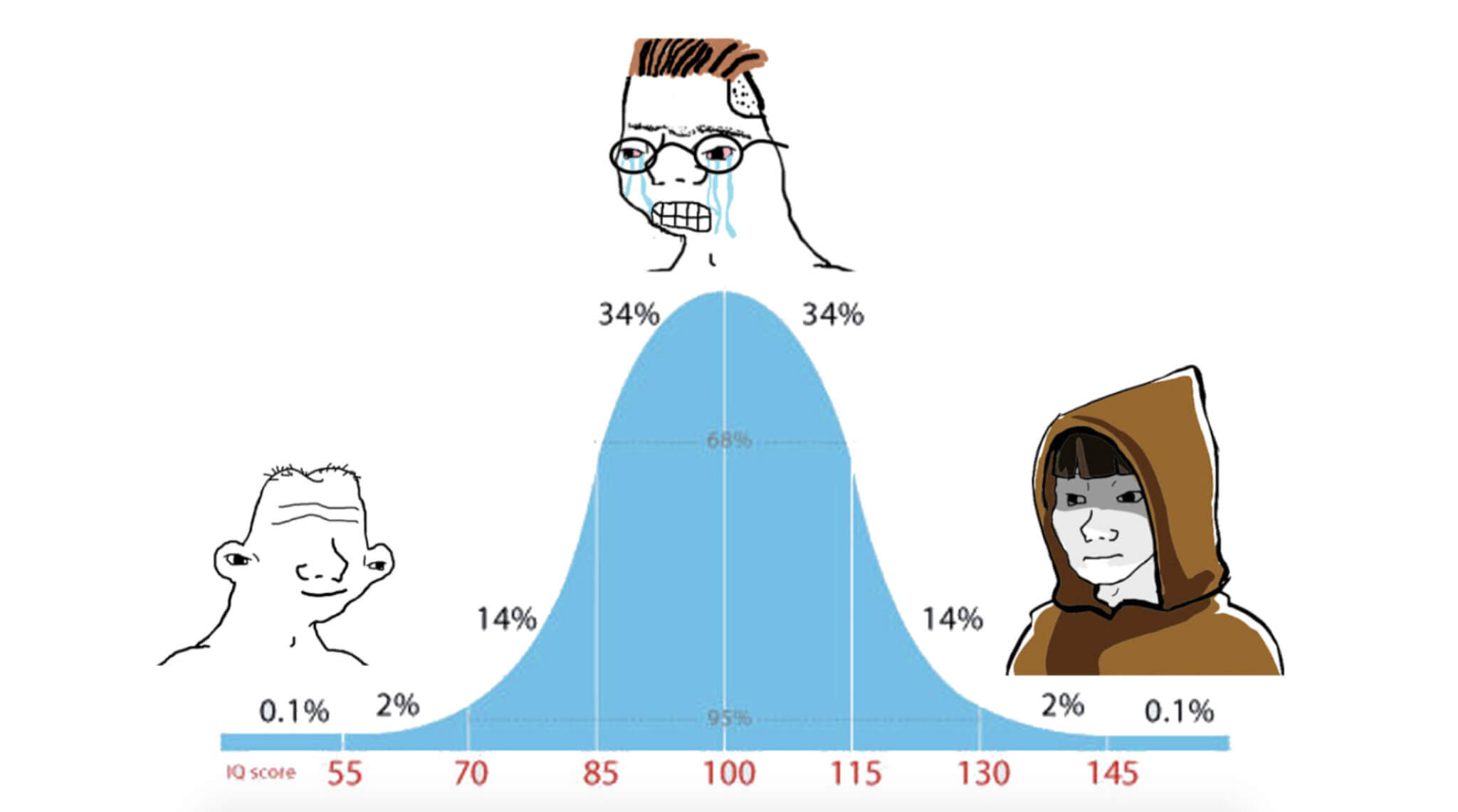

The authorized left-upright curve meme encapsulates this mindset perfectly. On one side, some contributors merely apply traits and provocative narratives without powerful consideration, conserving onto the hope, no topic how now doubtlessly not, that their chosen investment will fly in designate. On the reverse side are the more seasoned individuals who excel at recognizing hidden gemstones amongst the everyday. In between these extremes are other folks that be taught about the arena logically and receive cramped common sense in crypto market dynamics.

Most crypto enthusiasts, whether or not lengthy-time individuals or rookies, tend to gravitate toward either discontinuance of this curve. It serves as a visual illustration of the danger appetite that drives the ‘VC mindset’ correct by a bullish market interval. Trendy merchants are incessantly seen as conservative contributors who could well not align with the total mindset of the crypto market.

So, what drives this extremely esteemed ‘possibility-taking’ angle? Many are influenced by overconfidence, fueled by success experiences and the apparently easy profits showcased on social media, causing them to overestimate their investment skills. The anonymity within the crypto neighborhood additionally emboldens other folks to take dangers they'd steer clear of in more feeble environments.

Lowering Entry Boundaries

One standout characteristic of the crypto market is its inclusive nature by approach of investment alternatives. Now not like feeble project capital with closed networks and principal capital demands that is also daunting for many, the crypto station welcomes each person with commence fingers.

Whether it’s Preliminary DEX Choices (IDOs), token presales, or NFT launches, getting concerned requires minimal boundaries as lengthy as you've got a crypto wallet and some funds in a position to make investments.

Influencer-driven fundraising is one other provocative side of accessibility that has radically change synonymous with crypto. It’s no secret that social media influencers retain sway over market sentiments by their platforms.

On the exchange hand, a brand fresh form of influencer is emerging, opting to include more non-public investment by for sure backing up their words with motion. Startups and initiatives are launching applications where social influencers are given early earn entry to to fundraising alternatives.

A equivalent to feeble project capitalists, these influencers make contributions funds alongside with exposure, rising a mutual incentive gadget where all events collaborate for the success of the project.

Playing it Dapper: What Does the Market Want?

The inflow of funds and consideration correct by a bullish market can severely enhance the efficiency and price of crypto projects. While this gifts diverse alternatives, it additionally brings a few degree of volatility and speculation that is also both advantageous and detrimental to the market as smartly as its stakeholders. This raises principal issues concerning sustainability when it comes to possibility.

An more and more more ‘possibility on’ approach driven by inexperienced market individuals chasing after high returns take care of project capitalists can lead to bubbles and promote unhealthy speculation.

Furthermore, the abundance of projects competing for consideration could well discontinuance up in a decrease in quality, with hype assuredly overshadowing substance. This starkly contrasts with the feeble project capital approach, which relies on thorough analysis and a lengthy-term level of view to adjust dangers and verify investment viability.

No topic the accessibility and ability for mercurial profits in investing, it’s principal for merchants to proceed with warning. The announcing “DYOR” (Enact Your Personal Study) holds principal weight in this day’s climate. Somebody getting into the crypto market seemingly understands its unstable and speculative nature.

On account of this fact, conducting thorough analysis, grasping the dangers appealing, and enforcing a disciplined investment approach are principal. While the bullish market could well give a style of project capitalism to many, it'll additionally lend a hand as a stark reminder of the penalties when impulsive buying and selling surpasses classic diagnosis and prudent decision-making.

In Summary

It’s tempting to earn swept up in the fun of envisioning oneself as a savvy investor figuring out and backing promising ventures early on. On the exchange hand, upright project capitalism â whether or not in crypto or feeble markets â involves recognizing ability alternatives and taking measured steps supported by persistence, self-discipline, and possibility administration acumen.

Currently, striking a steadiness between making investments accessible to all while emphasizing education and prudence is key to fostering a vital market that advantages each person appealing.

Source credit : cryptoslate.com