How does Polymarket’s $364 million US election crypto prediction market work?

How does Polymarketâs $364 million US election crypto prediction market work?

How does Polymarketâs $364 million US election crypto prediction market work? How does Polymarketâs $364 million US election crypto prediction market work?

Polymarketâs innovative approach to making a bet on US political outcomes bypasses mature regulations and drives valuable client engagement.

Quilt art/illustration by means of CryptoSlate. Image involves blended stutter material that would also comprise AI-generated stutter material.

Polymarket is a decentralized prediction market platform that operates the usage of Polygon.

Fair no longer too long ago, it acquired valuable consideration by enabling users to bet on the outcomes of US political elections, a be aware primarily prohibited all by means of the mature US making a bet framework.

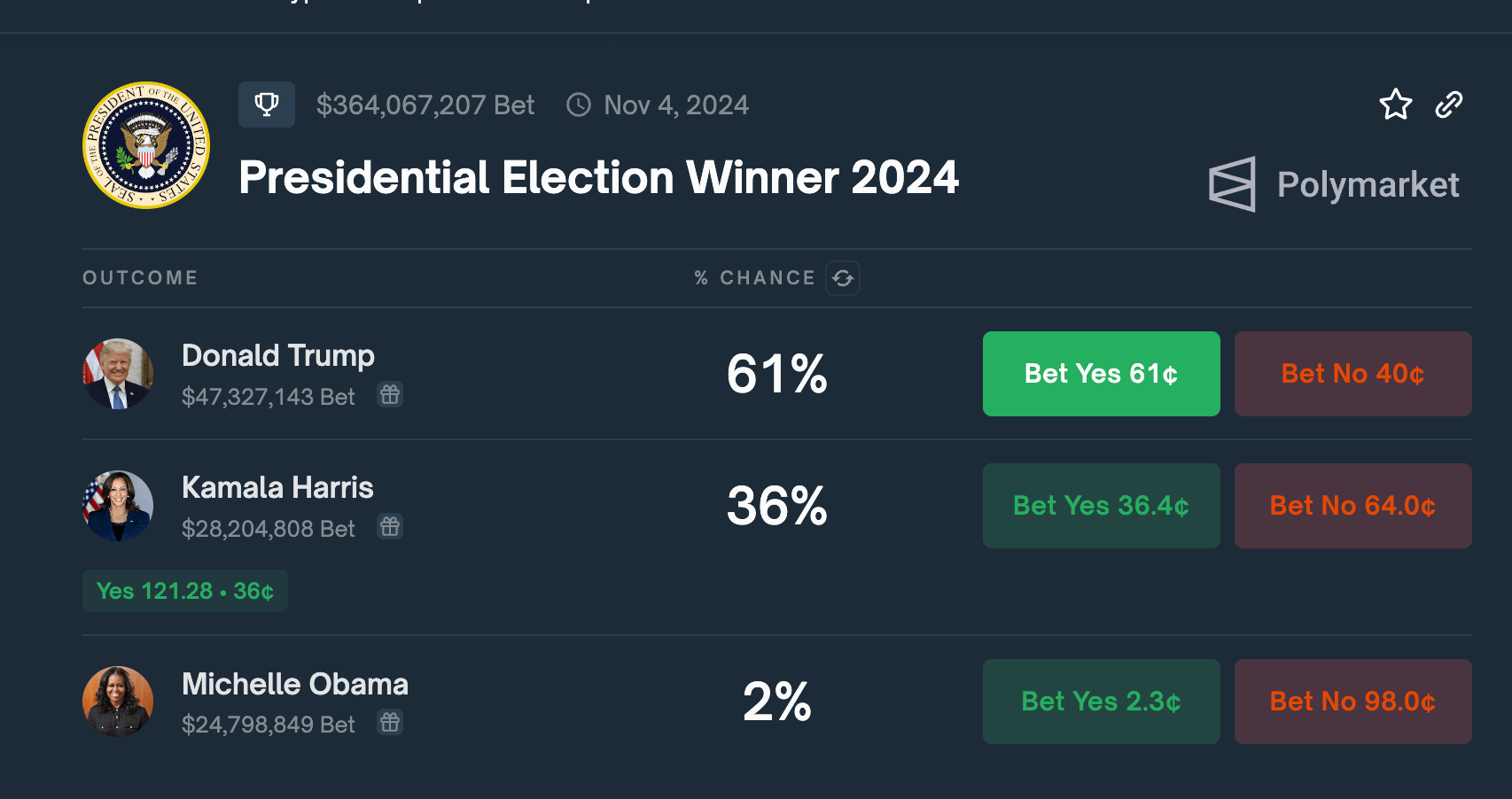

The platform’s marketplace for the 2024 US Presidential Election, to illustrate, has viewed huge engagement, with over $364 million wagered on possible outcomes as of contemporary data. This surge in process highlights a broader model the attach prediction markets esteem Polymarket provide a definite avenue for political engagement and speculation, circumventing the restrictions imposed by US regulators on mature making a bet platforms.

The Commodity Futures Shopping and selling Price (CFTC) has actively worked to shut down or restrict platforms offering election-associated contracts, reflecting the contentious regulatory atmosphere in which these markets characteristic. Despite these challenges, Polymarket’s innovative intention has positioned it as a key player within the worldwide zeitgeist, particularly all the very top intention by means of excessive-stakes election cycles.

Whereas Polymarket’s employ is formally restricted within the US, salvage entry to by means of VPN is peaceable possible. Though this violates the positioning’s phrases of employ, many US betters can also merely have the ability to interacting as a result of the inability of KYC necessities, which would possibly perchance well perchance perchance further restrict accessibility.

Market Structure and Execution

Polymarket aspects binary markets, the attach users can bet on “Certain” or “No” outcomes for diverse events. The platform uses a continuous double public sale mannequin, the attach prices signify the prospect of an tournament occurring. As an illustration, if “Certain” shares for an tournament are trading at $0.56, it implies a 56% chance of that .

As an illustration, to bet on the result of the 2024 US Presidential Election the usage of Polymarket, users first connect their EVM-acceptable pockets, equivalent to MetaMask, and deposit USDC into their Polymarket myth.

Once funded, users navigate to the marketplace for the Presidential Election Winner 2024, the attach they'll ask the hot potentialities for every candidate. As an illustration, as of July 24, Donald Trump has a 61% likelihood of profitable, with shares priced at $0.61 every.

Users can then aquire “Certain” shares if they keep in mind Trump will procure or “No” shares if they possess he'll lose. If Trump wins, every “Certain” share will be worth $1, yielding a profit of $0.39 per share.

Conversely, if Trump loses, the “Certain” shares will change into nugatory. This dynamic enables users to trade their positions at any time earlier than the market resolves, enabling them to lock in earnings or prick losses primarily based completely on evolving potentialities.

Technical Infrastructure & Reward Mechanism

Polymarket leverages Polygon to give a take to scalability and prick transaction prices. This allows the platform to accommodate a excessive quantity of trades with out congesting the Ethereum network or incurring prohibitive gasoline charges.

The platform provides developers with REST and WebSocket API endpoints for having access to market data, prices, and remark historical past. This allows the introduction of third-occasion instruments and integrations.

Unquestionably one of Polymarket’s novel aspects is its employ of the UMA (Current Market Entry) Optimistic Oracle for market resolution. The job works as follows:

- When a market is created, a resolution request is distributed to the UMA Optimistic Oracle.

- Users can imply a resolution to the request.

- A self-discipline period begins, allowing the proposed resolution to be disputed.

- If disputed, the resolution is submitted to UMA’s Recordsdata Verification Mechanism (DVM).

- UMA token holders vote to uncover the right .

This decentralized intention ensures that market outcomes are resolved reasonably and transparently with out relying on a centralized authority.

Reward Mechanisms

Polymarket implements diverse incentive structures to encourage liquidity and participation:

- Liquidity Provider Rewards: Users who attach resting restrict orders near the market midpoint are eligible for weekly rewards. This program targets to fabricate a wholesome, liquid market by incentivizing balanced quoting and discouraging exploitative behaviors.

- Provide an explanation for Scoring Aim: Rewards are calculated the usage of a elaborate system taking into consideration factors equivalent to market participation, two-sided depth, and spread from the midpoint. Each market has a configured max spread and minimum measurement cutoff for eligible orders.

- Weekly Distribution: Rewards are distributed straight to makers’ addresses weekly, on the total on Fridays on the hours of darkness ET.

- Market-Declare Rewards: The reward quantity is remoted per market, taking into consideration targeted incentivization of specific events or classes.

- Extra Incentives: Polymarket infrequently runs one-off public PnL/quantity competitions to stimulate trading process further.

Aspects and Advantages

Polymarket’s originate provides diverse recent advantages:

- Real-time Shopping and selling: Users can enter and exit positions anytime, allowing dynamic market participation.

- No Native Token Requirement: Now not like some competitors, Polymarket doesn’t require users to take care of or maintain a native platform token to participate.

- Self-Custodial Wallets: Users take care of attend an eye fixed on of their funds, bettering security and reducing counterparty chance.

- Huge Vary of Markets: The platform supports markets on diverse topics, including politics, sports actions, leisure, and more.

- Scalability: By leveraging Polygon, Polymarket can address excessive transaction volumes with low charges.

- Clear Impress Discovery: The continuous double public sale mannequin provides right, right-time potentialities for tournament outcomes.

Polymarket combines blockchain, aspect chain scaling, decentralized oracles, and innovative reward mechanisms to fabricate a sturdy and atmosphere friendly prediction market platform. Its originate enables for right-time trading, transparent label discovery, and gorgeous market resolution while incentivizing liquidity and participation.

Talked about in this text

Source credit : cryptoslate.com