How AI and crypto are shaping the future of finance

How AI and crypto are shaping the prolonged lumber of finance

How AI and crypto are shaping the prolonged lumber of finance How AI and crypto are shaping the prolonged lumber of finance

AI and blockchain innovation converge to free up a brand unique abilities of economic markets and companies.

Duvet art/illustration through CryptoSlate. Image contains mixed verbalize that would additionally encompass AI-generated verbalize.

Over the closing three years, the crypto space has gone through massive upheavals. Alongside the boosting from stimulus capabilities in 2021, mission capital (VC) corporations had invested $33 billion in crypto and blockchain startups.

The next yr, the Federal Reserve brought about a domino of crypto bankruptcies with its curiosity price ice climbing cycle, starting from the Terra (LUNA) fracture and culminating within the FTX Ponzi scheme give plan.

The promise of DeFi misplaced its luster, no longer helped by over $3 billion misplaced in DeFi hacks in the end of 2023. The continuing Bitcoin bull lumber reveals the inability of altcoin confidence because the so-known as Altcoin Season is but to manifest.

In June 2023, BlackRock’s head of strategic partnerships, Joseph Chalom, smartly-known that DeFi’s institutional adoption is âmany, many, a protracted time awayâ. Alternatively, there could be a case to be made that the emerging AI narrative can fuse with blockchain abilities and its capabilities.

Taking in classes from the old cycle, what would that AI-crypto landscape gaze like?

Laying the AI Foundation with Crypto Composability

Looking lend a hand, it is receive to negate that âDeFiâ modified into subsumed by corporations on high of tokenized layers, equivalent to Celsius Community or BlockFi, rendering DeFi into CeFi. These corporations efficiently drove crypto adoption as such, most effective to full up sullying the very word âcryptoâ.

A renewed DeFi v2 ought to restful then focal point on a superior person journey that doesnât spark the query for centralized corporations to manufacture it so. Most considerably, DeFi security must be fortified. Essentially the most promising acknowledge in that direction is the zero-data Ethereum Digital Machine – zkEVM.

By abstracting chain transactions through zero-data proofs (ZKPs), zkEVM increases network throughput and reduces gasoline costs. On high of that, zkEVM simplifies the person journey by facilitating different token funds for gasoline charges. In numerous phrases, zkEVM-like alternatives pave the avenue to scalability well-known for AI capabilities.

AI capabilities inherently comprise excessive volumes of data, making it a doubtless bottleneck for blockchain networks. With this obstacle forward, Polygon zkEVM makes it imaginable to generate AI art work through the Midjourney characterize generator. In this route of, the outcomes will be tokenized as NFTs with low charges.

Building further on tidy contracts of different forms, the crypto space has laid the groundwork for AI with composability and permissionless entry. Mixed, this creates an independent and efficient infrastructure for monetary markets. As every piece of market motion will be disassembled into tidy contracts, composability brings innovation in the end of three composability layers:

- Morphological – parts communicating between DeFi protocols, growing unique meta-parts.

- Atomic – potential for every tidy contract to characteristic independently or alongside with different protocolsâ tidy contracts.

- Syntactic – potential for protocols to focus on in step with standardized protocols.Â

In discover, this interprets to Lego DeFi bricks. As an illustration, Compound (COMP) enables customers to give liquidity into tidy contract swimming pools. Right here's one in all DeFiâs revolutionary pillars as customers no longer require anyone’s permission to both mortgage or borrow. With tidy contracts performing as liquidity swimming pools, borrowers can faucet into them by providing collateral.Â

Liquidity companies accomplish cTokens in return as curiosity. If the equipped token is USDC, the yielding one will be cUSDC. Alternatively these tokens will be built-in in the end of the DeFi board into all protocols like minded with the ERC-20 long-established.

In numerous phrases, composability creates alternatives for the multiplicity of yields, in verbalize that no tidy contract is left slothful. The reveal is, solutions about how to successfully handle this upward push in complexity? Right here's where AI comes into play.

Amplifying Effectivity with AI

When thinking of man-made intelligence (AI), the major characteristic that involves thoughts is superhuman processing. Financial markets comprise manner lend a hand turn into too advanced for human minds to handle. As a replace, other folks comprise with regards to rely upon predictive algorithms, automation and personalization.

In TradFi, this usually interprets to robo advisors prompting customers on their needs and possibility tolerances. A robo manual would then generate a profile to sustain a watch on the person’s portfolio. In the blockchain composability arena, such AI algorithms would accomplish worthy bigger flexibility to siphon yields.

By learning the market prerequisites on the flit as they entry transparent tidy contracts, AI brokers comprise the doubtless to decrease market inefficiencies, decrease human error, and manufacture bigger market coordination. The latter already exists within the comprise of automated market makers (AMMs) that ship asset label discovery.

By examining present flows, liquidity and volatility in right-time, AI brokers are perfect to optimize liquidity provide and even quit DeFi flash mortgage exploits by coordinating between DeFi platforms and limiting transaction sizes.Â

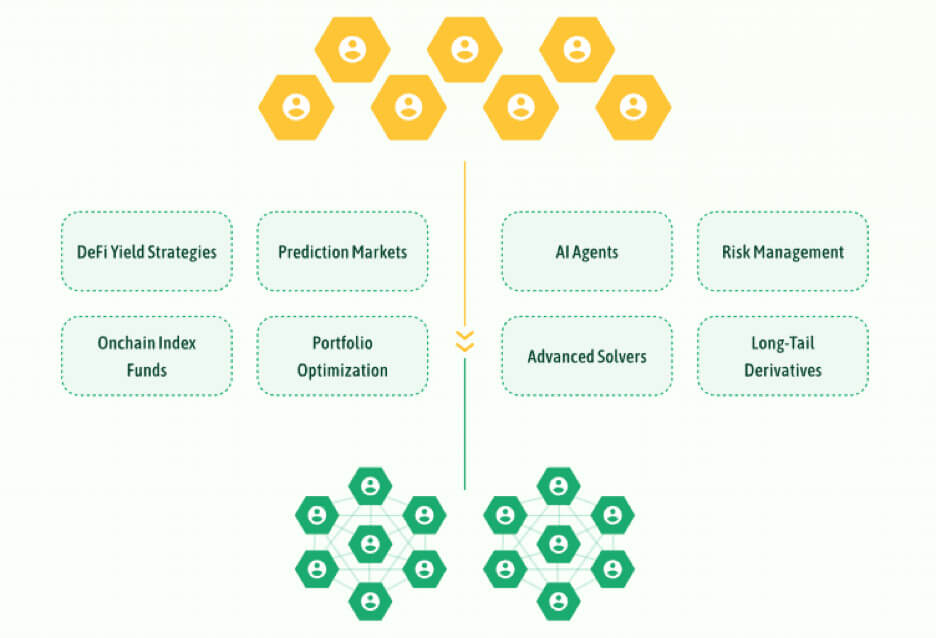

Inevitably, as AI brokers manufacture bigger market effectivity through right-time market monitoring and machine learning, unique prediction markets may well perhaps emerge as liquidity deepens. The job of other folks would then be to station bots to arbitrate against different bots.

At $42.5 billion in the end of 2,500 equity rounds in 2023, AI investments comprise already outpaced the crypto peak of 2021. But which AI-crypto projects showcase the vogue?

Highlight on AI-Crypto Innovators

For the rationale that originate of ChatGPT by OpenAI in November 2022, AI has been an consideration grabber. The distinction beforehand reserved for memecoins grew to turn into diverted into AI advancements in reasoning, art generation, coding and most lately, text-to-video generation through Sora.

Across these fields of human curiosity, all of them rely upon the scaling of data amenities. No longer like crypto tokens, which will doubtless be tidy contracts, AI tokens are the unsuitable blocks of text that the AI agent disassembles into relationship units. Looking on the attunement of each AI model, these tokens characterize contextual windows for the relationships between ideas.

For every person suggested, it is intriguing to permit maximum processing skill. When the AI model breaks the text into tokens, the output depends on the token dimension. In turn, the token dimension determines the usual of the generated verbalize, whatever it may perhaps additionally very successfully be.

Obviously, the larger the token dimension, the larger the doubtless of an AI model to comprise in thoughts the larger resolution of ideas when generating verbalize. Given such inherent boundaries, AI tokens naturally match blockchain tech.

Staunch as Web3 gaming tokenizes in-game sources for decentralized possession, tradeable forex and reward incentives, the same will be performed with AI. Residing proof, Procure.AI (FET) is an start-entry protocol to join Self reliant Financial Agents, through the Delivery Financial Framework to the Procure Properly-organized Ledger.

The FET token aims to monetize network transactions, pay for AI model deployment, reward network participants and pay for a selection of companies. And accurate as other folks join with DeFi companies through wallets, they'll join with Procure.AIâs agentverse with a Procure Wallet to take dangle of earnings of deployed AI protocols.

As an illustration, one in all the many AI brokers for the time being in beta agentverse is PDF Summarization Agent.

As a prospective pathway to democratizing AI agent entry and deployment, FET token has won 300% label since the starting up of the yr. In accordance with Market Compare Future, AI brokers market is forecasted to develop to $110.42 billion by 2032 from $6.03 billion 2023. This represents a compound annual state price (CAGR) of 43.80%.

In the atomize, we are inclined to gaze an ecosystem of AI brokers interacting with DeFi protocols and different companies that would accumulate pleasure from automating right-time choices. This may well perhaps additionally manufacture bigger to AI brokers assisting self-riding EVs or even helping attain heavenly surgical procedures and patient care. Pediatric surgeon Dr. Danielle Walsh on the College of Kentucky College of Drugs in Lexington said:

âA patient who wakes up at 1:00 within the morning 2 days after a surgical operation can contact the chatbot to query, âIâm having this symptom, is this odd?ââ

In clinical diagnostics, Massachusetts-primarily based mostly entirely Lantheus Holdings (LNTH) had already deployed its PYLARIFY AI imaging agent for early prostate most cancers detection. With AI-crypto projects like Procure.AI, many such companies will be tokenized to stout extent.

The Street Forward: Challenges and Opportunities

Before AI integration, blockchain platforms face the same reveal – institutional adoption. Pause smaller protocols comprise a gamble to penetrate the mainstream, or is this reserved for institutions?

DeFi may well perhaps additionally comprise paved the plan in which for tokenized monetary markets, but mountainous players are likelier to instill public confidence.

As an illustration, the Canton Community, which is supported by Big Bank and Big Tech, may well perhaps additionally supplant smaller DeFi fish. In the end, the comfort of same-day monetary institution transfers will be seamlessly built-in into blockchain networks. Right here's extraordinarily pertinent given that Microsoft is powering the Canton Community with Azure cloud whereas growing AI products.

On the same time, diverse customers would favor to preserve inner start-entry ecosystems, riding the associated rate appreciation of AI-crypto tokens. Moreover, crypto protocols donât must be straight geared in opposition to AI agent deployment. Residing proof, The Graph (GRT) will be vulnerable for AI apps as a blockchain data indexing provider.

In holding with this hypothesis, this âGoogle of Blockchain” has won a 103% enhance yr-to-date. One in every of essentially the most prospective crypto projects assisting AI will be Injective Protocol (INJ). Because it âinjectsâ AI algorithms into aforementioned DeFi market actions, Injective aims to simplify and automate advanced DeFi operations.

On the unsuitable layer of the AI-crypto intersection will be Allora Community, using its zero-data machine learning (zkML) and federated learning to manufacture AI apps for augmented DeFi journey.

If the rollout of those start apps is a success, institutional networks equivalent to Canton would comprise diminished charm. This dynamic will largely rely upon regulatory agencies, which will doubtless be but to materialize tips even for the crypto space.

Conclusion

AI is poised to manufacture data more intelligible, actionable and pertinent to a particular person. On different hand, blockchain abilities formalized and decentralized the common sense of human motion into self-executing tidy contracts.

When the 2 spheres meet, we accumulate AI brokers with a renewed cause. A brand unique generation of tokenized robo-advisors that seize stout earnings of DeFi composability. And as AI brokers explore unique prospects, unique markets will emerge.

From predictive diagnosis to injecting liquidity into on-chain markets, AI brokers are ready to craft a hyper-financialized future where, starting from Bitcoin itself, other folks will near upon diverse constructing blocks to capitalize on.

Mentioned in this text

Source credit : cryptoslate.com