Hacked crypto funds falls 98% YoY to $1.9 billion as US leads attacks: Report

In 2023, the blockchain security landscape witnessed a $50 billion descend in lost crypto sources, depicting a shift towards enhanced security protocols and the maturation of the DeFi ecosystem.

In preserving with crypto security agency Hacken’s cease-of-year file, final year marked a distinguished cut price within the dimensions of financial damages from hacks and scams. Total losses amounted to $1.9 billion, starkly contrasting the staggering figures recorded in old years. The lower in lost payment signals a gigantic pattern within the exchange’s efforts to enhance safety features and take care of vulnerabilities extra effectively.

All over the exchange, BNB Chain used to be subjected to the most attacks, at 214, with Ethereum in 2d predicament at 178. Particularly, most BNB Chain and Ethereum hacks had been categorised as ‘rug pulls,’ at 148 and 97, respectively.

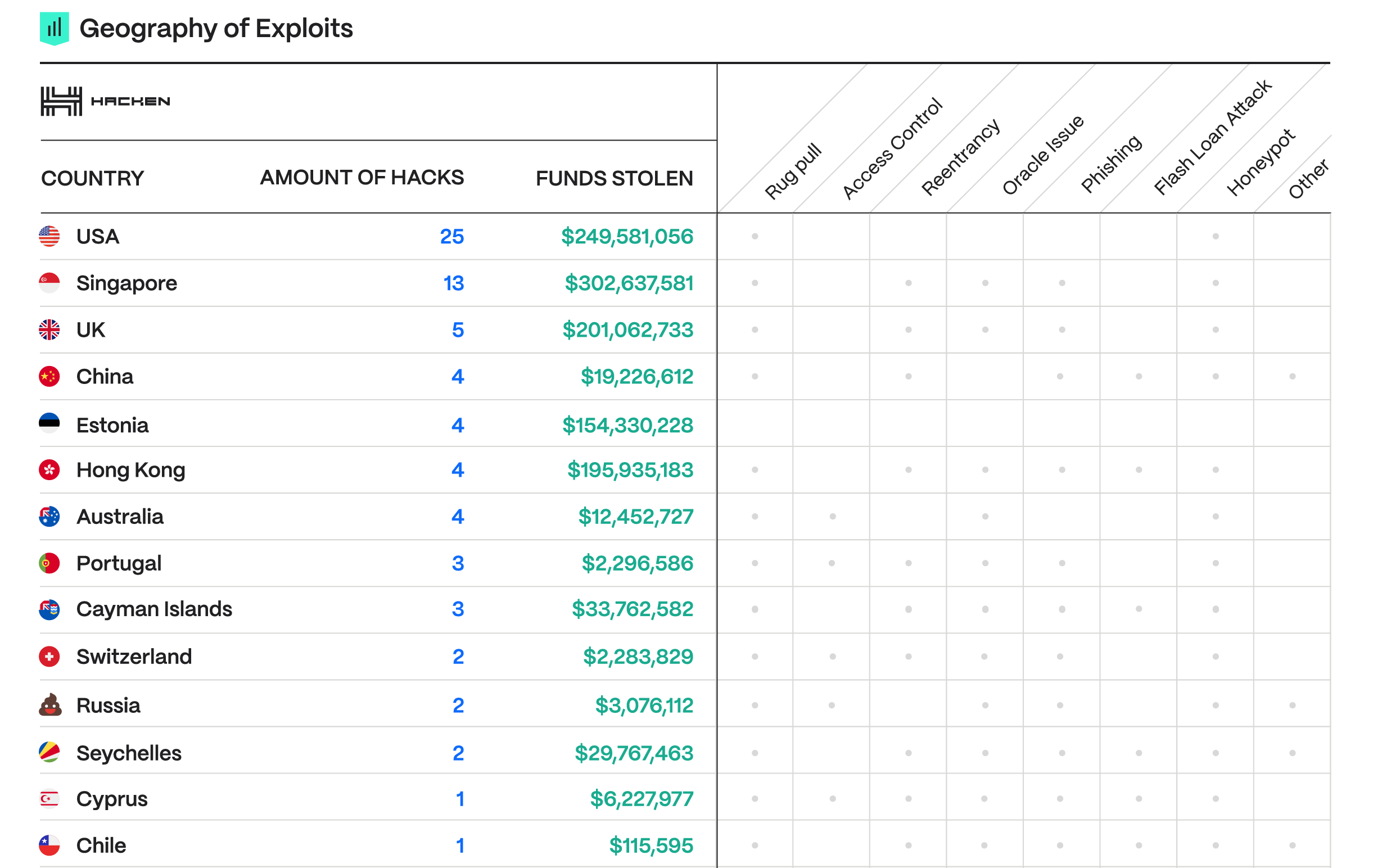

The file also highlights the geographical distribution of blockchain exploits, with main hotspots emerging in areas with excessive fintech activity. This geographic prognosis affords treasured insights into the global nature of blockchain vulnerabilities and the need for a coordinated global response to take care of these challenges.

The usa observed the most at 15, with Singapore (13) and the UK (5) in 2d and third. China, in fourth predicament with four, had one of many lowest payment stolen per hack at an average of $5 million compared with the united states at $10 million, Singapore at $23 million, and the UK at $40 million.

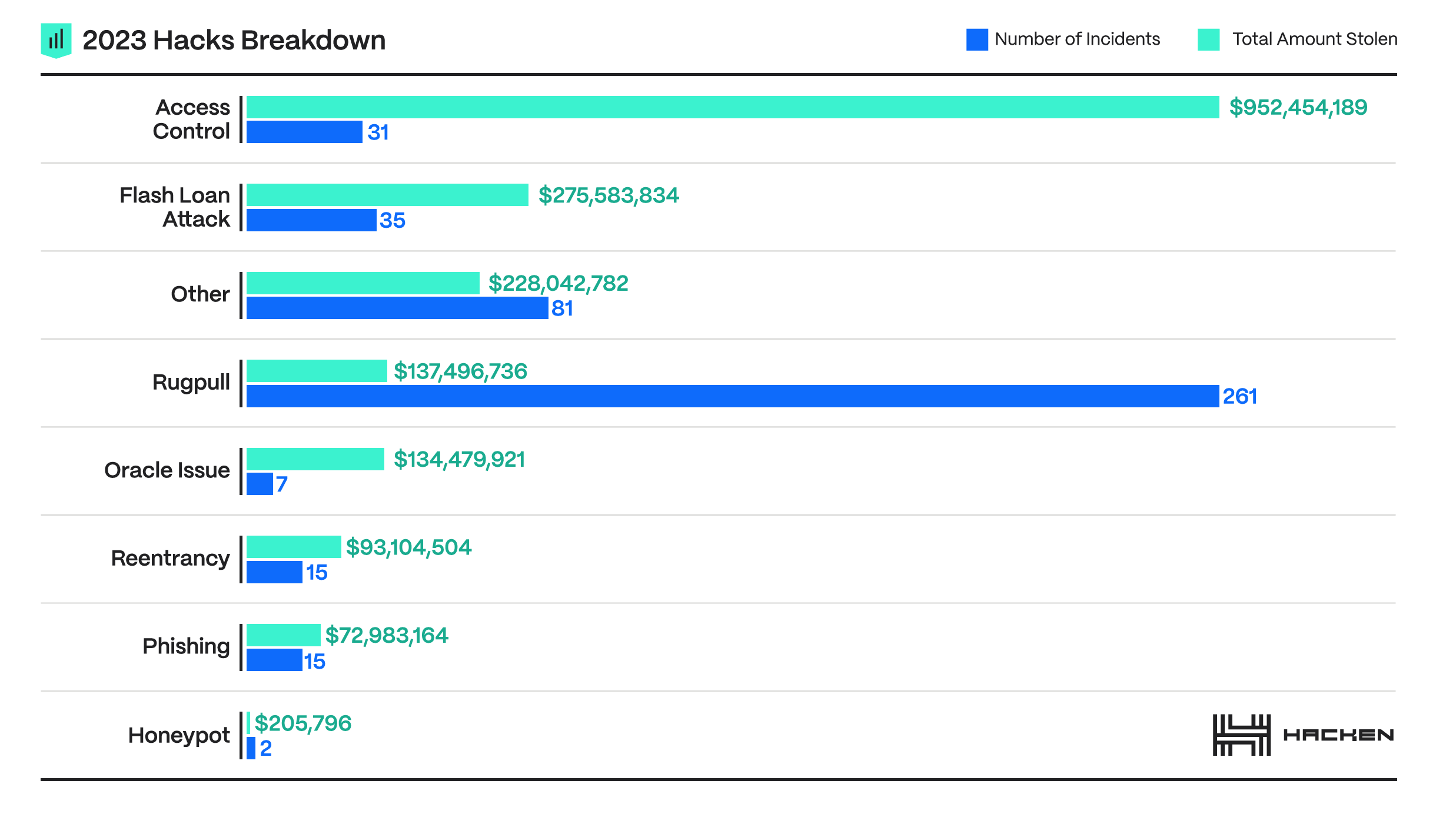

The year-on-year cut price in losses would no longer suggest a diminished threat landscape. On the alternative, the series of attacks elevated by 14% compared to the old year, highlighting an evolving and rising attack floor. The variety of these attacks, ranging from sophisticated procure entry to administration breaches to flash loan attacks, implies that attackers constantly refine their ideas to employ the complex internet of DeFi and blockchain applied sciences.

The year’s critical theft alive to the Multichain bridge, with $231 million drained, demonstrating the excessive stakes in securing rotten-chain operations. No topic the excessive-profile nature of some attacks, the exchange observed the first year all over which exploited protocols managed to procure better a gigantic part of the stolen sources, around 20% or $400 million. This restoration used to be made doable via rapid response groups, the goodwill of particular hackers, and elevated rules enforcement activity.

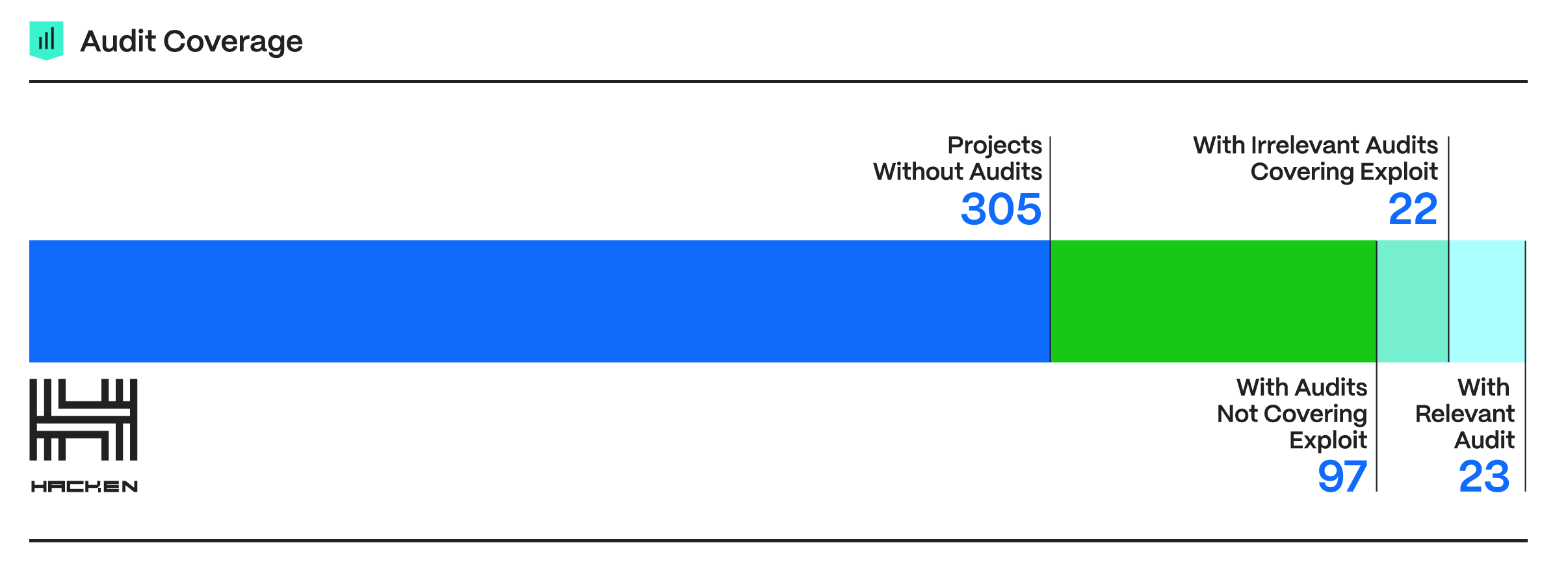

Hacken’s file additional stresses the main significance of total audit coverage and the role of worm bounty purposes in figuring out and mitigating vulnerabilities earlier than they’d perchance be exploited. No topic these safety features, the data displays that many projects live inadequately safe as a consequence of the absence of audits or the irrelevance of done audits to the deployed code. This gap in security preparedness emphasizes the need for a extra proactive and thorough strategy to security audits, guaranteeing that they are total and relevant to the deployed blockchain code.

Furthermore, Hacken emphasizes the effectiveness of proper-time monitoring instruments and developing procure pockets applied sciences as main components of a mighty security framework. These instruments play a extremely crucial role within the early detection and mitigation of most likely threats, enhancing the total security posture of blockchain platforms and keeping customers’ sources.

Having a ogle ahead to 2024, the file affords predictions and ideas for addressing future security challenges. Among these is the anticipation of elevated vulnerabilities as the exchange continues to innovate and extend, notably with adopting unique Layer 1 and Layer 2 solutions. The file calls for continuing to emphasise procure entry to administration and flash loan attack prevention, the importance of fostering a proactive security tradition, and the need for collaboration internal the exchange to crimson meat up collective defense mechanisms.

It is far apparent that whereas strides had been made in lowering the financial impact of attacks, the fight towards crypto-linked crime is an ongoing misfortune to withhold the persisted growth and balance of the DeFi sector.

Source credit : cryptoslate.com