Grayscale slashes Ethereum Mini Trust fees to 0.15%, lowest in market

Grayscale slashes Ethereum Mini Belief charges to 0.15%, lowest in market

Grayscale slashes Ethereum Mini Belief charges to 0.15%, lowest in market Grayscale slashes Ethereum Mini Belief charges to 0.15%, lowest in market

Market observers mentioned the switch would help the company prevent gigantic outflows from its legacy Ethereum Belief fund (ETHE).

Conceal art/illustration by the advise of CryptoSlate. Image involves combined instruct that could well presumably impartial encompass AI-generated instruct.

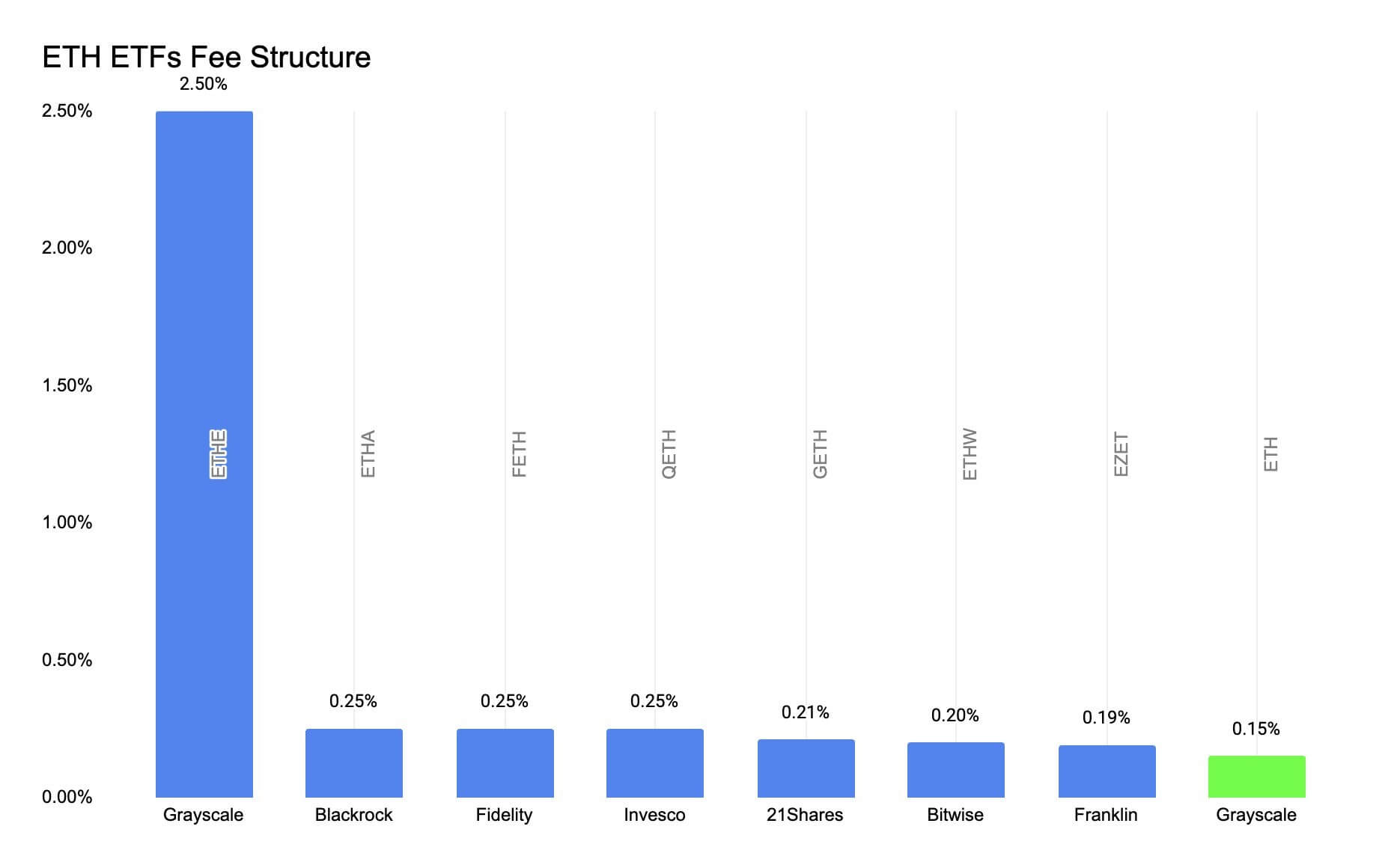

Grayscale, one in every of the issuers of the upcoming Ethereum trade-traded funds (ETFs), has reduced the administration charge for its Mini Belief to 0.15% from 0.25%, in step with a July 18 filing.

The company mentioned:

“Grayscale Investments has up up to now its registration express for Grayscale Ethereum Mini Belief to reflect a administration charge of 0.15%. Furthermore, we're waiving the cost to 0% for the first six months, applicable as much as a maximum of $2 billion in sources underneath administration (AUM).”

This switch positions Grayscale’s Ethereum ETFs as each and each basically the most charge-efficient and most expensive. The Grayscale Ethereum Belief (ETHE), which is able to became to an ETF, maintains a 2.5% charge construction, whereas the Mini Belief would entice basically the most charge-efficient charge within the market.

Market analysts previously predicted that ETHE’s excessive charges could well presumably force investors to more inexpensive choices from rivals esteem BlackRock, Constancy Investments, VanEck, Bitwise, and Franklin Templeton, with charges between 0.19% and 0.25%.

Particularly, a identical agonize took place with keep Bitcoin ETFs. Grayscale’s Bitcoin Belief has experienced over $18 billion in outflows since its conversion to an ETF in January, with investors piling into more inexpensive ETFs from BlackRock and others.

To forestall a repeat, Grayscale is seeding its Mini Belief by reallocating 10% of the $10 billion from ETHE. And by decreasing the Mini Belief charges, Grayscale offers basically the most aggressive charges.

Market observers imagine this switch would tame a couple of of the seemingly ETHE outflows. Crypto analyst Karl mentioned:

“Grayscale reduced ETH charges to 0.15%. It is a ways now basically the most aggressive ETF from a charge-level of view, it will seemingly preserve faraway from [assets under management] leakage from Grayscale and lower ETHE outflows. There are rumors the ETHE -> ETH conversion is tax-exempt, which could well presumably be even more bullish.”

Equally, Nate Geraci, president of ETF Store, highlighted the importance of this switch, pointing out it grow to be once a gallant diagram given Grayscale’s pivotal characteristic in launching crypto ETFs.

He added:

“Grayscale paved regulatory path for keep btc & eth ETFs. Duration. No motive to not capitalize on that by taking management situation in how they methodology competition in keep crypto ETF category.”

Talked about listed here

Source credit : cryptoslate.com