Grayscale to slash fees to 1.5% after spot Bitcoin ETF conversion, still highest among rivals

Prominent digital asset supervisor Grayscale will nick its administration charges to 1.5% from 2% for its proposed location Bitcoin substitute-traded fund (ETF), in accordance to an up to the second S3 submitting submitted to the U.S. Securities and Change Price on Jan. 8. The asset supervisor talked about the costs are payable within the head cryptocurrency.

The submitting further published that the asset supervisor added Jane Boulevard, Virtu Americas, Macquarie Capital, and ABN AMRO Clearing as licensed people (APs) for its proposed ETF. It also named Jane Boulevard, Virtu Float Traders, and Flowdesk liquidity suppliers for the ETF.

Excessive charges

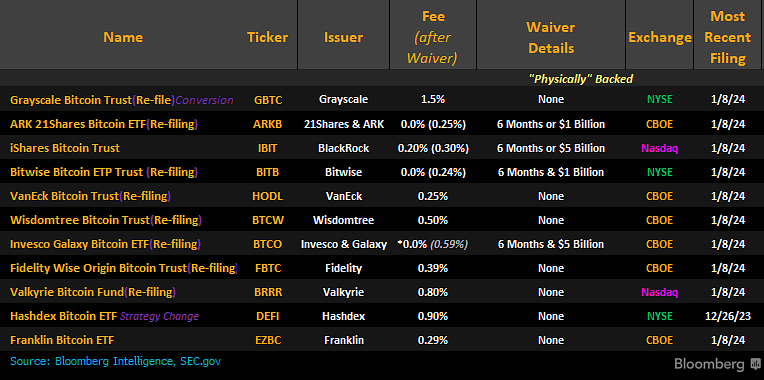

Despite Grayscale’s payment decrease, the firm’s price remains notably higher than the proposed charges by ETF issuers fancy BlackRock and others, who have largely charged below 1%.

Ark and 21 Shares reduced its charges to 0.25% from 0.8% earlier as of late while waiving its charges for the first six months or $1 billion. Any other asset supervisor, VanEck, also plans to model 0.25%.

In distinction, BlackRock has outlined a payment development starting at 0.2% for the initial 365 days and $5 billion of its ETF, which is ready to amplify to 0.3% later. Bitwise opted for a 0% model all over the first six months, adopted by a 0.24% payment thereafter.

Others, fancy Wisdomtree, Invesco Galaxy, Constancy, Valkyrie, Hashdex, and Franklin Templeton, model between 0.39% and zero.9%, respectively.

Grayscale stands out among ETF applicants by strategically focusing on the transformation of its Bitcoin Have confidence into a location ETF. This consuming ability positions Grayscale favorably towards competitors attributable to its mammoth present holdings of BTC. The firm holds virtually 620,000 devices of BTC, price virtually $27 billion.

Ryan Selkis, Messari founder and CEO, further explained why the firm could moreover very smartly be declaring a excessive payment, declaring that:

“The novel ETF issuers are racing to the backside on charges the put every BILLION greenbacks in AUM leads to $3-5 MILLION in annual income. Grayscale’s head launch up ability starting ARR [annual recurring revenue] of $420 million.”

Eric Balchunas, Bloomberg’s ETF analyst, also powerful that reducing Grayscale’s charges could well perhaps abolish their margins.

Source credit : cryptoslate.com