Grayscale GBTC investors still in profit with average cost basis 20% below current prices

In response to recordsdata from shopping and selling firm Webull, around 70% of Grayscale GBTC holders likely dwell in profit. The moderate shares were purchased at $27.82, some 20% below the unique tag as of press time.

The Webull recordsdata reveals the impart of the have confidence the day earlier than its conversion to a neighborhood Bitcoin ETF and implies that 70% of investors had a tag range between the $18.84 and $27.24 range.

Via distributions, basically the important concentration of shareholders appears to be positioned between $33 and $40. With the payment at $34.9 as of press time, it must be fascinating to investigate cross-take a look at whether the backside of this range acts as a increase for the payment amid persisted outflows.

The 2d concentration is essential decrease, between $18 and $21. This group will dwell successful till the GBTC tag falls one other 39%.

Will delight in to the payment tumble to this stage and its resources under management see an an identical decline, we’d witness a extra 230,000 BTC hit the OTC desks, worth around $8.9 billion as of press time.

The kind of drop would leave Grayscale with roughly 350,000 BTC, which at a 1.5% management price would still generate roughly $200 million in earnings if Bitcoin retained a payment of around $39,000. This underlines the shortcoming of rigidity on Grayscale to diminish charges along with the reputedly limitless seemingly for Grayscale investors to lift earnings. With few inflows into the ETF, the percentage of investors in profit is terribly high.

Thus, there would possibly possibly be with out a doubt an argument to be made that Grayscale’s rigidity on Bitcoin’s tag thru profit-taking would possibly be as severe as a near-40 % drawdown. For bears within the viewers, a 40% drop for Bitcoin beautiful now would lift it to Could perchance presumably 2023 lows of roughly $23,000.

Potentially 100% of Grayscale investors in profit at conversion.

Since its conversion, the ETF has viewed worthy outflows totaling roughly $3.5 billion. Its resources under management delight in additionally fallen to $22.1 billion (552,681 BTC) from a 365 days-to-date high of $29 billion (623,390 BTC) on Jan. 10. In buck phrases, its AUM all-time high became in any case extra back, aligning with the tip of the 2021 bull market at a staggering $44 billion (651k BTC.)

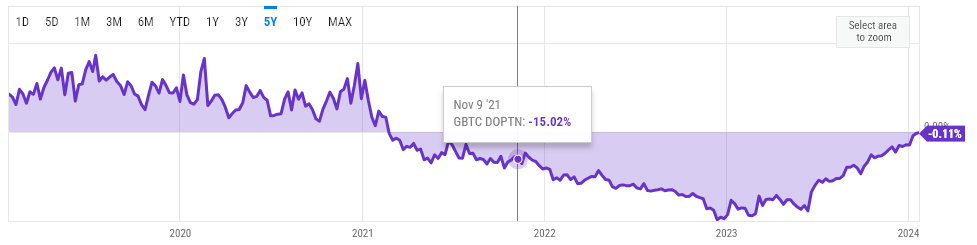

Curiously, even at the tip of the market, considerations about the have confidence’s make-up resulted in it shopping and selling at a 15% reduce tag to its procure asset payment (NAV), representing a tag top of around $58,000 as a replace of the gap tag of $69,000. This reduce tag persisted to develop till the originate of 2023, reaching -47% at its lowest.

Via the software program and eventual success of its conversion to a neighborhood Bitcoin ETF, the reduce tag has all however disappeared to a mere -0.11% as of Jan. 23.

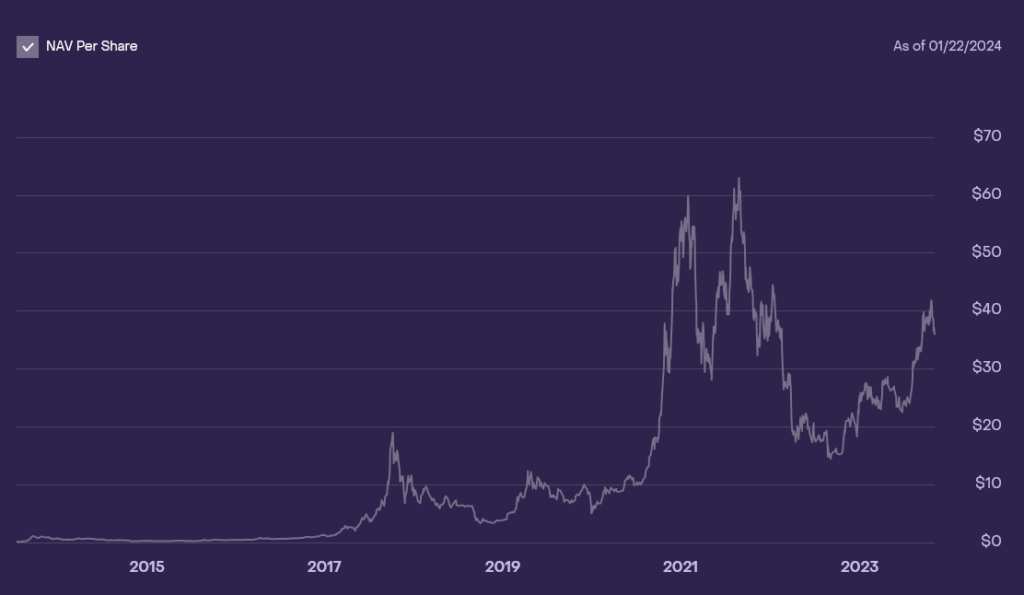

Curiously, the gap tag distribution chart from Webull above implies that every one investors who offered about $40.fifty three exited the have confidence earlier than its conversion. Compared with the chart below of the historical NAV tag, GBTC mostly traded above $40.fifty three for around 365 days between Could perchance presumably 2021 and Jan. 2022. On the other hand, Webull recordsdata recommend that when the have confidence closed on Jan. 10, its closing day earlier than its conversion to an ETF, 100% of shares were successful.

The TradingView chart below helps this claim, as it closed out at its easiest tag in 17 months. What’s more surprising is the selection of investors who had already exited the fund after having entered at larger prices all thru 2021.

Following the revelation that essential of the outflows from GBTC were a result of FTX liquidations, many within the Bitcoin neighborhood were buoyed by the chance of the ETF outflows slowing down. On the other hand, a extra 17,000 BTC became despatched to Coinbase High right this moment, Jan. 23, with procure outflows of around 15,000 BTC, valued at roughly $600 million.

The high selection of investors in successful positions puts the ETF in a precarious space for added outflows. Yet, the affect it must thrill in on the gap Bitcoin tag will handiest be viewed with time. Trades between the ETF issuers and its shopping and selling counterparty, Coinbase, occur over the counter (OTC), thus having a runt attain on the underlying Bitcoin tag straight.

Restful, right here is handiest factual as prolonged as there are customers ready to assemble Bitcoin. Will delight in to the OTC liquidity dry out, the payment affect would possibly be monumental. On the other hand, given the institutional ask for Bitcoin, I will no longer imagine investors esteem Michael Saylor turning down the chance to assemble some cheap Bitcoin.

Bloomberg analysts such as James Seyffart estimated handiest around 33% of GBTC outflows had been flowing into other ETFs. On the other hand, if the FTX liquidations are now over, it must be fascinating to investigate cross-take a look at if flows within the smash shallow and the majority simply swap to diminish-price funds such as Fidelity and BlackRock, that are at this time leading the Novel child Nine.

Source credit : cryptoslate.com