Goldman Sachs upgrades Coinbase rating amid crypto surge and market dominance boost

Goldman Sachs upgrades Coinbase ranking amid crypto surge and market dominance enhance

Goldman Sachs upgrades Coinbase ranking amid crypto surge and market dominance enhance Goldman Sachs upgrades Coinbase ranking amid crypto surge and market dominance enhance

Coinbase navigates regulatory challenges as market share and inventory value hover.

Quilt artwork/illustration thru CryptoSlate. Image includes mixed utter that will presumably perhaps presumably consist of AI-generated utter.

Coinbase, the leading US-essentially essentially based crypto exchange, has viewed a surge in its market share following the introduction of several role Bitcoin exchange-traded funds (ETFs) in January.

In response, analysts at Goldman Sachs contain upgraded their ranking on Coinbase shares from promoting to impartial and adjusted their value target to $282.

Coinbase shares

The bank analysts wrote:

“We are upgrading shares of COIN to Neutral from Promote, as crypto prices contain surged to all time highs, and COIN day-to-day volumes contain reached ranges no longer viewed since 2021 using a forty eight% amplify to our income estimates since early February.”

The analysts outlined that their decision displays the altering panorama of the crypto market and the corresponding influence on Coinbase’s efficiency.

Previously, JPMorgan analysts had downgraded Coinbase’s inventory from Neutral to Underweight because of pressures in the crypto market and doable income shifts a long way from Coinbase following the launch of the unusual ETFs.

Coinbase’s inventory has grown considerably all over the previous month, procuring and selling at spherical $244 all over pre-market procuring and selling at the present time, marking a considerable 105% amplify over the previous month, in step with Yahoo Finance recordsdata.

Market share utter

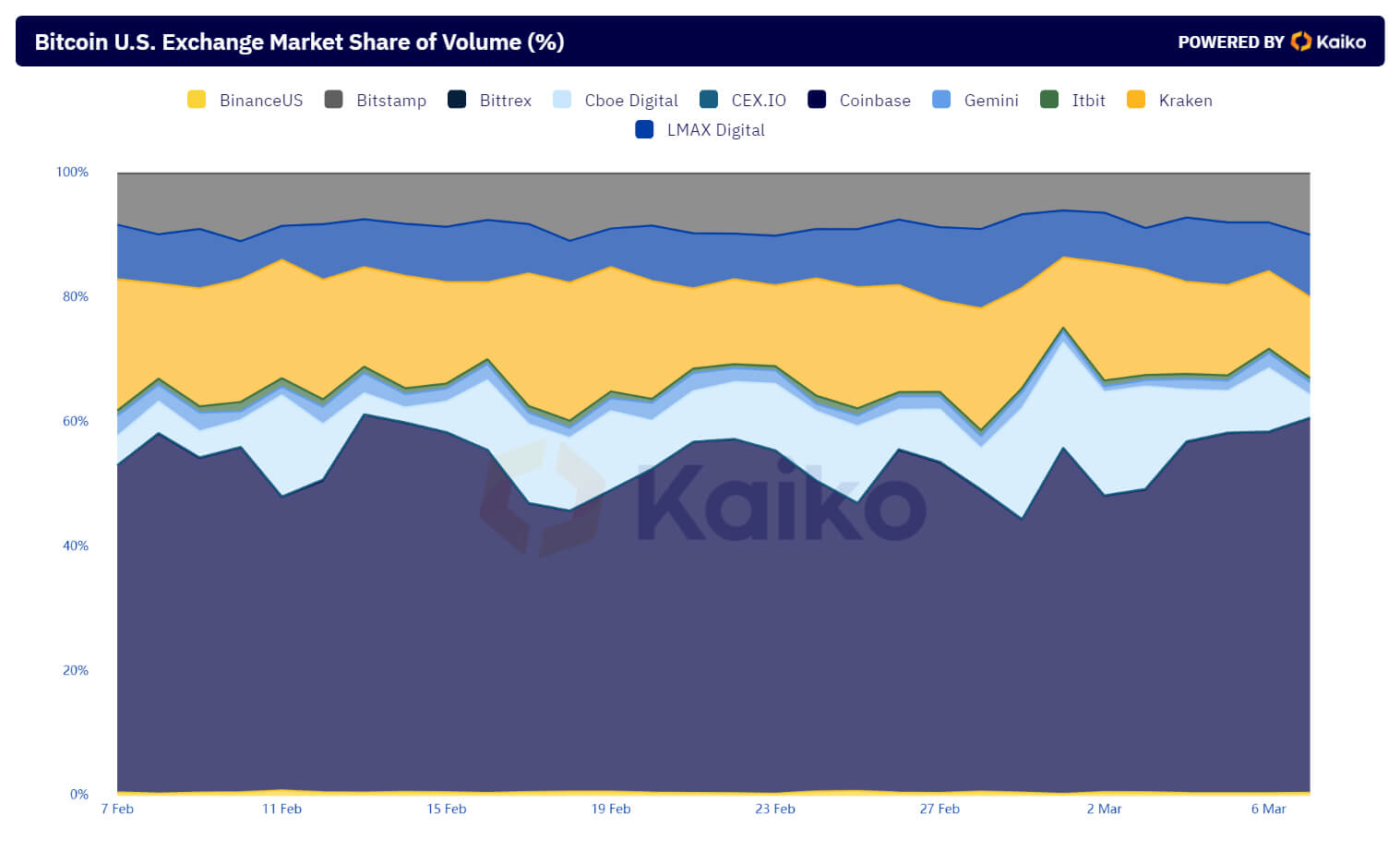

Coinbase’s market dominance has surged from 47% to 60% in the remainder three months following the approval of Bitcoin ETFs in January, in step with recordsdata from blockchain analytics firm Kaiko.

The platform’s considerable utter stems from heightened person engagement, propelling its app to considerable rankings. Currently, Coinbase is the thirteenth most traditional US finance utility, as tracked by a platform monitoring app utter, Sensor Tower.

Nonetheless, Coinbase has grappled with technical challenges amid this ascent, ensuing in users encountering zero balances of their accounts. Coinbase CEO Brian Armstrong attributed this glitch to the important spike in visitors triggered by the BTC’s ascent to unusual file highs.

Previous technical setbacks, Coinbase is also navigating a panorama fraught with regulatory hurdles, in particular with the US Securities and Switch Commission over the previous yr.

Talked about listed right here

Source credit : cryptoslate.com